Edition #23 – Thanksgiving or thanks for receiving…

27 November 2020

Like getting hooked on Lion King, Black Swan needs to wean off USA. Easy to say but hard to do.

It is so entertaining. From Rudy doing his Zorg impersonation from the Fifth Element to Republican supporters continuing to claim foul on the election. Donald J Trump…the J is for genius.

No time yet to look up the impact of Trump going on his Pardon spree, but the left will be going nuts I reckon.

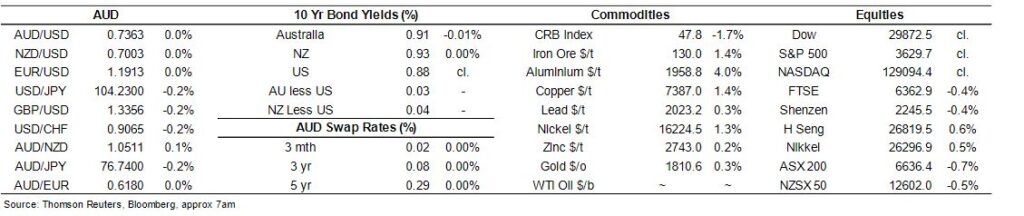

What is also going nuts is the equity market. The Dow hit new highs over the week and went into the 30,000’s before pulling back mid week ahead of Thanksgiving.

From smarter people than I…“the market is caught between two powerful impulses — optimism for the post-pandemic world and fear because present reality is that the pandemic is exploding throughout the country….markets could be choppy, but downside is likely limited by the vaccine.”

Globally, the pandemic is accelerating with the first million cases taking 91 days, the last million cases took just two days.

I subscribe to a couple of whacky far right social media pages for sport (opening meme courtesy of one). These guys are truly nuts – freedom rights or death is the cry. Masks are for wimps. Lockdowns mean it is time to get the guns out. Trouble is there is no shortage of them, and they are getting fed red meat via the White House.

Locally, Victoria modelled just how quickly the economy can bounce if you get on top of Rona. A few friends remain convinced that Australia should have been “looser” on lockdowns (though not as loose as USA) for the broader health and economic good. I accept the premise of the proposal, and history will no doubt show the winners and losers. I believe that Australia and NZ and very well positioned for a strong bounce back in 2021. On the flip side I think the USA populous and economy has got well ahead of itself. They are in for a very, very rough next 6 months – or longer as the vaccine will take time to roll out.

Aussie Banks and financials had a strong run in the last few weeks. Lots of possible reasons:

- Initial pullback was too strong in the first place

- People and businesses on interest deferments are lower now than was expected

- Vaccine clearly sets up a stronger 2021

- Aussie banks baseline is far more profitable than most international peers.

- Banks remain very well capitalised. Bad debts well provisioned and maybe over provisioned.

Personally I put a fair bit of stock (pun intended) on the last point. Many pundits saw a risk that with unemployment rising, SME’s struggling and house prices plummeting we had a trifecta for bad debt write offs. How the SME’s come out the other side is still not clear, and there will be some (many) casualties – but unlikely to be a tsunami

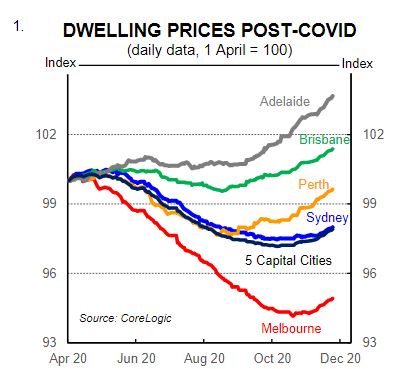

House prices far from plummeting, are having a solid run in most cities, and even in the regional areas that tend to stay flatter. Melbourne still down, but trending higher, and little old Adelaide (why would you go there..) has had a huge run by its standards – up 4.5% for the year. Many tell me that the key driver is related to a lack of supply, but locals tell me it is a hot market.

Whilst on SA. Guinness Book of records attempt to do 6 days of lockdown in 3 days. Achieved, but some poor Spaniard pizza maker over here on a visa is copping a hiding in the media.

Market discrepancies are always there and will always be there – just sometimes we can’t see them at the time.

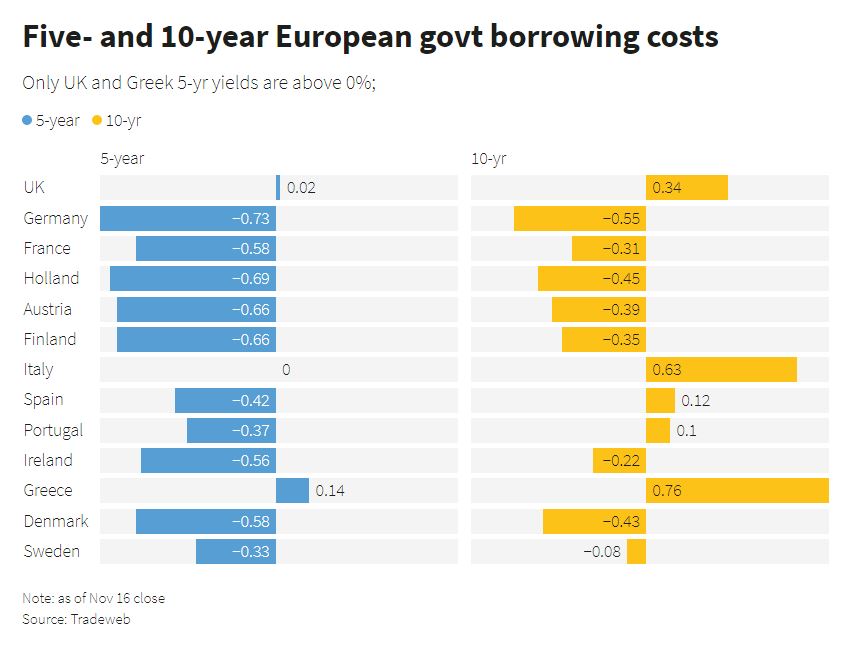

One that stands out like an old dogs under-carriage is comparative yields to me.

Low and negative yields across Europe is unbelievable. Maybe that is why the MMT (Modern Monetary Theory) is not freaking as many people out as it should. Governments can print money and blow debt as high as they like – it is is free.

But I am a pictures man.

Blue line below…aka the higher one is the long dated government yield curve. Green is the Italian equivalent.

Now I’m not having a crack at our Italian friends out there. I love their cars, bikes, wine and cheese. I would add women but Mrs Swan would rip a wing off.

But why oh why are we higher?

Ratings Agencies have us as a significantly lower risk as highlighted with Italian Credit Default Swaps trading about 7 times the cost. Lower risk should equate to lower yields….I know which one I would rather own.

After a couple of sangioveses, can someone please explain?

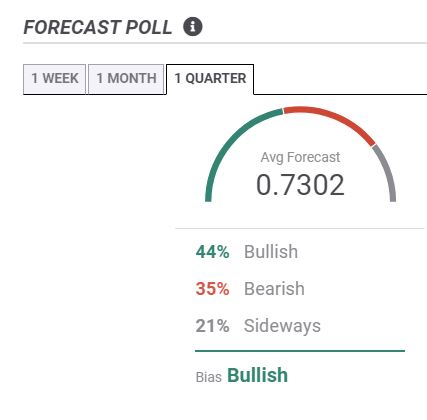

To be fair we followed the pack with our call, but we have been bullish on the Aussie dollar for some months now. With the pain ahead for the USA (and you would think by proxy thus the USD) we see that trend holding for some weeks and possibly months ahead.

FX Street see a pretty balanced approach in the quarter ahead. Survey was early this week so at a spot rate at .7360 the bulls are winning.

I have been promised an insider look at the Australia / China trade tension battle next week. Should be interesting.

Thought of the week.

Got some feedback on the article last week on Brokers. General gist was:

- It was too harsh on Brokers

- Customers need help in finance because Banks are shite at it these days

- Payment streams to brokers are largely appropriate and or fair.

Points made, and I stress that there a PLENTY of crap brokers out there that deserve to starve. But there is a number of very good brokers that earn their money and add value to many.

Haynes disagreed with the last dot point strongly and getting something more in line with Financial Planning may be the end game/solution.

Whilst on fairness and equity, a quick point on the Biden victory and what it may mean. Trump’s policies and especially deregulation of US Banking has been a major plus for many banks over there. The Democrats may well look to tighten up the areas where Trump has been the loosest.

When US Banks talk about overdraft income, they are predominately referring to unauthorised account excess fees, or what we may call insufficient fund fee. The 80/20 rule is close – 9% of account holders pay 79% of these fees. The big boys alone raked in over USD $11 billion last year on these fees – roughly the combined profit of our Big4 this year. One Wells Fargo customer got charged an overdraft fee on his overdraft fee. Not sure what changes would be proposed, but at risk is 5% of NII (non interest income) to the sector.

And this is the perfect lead into our real thought of the week.

Buy Now Pay Later is relatively new here – the closest I got was a Kmart layby. Buy now and get your two stripe sandshoes once you had paid. But Gen Me want the whole ‘shoebang’ now.

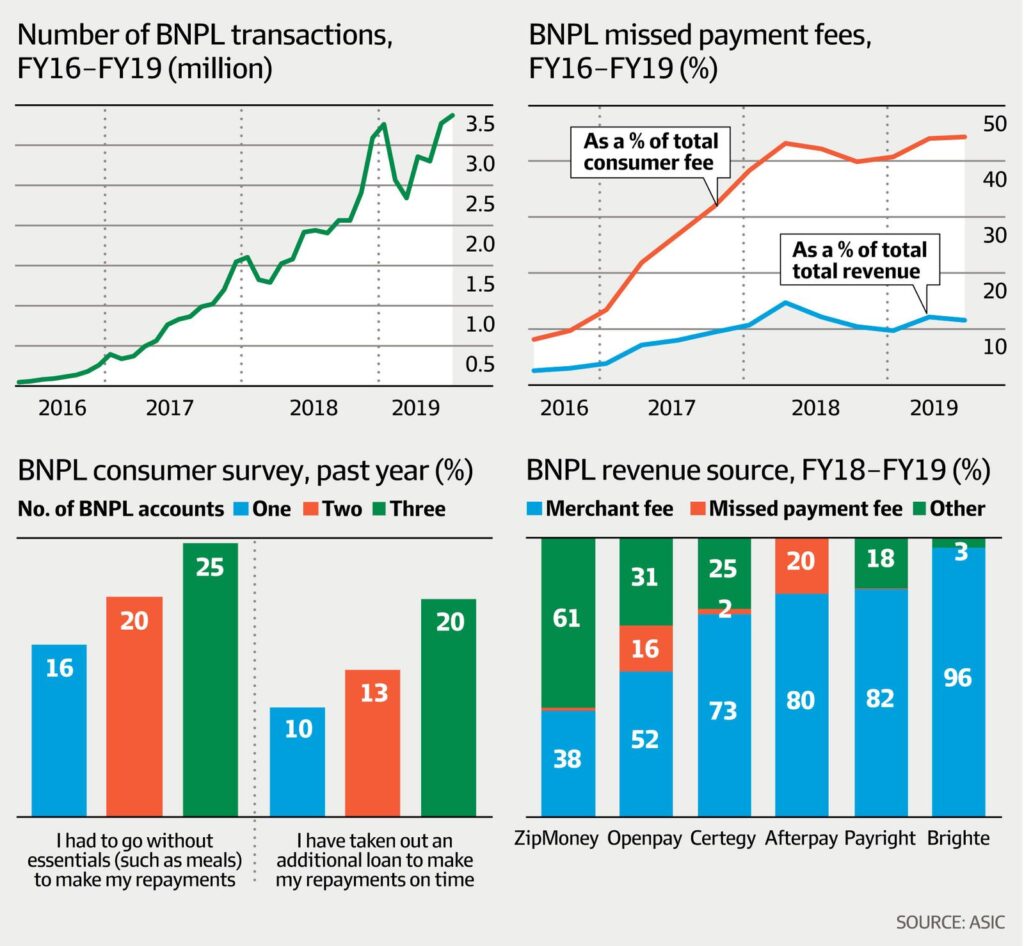

Afterpay is the big dog in this park – owning 73% of the market. Unlike banks, the industry is very unregulated. I had a friend that was a senior finance guy at one of these shops – and reckon they are dodgier than a Woodville pizza.

ASIC took a look at it recently, and the AFR did an article. Late and missed payments for Afterpay (as declared by Afterpay) rose by 49% in 2020 – and generated AUD $69m in revenue, or 16% of their income stream.

No guesses has to who is the majority of payers of these fees – the lowest income earners and the very young.

Harvesting your profit off the poor and vulnerable is a long standing tradition, and who is Black Swan to point such out. But for those of you that are shareholders, like the US Banks above, watch out. I suspect regulation is coming.

Second issue of mine for the likes of Afterpay is who actually “pays” – even if full payment is on time. The user/consumer of the likes of Afterpay is guaranteed that it is “interest free” and the price is the same as a normal punter. The cost of the transaction is recouped to Afterpay via a payment to the retailer. You can then assume one of two outcomes:

- Retailers are accepting a lower net profit for customers to use Buy Now Pay Later (disregarding the economies of possible higher sales volumes)

- Retailers are passing that cost onto all buyers via increased margins. In other words if you don’t use BNPL then you are subsidising the users.

I suspect the later and thus put it in the same bucket as my issue last week.

What is Black Swan drinking?

Back into the home cellar cheap and cheerful this week. Being a big fan of Grenache long before it got all trendy, McLaren Vale know how to do it well.

Great colour and fruit. Easy tannins even for a young wine.

Recommend 8/10

And listening?

I don’t know much about Bruce, but it popped into my spotify playlist.

Nice beat and seems to fit Thanksgiving day.

Until next week. don’t be a Karen or Julia.

Cheers BS