Edition #22 – They Otter vacate and vaccinate

20 November 2020

It has been suggested that ScoMo is wearing a G-string. That is an image and thought that haunts me. It is the upside down flag that confuses me. Put it on in the dark?

Another week and Trump has the sandbags piled high. His actions are very much in character, but I’m surprised that his Republican colleagues are happy to play along with the farce. I suppose fear is a good motivator for loyalty.

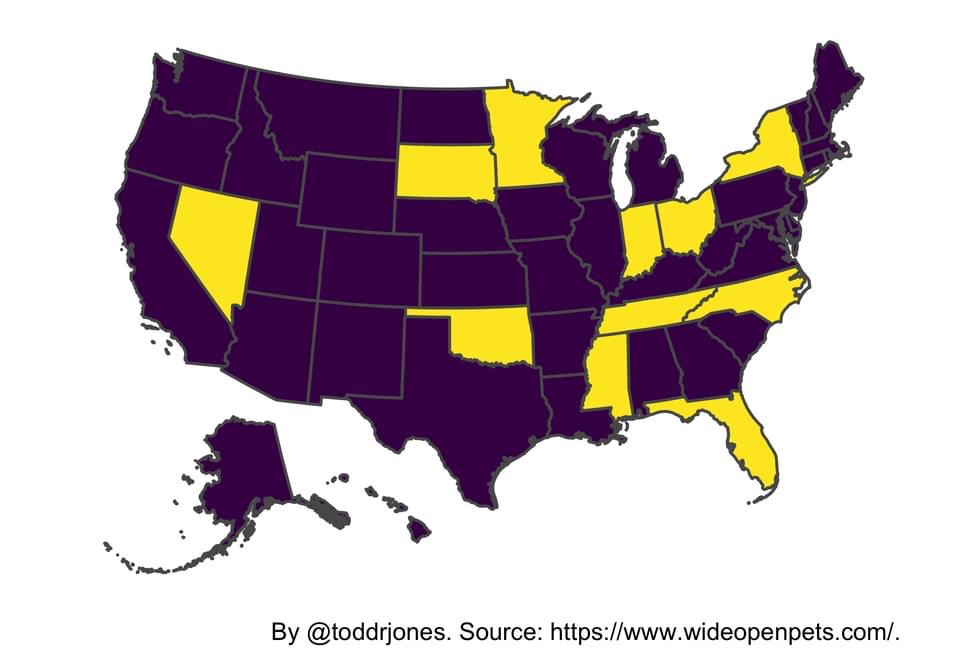

I thought we have all seen enough US electoral college maps this past month, so something different : Yellow States allow the legal keeping of otters as pets.

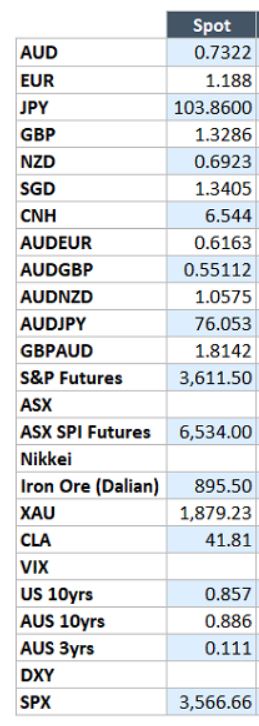

Markets wise, the tug of war between rampant Covid outbreaks and new players with effective vaccinations continue. Optimism is winning at the moment, but many still see the risk of a big spike in volatility in next 2 months.

New spending initiatives for the USA are factored in to the good news world and equity markets. If Trump does not accept the bleeding obvious, the timing for massive stimulus may well stretch into 2021 which would halt the equity and energy run.

Plenty of Trump fodder out there still, but a few favourites-

US and our yields are also climbing off the mat, but remain shaky.

RBA Governor Lowe confirmed this week that the November cash rate cut was highly motivated by a desire to keep the AUD low. Worked a treat. Melbourne Cup day it was trading two and a half cents lower than current. Some might argue it would be even higher without the cut, but I say bullshit – wasted bullet.

Aussie employment data out. Mixed bag of lollies. Headline level was unemployment up from 6.9% to 7.0% (better than expected) but good news in a lift in participation rate, albeit perhaps driven by the demise of Job-Keeper. Pleasing that nearly 180,000 jobs created in October though. Youth unemployment in the high 15%’s is a real worry still.

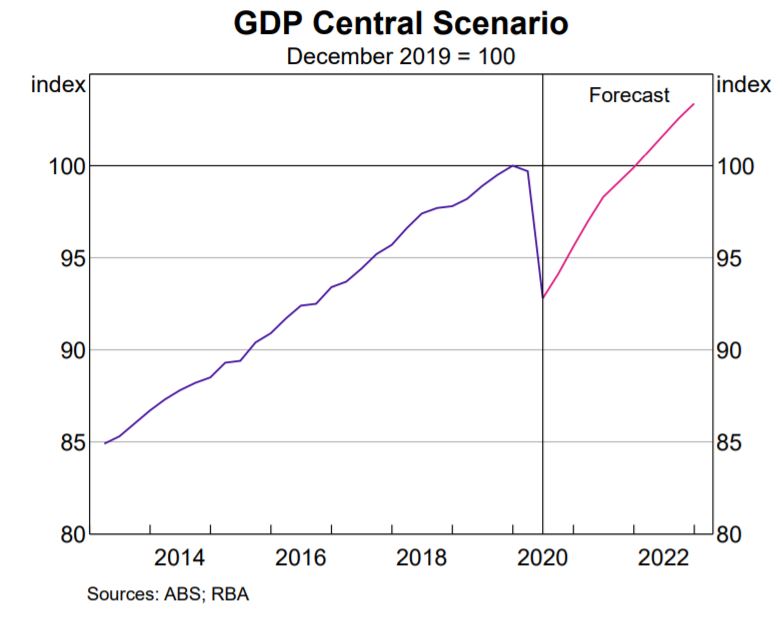

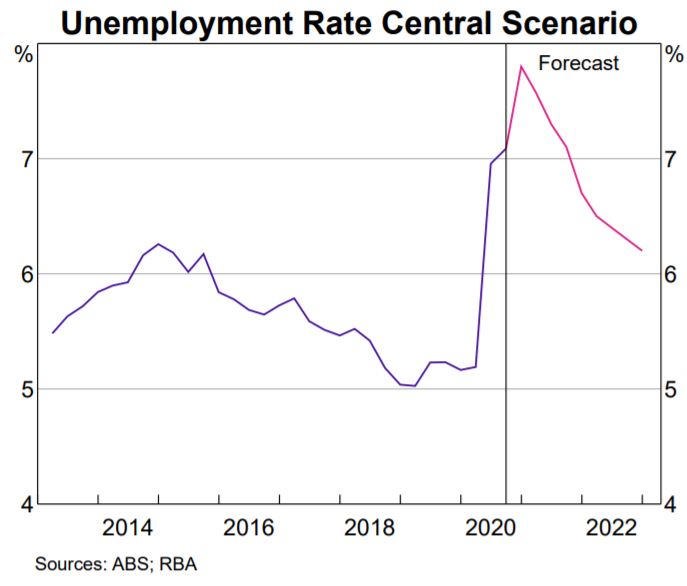

RBA Gov Lowe spoke to the Committee for Economic Development of Australia Annual Dinner this week on Covid and economic policy. The speech was worth a read. In short, GDP should bounce back. Baseline indicates that it may however take to the end of 2021 to get “back to” end of 2019 levels.

Unemployment may still be over 6% by the end of 2022.

He thus proffered that he saw little reasons why wages and prices would push higher in the next 2 to 3 years. Hard to argue against that theme.

But then he deviated from standard script and looked to explain where RBA may focus in the future. Whilst many Central Banks had almost a zealotry towards inflation control, he reminded all of RBA’s mandate “to promote price stability, full employment and the economic welfare of the Australian people.” With Australian population growth to be stuff all in the next few years he made it clear that priority will be given to employment over price stability (inflation).

Understandable ethos, but how will he/they do that:

- Keep rates lower for longer even if short term inflation becomes evident

- Keep rates lower to keep AUD lower (make Australia more internationally competitive = more jobs)

- Being more involved in the quantity of money available – via Quantitive Easing’s.

He also made what felt like a plea to Australian businesses to not become too risk adverse and push into technology via investment for productivity gains. There was a concession that productivity levels in Australia have steadily declined in the last decade. Funny to think that my long boozy lunches in the 80’s and 90’s were actually productive…

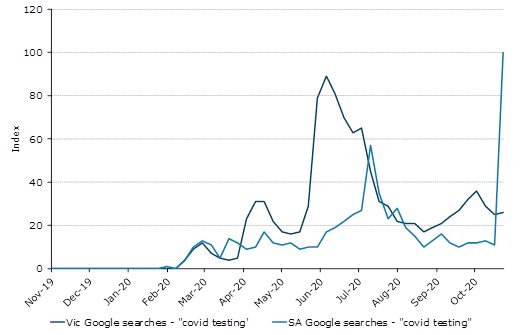

Covid made its way back to Sleepytown aka Adelaide this week. In scenes reminiscent of Victoria, key players involved medi-hotels, security and takeaway food.

Chart below tracks Google searches for Covid testing in Vic and SA.

US GDP figures late next week, but the week ahead looks pretty lean for new data releases.

I get asked occasionally why so much focus on the Aussie energy sector. I think it has largely to do with our mantle as “the Lucky Country” – a land blessed with infinite resources. More so, I get very frustrated by what I sometimes see as lazy politics and lazy economics.

In 2004 Blockbuster had just shy of 10,000 stores worldwide. In 2000 Netlix approached Blockbuster will an offer to sell to them for $50M. They were seen as too small and rebuffed. Blockbuster filed for bankruptcy in 2010 and Netflix worth is circa $200 Billion at present. As Julia Roberts said in Pretty Woman….”Big mistake…”

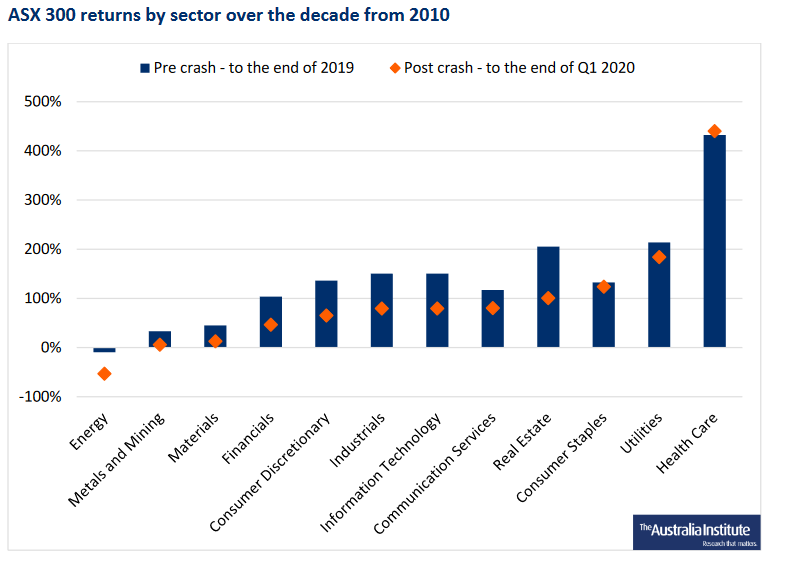

Energy is important, and I like the lights to work. But who is doing the heavy lifting required to ensure Australia is not the next Blockbuster. The market has spoken. Energy has been the worst performer on ASX300 for the last decade. Banks got smashed this year, but still are 100% higher in value. I had a look internationally and it is the same story.

It is an incredibly capital intensive industry, and long term investment and planning is critical to success in the sector. Who is going to step up to the plate?

At Federal government level all I hear is crap about gas led recovery and hydrogen technology. In opposition Albo and Funky Gibbon tear each other and the party apart as they vacillate on Climate Change policy and good clean coal.

Biden’s election win to me should only help sharpen our mind on the task.

To them both, I quote John Kennedy…”Don’t think…do”. Maybe think just a bit.

Thought of the week.

Finance Brokers…love them, hate them or need them?

Black Swan has spent a lot of time over the years representing Banks to Brokers.

Over that time the perspective that Banks had for Brokers varied. At times “we” kissed and courted and others we fought like hyenas.

One well respected Big Four CEO once told me, she (clue there) wanted to “wipe brokers off the map”. Banks were there to service customers…direct.

The reality is that Banks have trimmed their weight down so low, they are having real trouble servicing existing with any success. With loyalty to Banks at all time lows, the back door is open if a better offer is presented – something brokers are more than happy to present. From the Banks perspective, anything out the back door needs to be replaced via new business – something that is no longer a strong suit of bankers. So brokers can take…but also give. A symbiotic relationship.

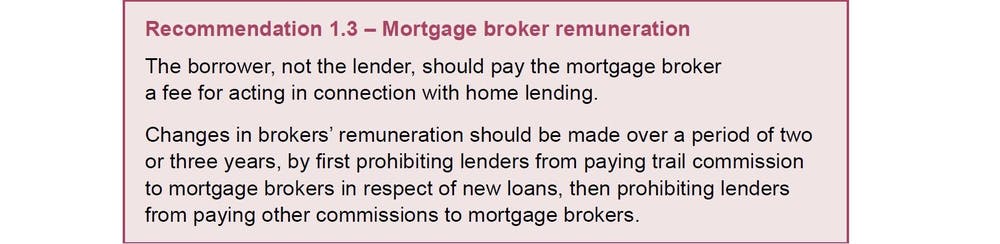

The Banking Royal Commission looked deeply into this love affair. A key finding was via the usual path – follow the money trail.

Initially the government was committed to accepting and implementing all of Haynes’s recommendations. This commission on trail would have been in effect as of July 1 this year. The key theory behind the recommendation is that eventually “someone pays” for the brokers commission from banks – and he feared it was been shared across all borrowers. In other words if you didn’t use a broker your rate includes an effective subsidy for someone that did. He wanted a more transparent user pays system.

Brokers wailed and screamed – it would be the death of a very needed and important part of the finance industry (they claimed). Secretly many brokers were soiling their pants thinking no one would actually pay them for service. Within 5 weeks Joshy Frydenberg back flipped and put all the Recommendation 1.3 on ice for review in 3 years.

My view? I wanted 1.3 to be enacted. From my experience it would have weeded out the worst and most incompetent within the industry – of which there are many. Yes, borrowers don’t like paying for sub optimum service or a tick’n’flick document filler.

The industry would instead need to focus on value add – to Banks and to their customers/borrowers – and justify money charged.

I know many brokers that actually wanted the change for that very reason. They are confident that what they bring to the table delivers better outcomes – especially of course in business funding over straight home mortgages.

Seek these brokers out if you have a need – they are the good ones now and will be good in the future. Let Black Swan know if you want an introduction.

We will see what 2023 brings for legislation, but I fear the chance may have been and gone.

What is Black Swan drinking?

Not bought by Black Swan, but I wrapped my lips around a fair bit of this beauty. Mate chose it at our local at a price point well above cheap and cheerful (circa $120). From a very well known part of Burgundy, this pinot had some serious fruit flavour and the balance that the frenchies do so well. Have with good friends, chocolate, cheese or well – air.

And listening?

For our brothers in SA, a upbeat Stones version for you to survive the next 6 days.

Until next week.

Cheers BS