Bias – I say bullshit

17 July 2020

Hard to put an update together. I get a sense that we all have “unprecedented” financial fatigue. Even record data releases are looked past and over. Meanwhile the equity market generally holds together.

32 million US workers unemployed – more than the entire Oz population. Yet June Retail Sales up 7.5%, well above market expectations. Covid-19 infections over there are well out of control. Majority of States are seeing rising cases and deaths, whilst ICU beds are fast running out again. You would expect the worlds largest economy (if China haven’t already passed it) to slow rapidly in the back end of the year.

So much for the theory that Covid doesn’t like warm weather. Looks to me like it has packed its towel and bathers and gone down to Florida to catch some rays.

All now rests on a swift roll-out of a vaccination. USA are throwing billions at it, and Trump needs a miracle to save his arse by November. Even if polls are notoriously wrong, he look to be in a world of pain at present. Can you imagine the shitshow if and when this vaccination is rolled out and the USA has bought the entire world stocks of it? That in itself could see the globe enter a very volatile period. Maybe the Chinese can roll out a cheap knock off quickly??

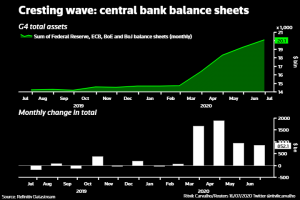

Maybe the broader financial market is betting on the too big to fail strategy? A fair bet if you see what Central Banks have done so far.

Natural bears/pessimists like me can’t but help think of what will happen if the Central Banks turn the taps off or say enough is enough. But then rational thoughts persist – they have come so far to date, why would they change tune? Certainly the pace has slowed but expect a good chance of a second ramp up.

Australian employment figures released yesterday showed unemployment at highest level since 1998 – long version of the #1 hit of that year:

Unemployment in the mid 7% doesn’t sound so bad, and even “record” number of jobs created for the month (albeit mainly part time). So all good then… except unemployment is probably closer to high teens in percentage terms.

A blunt warning from ANZ exec Mark Hand late last week. “We’re not forgiving repayments, the interest is being capitalised. So whilst interest rates are low, the debt that you have at the end of the deferral period is higher than what it otherwise would have been. So that will put a strain on the cash flow of a family or of a business,” he said. He was referring to home loans, but earlier comments from the same shop aimed at businesses was very similar.

Even ScoMo has referenced “Zombie Businesses” – companies that are dead but just don’t realise yet. Certainly my old banking shop holds a view that if you are a crap business going into Covid, you will be even worse on the other side – and maybe just call it a day. Be careful zombie businesses are real..

I want to finish this week by quickly covering “bias”. We all have it – either conscious or unconscious. Sometimes this bias can be a very rational thing and work to protect us. Other times our brains can let us down.

As a little aside – a test for all you smart readers:

A cricket bat and ball are for sale for $110. The bat costs $100 more than the ball. How much does the ball cost? **answer below

When you are discussing your investment strategies with your broker or adviser, or perhaps your borrowing needs with a bank you need to clearly understand their bias – and in particular any personal interest bias…even if unconsciously delivered.

Brokers and Advisers are less likely to “churn” than in the past, but they don’t get paid by advising you to do bugger all. They want you to DO something.

Credit Managers have a natural bias that you are all crooks and will default if at all possible. They don’t want you to do anything!

Bank Relationship Managers were nice people but generally have been neutered by the Big Bank systems and cannot make any significant decision or commitment. But understand they have boxes to tick, and generally would rather see you borrowing more than less, and don’t like loan repayments.

And then there is your bank Market Specialist.

This one deserves more space that available today – so until next week.

Aussie dollar cracked through 70 cents but is resting just under that level this morning. Still expect it to drag higher over coming weeks.

Yields are range bound for now – trapped between wanting to fall lower on the back of Covid outbreaks and new lock downs, but reluctant to move as the possible UK vaccine gets closer.

ASX 200 above 6000 after a good last few weeks.

Oil at $40 USD a barrel. Better but still below a number of producers costs.

** The ball costs $5

Ball $5 plus the bat ($5 plus $100 more is $105) $5 + $105 +$110.

Most of us (me included) would have defaulted to the ball costing $10. Our brains are inherently lazy and seek to make things as simple as possible.