2021 Edition #19 – Lock it in Eddie – lock ’em in.

2 June 2021

Apologies for delay in publication.

I had exposure to a Collingwood supporter, so I have been isolating in a cave for a week, pending test results.

Victoria back in lockdown again – and all expectations it will go past the proposed 7 days. Melbournians that I speak to see resigned to their fate.

Markets keep being the markets.

I traded my “triple bear” strategy last week – so you should all feel confident now that equities will go higher for years to come.

RBA left rates at bugger all. They stuck with guidance that rates will remain at current levels til at least 2024. Some early indications however that they may taper the size of their bond buying QE programme. So at least some recognition that the broad economy (noting some holes) is tracking stronger than all expected.

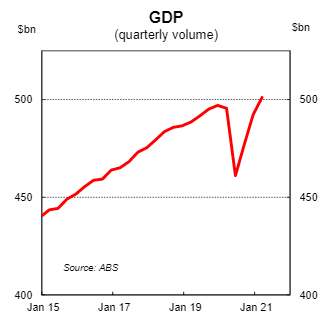

GDP data out today only support that strength. March end quarter rose 1.8% FOR THE QUARTER! Annual rate is only 1.1%, but significantly it is higher than pre Covid. The deep long recession just didn’t happen.

GDP was strong in most areas and high iron ore prices pushed nominal growth even higher. The wind back of Job-Keeper seems to have been well timed – but Victoria lockdown will no doubt test many small businesses. Victorian business investment will also suffer you would think – hard to commit to buying new equipment or putting on new staff if you are not confident that doors will be open.

On that front fortunately it is “not a race” for the vaccine roll out – or so we are told. And weasel words make it worse. I thoroughly understand the huge complexities involved. The humanitarian side aside however, it is a bloody race. The globe has pent up demand and Australia remains a desirable destination for tourism/education/immigration and investment. We MUST be match ready with our population protected when the doona gets lifted. Amazing how the doona was bad 12 months ago, but good now. Anyone would think an election is coming.

So on spin, it was amazing to see “everyone” was a legal winner this week. ABC claimed a win and Porter claimed a win. The media had totally different views depending on ownership.

My take is that the “missing 27 pages” of the ABC defence will be ultimately released into the public domain. If that happens pre election, Porter’s seat may fall with his standing. Has it been a kangaroo court of public opinion, and should we rank and file be concerned that it could happen to anyone? Is he a fit and proper member? Leave both those questions to you.

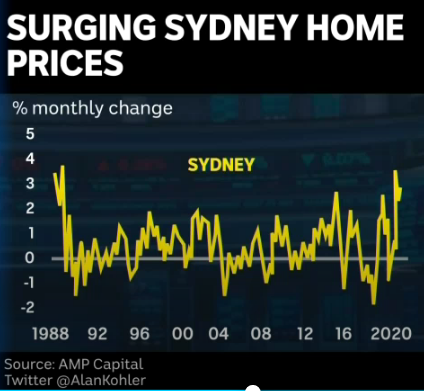

House prices (and housing approvals) are on the fly across Australia. No more so than Sydney.

Prices rising quicker than pre GFC and 2016 when the RBA stuck it to the Banks to tighten up credit standards and increase rates for investor loans. This time around, NAB has just announced that it is lowering rates for investor borrowers and RBA seem pleased. Forgive me if I get confused.

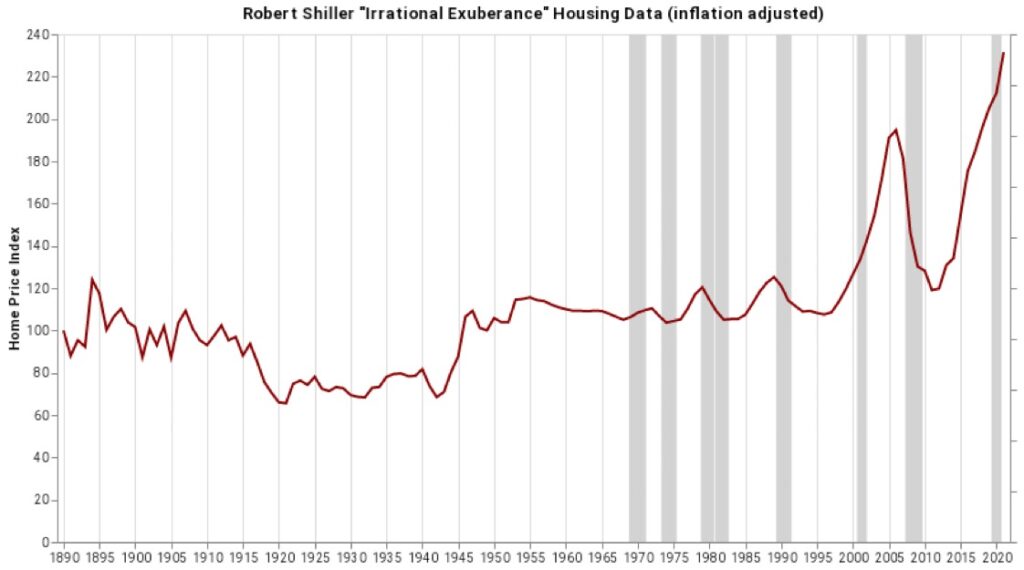

This issue is not just for Australia though. Charts below show exactly the same thing is happening in the USA. Prices rising quicker now than just before the sub-prime collapse in 2009.

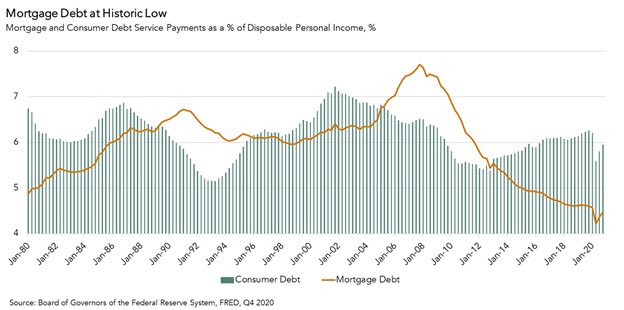

Of course you could rightly argue that that is standard economic rationalism working as it should, given how “cheap” debt is at present. Mortgage borrowers are paying less as a percentage than any time in the last 50 years (yellow line chart 2);

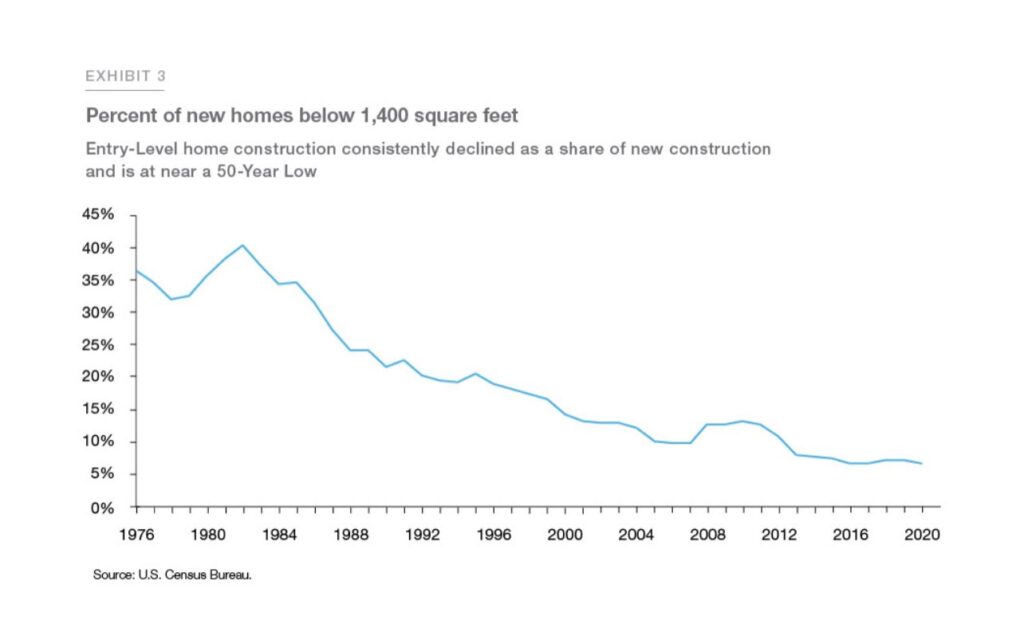

I found the chart below interesting as well. Maybe prices are rising because we all want bigger houses. US based, but back in 1980, almost every second house was below 1,400 sq feet (130 m2). Now that is one in every 20 houses.

My gut feel is it would be similar here, but if anyone has the data, I would love to confirm.

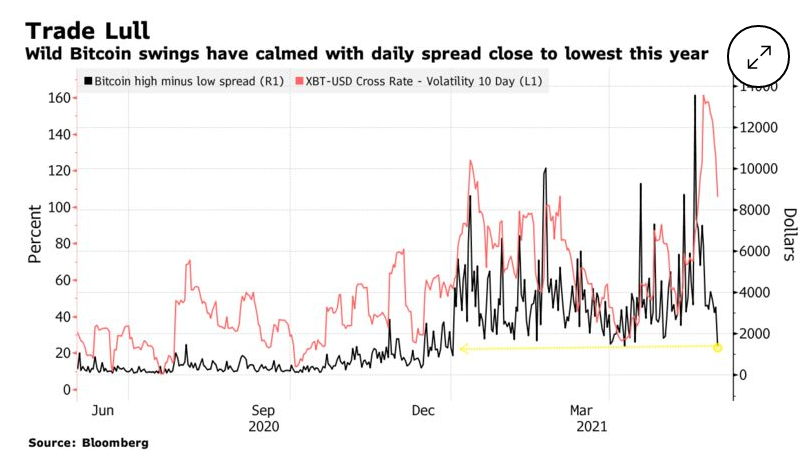

Crypto stories of disaster seem to be abating.

It would be easy to jump on kicking a sick dog, but Bitcoin at least seems to have formed a base. Bloomberg even suggest that the fall in volatility over recent days may be a bullish sign. Their chart:

In fact one of the larger holders (well less large now) of Bitcoin told me today, “I’m quietly not slitting my wrists…!”

But for me FOMO is not strong enough. One reason is fear of regulation, that one of our guest writers, Stark Dar shared with us all recently in Edition #12.

They have given us this link Biden crypto regs

It puts a fairly positive spin for the future. Stark Dar says however:

“Although it is informative, I think whoever wrote this piece is truly in fantasy land trying to cast greater regulatory scrutiny and oversight as some kind of good thing for the crypto Wild West. I have heard such rubbish from other crypto protagonists, and it is thoroughly unconvincing. That great hissing sound is the air coming out of the tires on the crypto dune-buggy….”

Of course Twitter is full of crypto warriors that support the concept and equally feel the need to put a counter argument out there. As one of our readers put it, if you saw this:

*- 27 trillion in circulation*

*- unlimited supply cap*

*- only 1 node*

*- 1% of holders own 30%*

*- 25% supply minted in the last 6 months*

*- 38 million notes printed every day*

*- loses at least 3% of value every year*

*- in a bear market since its conception*

Would you buy it? Plenty are willing to – because that is the mighty Greenback aka the USD.

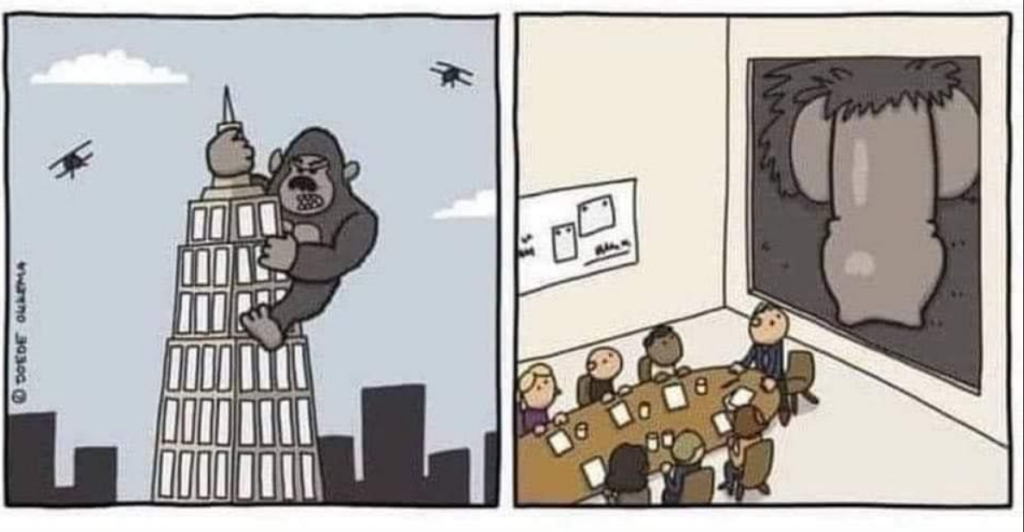

Maybe it is a bit like King Kong – looks strong from the outside, but from the inside is just one big balls up…

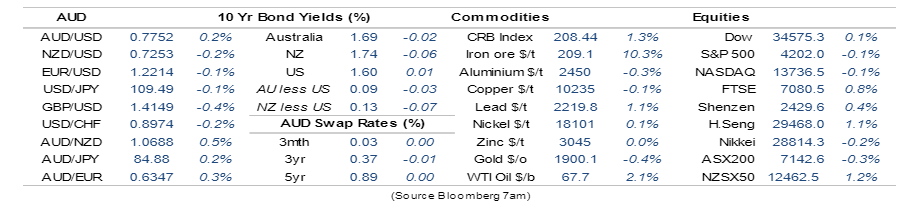

Another week of the AUD doing very little. Thus little to comment.

Iron ore off a tad on the week. The big climber is oil, hitting a two year high.

CBA data

Thought of the week. Inflation…get your TIPS out.

Of course, just about every issue above…house prices, growth, equities, crypto all hinge on one BIG thing. Some are boosted higher by current artificial pump priming. Some are held back. The big thing:

Inflation. The US Fed and and our RBA believe that have it completely under control.

In fact I hear the Fed read a prayer out before each meeting:

“Our Chairman, who art in Eccles, Powell be thy name.

Thy QE come, thy market run, with prices that rise towards the heavens.

Give us this trade, our daily bull, and forgive us our bearishness, as we forgive those who are bearish against us.

Lead us not into losses, but deliver us from fundamentals.

Amen

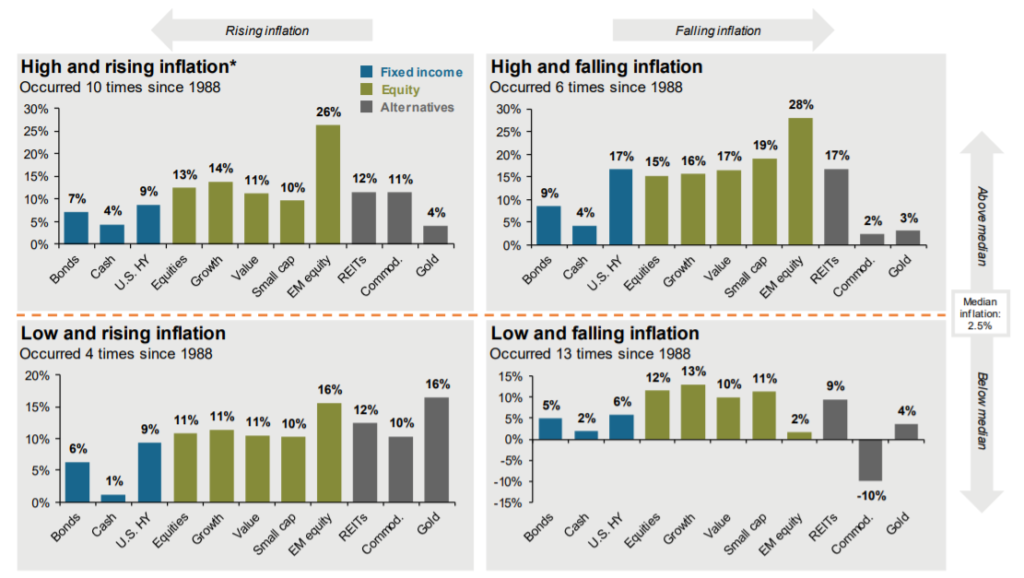

Found the matrix below this week, that tries (with a US lens) to analyse what happens when inflation is moving higher or lower.

Bottom left is my current pick and explains my recent gold purchase. My pick is 100% accurate – only the timing is in absolute question. 2022 or 2032 ??

There is another mechanism you can use to protect against inflation. You can purchase inflation bonds. In the USA they are called Treasury Inflation Protected Securities….aka TIPS.

They give a real return benchmarked to CPI.

I would normally suggest it would be a great time to think about splashing some cash and get your TIPS out.

But TIPS have gone a bit tits up lately for two key reasons:

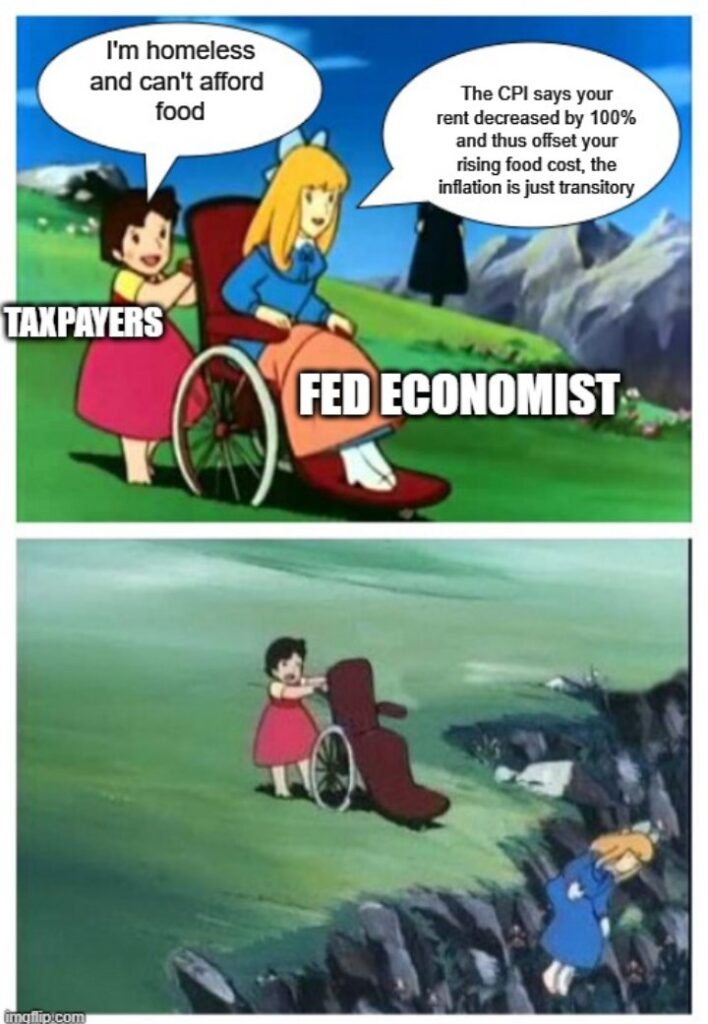

- The way the FED measures inflation is considered by many to be flawed. Price rises are often hidden, smoothed or excluded.

- The other reason is that the FED has bought back $175B of their own TIPS in the last year and now own over 20% of all TIPS issued. This has corrupted their trading prices to be actually a negative yield.

The way we measure CPI here in Australia is also open to question at times, but I don’t think we have the second issue problem. The Commonwealth have issued stuff all Indexed Bonds.

States issue them – but not very often. Of course as a holder of an inflation linked bond, higher inflation gives you a better return.

I remember years ago, my then girlfriend (now Mrs Swan) asked me to invest some of her recently retired Mum’s cash. It was “only” a ten year term, and as a retiree, I though inflation linked made great sense. From my arrow at purchase date, I didn’t get off to a good start with future Mother-in-law.

There are EFT’s out there that smaller punters can invest in if that is your bag. No recommendation (I’m not a holder with no plans to be) but Vanguard do one. Vanguard CPI linked

Drinking favourite…

Did a cellar inspection this week.

Found this bottle that looked like it needed drinking.

Knew little about it. Actually bought it at an auction of an iconic CBD restaurant that had shut up shop approx. 10 years ago.

Apparently made by Geoff Merrill and hails from between Maclaren Vale and Adelaide.

Cork actually came out okay.

It poured more like a pinot noir than a chardonnay.

It tasted more like apple cider than wine.

Remember – don’t keep aged wine just for sport. Drink it before it is wasted.

0/10

Listening to…

I mentioned Moby a few weeks ago, and low and behold he releases a new album – a quasi mish-mash of old songs.

I read an article last month that his personal low point was waking in a strange bed one morning covered in poo – not his….and no recollection of how.

We have all had our lows, but that alone makes this album worth a listen. Natural blues to be sure.

9/10

Cheers BS