I could claim strategic and technical errors for delay, but truth is the market has me quite confused at present.

A bit like the ABC getting abused for being too left and being abused at the same time for being too right, I’ve been told I’m being too pessimistic on the market in the last issue…and too optimistic.

So :

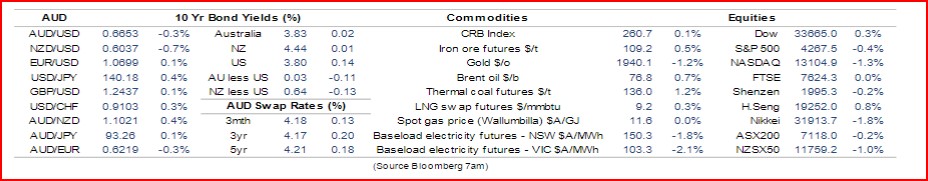

The ASX is up 4% year to date, yet my portfolio is off by near 10%. Not helped by my bank stocks that are wobbly in the knees – see later.

I would have suspected a bigger uplift in market mood following the successful passage of the US debt ceiling. I suppose no one expected anything different, but I did see a risk that the GOP would rather see the whole house burn down than pick up a bucket of water.