2021 Edition #34 – Are we in Barney Rubble?

30 September 2021

“Barney Rubble” ahead.

Ethics and compromise. Are they two words not suitable or applicable in economic markets nor politics?

Big Picture

Part of the reason for market pull backs in the USA (equities down and bond yields up) is that the regular Federal dance between parties for a lift in the debt ceiling is heading to the wire. Republicans, perhaps under the instructions from the ghost of Trump, appear comfortable to see the USA fall apart for political gain rather than do what is “right”. Yes, the Congress have spent $28 trillion recently, but both parties had their hand in that. I believe the Republicans will fold later this week. Voters would tear them apart in the 2022 mid term elections if public servants are not paid and social service benefits are not distributed because the cupboard is bare.

The other issue is that inflation is back on the agenda again in the USA. Long-term yields have risen. All those “growth” tech companies that are not making a profit (yet) need very low interest rates to justify their valuations.

Like the boy crying wolf, I’m not fully convinced inflation is fully baked in. Just as many articles out that are calling on stagflation. Perhaps the market is looking backwards to 2013 when “taper tantrums” drove yields higher before a big correction. The FOMC almost seem keen to over communicate with everyone. “We will slowly reduce QE bond buying and rate increases will be some time off and moderate”. Mind you, how much stock you place on the FOMC is always questionable at the best of times. This week, two Fed regional chiefs resigned suddenly when investigated for security trading controversies. At best, dodgy.

Local

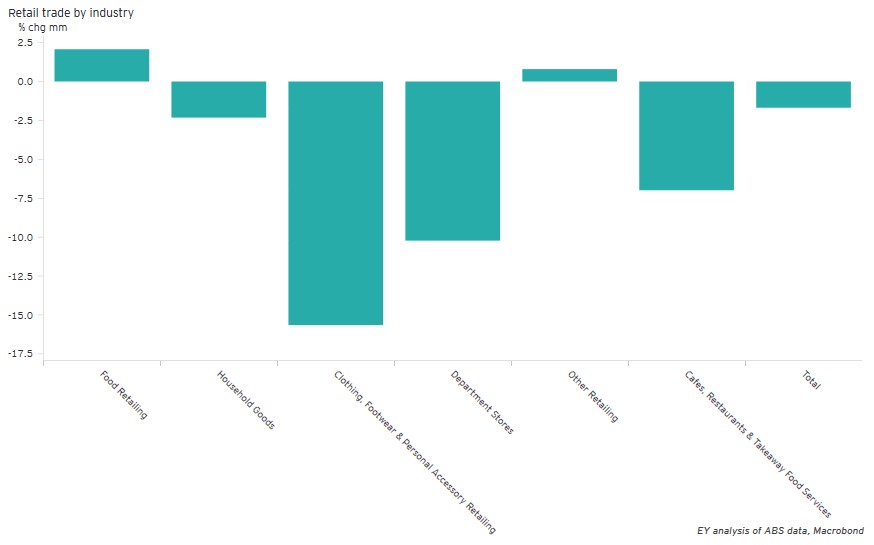

Retail Sales dominated the local market data releases.

August numbers fell by 1.7% following a bad June and July. Clearly lockdowns in Vic/NSW did not help. Proof of that is in the State breakdowns:

Department stores, clothing and cafes fared worst.

Food was the only sector that went up. Home delivery of caviar.

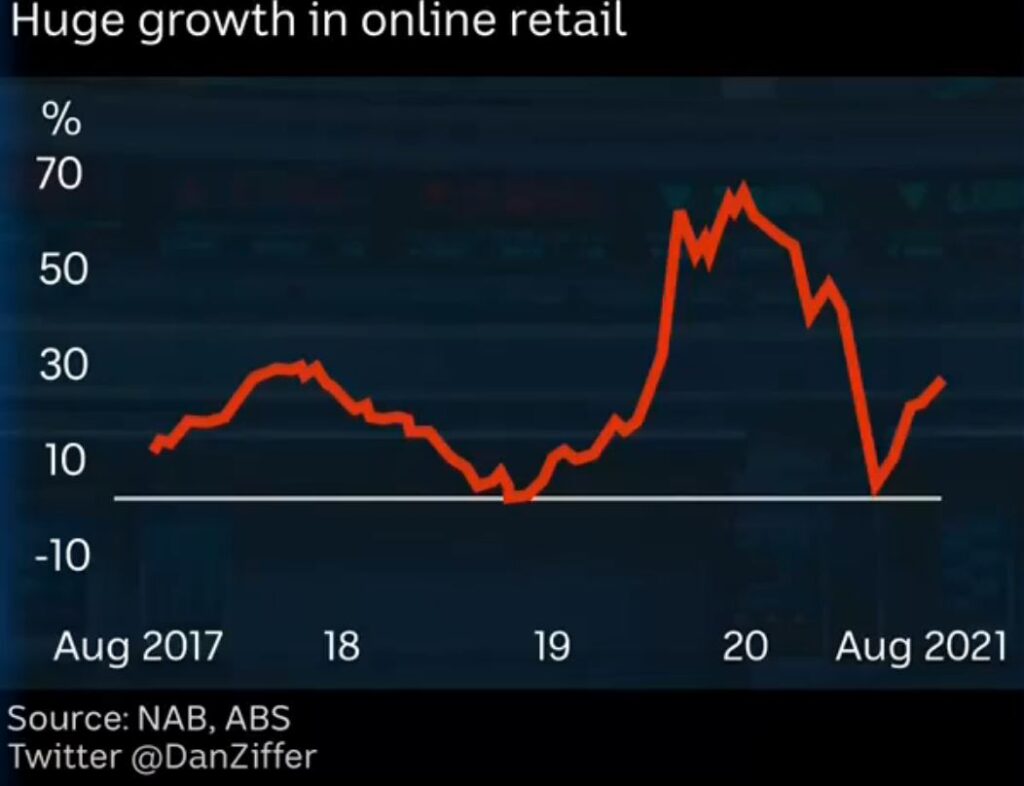

Our little mate with the wild hair on ABC, Dan Ziffer, showed the increase in online sales. Growth post the initial COVID lockdowns could not be sustained, but it is on the rise again. He did point out though, that as a percentage of all sales, online only accounts for 14% here in Oz. In the UK that figure is 24%.

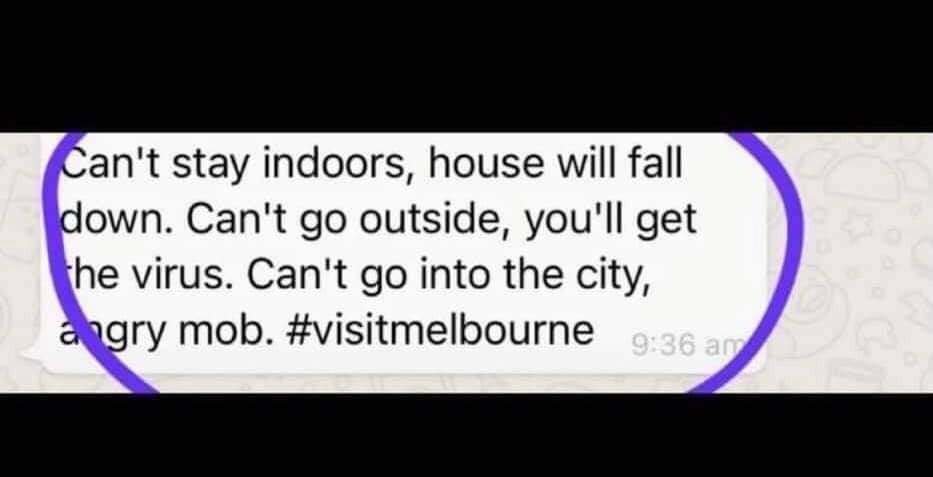

Not related to anything at all, but is Channel 7 taking the pi$$?

Housing

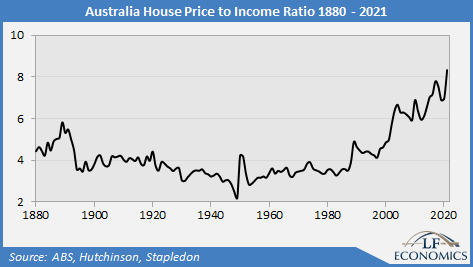

Talk is starting regarding who is responsible for getting house prices down. The Coalition seem to think it is all in the hands of RBA (via interest rates), whilst the RBA seem to think it is more a macro-prudential control issue – via the government ensuring only qualified applicants get a loan from Banks.

Chart below is showing a significant distortion in the market. House prices to income is higher now than any time since Captain Cook landed.

Certainly we can all argue that the balancing item is low interest rates that are making affordability as good as ever. Yes, but the big BUT is will this last for the next thirty years (no) and how will borrowers react to tightening rates.

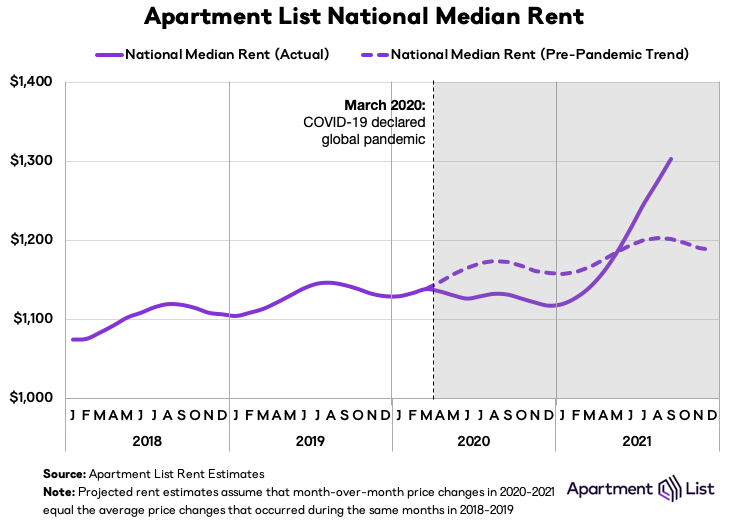

I don’t have rental data for Australia, but below is an indication of what I think may be happening here too.

It is a real issue, especially since many young people will be renting for a lot longer as they chase their tails trying to getting a deposit saved up for a first home buy.

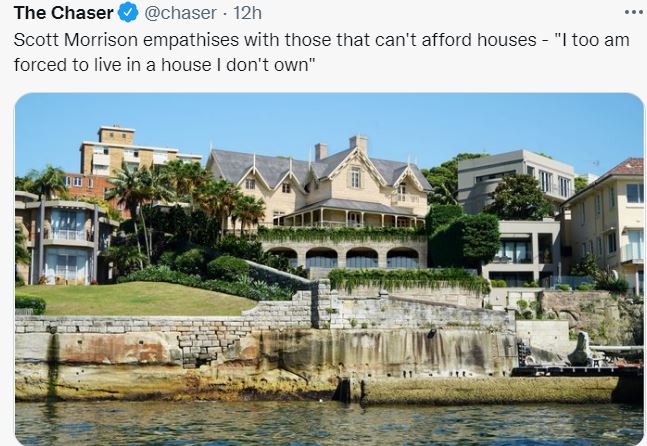

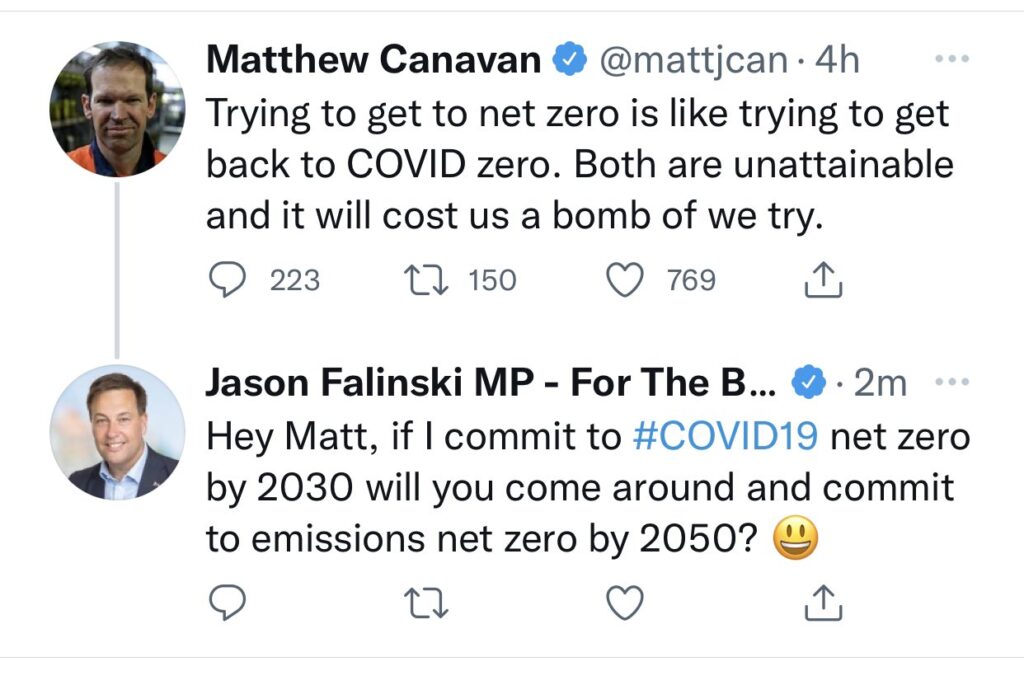

A contender for tweet of the week:

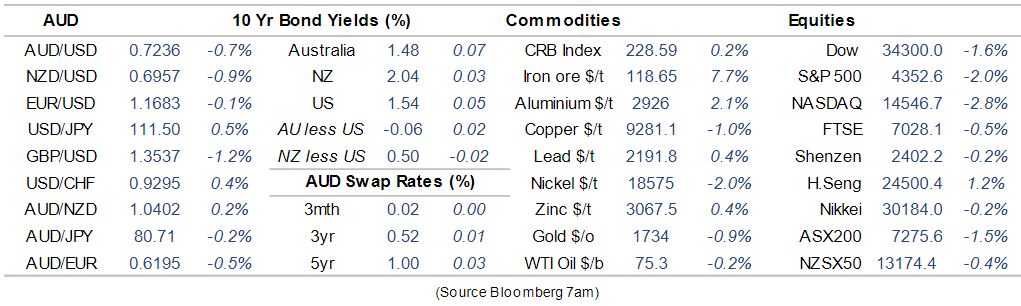

The Aussie Dollar:

Bugger all change on the week.

More focus on oil and gas prices this week. Particularly so with the UK having severe energy issues. Gas prices have sky-rocketed.

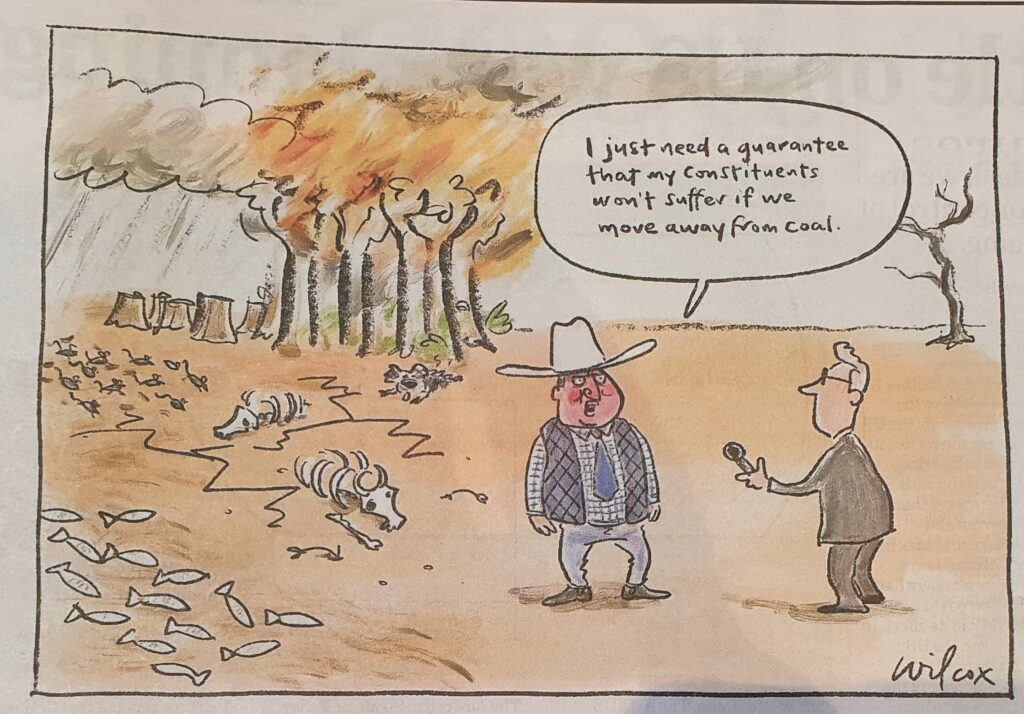

Our beloved leaders with a vision, aka Barnaby and Matt Canavan, jumped with glee upon UK’s issues. All it’s problems, according to them, is a result of too fast a transition away from coal.

This is true to some degree. But is is also a failing of the UK government to foresee a few key challenges. They have a heavy reliance on wind, but this year wind levels have been calmer than for many decades.

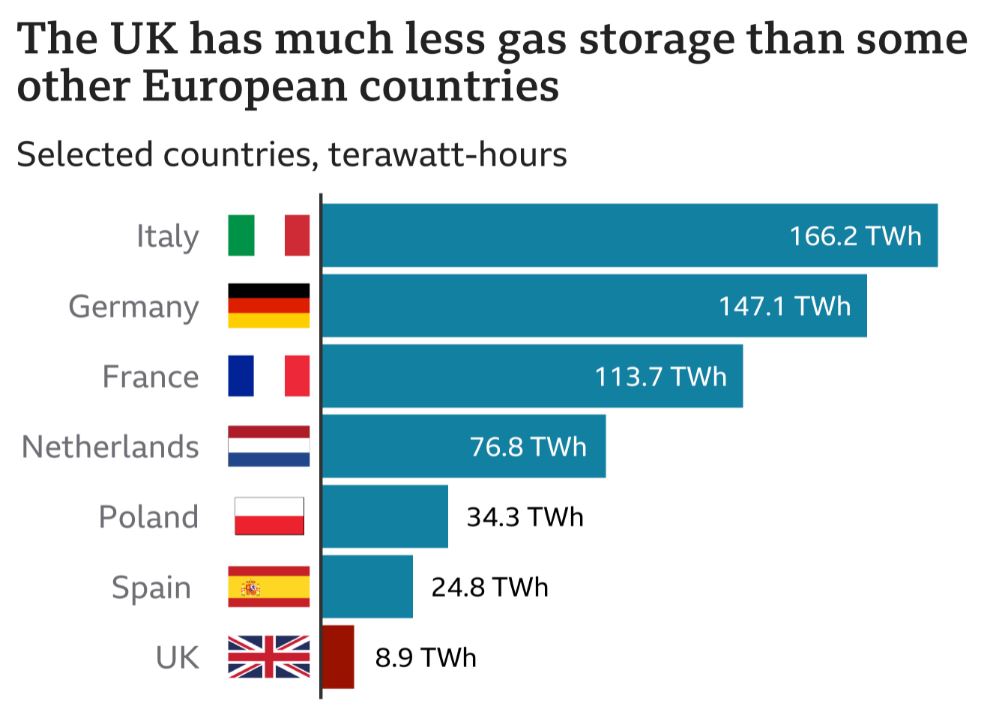

The other issue is that with falling gas supplies from their North Sea reserves, they import gas from around Europe and beyond. After a cold winter last year, reserves have been depleted. Worse for the UK, they hold so much less in reserve than many other countries.

So yes, a problem, but one of their own making.

Meanwhile, a totally unrelated truck driver strike has seen oil deliveries to petrol stations impacted. Much like a toilet roll run, the more Boris says stay calm, the more people are looking to run like Boris. All logistics, no sense.

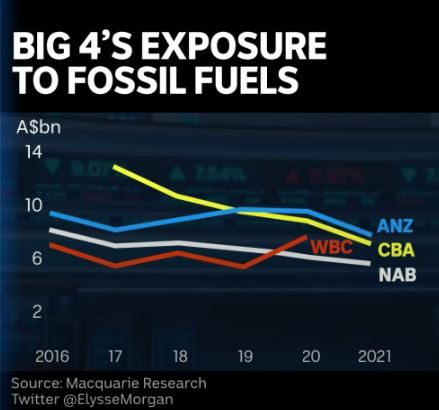

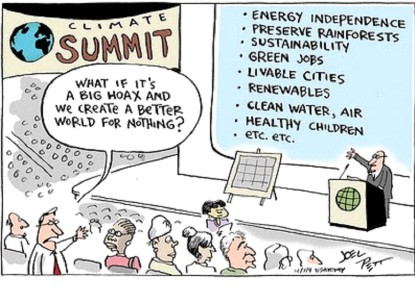

I refer Barnacle and Matt (and Peta Credlin) to the Big 4 Banks (minus WBC) for their view. Even China are now officially out of funding offshore coal power production.

In the interim, the Glasgow Summit approaches and SlowMo is getting squeezed from every which way. Even his ex-Prime Minister is giving it to him.

By the way, am I the only one that thinks it is a strange coincidence that Rupert Murdoch’s Newscorp and Sky News changed their collective position from climate change denialists to activists a few months ago – just weeks before Josh Frydenberg and a few of his mates start campaigning for climate action?

CBA data:

Crypto and Gold land

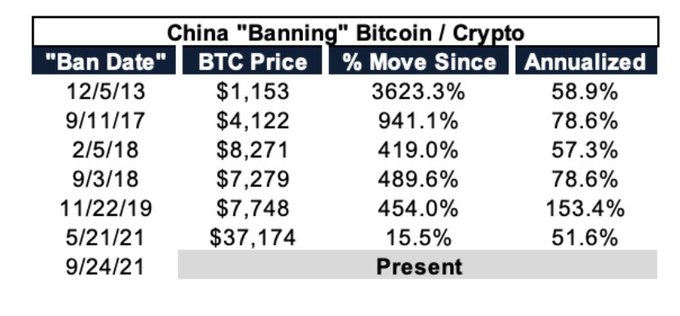

The big deal last weekend was China making all Crypto illegal.

My Ripple purchase finally got a bit of volatility. Down significantly.

To my surprise it bounced back (not all the way) pretty quickly. Apparently China ban crypto on a regular basis. #7 apparently. Chart below benchmarks China’s impact on Bitcoin – not overly significant.

Gold going nowhere.

Not there yet, but…

Thought of the week. Various…

57 years ago this week in 1964 something special happened. Yes, Melbourne F.C. won a premiership.

That was important.

But bigger news was Gilligan’s Island first appeared.

It started the argument that still rages today. Who was better: Ginger or Mary-Anne? Just sit right back and hear a tale…

Elsewhere… It took SA Parliament 27 years to pass it’s recently re-introduced voluntary assisted dying Bill. Many Senators argued this year that it was being “rushed” through.

However, a Bill to knobble the SA ICAC was passed unanimously within a day.

Many say the SA ICAC did not operate very effectively. Maybe so, but now potentially corrupt politicians will be investigated by the SA Ombudsman. You cannot but believe that elected parliamentarians’ have chosen to protect themselves over that of the appearance of trust and integrity. Maybe gives some sense to why SlowMo committed to a Federal ICAC over 1,000 days ago, but hasn’t been able to get around to it yet.

Drinking favourite…

An interesting bottle this week. You may have noticed I don’t drink a lot of Cab Sav these days.

Another that was $15 at release in 2006. Appreciation to 2021 to $100.

Cracking wine with great depth and subtle tannins.

Listening to…

I might have used Lime Cordiale before. But I like Apple Crumble.

Finish with some solid toilet humour…

Have a good week.

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

Cheers BS