2021 Edition #32 – Better than naval gazing

14 September 2021

Naval gazing

Long one this week – but much is in the Crypto space that you can skip over if it’s not yer thang.

My biggest worry is the “irrational exuberance” of this market. As Yazz sung it appears… the only way is up.

A week of modest but steady pullback in the equities market is, I think, generally a good thing.

As you may be aware, share market professionals tend to bunch assets into two buckets – growth stocks and value stocks. I was sent a great read last week about the USA’s appetite for growth stocks. Chasing the next big thing.

Like us here in Oz, they have a large wedge of superannuation funds that comes in every month – and much of it enters the stock market as “new” investment.

The chart below is MASSIVE. It shows more than a quarter of every individual US stock is valued at more than 10 times the value of annual sales.

Whilst we may look more often at earnings per share (EPS) as a valuation tool, this chart flags some scary levels. The 1999 tech-crash was the last time it was higher – and pain followed.

In plain English, this means people are buying stocks at a premium in expectation that the FUTURE will be brighter than now for these companies.

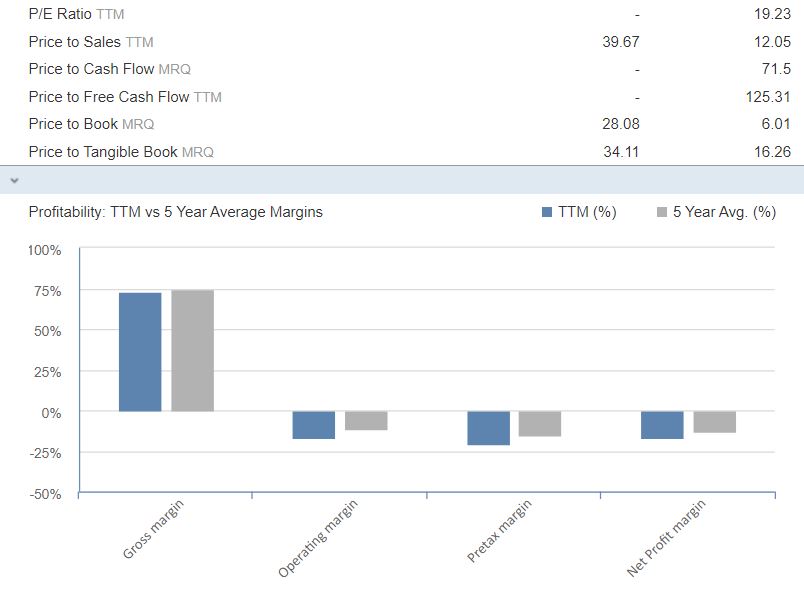

Let’s use AfterPay as one local example. As you can see below, it is trading at a Price to Sales of close enough 40X. In fact, it has never made even $1 in profit yet, so Price to Earnings can not even be calculated.

With a share price that has moved from $80 in May this year to current $127, buyers NEED a brighter future to justify that price.

Board’s and CEO’s of these growth stocks often lie awake at night knowing that everything, and more, needs to go right to hit those lofty future targets. Or perhaps more often they lie in bed planning their exit before the music stops.

A bit of blue sky optimism is not only a nice thing to have, but a necessity.

But value stocks are often not the pretty Prom Queen… but they are the ones most likely to deliver a dividend… and a more predictable share price behaviour. For example, whilst I have been negative on Banks for some time now, they still sit prominently atop my portfolio.

To me the growth stocks are sometimes similar to the crypto world – driven by FOMO (fear of missing out). The great economist, John Maynard Keyes understood FOMO in his 1936 works on market behaviour. He didn’t called it FOMO, but rather Animal Spirits. Fundamentally, he postured that human emotion often overruled intrinsic value. He covered both bubbles and crashes because the swing moves both ways.

Here is my animal spirit…

Anyway…. that is a long diversion towards my initial point that a check on the perpetual upward momentum is a good thing.

Reasons for the US pullback was varied.

- Inflation fears rose again (yes/no on transitory)

- Delta Covid getting a grip on some States and may slow economy

- China syndrome

As they said in The Castle… The general “vibe”

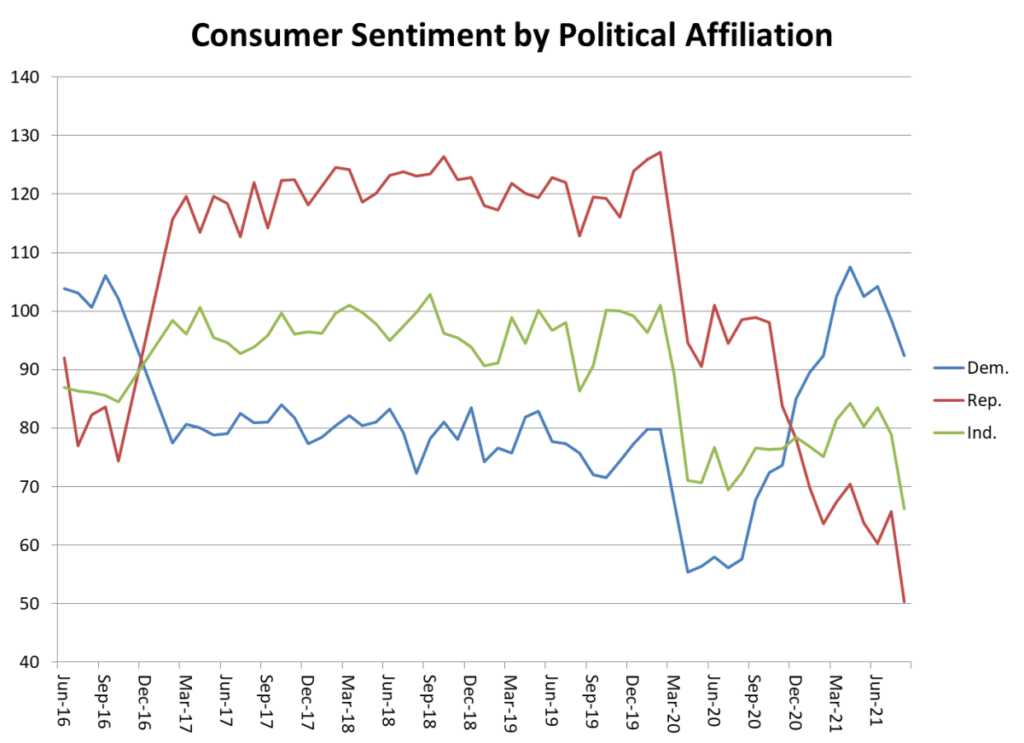

I did see this other nifty chart below. Like us, the USA have a consumer sentiment survey where a score of 100 means there is a perfect balance between optimists and pessimists. Although this one measures by political party affiliation.

Democrats have fallen below 100, but in pretty good shape. Republicans are at 50 – a score that usually is associated with a deep and severe recession or depression. No wonder there are issues with civil disobedience. Many feel there is not much to lose.

China is also ruffling USA’s feathers in two ways. Firstly, they have suggested they may just run a couple of their Navy warships past the coast of the USA… just as a bit of fun…

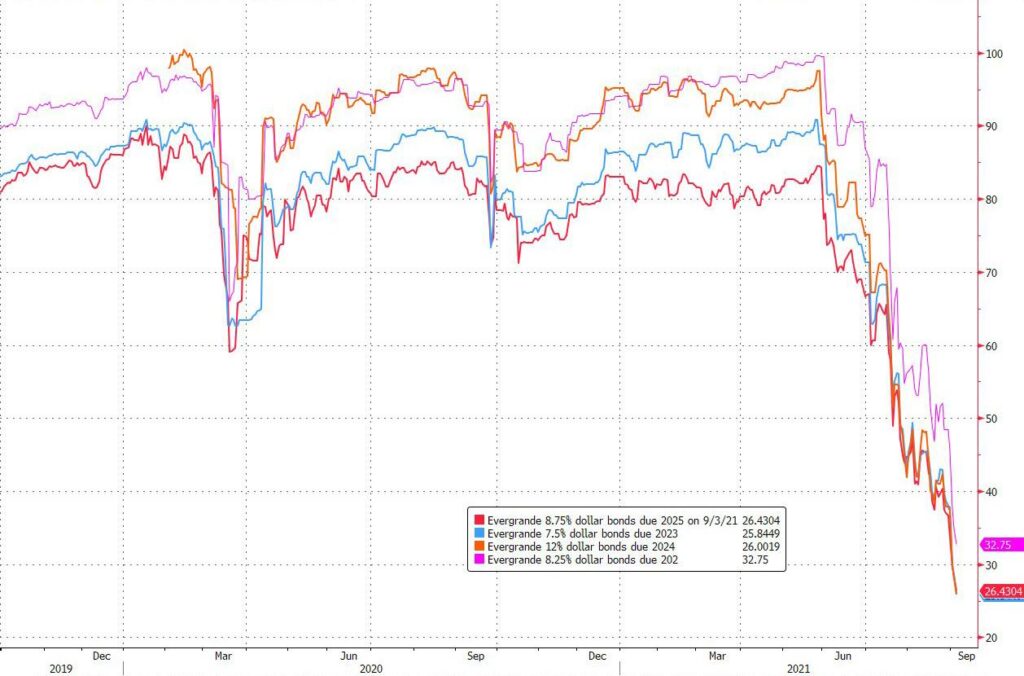

Secondly, we talked about the huge Chinese property company Evergrande a few issues back. They have a market cap of circa $300B USD. Their bond values fell by 25% last week when rating agencies declared a default is likely. Many are calling it a possible Lehman Brothers moment – where interlocking debt and connections start a domino contagion. Still just one to watch at this stage, but this one will not just affect China.

The VIX (fear) index is higher, but in my mind, not enough given issues above.

The Aussie dollar lost all those friends at 74 cents. Starts the week at .7350.

Employment this week will most likely give it a direction either way. CBA are calling employment much lower (-300k vs -80k market expectations).

That number would scare many if true, and the AUD could be looking at a 72 handle.

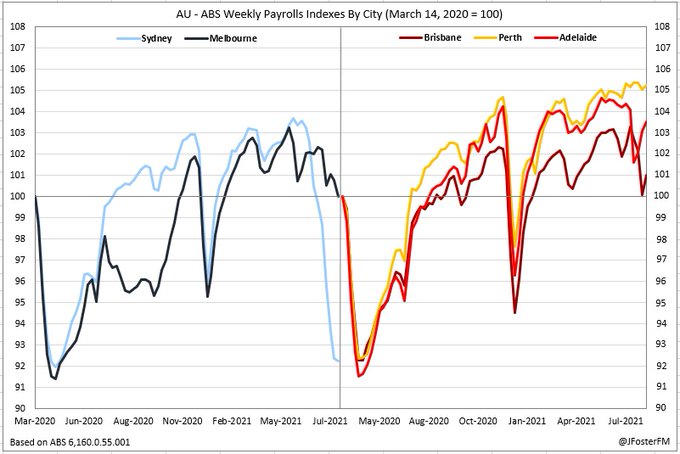

The chart below shows the payroll effects of the lockdowns in Melbourne and Sydney (LHS) compared to the rest of “free” Australia. Employment may actually follow that same trend.

CBA data:

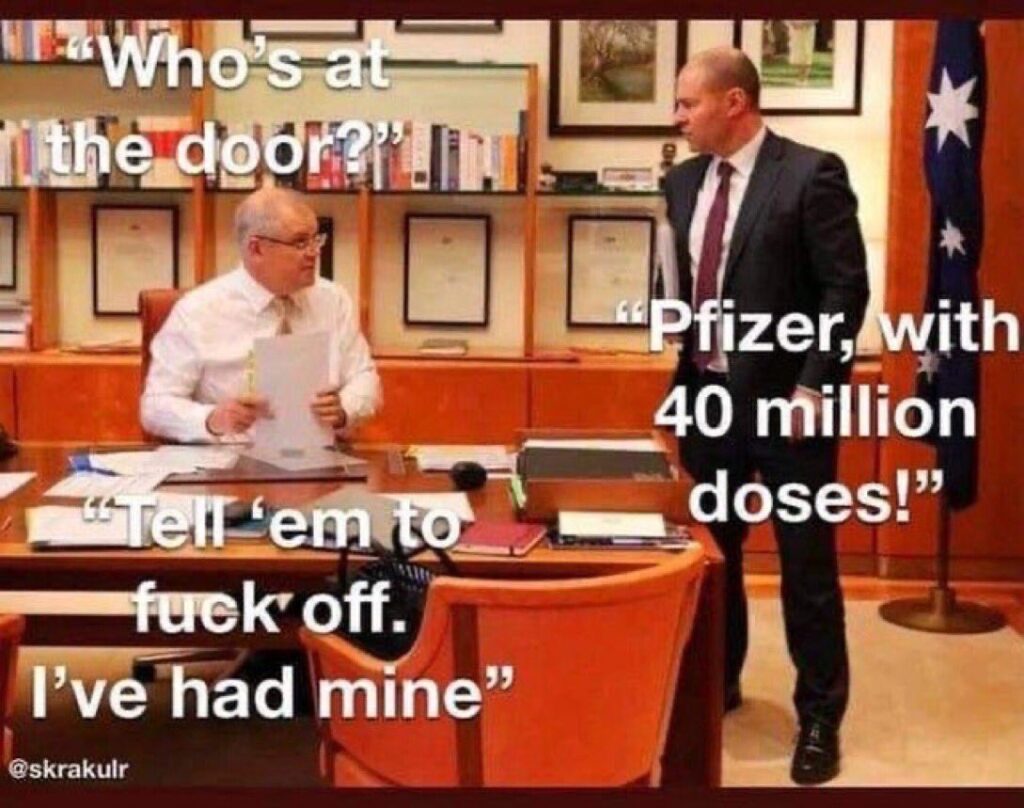

My Tweet of the week:

Crypto and Gold land

Gold up marginally again, but certainly not enough given the multitude of issues above.

Interesting quote last week: Riksbank Governor Stefan Ingves: “Private money usually collapses sooner or later. And sure, you can get rich by trading in Bitcoin, but it’s comparable to trading in stamps,” he warned at a banking conference in Stockholm. Earlier this year, Ingves said that cryptos as a whole are unlikely to escape regulatory oversight as their popularity grows. “When something becomes large enough, factors such as consumer interests and money laundering enter the picture.”

Negative Nelly, but we have something “special” this week.

A keen reader and equally keen crypto player has decided to share (at least part of) his portfolio strategy with us.

>>>>>WE STRESS THAT THIS IS NOT A RECOMMENDATION OR ADVICE>>>>

XRP (Ripple) Play:

What is XRP:

https://www.forbes.com/advisor/investing/what-is-ripple-xrp/

Black Swan take (with possible ignorance) :

Behind the XRP, Ripple itself looks like a mongrel looking for a home. Happy to play in folding cash stuff as well as all blockchain and even gold. Any banker readers would be familiar with the Swift system for bank to bank currency movement. I don’t believe Swift can cater for cypto transfers and Ripple hope to essentially steal this profitable space.

XRP is the coin/token that is attached to the Ripple network… i.e. the same in many ways to say Bitcoin.

The issue with XRP appears to be that unlike many other crypto currencies, it is not totally decentralised. You would think this would help getting banks on board… some sense of regulation and control.

Unfortunately though, the US Security Exchange “sort of” feels that XRP is not like BTC, ETH and the others. Consequently, they instigated a legal case against Ripple saying that XRP was a security and thus needs a raft of regulations attached. The legal case saw the price fall. The legal case is coming to an end and most believe that Ripple will win and SEC will be left looking stupid. My immediate thought is if the SEC “win” would that not mean all crypto’s are securities – in which case the entire industry could implode.

Anyway – the player that has skin in the game tells their story:

“XRP has a market cap of circa $50B USD and is ranked #7 of all Crypto Currencies by Market Cap.

XRP is currently sitting at $1.50 AUD ($1.10 USD). XRP flew to $3.84 USD in January 2018 and has been as low as $0.13 USD in 2020. Many other top 10 Crypto Currency Alt Coins are up over 150% of their previous cycle all-time high achieved during late 2017 / early 2018.

Although many crypto purists (if there is such a thing) dislike XRP due to the fact that it’s not truly decentralized and has been designed to work with the banking system, it has a strong following.

Token history by Market Cap down to XRP:

- Bitcoin – Has achieved 220% higher than previous cycle ATH (all time high)

- Etherium – Has achieved 207% higher than previous cycle ATH

- Cadano – Has achieved 120% higher than previous ATH

- Binance Coin – Has achieved 1400% higher than previous ATH

- Solana – Launched in 2020 at $0.60 USD, currently trading at $192.52 USD

- XRP – Previous Cycle ATH: $3.84 USD, currently trading at $1.10 USD

Key assumption: the SEC’s court case alleging that XRP is a security with the implication that Ripple Labs (curator of XRP) had breached a number of securities laws – which was announced in December 2020 – has been the primary driver for XRP not performing inline with other large cap crypto tokens.

Based on the above, if Ripple Labs and the SEC settle, it would be possible (reasonable maybe) to assume a 150% uplift from the previous cycle ATH to circa $9.60 USD.

US Based Cyrpto Exchanges all delisted XRP after the announcement of the court case. I haven’t verified this next part: There are a range of crypto baskets which cover the top 10/top 20 crypto tokens by Market Cap. Based on my understanding, many of these have excluded XRP due to the court case between the SEC and Ripple.

The Big IF:

If Ripple and the SEC settle, I would expect significant upward pressure on price due to relisting of XRP on US Crypto Exchanges and inclusion in ETFs/Baskets.

There are also rumours that Ripple are planning to list on the NYSE post settlement with the SEC. If this occurs, I’d expect $15 USD – $30 USD possible albeit possibly for a brief spike.

Plenty of If’s but I’m loving the risk reward. Even if we assume 80% downside risk and a $10USD target, this is attractive for a small position.

How I’m playing it:

I currently own 16,250 XRP (having added 6,500 for $10k AUD earlier this week). My previous holdings are effectively free having bought 20,000 at $0.18USD in April 2020 and sold some to gain my initial invest back.

I have set a sell order for $12 AUD for 12500 XRP which would yield $150k AUD but leave me with 3,750 in case XRP achieves it’s design case, which was to supersede the Swift payment system.

Potential play for first time crypto specvestor: Purchase XRP at $1.50 AUD. Set sell order for 20% of holding at $7.50 AUD to take all risk off the table. Set another sell order for $x AUD (I’m thinking $12) for the remainder.

Black Swan summary:

Makes sense – even with the massive caveat that a lot of ducks need to align. I have even bitten the bullet and bought some myself (only smalls). This action by me alone could see the demise of the entire industry!

I should also mention that the moment I transferred funds to an online crypto exchange, my online banking system was locked – apparently to protect me from hackers… or maybe myself??

Thought of the week.

See above.

Drinking favourite…

Drinking with mates again….

Pizza – but good pizza

8.5/10

Listening to…

A tad more civil this week.

Peter Gabriel has been around forever.

My Body is a Cage is a personal favourite of mine. Reminds me of Mamma Swan who suffered severe arthritis for decades but like Con the Fruiterer, she no complain…

You will notice I have stayed clear of all politics and climate change… at least for this week…

Have a good week.

Feedback always appreciated….

If you want to write a piece – long or short, drop us a DM.

Cheers BS