USA – what could go wrong?

23 October 2020

USA – what could go wrong?

Possibly like me, you have been watching the battle of Titans over recent years, and wondered if and when China would pass the USA as the largest economy in the world. The thing is though, like so many things in this crazy world – it is a matter of which statistics you choose to use. The World Bank uses “international dollars”. Others use Purchasing Parity Power (PPP). Using World Bank as a benchmark it shows 2019 as:

- China $22.5 trillion, or 17.3% of global GDP

- USA $20.5 trillion, or a 15.8% share

More over, China have been bigger in each of the last five years.

I say this without any great feeling of joy – more perhaps frustration that our historical ally, is stuffing around. Two old men throwing punches that are totally ineffective. You could make a movie out of that…

Here is some data though that puts it all in perspective. CNN Business report that China’s GDP grew at 4.9% p.a. in the third quarter to end of September, following a 4.4% figure in Q2. They look highly likely to be the only major economy that will register a positive growth figure in 2020. China’s auto sales for example grew 12%.

Until last week, China had gone 2 months without a coronavirus case. They then had 12 cases appear in Qingdao (16th most populated city in China at 5.6m). So what did they do? They tested 10 million people in the city in a week – well over the entire USA.

China are also rightly criticised as been massive polluters and contributors to greenhouse gases. Yet unlike USA (and Australia for that matter), has the balls to call carbon neutrality by 2060. There are 862k electric car charging ports in the world. China have 60% of them, and growing. They are manufacturing new electric cars for sale to lower and middle income earners. Meanwhile the old world economies procrastinate and flip flop on how to deal with growing virus outbreaks.

On the upside Trump seems to have a foot in both camps..

As China continue to get the jump on the USA, budget deficits in The States will no doubt also continue to grow. As the world currency, all the above should see the USD greenback fall. This has already started to happen to a degree. That is the predominant reason why we don’t see the Aussie dollar falling far from current levels into the year end. Technicals support, and 71 cents seems where we are heading in the short term. (*update…there now)

Thought of the week – Negative the new positive.

RBA Assistant Governor of Financial Markets, Christopher Kent spoke this week on RBA and Monetary Policy.

I’d be a rich Black Swan if I had a dollar for every time someone asked me if rates were going to go negative. Until this week I was adamant in the no way camp. I’ve switched sides – sort of. But even if they do, what does it mean to a borrower?

Firstly – why would a country even consider negative rates? In my opinion the main driver is global competitiveness. The lower your currency is the cheaper your stuff is to sell overseas. This is true largely to the fact that a currency value is driven by its cost of “carry” – i.e. interest rates.

Countries defend negative rates via the well worn path of justification – we are defending ourselves against deflation.

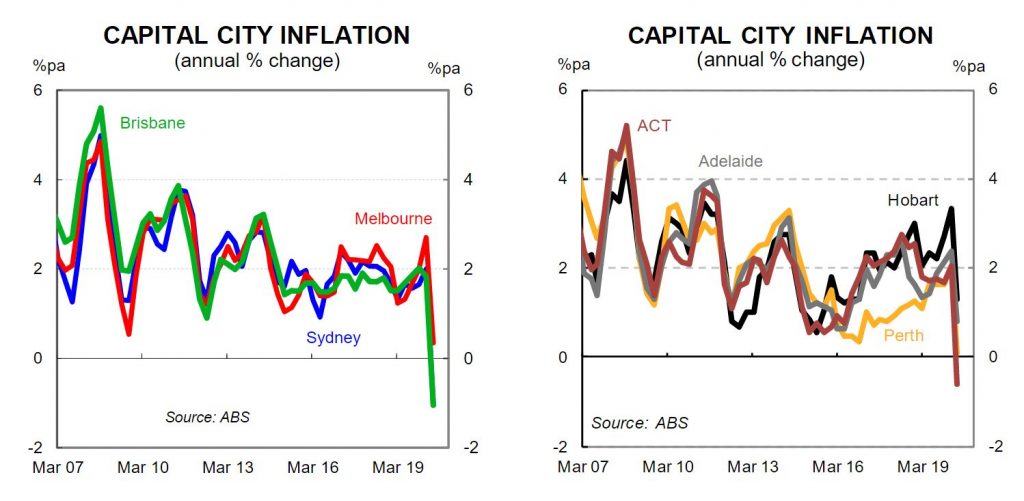

Australia could (perhaps) argue inflation is well below where we need it to be. CBA had State inflation figures this week. Pretty dire.

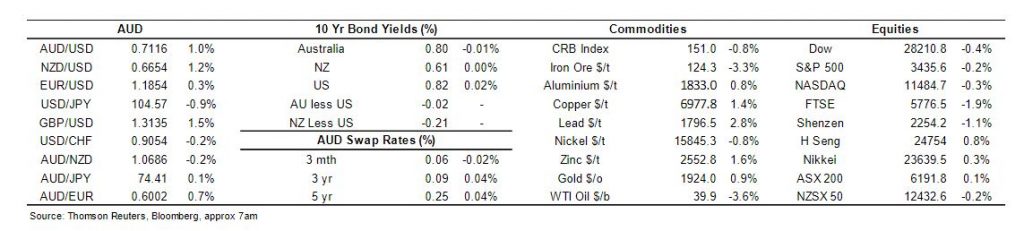

Table below shows were we sit internationally.

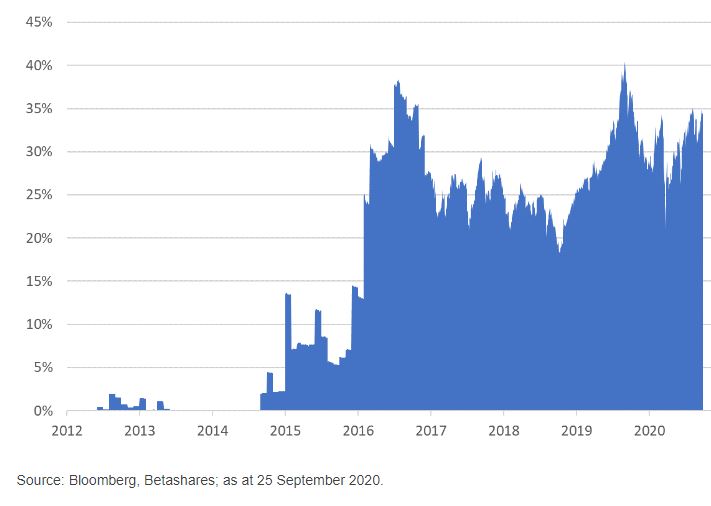

Last table for now – the percentage of international government bonds that are below zero percent. In other words a third of global “investors” pay to hold a piece of paper.

Why would they? Three main reasons:

- They have to hold “risk free” assets and need a guarantee that they will get their money back

- They believe that rates may even go more negative…and they could make a capital gain/profit.

- They are idiots

RBA are pretty cagey about flagging actual steps ahead. But even so, Kent seemed to be to be happy with a cash rate move to 0.10% (ish) on Melbourne Cup day.

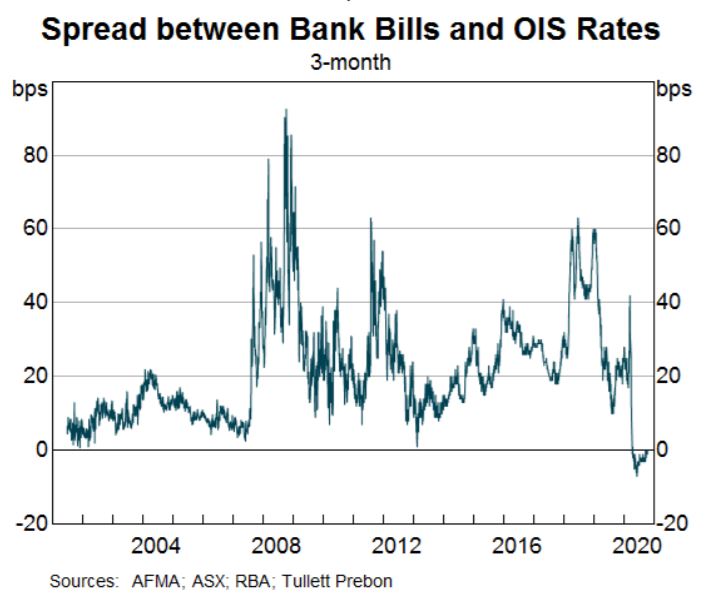

So not negative. But Kent acknowledged that Aussie Banks are full as a Pommie complaint box with cash. So they don’t really need to fight each other for cash and a key benchmark for Banks, 90 day BBSW is sitting at a spread to cash lower than any time in the last 20 years, or when the Adelaide Crows last won a premiership.

This key benchmark could slip negative in November.

So does that mean that Aussie Banks will actually pay you to take their money? Hell yeah….oops I mean hell no.

Your lending rate may be just one “all in” rate or if you are higher up the totem pole, it may be a separate declared margin. Either way, Banks charge you a rate that is made up of:

- Bank benchmark rate (usually BBSY 90 days)

- + Cost of funds pick up – they borrow cash out along the curve, not just 90 days, and have different credit profiles or credit ratings

- +Your individual risk profile, history and likelihood of you actually be inclined to pay the debt back

- +Administration, regulatory, staff costs

- + Fat, aka profit.

Unless the first gets below circa negative 3% you will still be paying out an interest bill. The other small issue, is that whilst this was not even a serious consideration in the last 50 years, Aussie Banks lending documentation tends to have included clauses that protects them from such an issue. If rates get below zero, then the Banks will consider it zero.

For somewhat complicated reasons, this does not work for larger commercial debts that have an interest rate swap overlaid. You are sitting in the hurt locker at present – and will be even more out of pocket in a negative world. There are a few steps you could take to mitigate that risk – speak to your Bank this month is my tip.

Don’t worry – it could be worse.

I’ve gone back in time a little in my listening this week. Very dreamy, very trippy. Late at night stuff.

On the drinking front, not every night can be Grange. I bought this crap online and have struggled to finish the dozen. Thanks goodness – last bottle. Certainly cheap – but not cheerful. Best drunk once your taste buds are smashed….

It has been a funny old week. Victoria seem to be on top of the virus, and outside of maybe New Zealand, we remain a fantastic country to live in.

Even drinking average wine. Time for a rest.

Cheers

Black Swan