US Election edition #20

6 November 2020

More on the election later, but first lets look closer to home.

RBA sat on a strange Melbourne Cup Day. Mate of the Swan won big when he bet on the “wrong horse”….that then won at handsome odds. This was him last year, so who knows how he ended up on Tuesday night:

As expected they cut rates from 0.25% to 0.10%. As is often claimed, the essence of insanity is doing the same thing over and over and expecting a different result.

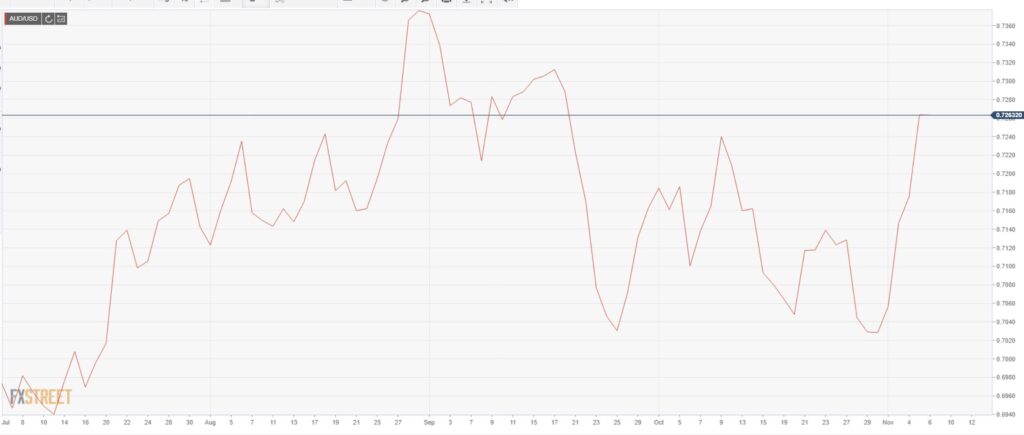

Not much doubt that the impetus was to push the Aussie dollar down – to help our export market. The report card would read “fail” on that. The last bullet left in the gun was a damp squib.

AUD higher now than pre cut. Admittedly a falling USD currency is not helping.

Word from UBS: “Price-supportive fundamentals for iron ore and improving risk sentiment as the global economy recovers, will be positive for the pair going into 2021. We expect the AUD/USD pair to recover to 0.74 by the end of September next year amid broad-based USD weakness.”

For interest rate yields, they were pushed lower by the RBA announcement – more so by the advice that RBA would add another $100B AUD into the QE mix over the next 6 months by buying bonds out as far as 10 years.

It would be acceptable then if you took a pretty bleak view of where we sit. RBA were however pretty upbeat in their statement. They actually upgraded future GDP forecasts and lowered likely unemployment figures. Still way too high at 6% by end of 2022 however.

US Election

As Black Swan writes this, all is quiet from the White House other than some random unhinged tweets. But…

It was far from the result I or the pollsters had predicted.

It looks like old Biden will just fall over the line – but missed out getting the Senate, so getting significant change through will be difficult/impossible.

As someone said this morning – you get what you deserve.

You can’t blame the American people for not voting – they are more “engaged” than ever.

Don’t hold me to these figures, but they are pretty close in a exit poll:

1/ How important is abortion rights to you as a voter:

Republican’s 89% / Democrat’s 11%

2/ How important is climate change to you as a voter:

Republican’s 11% / Democrat’s 89%

How do you unite such a divided country?

It would be easy to have a cheap shot at the uneducated redneck middle American, but the challenges over there are huge. Can the USA survive Trump’s exit?

Poor old Sleepy Joe will now have to face a hostile middle America, most likely implement a severe lockdown as the Rona continues to surge. After all that you will have a scorched economy to deal with. Perhaps after a few years he may wish that Trump actually got up in this election.

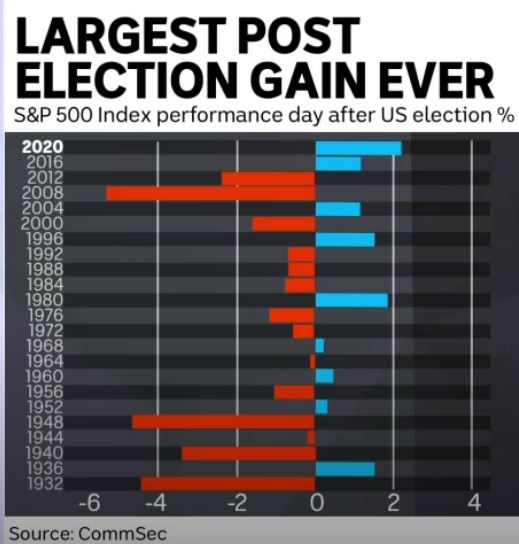

The ASX liked the likely result though and had a boom session yesterday – and looks solid again today.

The USA index added to the unprecedented year of unprecedented figures.

Song of the week seems in tune with the mood.

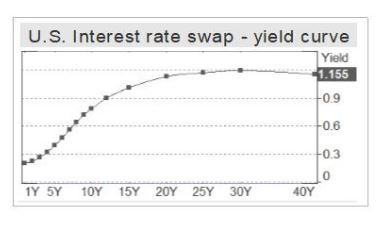

US yields plummeted late this week as the result becomes a little clearer. Yields lower as players see Biden’s big cash splash being limited now – thus the deficit and inflation might not be as big ahead.

I can’t believe yields at the moment. 40 year yield on a US swap at 1.15%. Unbelievable. In essence that is saying inflation will average below that figure…for the next 4 decades…. And that is before any time/risk premia.

World has truly gone mad.

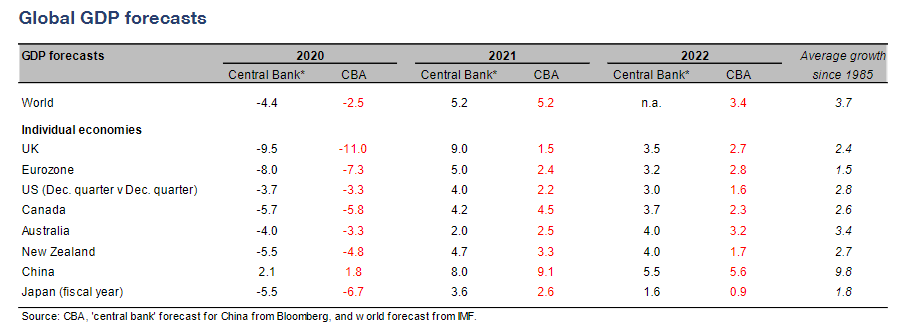

This is especially true if Central Banks and CBA/IMF forecasts for GDP are correct in 2021 and 2022. Pretty bullish and one can assume it is predicted on a vaccine in early 2021.

All in all – the markets remain a mystery to many, and when and where should you invest all that cash under your bed is no more certain than last week. Jump on that Bitcoin bubble … but understand currency risk along that journey.

Or as some one else put it…just make sure you “beat the bomb”.

Thought of the week.

Will need to be short here. Disclaimer as always. Black Swan swings both ways – electorally.

Banks finished their reporting season.

Westpac had what they described as a “disappointing” result. Not sure if they were referring to their dividend cut or their drag on earning from regulator fines. At $1.2B they were were third highest fined bank in the world this year. If they really desperately want to take #1 spot they will need to lift/lower their game to match the Goldman Sachs $8.7B. I believe in them – you guys can do it!

NAB results were similar in style, but less fines. They also had market trading income of circa 500M helping the bottom line. ASX investors favoured the result with shares up 3%+.

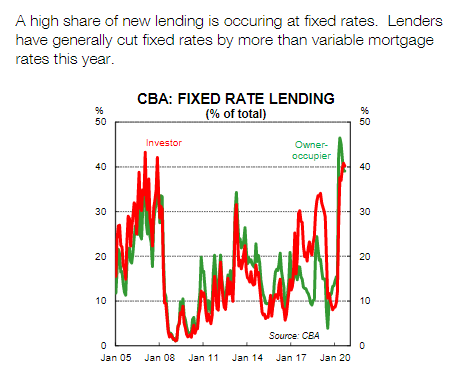

As a quick aside, CBA are seeing the highest percentage of home loans being fixed than in the last 20 years.

All banks seem to have provisioned a truck load of cash for impending consumer and SME failures. No doubt there will be plenty, but also a chance that some of that cash may pop back into shareholders pockets in years ahead if the recovery gets momentum.

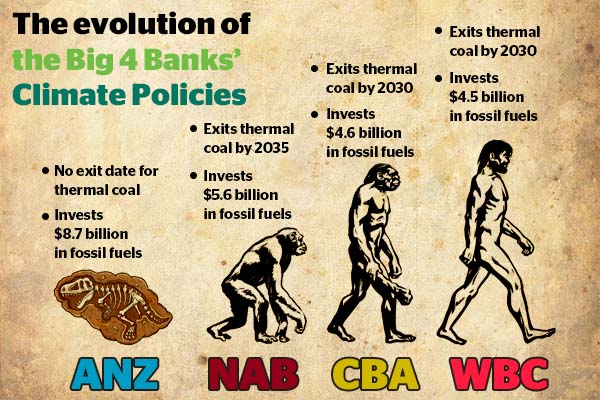

Black Swan mentioned ANZ’s results last week. Also flagged that they were looking for large fossil emitters to show them a plan for transition in the coming year. I would have thought that reasonable just from a financial risk metric.

Some hippie Greenie sees Aussie banks as follows:

You would thus say ANZ is not the harshest Aussie bank in their actions in this space.

Yet little dreeb David Littlepoud fired up with more passion than ScoMo’s hatred of Cartier watches.

He actually threatened to seek a revocation of the Federal Government deposit guarantee (only for ANZ). What a dickhead. As he himself puts it ” It shows just how out of touch..ANZ is…” delete ANZ and insert dreeb.

His best one is “Banks are not and should not try to become society’s moral compass or arbiter”.

Well the multitude of bank fines probably shows that banks moral compass has been stuffed for years anyway. But dare not try to fix it!

I wonder how drug dealers and terrorists would interpret dreebProud’s flavour? Banks should clearly support all.

Just had enough of Queensland dog whistling. They grow good mangoes and Rugby League players – just leave it at that.

What is Black Swan drinking?

Firstly no update on last weeks bottle – it remains unopened. I hid it from myself then couldn’t find it.

I shared a bottle of this with good friends last weekend.

I am usually a fan or terroir for wine. Drink riesling from Clare, shiraz from Barossa and cab sav from Coonawarra etc.

This puppy might be hard to find these days, but worth a hunt. From out Balaklava/Riverton way the grapes are from outside traditional regions, but close enough. Also dry enough for the grenache to ripen with great subtle tannins.

Plenty of life in it still for a 16 year old.

As I said last week – we may know more next week.

For my mate Gazza in Melbourne….

Till then. Search and ye may find.

BS