Thieving Bastards

23 June 2020

Thieving bastards

A bit harsh on Dentists, I reckon. What say we substitute Financial Planners, stockbrokers and bankers in there instead?

More of that later.

Been “off-line” for a few days. The good thing about being Incognito is that no one knows who this is. Thus I can say…”Web Master – get your shit together…”

Markets wise it remains all about Covid/Corona and the second wave. Victoria don’t seem right on it yet, but elsewhere Oz looks the goods.

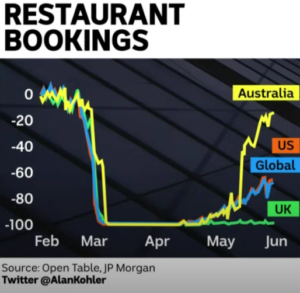

The Trump/Brazilian approach to re-open the economy early may ultimately prove to be a failure. No guarantees in 2020 but it looks like NZ seem to be bouncing back, and in Oz we seem to be ahead of the game too. Restaurant bookings are nearly back to January levels as my love-child (alright – love grandfather) showed on ABC:

If you watched the follow up to the ABC Finance report you would have got the razor blades out when Kohler looked ahead for the economy.

He spent some time on the real estate market – both rental and home owner. Commercial stuff aside, it will be interesting to see how Oz house prices hold up in the next 6 months. Hard to mount a case for higher prices, so maybe more a case of how much will the fall be?

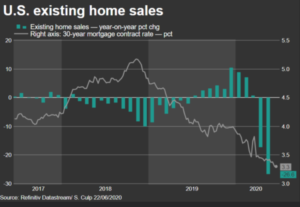

The number of US house sales fell by nearly 10% in May – almost the lowest in 10 years. Listings are also falling, but prices are holding up so far. Interesting chart below. Unlike here, the Septics tend to fund themselves into houses with a 30 year fixed rate –yes unbelievable. Mind you at 3.3% I reckon even I could be tempted.

Anyway – back to thieving bastards. I was wondering the other day how banks could justify a 20%+ p.a. interest rate of credit cards when RBA has cash rates at 0.25%.

Is that not just way out of whack in a post Royal Commission world?

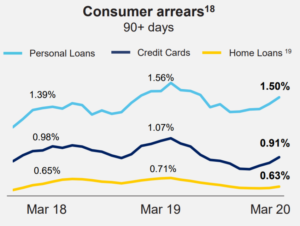

How can they justify it? I recall that when I was “in” the system the stock answer was that credit cards are the top end of risky unsecured lending and bad debts were horrendous. Of course that is partly true, but a quick review of CBA’s own investors report for March 2020 show credit card bad debts are not that much higher than home loans and well below personal loans.

Of course fraud must be huge – and most of it would get written off (from memory I’m only responsible for a maximum of the first $20 bucks). Well the latest figures I could find was December 2018. It showed in Oz that transactions are growing by 5% odd annually. Last year the total spend was $790 Billion. Fraud grew by only 2% though, to $570 Million. As a percentage that is less than 0.1%…and falling.

So we discount that too.

Then “why is it so”?

One big thing is apathy. Who cares? I know I don’t give a toss – I pay it off every month, so I pay bugger all. So how does that look across the nation?

According to RBA in June 2020, we have circa $47B in credit card balances, but only $26B accrue any interest. Thus only 55% of the punters are paying top whack. If that was shared “evenly” then a 21% credit card rate would be actually closer to 11%. Trouble is, it is Joe Smoe from West Shitsville that usually pays interest on his purchase of Wingfield Reds and cartons of VB – and expects to pay the card off in full, when he backs the winner in race 5.

Not mentioned anywhere, but it looks like we have racked up something like nearly $150 Billion in credit limits over the years – well not me personally. Thus we have on average over $100B in un-utilised limits each month. Anyone that has had an un-utilised business credit line over recent years would know banks hate giving “free” limits away.

Then there is the credit card reward system. Someone’s got to pay for all those frequent flyer points that gets you the upgrade to the front of the bus…well when that bus flies again.

I would love to see all bank credit cards reward systems scrapped – but I might be in the minority.

So..all up summary. Is the rate fair, or is there thievery in the highest order?

I’ll take a soft rooster approach, and let you decide. As I said earlier, pay your bills on time and “penalty” rates can be whatever they are and you don’t care.

It will be interesting to see how the banks respond to their tight grip on the cards market though as the likes of AfterPay and Flexi-Pay nibble at their toes.

ASX has just closed. Up a poofteenth, but banks are down again. Time to up those credit card rates.

AUD floating around 69 cents still.

With the Olympics now postponed till 2021, a lot of athletes are still training at home. I see below the English Cycling Team are putting their training to good domestic use.

Bye.