The glue holding this shit show together

5 August 2020

Best endeavours to be up and about this week, but it is getting tougher to see that economic light shining brightly. More chance understanding the AFL fixtures.

No need to keep your beers in the fridge this week either, just leave ’em outside overnight.

And yet the ASX correctional direction remains on track, as does the Dow Jones.

President Donald Clunk just looks sick of it all in this last week. By November, if he is not in jail, he may just say stuff it and head back to TV Reality shows – and somehow claim a masterful victory in the process.

Biggest US challenge at present is getting cross floor government support for Covid relief package #2,659.

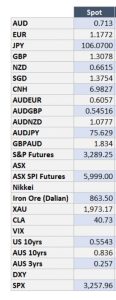

Gold is up 33% since March and went past $2,000 an ounce for December contracts yesterday. Some are calling gold at $2,500 from here. Silver is doing very nicely too thank you very much.

One reason for golds continued run, is the mighty greenback aka USD is getting punched in the head. Aussie banks have upped their AUD predictions as a result. One is calling the AUD to climb steadily from here to hit 80 cents in 2022. Seems possible, but easier picking the winning lottery numbers than foreign exchange.

I recalled doing some data work for Michael Chaney many years ago when he headed up Wesfarmers. He looked at Bank forecasts for rates, commodities and FX over a number of years. He subsequently presented his findings to a business luncheon crowd. The result? No surprise to many of you, banks were (direction wise) correct almost exactly 50% of the time.

In other words Punxstutawney Phil has as much chance of getting it right.

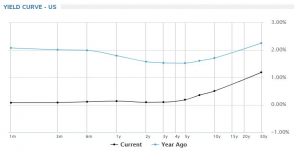

US ten year bond yields fell this week despite some good manufacturing data – which helped the Dow.

That yield curve above still tells me that the Bond market doesn’t buy into the equity jungle juice. But again as we have said, money has gotta go somewhere…

Aussie yields follow a similar theme, especially given Victoria’s pain.

I’d like a dollar for every question (statement) about Aussie Banks’ imminent demise from lack of income with an overlay of a dash of extreme bad debts.

I’ve been bearish on Banks for years – but I’ll tell you something for nothin’ – they are a bloody big beast, with skin thicker than a rhino. Not many countries have that but with quasi government sponsorship of the cartel…. oops that slipped out – Ed to delete….

With the 4 majors seeing a circa 50% hair cut in share prices already, is now the time to sell…or a stand out buy signal?

Thus I took a look at a June end report from one of the Big 4 this morning to gauge a quick feel – Barnaby style.

A few quick comments on each:

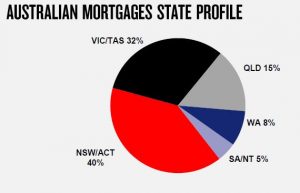

Nearly a third of home loans are committed to the pesky Vicmexicans – thus wave #2 effects will be significant.

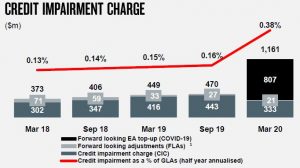

Bad debts have already largely be factored in – both to balance sheet and share price. Maybe the real question is will current provisions be enough? A few of my banker contacts say maybe…and maybe no.

With unemployment tipped to hit 10% according to RBA, this is THE key risk.

So sell,sell, sell.

Nah – on the flip, about a third of all mortgages for this particular bank had at least 2 years payments ahead of requirements. Some fat there.

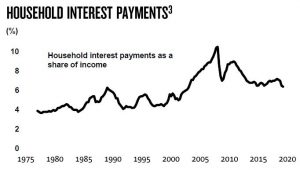

The second part of that play is that according to ABS, household interest payments as a % of income (assuming you still have a job!) is as low as any time in the last 20 years. Low costs of debt being the main driver of course.

Net interest margin (NIM) is how much the bank makes in profit, once all is said and done. Aussie banks are all pretty similar around 1.80% although Macq Bank trade about 40 bps lower. They are much lower than other countries surprisingly and have been creeping lower over recent years – but no measurable impact yet.

Finally, bank share prices should and do reflect not just state of play now, but growth and dividend prospects ahead. Here in lies two other snapping crocodiles:

- Where is growth coming from ahead, when corporates are in retreat, and house prices/employment are expected to be under the pump?

- New players – yep, overseas players may not be seen here for a while now, but like a shark on a whale carcass, fringe players will seek to bite into easy pickings. Non bank lenders should do well, and AfterPay/Flexipay are on a run.

Time to make a call. I’m not a buyer in being a buyer. But banks are not extinct dinosaurs that just don’t know it yet. They will survive. IT transitions underway will see their delivery costs (aka staff) fall. And nothing like a good pandemic to get those pesky regulators off your arse for a while.

Getting money out of a bank may get harder via tougher credit assessments, but will be even tougher for those planning a heist, given branches keep getting closed.

Listening old school again.

Short one this week. I get the feeling that a better picture ahead is just around the corner.

Till then stay safe, and don’t be a Karen.

I’m away this weekend. Plans below…