Stockbrokers are not that smart…?

13 June 2020

Late update that allows us to include Friday’s machinations.

The plan was to dig a bit deeper into interest rates and where they may be going (or not going). That seems not the best use of a short report at present, so we might dig into our opening statement. Not all brokers are idiots – just most of them.

They seem to believe that the world revolves around their mid and small cap “penny dreadful” stocks – for them the big picture is Wall Street (modern version with drugs, not original)

US equities got rightly smashed late in the week as unfounded exuberance bumped smack bang into Fed Chairman Powell. He didn’t take the Trump approach of feeding the chickens what they want – he told it as he saw it. A long hard road ahead, which reminds me of my latest Spotify find – On the road again

One of his answers in the Q&A session got a good media run. “We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates.”

Rates fell on that release but the real drama hit the equities market that had been running hot ’till then.

Big boy pants player Magellan has increased their cash holdings from 6% of funds under management to 17% at present, so they aren’t buying the Trump candyfloss. But are equities cheap or expensive at the moment? To answer that question (and looking at Corona separately below), then yes, brokers do look past the current lay of the land and guess what the horizon may be like. That beautiful sunrise that they see, may in fact, be a mushroom cloud.

But like everything, value is a comparative thing. If you are looking to invest, what are your main options:

- Leave it in cash…bugger all return there

- Buy bonds/fixed rates. Yields also stuff all and some are even negative.

- Buy property – valuations under the pump as Corona changes work habits

- Buy shares – potential dividend yield and capital gain (shares never fall do they?)

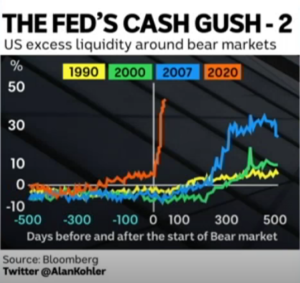

So shares are the best of a bad bunch? Maybe. But why would you consider them in the current uncertain climate? One reason may be the chart below. Back to the US Fed Reserve. They have pumped more cash than ever before and quicker than ever before (the orange line).

With cash sloshing around like a drunken sailor finally let off his Corona infected ship, the conditions are right to buy, buy, buy. Next six months might see that turn to bye, bye, bye.

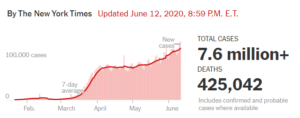

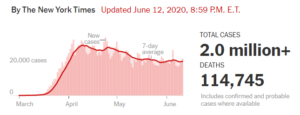

Watching CNN this morning a few prominent medical types challenged the concept of the US having a potential second wave of Corona (ok COVID-19 if you must). Their challenge though, is that the US hasn’t even got wave 1 under control yet. That and the rest of the world, including those pesky developing nations, are still on the rise. My medical experience is usually focused on hangover cures, rather than vaccinations, but three charts below may be a useful stop and look moment.

First is the world and trend is not your friend there. Second is the UK that I thought were making a meal of it, but trend looks good. Last is the USA. Trend was starting to look ok, but it has moved the wrong way recently and that is prior to the protests/looting/bible photo’s. No need to show Australia – still in silver medal position behind the Kiwi’s.

If like me then, you are not a buyer of a V shaped global recovery, and not even really comfortable with a W recovery, what will the market do? Anyway who wants a VW….??

ScoMo and Josh have $60B (sort of) to throw at the problem and that may be needed.

Aussie Banks may have defaults above even the large amounts that are currently factored even.

Employment growth will be limited and spending thus constrained.

Asset valuations of all classes will be tested.

Yes we in Oz are in better shape than most and will be extremely well positioned in coming out the other side. But we are figuratively and literally an island. Thus the “Trump conundrum”. Open everything up and acknowledge that the economy is more important than your vulnerable citizens, or maybe die a death of a thousand economic and social cuts. To be absolutely fair, it is a challenge well above my pay grade.

Sorry to end on a downer (but at least not the Alexander type). Given I haven’t liquidated my portfolio, stuck cash under the bed and sold my excess toilet paper for baked beans, it also factors in a chance that we just muddle our way through again as the true Lucky Country. All that aside, I have installed a new security monitor.

Rates and FX in the spot light in coming reports – promise.