Special Edition: China

7 December 2020

Quick Links:

Is there really a trade war going on between Australia and China?

Explicit list of grievances against the Australian government

How have exports been affected by this trade war with China?

Has China undertaken a trade war before?

So what does this mean for Australian companies exposed in China?

Penfolds spin off from Treasury Wine Estates

How did we get to this point where Australia is so leveraged to China?

Can we penalise the Chinese with Iron Ore?

The short answer is YES, of course we are in a trade war with China! What else would you call it?

There has been a fair bit of naivety and perhaps some wishful thinking amongst the pollical classes in Australia over the past 12 months or so as increasing trade barriers have been erected around key Australian exports. This is not going away, was entirely predictable, and equally ignored by government and industry as something that will be resolved through diplomacy and the international rule of law…

Well that hasn’t worked so far, so not sure why it would work into the future. Remember we are dealing with the Chinese Government that was found to have acted illegally when building fortifications on random sandbars in the south china sea, by the Permanent Court of Arbitration….and that hasn’t stopped them doing it and continuing to assert sovereignty and commercial rights to the entirety of the natural and mineral resources of the South China Sea.

China only accepts the international rule of law when it is in their favour.

If this is a trade war isn’t this supposed to be a two-sided battle?

Last week the Chinese Embassy helpfully provided an explicit list of grievances against the Australian government that they asserted needed to be addressed in order for this trade war thingy to go away. This included:

- Reversing Foreign Investment Review Board (FIRB) rulings to prevent Chinese companies investing in 10 projects based on National Security Grounds.

- Allowing Huawei and ZTE to be able to roll out the 5G network – so that the Chinese Government can effectively spy on Australians….

- Removing the foreign interference legislation – because it “unfairly” prevents Chinese government agents from interfering in Australian politics

- Stopping the politicisation of normal exchanges such as revoking academic and journalist visas – because these Chinese government spies should be allowed to continue to operate in Australia to infiltrate Australian institutions.

- Remove calls for an independent international investigations into the emergence of the COVID-19 virus…… Does China have something to hide?

- “The incessant wanton interference” re human rights concerns about Chinese Government treatment of peoples in Xinjiang, Hong Kong, and Taiwan etc.

- Stop talking negatively about Chinese fortifications in the South China Sea, particularly at international forums such as the UN.

- Stop pointing out that China has an unusually low infection and death rate from COVID-19 despite every other similar country having large numbers of cases.

- Reverse decisions to prevent the Victorian Government to be a party to the Belt and Road Initiative.

- Stop funding independent research institutions that have provided analysis on the human rights abuses in Xinjiang

- Apologise for investigating Chinese “journalists” in Australia for being spies.

- Stop making thinly veiled accusations that China was involved in cyber attacks on Australian institutions….

- Australian politicians should not criticise the Chinese Communist Party.

- The Australian media should not talk negatively about China.

I have not made this up….its genuinely the list, and demonstrates the problem. The Australian Government and the industry partners that have done business with China over many years don’t have any ability to address these “concerns”.

BS: Is that wanton interreference or ScoMo’s wonton interreference that is a sticking point?

Has China undertaken a trade war before?

Of course it has, the past four years of antagonistic trade battles between the US and China have been devastating for US farmers, with tariffs raised substantially on US agricultural exports to China on soybeans, and other critical agricultural exports. There was also the increase in tariffs on US wine exports from 14% to 93%, which collapsed more than 30% in 2018 and 2019.

There is a more interesting example of China’s use of economic weapons to assert political outcomes. In 2010 the Nobel Peace Prize was awarded to Chinese Human Rights activist Liu Xiaobo. The Chinese government was furious, and immediately suspended all trade negotiations for 8 years, and imposed bans on Norwegian products to China including Atlantic salmon one of Norway’s largest food exports.

How have exports been affected by this trade war with China?

The Chinese government has used a few different mechanisms to restrict trade with Australia. The restrictions have largely been focused on areas which will have political pain in Australia – mainly effecting the farm lobby.

Barley Exports

China has asserted that Australia is dumping barley into China below the “normal” Australian domestic price of barley. This resulted in the implementation of an 80.5% tariff on Australian Barley exports – which effects $1.1billion of exports to China. Barley is a globally tradable comm

odity so this doesn’t really have as much of an impact, as other exporters of barley will need to now supply the Chinese market, and Australian barley will be substituted elsewhere.

Lobster exports

China first held up a $2million shipment of lobsters at the port, forcing them “to go off” and the stock abandoned. Subsequently the Chinese Government has “banned” lobster exports worth $700million per year.

BS : Aussie lobster at Chinese airports.

Beef Exports

Australian beef exports reached their quota limit around July, and have higher duties now applied. Additionally, China has decertified 4 abattoirs in Australia for “food safety failings”. This has widely been seen as an effectual non-tariff barrier to restrict Australian exports to China.

Cotton, Coal, and Timber Exports

Chinese government have told buyers that they cant import Australian products in these categories… which would put at risk more than $14Billion of exports to China.

Wine Exports

China announced in August an anti-dumping investigation into Australian wine exports to China. They subsequently announced a subsidy investigation into the wine industry. On November 27th it was announced that Australia had been deemed to be dumping wine in China and tariff levies would be applied on Australian wine exports from between 107% to 212.1%.

Not entirely. China has used the rules of the World Trade Organisation to its advantage. It has undertaken an investigation of a number of industries, and asserted dumping has been found, and then applied countervailing measures – high tariffs. These are all within the international rules. The Australian government will dispute these findings, but it will take time to prove, and go through an arbitration process at the WTO. This is a multiple year process. Australia may ultimately be found to have not been dumping, but by the time the arbitration has occurred, the industries in Australia will have been severely damaged.

So what does this mean for Australian companies exposed in China?

Its time to diversify, and prepare to find different markets. This trade war is not finished, and will only get worse. Australian companies in the industries already impacted by the trade war need to immediately find alternative markets, as the Chinese market is closed.

Penfolds spin off from Treasury Wine Estates

In April 2020, on the back of ongoing export growth to China of Treasury Wine Estates – Penfolds brands, suggested it was looking to spin out the Penfolds business as a separately listed entity. The anti-dumping finding against the Australian wine industry including an applied penalty tariff of 169% on Treasury Wine Estate has effectively put an end to the rationale for this spin off. Its dead.

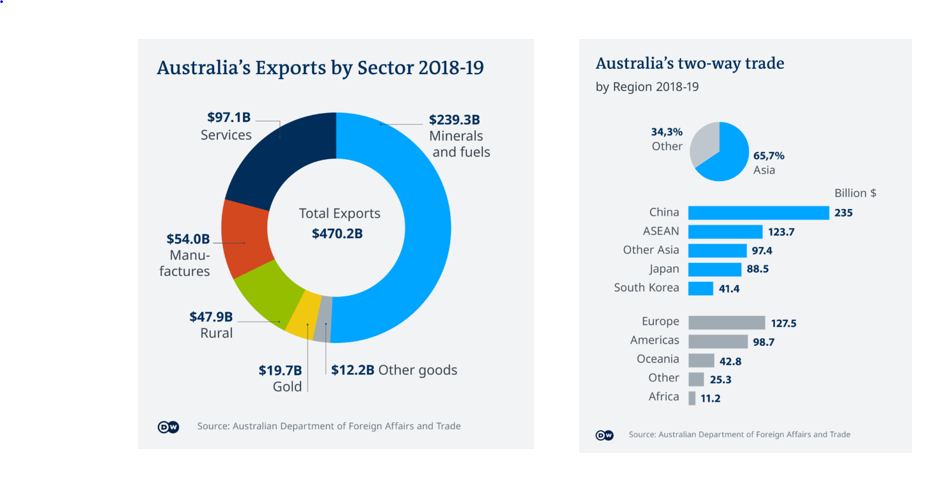

How did we get to this point where Australia is so leveraged to China?

Iron ore, iron ore, iron ore. Australia is one of the few countries in the world where we have had a positive trade relationship with China. That is to say we export more than we import. However most of these exports are Iron Ore, which has been used to build the economic infrastructure and growth in China over the last 15 years. Australian governments of all persuasions became sucked into the China vortex because of the huge demand for products and the associated tax receipts that flowed into government coffers as a result. All government export programs recommended companies explore China as a market, and many did. The China Australia Free Trade Agreement further enhanced Australia’s preferential access to the Chinese market, and industries such as the wine industry exploded in growth from $300 million in 2015 – $1.3billion in 2019.

This export growth was often at the expense of other international emerging markets such as USA, UK, Japan, South Korea, Taiwan, Vietnam, Indonesia and the Philippines.

Australian governments who have suggested there was nothing to see here, and there was nothing to worry about. The current trade imposts effect around $15billion worth of exports (when including all coal exports), which support around 100,000 jobs across Australia. These jobs will need to be supported, and so despite the already constrained economy due to COVID, the Australian commonwealth and state governments will need to implement industry support programs to mitigate the effects of this export shut down.

Wine Australia should also be worried. It was only in October, when Wine Australia sent out a press release to identify that the September quarter was the biggest export month on record, and driven by huge export growth in China. Behind the scenes, Wine Australia and its executives were saying that it was impossible that China would find Australia guilty of dumping, and therefore there was nothing to see here. That was naïve and poorly conceived. It could be said that the press release has accelerated the anti-dumping finding against Australia well ahead of the proposed timeline of August 2021 when China originally suggested it would release its findings….. CEO Andreas Clark might need to find another job.

There has been some naïve commentary over the past couple of weeks from business executives who have a vested interest in de-stressing the china trade situation. A good example was the comments by a2 Milk Company Chairman David Hearn who only 2 weeks ago suggested:

“We would urge the government to try to produce a relationship with China which is more harmonious – not to back away from genuine questions where they are required, but to do so in a less overtly confrontational way.”

a2 milk company Chairman David Hearn on 17th November

After the tweet this week from the Chinese Government, its hard to suggest that they have been acting with anything but a highly confrontational manner…. Perhaps our business leaders that are overly leveraged to china need to mitigate the risks through diversification to other markets because this doesn’t look like its going away.

Can we penalise the Chinese with Iron Ore?

A number of people have asked whether Australia could retaliate against the Chinese by refusing to export Iron Ore….now this would be fine if we were interested in cutting our nose off to spite our face. China accounts for 81.5% of Australian Iron Ore Exports representing US$55 billion in exports in 2019. These exports provide substantial tax receipts to the Australian Government, and there is no other large market that could replace this volume of exports.

This doesn’t mean that China wont seek to turn the screws on our Iron Ore Exporters. Australian Iron Ore make up 60% of China’s imports of iron ore, with the rest coming from a variety of countries such as Brazil, South Africa and India. The Chinese have invested heavily in Iron Ore mines in Africa in the past couple of years to lessen their reliance on Australian Iron Ore…..given the current confrontational nature of the relationship we need to watch this space.

Black Swan comment : I did ask the writer above if China is as big a bully with other countries (USA aside). Outside of smaller developing nations, we seem to be the centre of their anger for now. I did note though, that maybe their recent actions have even empowered other countries. Qatar for instance announced steps to shut over Aussie lamb this week. $300m is at risk – and can only be seen as a response to our political “outrage” to the baby in the bin episode.