ScoMo is watching, or the eyes have it…

28 August 2020

It is all about hope this week.

Hope that we are near the end of winter.

Hope that a vaccine is imminent and we don’t need to drink bleach.

Stocks continue their positive run – miners on the go. Aussie banks get a 2% kick higher one day then sell off 2% the next. Wetpatch confirmed no dividend, which is pretty spectacular, but from memory they haven’t had a capital raising either – effect of which would be to dilute share value.

Speaking of Wetpatch, they are calling the AUD to 75 cents by year end and 80 cents by year end 2021. Yep, possible but not putting the house on it. Main play again seems to be an expectation for a continued fall in the USD in months ahead. Of course a rising Australian dollar also makes us less competitive and will not please our Reserve Bank. What they do (or more to the point can do) about it is interesting. Cutting cash rates seems unlikely still, and entering the market as a player will have little impact I reckon.

ScoMo claims not to follow the popular contest, but he has been very reluctant to push the border opening agenda he holds, given the voters have spoken. Clamping down on China investment into Australia is however a vote catcher, and seems to come straight from the Frump’s playbook.

Don’t get me wrong, it probably is overdue to put some parity back into the international trading agenda – China has abused its status and thieved intellectual capital for too many years. But accelerating this fight in the middle of a pandemic can only add more fuel onto the fire…

Aussie Capex (what business have or are expecting to spend in improving their business) has fallen nearly 6% in Q2. Like retail spending, it is important that big and SME businesses reach into their pockets and splash the cash to help the recovery – but this won’t happen till some confidence has been found behind the couch.

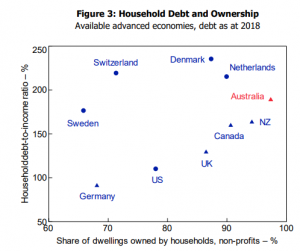

Reserve Bank has done some modelling on household debt/employment and default – all about Bank stability.

Two charts to share:

First one is a cracker. Household debt levels on the left axis and percentage of home ownership on the bottom. Australia is an outlier on ownership to the high side, and debt levels are also up there. However we are in good company in that department.

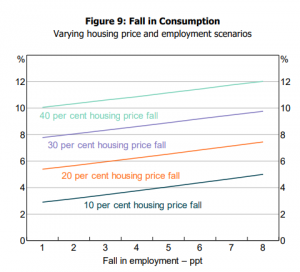

The second chart modelled what might happen at worst case scenario being a 12% unemployment rate – most likely a 40% fall in house prices. Of course this is a bit of chicken and egg stuff but the final result is best delivered as a quote:

“The level and growth of household debt reflects high incomes and direct ownership of rental housing, not evidence of widespread excessive leverage. Household borrowing is a large share of banks’ assets and so is important for their performance, but overall high lending standards, low loan-to-valuation ratios and banks’ high level of capital mean they are highly resilient to adverse shocks to households. Rather, the implications for consumption of household indebtedness are an important mechanism to take into account when targeting macroeconomic policy to respond to economic shocks.”

In other words Banks would survive even that scenario. Banks may, but there would be a shit load of pain along that journey as consumption falls and the economy hurts for longer.

Brief look back to last weeks review on possible inflation risks ahead. NAB Research covered that very issue this week, and acknowledged possibility but only as a faint risk. I feel even more confident of a future spike now as a result…

The US Fed changed their approach to inflation targeting overnight. Shooting for a longer run “averaging” around 2%. Pundits are thinking this will also work to keep rates lower for longer. If you were Mel Gibson and a conspiracy theorist, you would fear that by the time the Fed will now act on higher inflation, that horse will not only have bolted, but mated with every mare in the top paddock.

One thing I did get wrong was a prediction that After-Pay share price was a bubble…and that was at $71 a share. Now trading at over $91, you would need to surely change your view? Their annual results were out yesterday. They “improved” the bottom line by almost double or more than $20M compared to last year – they only lost $19.8 million this year. Thus I remain on the bubble call – only my timing is out so far… I’d be running away from it like bubble girl.

I value predictions more than “look backs”. I stumbled across a Forbes article this week, that was written in Oct 2019. It was about preparing for Black Swan events. The essence of the argument was that no-one can predict where, when and what pandemic will strike – but we can predict one will “hit us” – and should prepare for it accordingly.

In the study “Global Trends 2030” researchers found that, “No one can predict which pathogen will be the next to start spreading to humans, or when or where such a development will occur. An easily transmissible novel respiratory pathogen that kills or incapacitates more than one percent of its victims is among the most disruptive events possible. Such an outbreak could result in millions of people suffering and dying in every corner of the world in less than six months.”

Wow – if they had a Bookie that offered a betting market in that, they would have cleaned up big.

To finish off this week, I want to quickly touch on what gets asked of me on a regular basis – namely if a Bank tells me to hedge my currency, or fix my rate, I should run a mile away very quickly. Banks know the market and if they say “fix” then don’t…. In other words Banks win when I lose.

Plenty in that sentiment and many may feel it well founded given what has happened in the last few decades. I’m quite happy to take a swipe at Banks over many things, but usually that sentiment is misplaced.

First and foremost, Aussie Banks don’t hold that risk on-board. They (in large) try to be neutral on market risk – which is to say if you get a hedge “right” they can be as happy as you. Also, your credit “risk” improves when you are holding a good position.

Secondly, the market person you deal with is not a Trader anyway – they pass your risk on. Personal bias aside (see my earlier article) they most likely are giving the best of their, or their house, view at the time.

On rates – the bottom has been called so many times. RBA cash at 4%, 3%, 2% etc etc. But it keeps falling. The old adage is…”if your try to pick a bottom all you get is a smelly finger”. This bloke is calling the bottom now…

When you fix an FX rate, most commonly you then end up with a FX Forward contract – in essence similar to a fix interest rate. In fact the forward rate is only a factor of interest rate differentials in the market place – no allowance is made for forecasts of where the spot rate will be trading at that forward date. The only variable to the rate you end up with is margin to current spot rates and forward points that a Bank may take.

Fixed interest rates are slightly different. Ultimately they are bench marked back to swap rates – and swap rates very much influenced by current and future economic market conditions and expectations. If we take a 3 year swap rate as an example and assume a fixed rate is offered of 1.2% versus current floating rate of 0.5%, how is that determined?

The 1.2% represents the average of 90 day bill futures for the next three years – or 12 x 90 days bills. A hypothetical bills future “curve” could look like this below…

| Aug-20 | 0.5 |

| Oct-20 | 0.6 |

| Dec-20 | 0.75 |

| Feb-21 | 0.75 |

| Apr-21 | 1 |

| Jun-21 | 1.1 |

| Aug-21 | 1.25 |

| Oct-21 | 1.25 |

| Dec-21 | 1.25 |

| Feb-22 | 1.25 |

| Apr-22 | 1.25 |

| Jun-22 | 1.5 |

| Aug-22 | 1.5 |

| Oct-22 | 1.5 |

| Dec-22 | 1.5 |

| Feb-23 | 1.75 |

| Apr-23 | 1.75 |

Of course the BIG thing is that the curve will be “wrong” ultimately bill rates will be either higher than was expected or lower. Thus your fixed rate will either make you feel smart or like an idiot. But it is up to you to decide where that value lies….along with a myriad of the other risk fundamentals of cash management principles.

Time has run out again this week, but my listening has moved upbeat. Lime Cordiale a young upcoming Aussie band. Listen to their other hit Robbery as well.

Leave your comments below. If we like them we might even respond.

We are keen to expand our subscriber base. We took a few tips from this bloke, but maybe just get your mates to subscribe for us instead…

Cheers

BS