Look and you will find.

29 July 2020

Your humble scribe (like Barnaby) remains highly aroused but confused. Is the market too optimistic and the US of A will drive the international wealth of many down the toilet? Or in my typical counter cyclical way of looking at the world, have we positioned ourselves for neo-economic destruction and the bounce back will be terrific….aka Donald Trump is right.

Hard to see DT being on the money, but would you bet the house against him?

Perhaps more importantly the critical thinking must be towards what will “getting back to normal” look like?

The core genesis of capitalism has been tested in recent months. The more you make, the more you consume, the more, the more L’Amour. Don’t for a second get me wrong – I am far from some hairy leftist looking to stir your pot. I love money…and what it can do. I spend more time worrying about the lack of it than I should.

Our recent column looked at Modern Monetary Theory (MTT) and why helicopter money may be appropriate. My conservative roots caused me to doubt if this theory had long term benefits.

But can we perhaps look backwards for lessons for the future?

My old mate Joshie Friednboiled got himself into a right pickle on the weekend when on Auntie ABC, rather than the more accommodating Sky News. He hailed Ronald Reagan and Maggie Thatcher as heroes of the past that we should model policies on. Given the audience I reckon he might want that time back again. Like Do-Re-Mi it was Man Over-board. Labor’s Albo was quick to tweet a very unsettling image….

So you have Liberals presiding over massive fiscal stimulus under a treasurer that clearly wishes he didn’t have to.

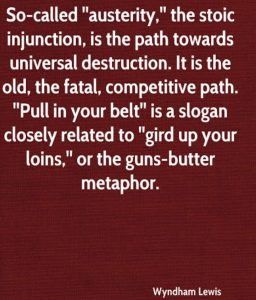

Maggie T was before my time, but she knew how not to spend money. She was perhaps the master of austerity in the UK. And here the bizarre confluence happened.

I stumbled across some quotes from Wyndham Lewis. https://artuk.org/discover/stories/the-rise-and-fall-of-wyndham-lewis A very interesting cat with a wonderful story, long since deceased.

He was at times a writer of both the far right and the far left.

But living in London in post World War II he saw the extended pain of austerity. On the same day as reading this, Spotify randomly played Do Re Mi’s song “Guns and Butter”. As we all know, they only had one hit song really.

So what is this Guns and Butter stuff?

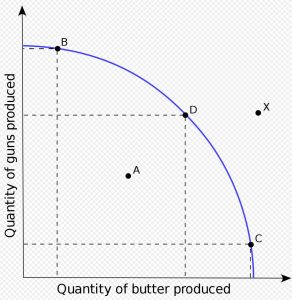

It is in fact an economic theory that until this week I had not read. It’s simple premise is that a nation has to choose between two options when spending its finite resources. It may buy either guns (invest in defence/military) or butter (invest in production of goods), or a combination of both. In other words, at a point, defence spending must detract from feeding your people. My image of an example of that might be modern day North Korea.

The graph looks thus:

Only interest really is a full loop back to a likely “new normal” in coming years. Probably like you, I was reasonably pleased with the recent Fed Government announcement of increased spending on our armed forces given current global tensions. But if you overlay that with a Treasurer that isn’t that fussed about giving us peasants the butter, then unrest may be ahead.

The Do Re Mi version was pretty average to be fair. Below has more bang for the butter.

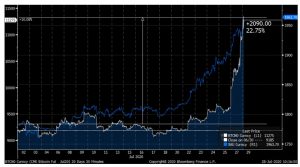

Closer to markets, gold remains on a flyer. Maybe more to go as well.

Two charts below – first showing the rapid kick higher for gold AND bitcoin.

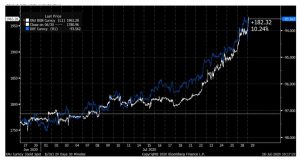

The second perhaps explains why….Gold price matched against an inverse USD. Lower Greenback = higher gold price.

Also goes a long way to explain why the AUD is now above 71 cents. We picked it well, and remain of the opinion that 73 cents+ is a possibility.

Aussie inflation out later this morning. It used to be a very exciting day for Markets. A good/bad data figure would see “big” moves on yields, FX and equities. Those big moves now happen every day before coffee, so data fatigue remains. What could be different this time though, is some serious deflation. Only thing worse than inflation is deflation. Why spend money now, when things will be cheaper next month? Hard to ask for a pay rise when things are getting cheaper? Why build your inventories? Deflation can seriously slow economies down.

Then also think about your $1m in bank borrowings in deflation – net effect is you will owe “more” in the future. That theory also true for our massive Government debt as well.

Good news is, most reckon this is a temporary set back and is not baked into the next few years. The big BUT is that deflation is a bigger beast to tame than inflation. Just look at Japan’s extended fight to kill it off.

NAB in a recent report on the commercial property sector highlighted many challenges ahead as you would expect, as the “new normal” unfolds. One chart that took my eye was vacancy rate expectations for the next few years. Retail and Office to struggle, but Industrial expectations are much better;

AUD .7150

Gold $ 1960

90 day BBSY 0.15%

2 year swap 0.20%

10 year swap 0.87%

Cheers

BS