June 9 – Trump is a Dickhead

9 June 2020

Welcome to the inaugural incognito insights – say that three times fast…

I awoke to a fine but crisp morning after Queenies long weekend. You are thus right if you think I’m based in Oz. Wasn’t it great to see Bronwyn Bishop get a gong for services to helicopters?

The concept of this site is to give you an update, with an opinion. Opinions are like the proverbial (cause we don’t want to offend by saying arseholes). So why read this one?

Everyone involved on this site have extensive exposure to banking/finance/markets. We have seen what it does for the good and the bad. Banks for example don’t try to give “fake news” but they have a natural axe as we call it – a view that is more favourable to their outcome.

We not have an axe (or gun). We are fascinated by world markets and talk about it a lot – it used to be over a pub pint, but lately over a Zoom pint. Read our view and let it inform you and shape you. Or don’t. Go find another team to barrack for if you don’t like our game style.

Key to our success (which will mean more drinking) is to get people to share their views – either as reader commentaries or as an incognito contributor. Like Homer Simpson – a chance for fame, but unfortunately no one will know it’s you.

A few personal caveats – I really don’t like Trump. He is a divisive dickhead. You may think that is strange for a Free Markets report, but if you break it down, the short term nature of his “policies” is not conducive to sustainable economic growth or uniting a political party, let alone a country or the Globe. The immediate response of many that have the opposite view is to point to the Democrats and say “look at those loonies”. And to be fair, they are also right.

Anyway – onto the markets.

The wonderful thing about the markets is that it doesn’t give a stuff about social fairness and equality. The USA has managed the Corona Virus (Corona sounds so much better than COVID) appallingly. Some of that is Trump, but some of that is their own stupidity. I mean really – placards stating they have a right to die from Corona over lock-down.

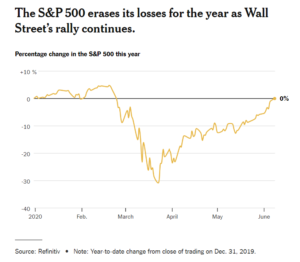

None the less, Markets have looked past now and seeing better days ahead. The S&P starts today higher than the start of the year pre Corona. Bizarre but true.

Our equity market has had a few good weeks too recently but not nearly as strong. Largely because the ASX 200 is dominated by our big 4 Banks that got creamed it the initial sell off.

Question is, will this all get wiped out when the highly expected second wave hits? I think the answer is yes, but I am too unsure to cash out my portfolio in case I’m wrong. Going a little defensive now though would be the smart play. Gold to have its day again?

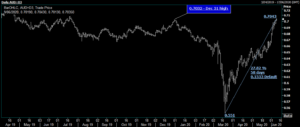

Our little Aussie Battler has just gone through 70 cents to be back at an 11 month high.

Don’t worry about those blue numbers. Chartists and followers of Fibonacci should not be reading this….go play with your models.

Why is the Aussie dollar so high? My view is two main reasons:

1/ Iron ore has done through $100 a tonne as Brazil production is reduced under Corona.

2/ AUD levels are relative to our strength but also the USD weakness. USD weakness is also the case at present as people that bought USD as a safety measure in March are now selling to get into other riskier assets.

Yields have gone higher in recent weeks – thoughts of negative rates here and in the US seem to be old news. I’ll dig more into rates and yields later this week, but that might need to do it for now.

Not much on the economic release radar to worry about today.

Pub’s are starting to open up so a rare glimpse of your correspondent below. Fortunately Henrietta hides my face… Welcome and goodbye till Friday.