It’s OK – we’ve got this

13 August 2020

The writer has been known to have a socially responsible drink or three occasionally. What really gets up my nose is being accused of being a capitalist pig, only concerned about the mighty dollar. But, even more annoying is getting pinned as a leftie tree hugger with no regard for “the system”. Previous editions have been declared, that in fact I do like money – particularly as a source of exchange for goods and services. No complaints have ever been lodged because I have too much of the stuff. But I do like to place myself as centre/left on the spectrum – maybe like a smaller version of Amanda Vanstone or even a Christopher “Fixit” Pyne without the poncy accent.

What does scare me though in current times is the rapid spread of wealth – or put differently, the disadvantaged are getting rogered. Scared, because that is not the (broad) basis of our country’s historical success, and also concerned about risks that come with the global move to “have” or “have not”.

This bloke is clearly in the have not set, but seriously needs to work on his approach to income production.

Is the Aussie middle class an endangered species? More on that later.

In the interim, speaking of doing it tough, I spent a week at home, building a BBQ with an inbuilt esky for the Coopers XPA. Very happy with the end result…

Markets wise, I had hoped for just a tad more clarity about direction by now. Instead I am perhaps more confused.

Equities hold on ok here and in the US of A. In the US, equities were supported by belief that Crump will get more pandemic support (read money) into the system sooner rather than later. Also cautious optimism re Russian claims for a virus vaccine. I’m far from an anti-vaccer, and good on Putin if it is winner, but the inbuilt sceptic says keep that needle away from me…

As an aside, Goldman Sachs did some research on the AFAMA issue – being Apple, Facebook, Alphabet, Microsoft, Amazon.

They make up an incredible 22% of the S&P. They have rallied 70% since March. Strip them out and the S&P has fallen by 10%. Ok – so it’s a bit like saying the Crows would be in the Top 8 had they won their last 10 games, but…..they didn’t.

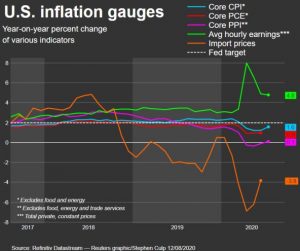

The other “win” for equities is the pull back in bond prices as yields moved higher. Reason for that started as technical, but got good momentum when inflation figures showed a dramatic move higher.

Early days one to watch into next year.

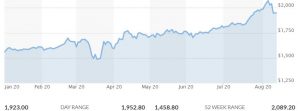

Surprisingly though, spikes in inflation should have supported gold prices, but they (like silver) had a rough week. Punters called it a one way street higher last week, so it was bound to dip. December gold delivery back to $1,950 an ounce. Part of the reason was deemed to be profit taking, but to my mind it was more of a case of consolidation in the US dollar.

The Aussie dollar has held up OK though, and sits just under 72 cents. A big jump from below 66 cents in May. For importers that is a 10% jump in cost of goods, over and above higher prices that we are hearing are being demanded from offshore providers.

Locally, employment data just out. Key numbers:

- Unemployment moved from 7.4% to 7.5% – up 16,000

- 115,00 jobs created and participation rate higher.

All round – better than expected.

As an aside, I was surprised when I saw NZ unemployment is sitting at circa 4% still. They now have moved to tighter restrictions following a small outbreak, but an interesting comparison to the quasi herd mentality that the US are going through at present.

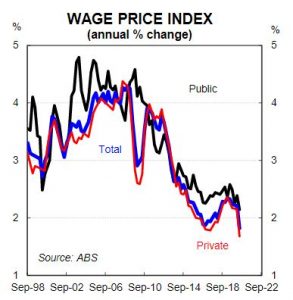

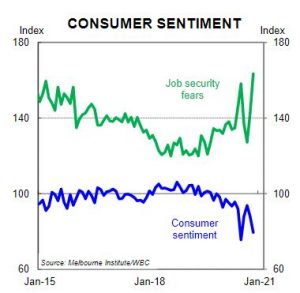

Of course the data earlier in the week was less positive. The RHS chart resembles Felix Baumgartner when he became the first man to hit 834 mph unassisted. Wage growth is the lowest level since the series started in 1998. With surplus labour around for awhile, and bugger all inflation (as yet) you can expect the trend to continue.

That is not to say household incomes have followed the same trend. Because of the massive government stimulus spend, households (in general) are doing OK, and banks are reporting term deposits volumes are well up from normal levels – despite investors earning two fifths of bugger all.

Maybe households with either a job, or temporary benefit payments are squirrelling away their nuts for a bleak season ahead. Consumer sentiment is stuffed still, with employment fears heading north.

Household matters are always delicate, and in the TV interview I watched the other day, Mike was very sensitive to not touch on matters he shouldn’t. Well trimmed appearance too.

Consumer sentiment is an interesting one. I attended an RBA meeting a few years back. The then Deputy RBA Govenor was being asked about Consumer Confidence. In a rare glimpse of humanity, he launched into Tubthumping – theme being it gets knocked down but gets back up again. It will need to be a bigger comeback than Rocky against Drago though….

Business sentiment (in the markets we call it the “animal spirits”) is similar as well, NAB’s latest survey was interesting though – sentiment down, but actual conditions were not that bad. Maybe it will be the first to turn, but we need Victoria to get on top of their issues.

Run out of time for a proper deep dive, so I’ll leave you this week with this cooking tip…

Feel free to comment on what you have read or what you would like Black Swan to dig into.

What markets would you like the torch on?

Till next week.

BS.