I need money…

2 October 2020

Biggest corporate fine in Australian history awarded to Westpac. $1.3 Billion Aussie dollars would buy a truck load of wagyu and shiraz.

I must confess I only watched the saga from a distance and have little view if the fine was appropriate or “light”. No doubt it will focus the other Banks to get their house in order.

Of course it was largely expected and also provisioned (to $700m) but the fine barely affected the share price. Wish we could be that resilient to Covid.

Interestingly the newly formed Banking Code Compliance Committee (BCCC) yesterday sanctioned Bendigo and Adelaide Bank for “serious and systemic breaches” in how it has treated customers since 2015. The major fault seemed to stem from debt recovery. No fine lobbied – just named and shamed.

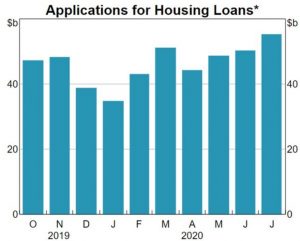

Hot on the heels of these two decisions, the government announces a rollback on some regulations to confirm borrower repayment ability. The claimed aim is to free up money to borrowers as credit was seen as too tight and restricting the economy. Trouble is that RBA data does not seem to support that argument – applications at 2 year highs.

My word from inside the Banks though is that the previous legislation was a complete crock, and added no safety to borrowers – just pain and costs/time to verify and validate.

But here is the kicker…. Wetpatch market capitalisation is at circa $60B. Their share price rose by 6.5% on the day the changes were announced. This means WBC picked up a lazy $3.9B in value. Makes their fine seem a little more wagyu and shiraz I suppose.

Of course everyone thinks Black Swan is either a jaded ex-banker or like a Crows footballer -high on smack. Far from it. I praise the Australian Banking community for being so strong – it allowed us to have nearly 3 decades of uninterrupted growth and for many it allowed them to get past the GFC with nay a scratch. But I see the nature of man at work – you put rules and regulations in place and there will be a percentage of people that will work very hard to find loopholes and weaknesses to exploit. As Ken Henry said before he got rissoled, it is the cumulative culture that needs to change – and that will take focus and time. And like the USA culture issue below, I don’t see it happening.

Thought of the week

Late to the party, I have started recently to listen to Podcasts in my commute or down times. One in particular (The Jolly Swagman) is quite long but explores interesting topics with interesting guests. This week he interviewed Eric Weinstein – a mathematician and the Managing Director of Thiel Capital.

He seemed to help me clarify a few conundrums I have been battling. He is a proud American and of course covered the current political campaign. He pondered how many people in 1990 would challenge the concept that the USA was the big dog on the world stage. Not many. If you asked that question today, many would rightly argue that the USA has lost that mantle and as I often argue, are a conquered nation that just doesn’t realise it yet. Most would agree that this has not happened in just 4 short years and may be more cultural than political.

He also proffered that the noisy crowd crying out for fairness and equality were on the wrong path. Massive fan of fairness, and particularly so for the less empowered. He however argued that equality only happens when you are punitive to the hardworking successful individual to gift capital and resources to the lazy or incompetent. A point well made is that “elite class” is a comment made in derision, but if your country is threatened you are pretty happy to have elite forces, or perhaps more resonating is that if your child is critically ill, you seek the services an elite medical help.

So if the USA is at a major cultural cross roads is Trump the man to lead them out? And what are the lessons for Australia?

I think you know Black Swan’s view on the first. An individual that prospers for division is NOT what the USA needs now.

The lesson I take for Australia (and our Kiwi cousins) is what I often endure these days at pub drinks. If you have a view on anything you get pigeonholed, alienated or ostracised into one “camp” or another. If you value the environment (as an example) you must be a numb-nut Greens voter with no commercial acumen or intelligence. If you seek border protection and think that a sovereign nation can decide who is or isn’t a citizen, then you are a monster and must have Peter Dutton’s poster on the wall. Australia has long been the place where we prosper through political indifference or at least have a massive “middle ground” contingent. We need to value and nurture that middle ground and not follow the USA template. I know we CAN do it, but not 100% sure we WILL do it.

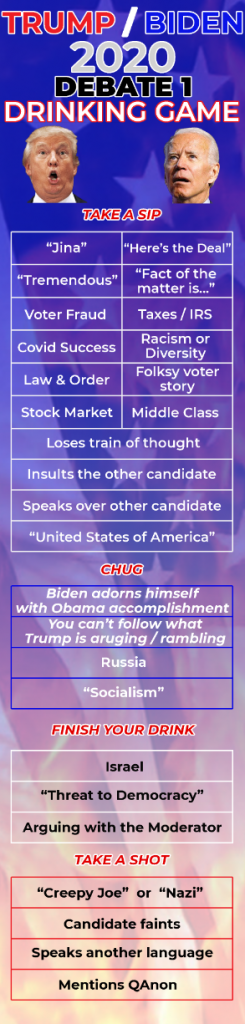

That same approach should be overlaid with the assessment of the first USA Presidential Debate. You know what you are going to get from Trump – and he delivered in spades. But I thought Biden was quite underwhelming. But as has been highlighted, he at least stayed vertical with eyes largely open. You wanted him to go harder “at the man” but how do you do that without getting drawn into that black hole?

I played the drinking game below, but must confess, it was hard to drink that much.

To support the drinking game, I chose my wine poorly. Not because it was a bad wine at all. They call it Mudgee Mud for a good reason. Kick like a mule, but after letting it settle for 10 years in the Black Swan pond, it is drinking beautifully. Last bottle unfortunately.

Interesting to see the market “sell off” during the debate, as the money assessment is that Trump may now be doomed as one term leader.

Trying to stay in that middle ground, my view is that if ever in recent history the USA could benefit from a Federal Government that appears committed to spending big, it would be now. The key risk is that the spending was initially planned to be funded via higher Corporate taxes. This would be disastrous in the next few years, but I have no doubt, any government that can get away with massive deficits over raising taxes would take the easier first option.

Speaking of taxes…

Markets

To cover off on above, the US election gets closer. I discount, for now, the likelihood of riots at the White House and the army dragging Trump out as they fight against his redneck para-military. for now.

I get the feeling that the equity market has already largely priced in a Democrat victory. My guess is that there may be the initial sell off, most likely modest, before bigger issues like vaccines take back the centre stage and future value.

US employment data last night was pretty shite, but the market actually held up ok as the next multi-trillion dollar rescue package works it way through.

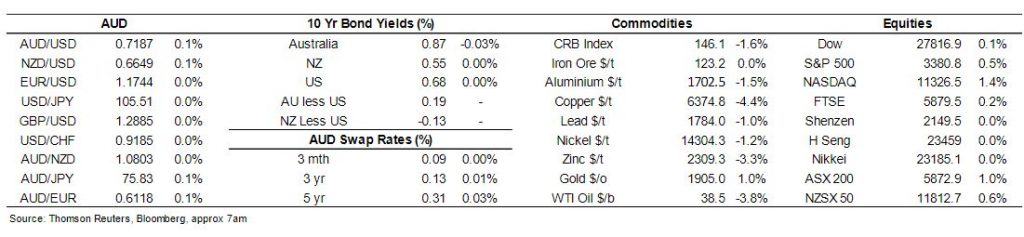

Latest market data – ref CBA

Reserve Bank meet next Tuesday. My guess is that they will sit on their hands again, with a statement that they standby ready to do what they need to do. The market will take that as signs of a November cut. Maybe.

Aussie dollar has lost its upward moment and again seems happy just above 70 cents for now. Gold also struggling to stay above $1,900 an ounce. With petrol prices rising at the pumps you would think oil prices have improved. They haven’t but someone’s profit margins have.

And of course we have the pending Aussie Federal “spend like drunken sailors” Budget. Might help at the fringes.

I’ve been revisiting some blues roots this week, and stumbled across an old favourite, that ties in with fairness and equality..

Until next week.

Please share with like minded thinkers.

Happy to support any budding writers that want to contribute – direct message via Facebook to ensure you remain incognito…

Cheers

Black Swan