Edition #24 – We have them just where we want ’em…

6 December 2020

Apologies for late report. Black Swan has been travelling overseas, believe it or not. No government funded chartered jet for me though.

In the US, we will put Trump’s lunacy to one side and just look at the carnage of Covid that is ahead for them post Thanksgiving and pre Christmas. Poor old Fauci is pulling his grey locks out in dismay at their behaviour.

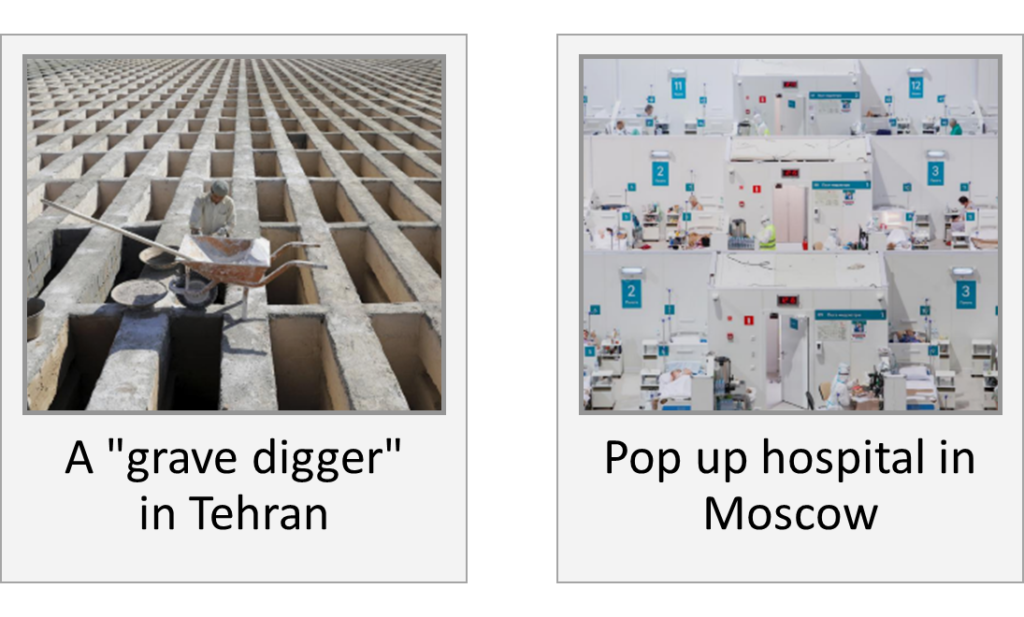

Of course the USA is not alone in not dealing well with Covid. Two true photos below…

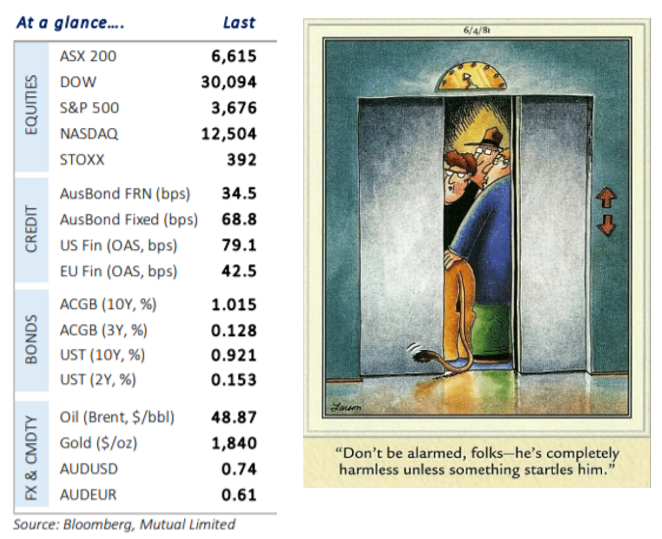

Global markets are back in Alice in Wonderland territory again. Big hopes for the various vaccines…almost as if they are here and rolled out already. Equity markets hitting all time highs, and US yields FALLING because of a disappointing employment report. Usual fundamentals (aka logic) would be the other way around, but the thinking is that a poor report may fast track government stimulus spending. Thus the free ride continues.

Whilst it may seem like true madness, Deloitte’s gives a good chart view that may help explain – in part.

It is not just the Federal Government splashing the cash, States need to spend as well and revenues have been hard hit. Great and courageous move by NSW to phase out stamp duty as a source of revenue – lets hope others follow.

So net State debt rises sharply (take a look at NT, which is getting smacked hard with GST revenue falls), but TOTAL interest service costs are as a whole, lower than 10 years ago.

Lets hope that spending is on productive infrastructure and not on one way roads to nowhere.

RBA kept the cash rate unchanged this week, and seemed cautiously upbeat, supported in no small part by a strong Q3 GDP. An increase of 3.3% in theory has seen the recession finished. Black Swan can’t find anyone that believes that.

The other piece of not unexpected, but good news, was the confirmation that house prices continue to rise and first home construction is literally booming.

Dark clouds continue, but a few cracks of lights shining through.

Aussie dollar continues it’s run higher – sitting comfortably in the 74 cents range this weekend.

Gold is getting smacked around on all this “good news”. I was speaking to a stockbroker that dines on gold for lunch and dinner. He is frustrated by the pullback and doesn’t see valid supporting arguments. He believes gold is a good buy at current levels but you may want to average in – just in case it goes a tad lower before the big bounce higher.

Swap rates climbed higher in Oz this week – and is a good reminder that RBA will work to keep bond yields inside their “agreed limits” but what corporate borrowers pay for money is set very independently.

Like one of my favourite Far Side cartoons – everything will be ok, as long as there is no surprises. And what are the chances of that….?

Thought of the week.

As promised we have a real Incognito presentation on the current trade tension issue.

We can’t give too much away, but they operate an international strategic advisory firm – working with clients and governments and specialising in China and the broader Asan market. Their opinions have been sought by mainstream media this week (or lamestreet as Trump would say). Their more balanced view in media interviews have been stripped down and the real truth is below. If you want their help in this matter contact us for a (possible) introduction.

The trade tensions took a real nasty turn this week, and Russia and China have shown that hypocrites are not just limited to The Whitehouse.

Click here to read it: China Trade War – What’s going on and should we be concerned?

What is Black Swan drinking?

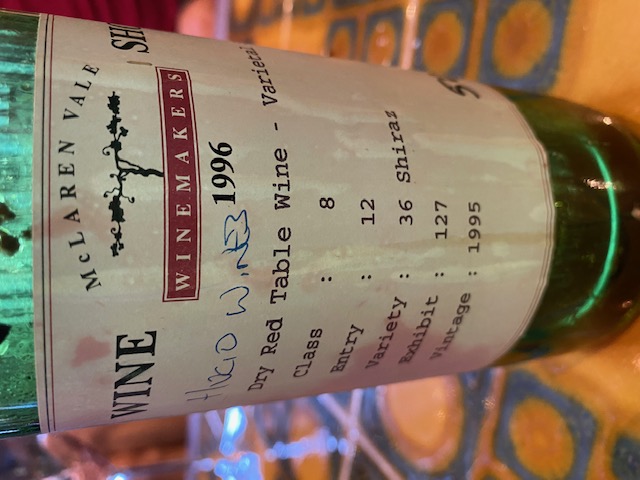

Lucked out big time this week.

Local pub/wine bar holds a small stock of aged reds for the punters they like. All these “clean skins” are gold medal winners from McLaren Vale Wine Show…the only problem is that you don’t know by whom.

This one had “Hugo” handwritten on it. A 1995 vintage shiraz from Hugo Wines. Extremely well priced for what it was, at circa $75.

For a 25 year old it was most unusual – very well behaved and pleasant to be around.

Had a big kick in it though, judging by the following morning.

Highly Recommend – if you can find it. 8/10

And listening?

Another old one that popped into my playlist. Wreckless Eric.

British punk rocker, this song was released in 1977 and is on Mojo’s list of best punk songs of all time.

Let’s just hope “she” is not in China.

![]()

Until next week.

Cheers BS