2021 Edition #7 – Tongs are talking

5 March 2021

I tried but failed…

Wow – a quiet (ish) market week overshadowed by politics.

Even Bitcoin seems to have gone quiet.

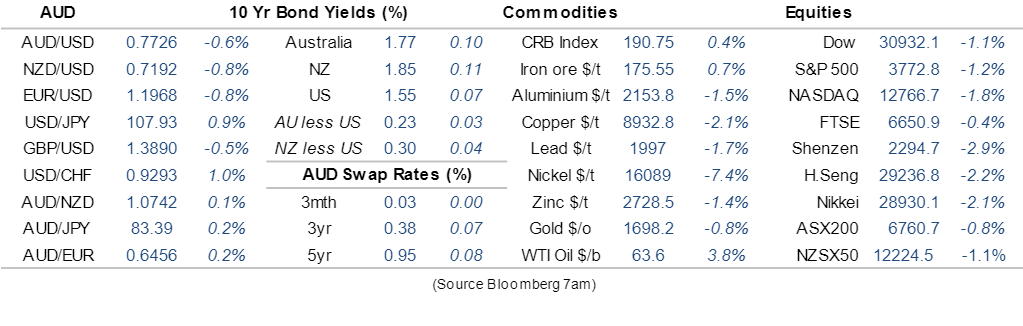

I was pretty plucky early in the week, when my #edition 6 call on a likely pull back in yields actually eventuated. You had to be quick to jump in though. By week end US 10 year yields are back at 1.55%

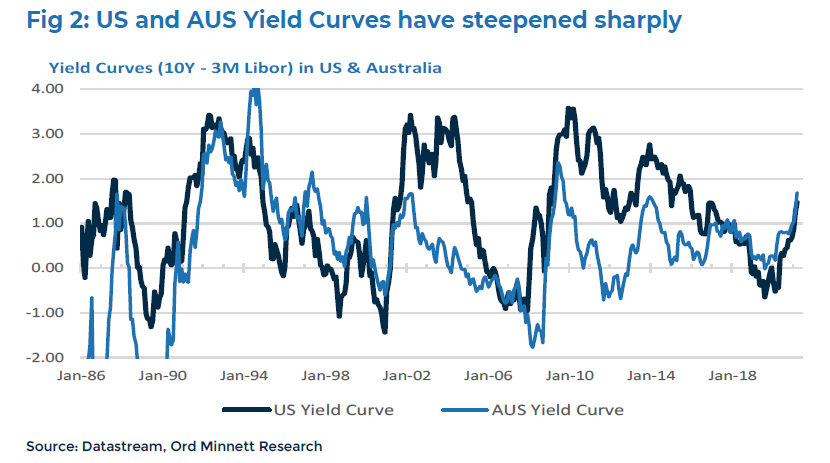

Ord Minnett yield “curve” chart shows the difference between 90 day funding and 10 year funding. It highlights two things:

- How sharp the turn has been

- Why we (Australia) needs to always see what the Septic Tanks are up to. We follow the US very closely.

Up until recently the bond market and equities had a love tryst going. Both were going up together – remembering that bond prices go up when yields go lower.

This love seems tainted now. Moreover, the rising bond yields are hurting equities. Basic reasons are:

Investors looks for value – especially compared to risk. Higher bond yields give investors an alternative to riskier equities

Companies are generally better off in low interest rate environments. This is especially so for new tech companies that need cash flow to grow and are probably yet to make any profit.

All the meanwhile Central Banks are busy feeding the chooks. “All is good…we have plenty of ammunition left….rates will stay low until at Keith Richards drops off the perch..etc etc…” Central Banks can’t afford a big bond rout that sees a 20% share market sell off that would put a fragile eco-system into very salty water.

Attached to the above of course is other asset price appreciation – housing especially. Banks got slammed in the Royal Commission for being too lax in lending assessment, and new rules were instigated. Then RBA flagged that tight lending policies were inhibiting Australia’s economic recovery, and they should ease off. I am aware of at least one local home lender that undertook meetings as to how they could fast track lending and be less “big brother”.

All that make sense until this week when RBA kept the rates unchanged, fed the chooks again, but added, “housing credit growth to owner-occupiers has picked up, but investor and business credit growth remain weak. Lending standards remain sound and it is important that they remain so in an environment of rising housing prices and low interest rates”. This was taken as a shot across the bow of banks to ease up.

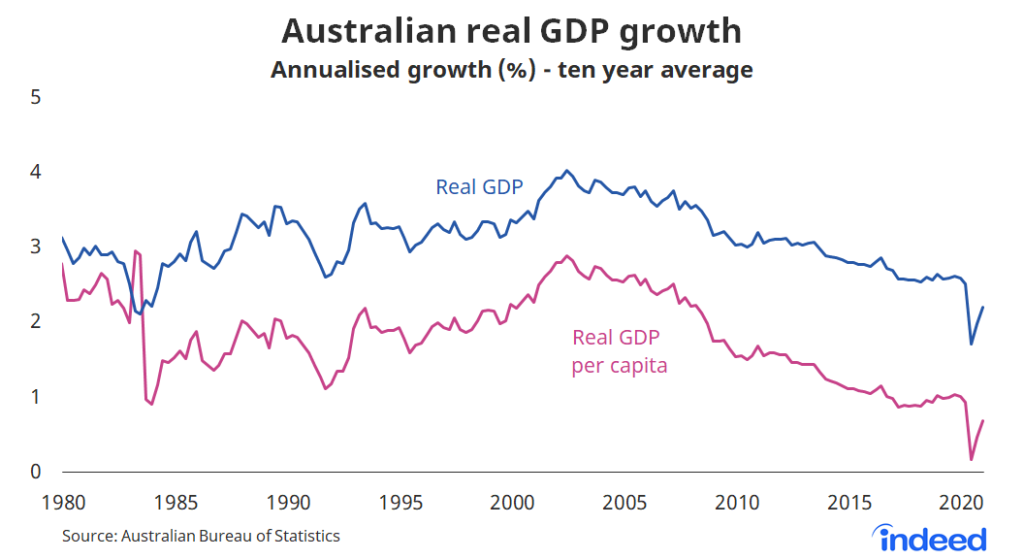

Aussie GDP came out later in the week. A very healthy 3.1% for the December quarter. Led by a whopping 6.8% jump in Victoria’s share of the action as it came out of lockdown #59.

We are still not square to the pre Covid card, but a spectacular jump compared to most western economies. Interesting chart below challenges our headline success though. The red line is Real (inflation adjusted) GDP per capita, which has substantially lagged behind. I am guessing this is largely due to nominal GDP being propped up by our substantial population growth via immigration, compounded by our poor productivity improvements over the last two decades.

Have a curry and a baby for Australia

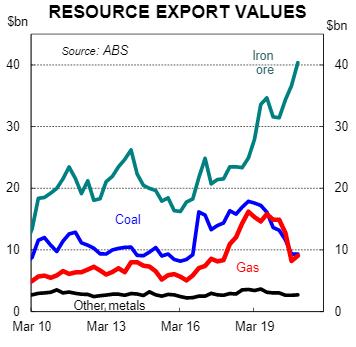

Our overall position had yet another boost on Thursday when Australia had a record Current Account surplus. Exports up and imports down. Blah, blah, but the volume of iron ore exports actually fell. But with prices higher than Snoop Dog, all is good.

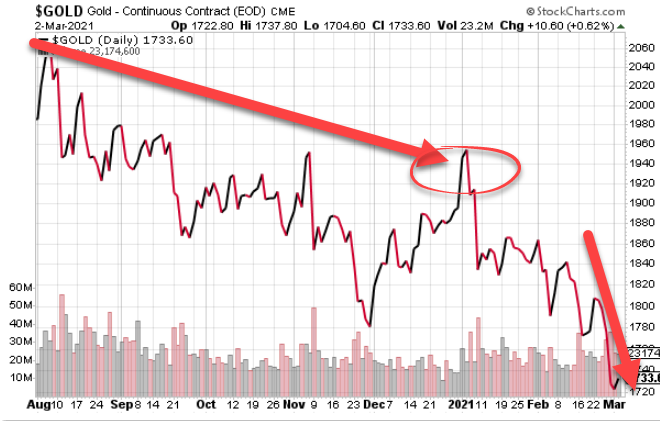

Talking metals, an update on my gold play. It is down since purchase, but patience is required. If you look at the chart below, you would be selling now and cutting losses. But I believe in the longer term strategy. Inflation is coming – only the timing is in debate.

The last thing on gold, is the more you read, the more you learn…and maybe get confused. As a USD based commodity, if my view is right, then as the gold price rises in USD terms, historical data shows I will be giving up circa 50% of my gains in FX losses. The theory being that the value of $1 USD will be less and thus my return is reduced. You can buy an Australian gold EFT that is hedged against this very risk, but of course the hedge premium costs money to buy and reduces your return. You get nothing for nothin’. So I will leave my arse in the breeze. Maybe I fell into this mistake..

Can you buy a gold border collie?

My decision to tip out a chunk of bank stocks is not looking all that smart at present either. Thus caveat emptor. Much like my last car purchase.

Last local news was Myers result. Sales down 13% is bad, right? So profit up 70%+ is a miracle, right? How was this magical $43M profit materialised? Where do we start? How about $51M in Jobkeeper payments courtesy of you and I topped up with $16m in rent waivers. Magic complete. At least (unlike Gerry Harvey) they had the good grace and a shite balance sheet, so no dividend paid. Feels and smells bad to me.

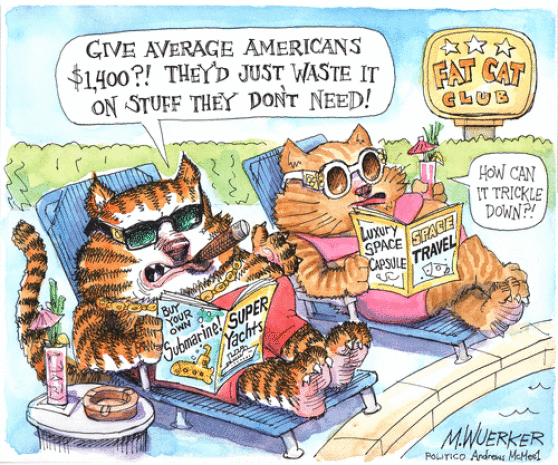

Speaking of smelling bad, new US President Biden is having some trouble getting his key (and popular) Covid relief bill passed. Republicans are just being dicks, but even some of his Democratic mates see it as being too big. Liked this cartoon:

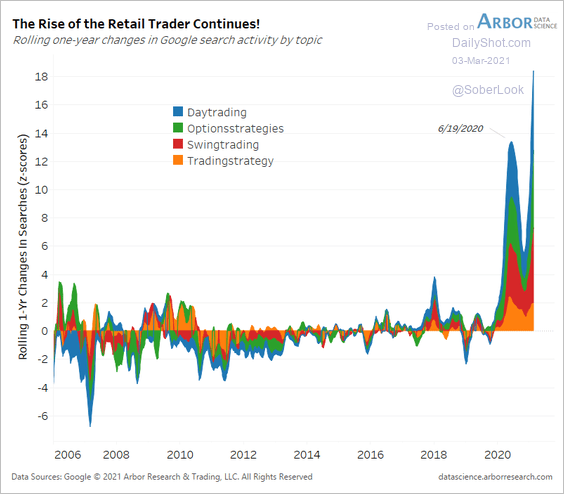

The US equity market had a slightly off week. Still seems to me that every serious dip just encourages new players into the game though. I was staggered to see confirmation that much of this new money appears to be coming from first time players. No guarantee that a simple search results in trades, but it would be safe to assume some correlation.

Of course the US is quite different from here in so many ways. For one we don’t have “free” trading platforms like Robinhood. If they do everything for free, how do they make a profit to justify their $12B USD valuation? An article in this week’s AFR gave some insight. Firstly they sell your details and trading data. As they put it “The answer lies in the in the much-cited quote ‘If you are not paying for it, you’re not the customer; you’re the product’.”

The second way is picking up commission by bulk selling activity to market makers. But here is another catch. They only make 2% of revenue via trades in the S&P top 500. 35% comes from small stocks (usually more volatile) and 63% from options trades. If the players are young and inexperienced, you do not need to be Nostradamus to see future cock up right there.

Retail equity trader…aka mad punter

Aussie dollar just under 78 cents. Seems stuck for now.

My mates tell me they are outraged by the level of outrage out there at the moment. Dr Seuss review has binned 6 out of the 60+ books. Outrage. One for example wanted to capture a turbaned Arab to put into a zoo of unusual beasts. Get the picture? Things that were appropriate 117 years ago, need to be tested.

But what a week….next Mr Potato Head….

Relax Piers, both Mr Potato and Mrs Potato remain as is. Not sure about his butt monkeys though.

Thought of the week. Water

Short thought this week.

I have thought for some time that water is undervalued – and particularly for we city folk that turn a tap on without too much deep thought.

We grizzle about our water bills, but how much would we pay if the alternative was no water?

Our national water policy approach has been (by all political parties) is in the same cluster fuck as energy/climate.

Our eastern seaboard river system has been a lifeblood to the country for thousands of years.

But everyone wants a piece of the action.

One SA market player was an early adopter for water trading. Duxton Water (*no shares owned…) got plenty of press last year when it was suggested they were with-holding supply in an attempt to push prices higher. The ethics of them making money as irrigators suffered make for poor optics. This despite a current return of 4.1% on capital being frankly very average.

I have met their main man quite a few times. Other than an imported accent (New Yorker) he strikes as a pretty astute cat. What is not as well known is that the broader Duxton Group has a pretty large and diversified interest across broad acre agriculture, nuts, vines & wines, dairy, orchards and even bees.

The group in and of itself is a major user of water.

I do know that one catalyst for them going into water in the first place, was as an American he knew about almonds. And he saw just how many new almond plantations were been established in the Murray-Darling basin. Almond trees are thirsty buggers. At Writers Week this week Richard Beasley SC revealed his experience as a senior counsel in the Murray Darling Royal Commission. Unlike rice or cotton where you can harvest in seasons when water is abundant and sit out dry years, Almond trees need water to stay alive. Beasley revealed it takes 35 litres of water to produce just one of these puppies

Duxton saw an opportunity. Supply and demand. On the supply side, water will become less abundant, On the demand side, the sky is the limit it would seem. Time will tell.

Finally Round Two of political scandals.

** Amendment to last week’s contestants. I identified the wrong Bush…. It was George H W Bush that threw up. Minor error, unless you were the 43rd US President rather than the 41st.

Who could have predicted that there could be some contemporaneous applications from the current crop. I will leave that well alone (of sorts) other than to say recent issues must surely bring a “test of character” analysis of a number of politicians. In 1982, Michael MacKellar, a Fraser Government Minister, brought a colour TV into the country, but listed it on the customs form as black and white, therefore avoiding duty. He was sacked, along with the Minister for Customs, John Moore, who handled the issue clumsily. What would it take these days, do you think?

Anyway – our players today:

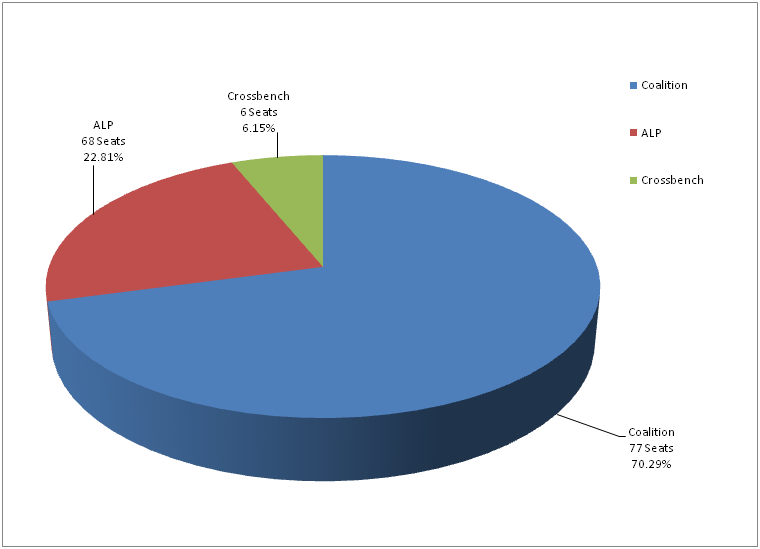

A: For Australia : Ros Kelly 1993 Sports Rort.

Put 2,800 submissions for sports grants on a white-board and then had a chat with a few staff before deciding who got what. $30M of funding in total. Reluctantly sacked by Keating in 1994 under pressure from Hewson and Howard.

Interesting to me to overlay that with the current $102M McKenzie Sports Rorts. Harmless hi-jinx surely. Awarding the poor and struggling Royal Adelaide Golf Course $50,000 for solar panels is money well spent to those down and outers…

Chart below is the allocation of grants from the current Federal Government. Seems fair….not….

Point is that they both do it. Just don’t like getting caught.

B: For USA : Wilbur Mills 1974 The Fanne affair

Wilbur ran as a Democrat for the Presidency in 1972, won by Nixon. Studied law, county judge, married, good family – silver spooner.

Pulled over in his car by police at 2.00am in Oct 1974. Headlights not on. Full pissed. Face is scratched from his passenger, Fanne Fox – an Argentinian stripper. She jumped into the nearby lake to escape…Ben Cousin’s style.

Despite the incident, he ran for his seat again and got re-elected in November of that year. He ran a press conference from Fox’s burlesque house dressing room.

He did not contest in 1976 and conceded due to alcoholism he did not remember anything about 1974.

What is Black Swan drinking?

Anyone would think I have a thing for SA wines. I do.

Barossa Valley – young and meant to drink young.

Blend of three of my fav varieties.

Maybe not for your big porterhouse steak, but a winner for a lighter meal.

8/10

And listening?

New out this week. Kings of Leon – you get what you expect.

Serious finish to this a long weekend.

We live in troubling times. I don’t wish or expect those that disagree with me to change their opinions. Nor should they – I could be wrong. But I ache for the large and happy middle ground that was once well supported, but seems to be rapidly shrinking.

Cheers BS