2021 Edition #6 – Don’t get too cocky

26 February 2021

How much for a bridge climb? Yeah…nah

The week was sort of same/same….but different.

Great news from Tourism Australia…oops I mean the Liberal Coalition…oops I mean the Australian Government. We beat Antartica to the jump to be only the second last continent to roll out the Rona vaccine. Take that, penguin.

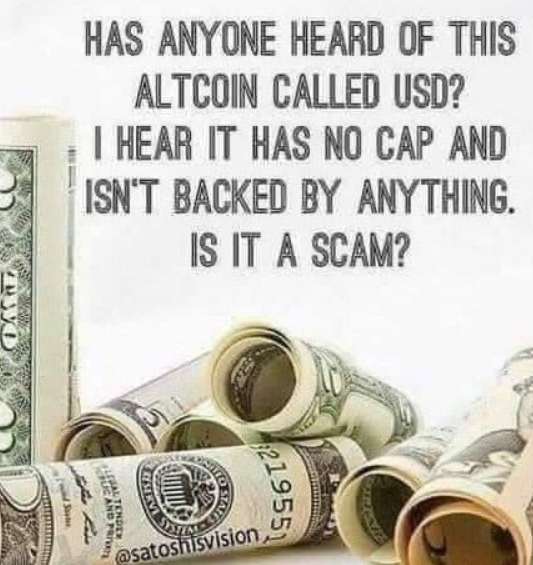

Let’s start on my favourite new “currency” – Bitcoin. Basic definition on currency is that it is a store of value. I see fark all of that – on the up or on the down.

Elon Musk lost his place on top of the new world order of wealth when he tweeted a basic fact – that he thought BTC seemed high LOL (sic). Anyhoos, Tesla dropped $18B USD and his orginal $1.5B investment looked less of a brilliant manourve than it did a few days ago. Now, I have little sympathy for the little rocket man, but it pays to shut up when momentum is your friend. Having said all that, the 17% fall looks pissy compared to the rise over the last 12 months.

I’ll share some (paid for) technical data in coming weeks…but first I need to try to understand the data. One thing of interest is techno bods classify and track buys/sells by ownership characteristic. From smallest to largest they label as:

- Octopus

- Fish

- Dolphin

- Shark

- Whale

- Humpback

Now, I’m no marine biologist, but I’m pretty sure if I was a Humpback I would be taking issue with being ostracised.

Octopi and whales are diving and dolphins are rising.

It’s all a scam….

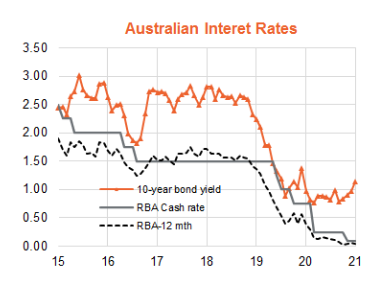

Seems like the entire media and market jumped onto the rising yield story this week. US 10 year yields up 11 bps last night to hit 1.50%. I’m starting to think that it might be like the flu – by the time you feel sick enough to go to the doctor, you might just be past the worst of it.

Yep – the market is “reconfiguring” the recovery scenario, and a V seems more likely than a U or L. But just how much further can interest rates go without physical evidence of actual inflation? Or more to the point, actual rises in central bank cash rates? If they go much further than current levels, to me it says that the US Fed and RBA are actually downright wrong – they will need to back track from low rates and start to hike by 2022.

There are always checks and balances in the market. Traders could buy a long dated bond at high yields, then pay for that by selling a strip of bills futures out to that same maturity. If the bills are cheaper than the bond, then they pick up a risk free premium (arbitrage). This hole or opportunity never lasts – either bills rise or bond yields fall.

So the damage might be limited from here.

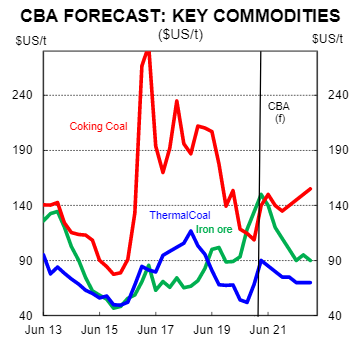

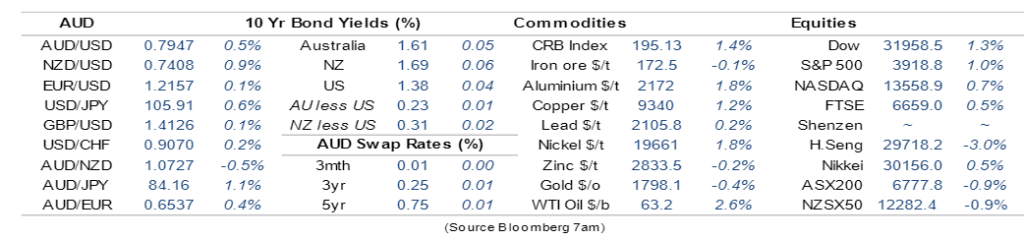

But with Aussie terms of trade climbing, commodity prices holding high and our economic recovery apparently backed in quicker than just about the entire globe (let’s exlude China), the Aussie dollar looks destined to get through 80 cents in coming days. CBA do see a cap on the AUD with some commodity prices likley to fall later this year. Coking coal (for steel) is expected to go the other way though. It fell when China said “thanks but no thanks” to Aussie coal, then realised that they actually didn’t have as much of it hidden behind the bike shed that they thought, and now have a shortage.

A high Aussie dollar will not please RBA at all, but little they can do.

Qantas had shite results this week. A lazy $1B down the tube, but share price ok. Our maket getting punched today after a bad night in the US.

I’ve been all for government spending to prop up the economy whilst the private sector was knobbled by Corona Virus. There does seem to be some severe piss-taking along that journey though. An analysis of corporate accounts by The Weekend Australian shows that across 16 companies, a total of $236.1m in Jobkeeper payments were reported as received in the six months to December 2020 against a collective $1.84bn in profits, while several paid out dividends to investors over and above what they received from the scheme. Pretty dodgy and I hope the Gov does chase this up with as much vigour as RoboCop debt.

Despite common protestations, Black Swan considers themselves a centralist/moderate. I read stories of politicians fighting toe to toe in parliment, then have each other over for dinner – maybe like an opposition cricket or footy team used to do.

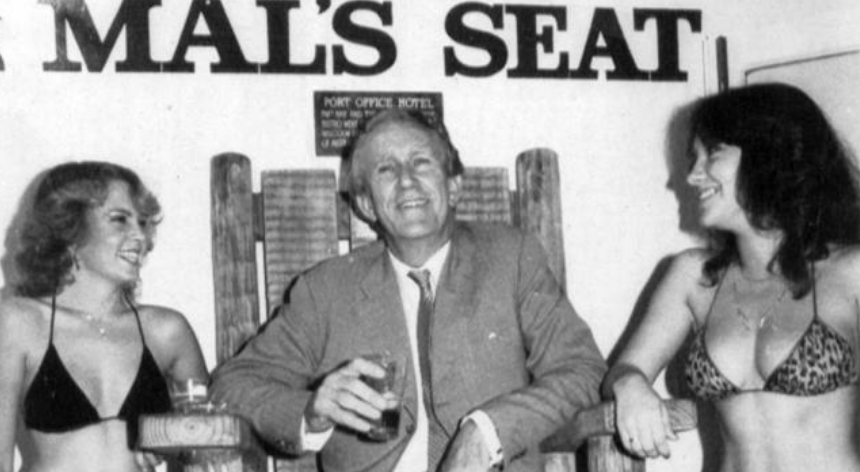

That doesn’t seem to happen anymore, and concensus of policy is worse for it – here and in the USA. There is no quarter given, but worse, no respect. The Federal Government is in deep strife over recent issues around culture and behaviour. Whilst this is not limited to one side of politics, if ever one photo highlights what is wrong with our leaders it is this one:

“Can someone wash the kitchen dishes please…?”

Some US inflation data out tonight, and given current hyper-sensitivity, it could move markets.

Thought of the week. Bad things can happen

Black Swan is a moniker that describes the fact that massive events can/WILL happen in the future….just what and when is the current unknown.

I think that remains 100% true for the financial world. My thought of the week is tying that into our personal world.

This is relevant given a close to home example where a great love story unfolded. Vows were exchanged, documents signed and finances melded. Common theme and most of us have done it. Issue is that the vow of love has turned massively sour….like milk left in 40 degree sun for two days.

Often this means a temporary broken heart then a rebalance of your “portfolio” – of finances and partners.

What I am seeing though is a demise of business, passion and livelihood. It is still raw and unfolding, but with some certainty I can see little upside to either party.

Love can endure, love can conquer. But love can rip the arse out of your jeans (genes).

Personal Black Swan events can be broader too. Accidents, health or just misjudgements can all bring you undone.

Short of being a counsellor, I don’t have a cure or solution. And there is no point entering a “joint venture” with a view that it is doomed to fail – because it will. But when my young cygnets look to find a new pond, they will have two great starting points:

- No significant assets or income to lose

- A parent that will help position and protect them against Black Swan events. And try to get them to enjoy their pond whilst it is still.

Onto a very different thought. This possibly has the makings of a series…

What is the worst political faux pas possible?

I have dug the archives to come up with a few beauties, but today we have two contestants

A: Mal Fraser losing his pants.

or

B: George W Bush throwing up in the lap of the Japanese Prime Minister?

A bit of background on both.

A : Mal Fraser 1986

Not a noted pants man, Mal was guest speaker at the Memphis Country Club. He had a few brews, and later got stuck into some local whiskey. After midnight he booked into a seedy hotel under the name of John Jones.

He woke up next morning without his $10,000 Rolex, passport, cash or pants.

Taxi driver Roy Wilson gave him his own pants (without payment, given Mal had no cash) “They was good trousers” Roy said.

Mal never really explained what happened, but his wife Tamie said “they were setting him up. Poor old boy. It’s really horrible. He was so embarrassed.” You and I probably have a better idea of the run of the night than Tamie.

Where do you find a wife like that…?

B : George W Bush 1992

George W was on a Japanese trade trip and was to speak at a state event for 135 diplomats at the Japanese PM’s residence.

Between the second and third courses, George W “feinted” and fell into the Japanese PM’s lap, vomiting as he went.

Barbara Bush mopped him up with a napkin, and the US Secret Service placed him on the floor. His personal pyhsician was in attendance, who explained that George was by then conscious and said “Roll me under the table until the dinner’s over.”

Next day it was claimed he had a common intestinal flu.

In Japan there is now a common term of phrase – Busshu-suru. Which of course means to ‘do the Bush thing’.

Happy to take you vote as to who goes into the second round, but I vote for George. Bigger stage and bigger stakes. The fact that it was captured on TV an added bonus.

If only Trump did drink……

What is Black Swan drinking?

Can’t hide the price on this one.

Was not my choice, but very good none the less.

Another boutique Adelaide Hills wine, and interesting given the sommelier recommended the 2020 vintage over earlier years that were available.

Very good – one bottle not enough though

8.5/10

And listening?

Back travelling down memory lane. Good trip. Good beat.

Thoughts are with Tiger. Harsh but fair.

In keeping with Thought of the Week, the snippet below from a Chinese e-commerce site. I think I agree with their sentiment, but not sure….

Cheers BS