2021 Edition #4 – Weeknd, come at me bro’

13 February 2021

Be a mummy not a dummy. $7M well spent….

Chart question last week got a spread of answers.

One offer was that the chart represented his partners sex drive

Many thought it was various politician’s popularity.

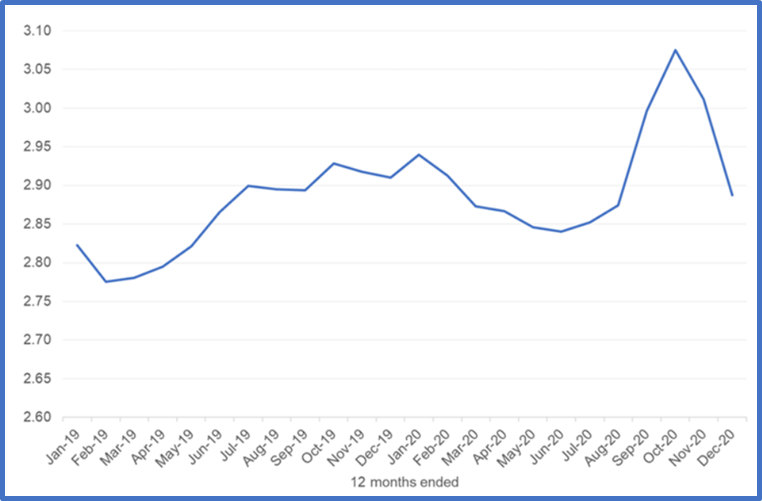

The winner of the wine is a very late entry – Tushar Joshi. Whilst they believed it may have been wine exports to China, it was actually Australian wine exports globally. Even given China’s tariff attack, we are still relatively high. Tushar – send details and we send wine. Also a test of spirit for all entries, to find a way to reach us. The “no reply” is a hoax….

Another competition next week.

Australia has passed the 12 month anniversary of Covid’s arrival to our shore. It is one that we will remember for generations. It has changed the social, economic and political agenda. It may yet be both a painful but historically positive time.

I remember very early in the pandemic a NAB worker in their Bourke St HQ missed a day at work and then phoned in to say he had been tested positive for Rona. It resulted in a panicked (think of people trampling over people) evacuation on the multi story building and a multi million dollar “super clean” of the building. It was probably at this point the bloke just wished he had made up a common flu excuse. His lie became too big to deny, but he was eventually found out. I believe he is no longer a banker.

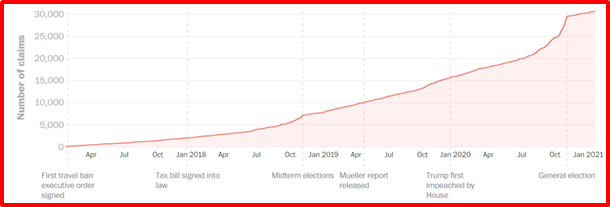

Speaking of lies, Black Swan’s best buddy, DJ Trump is in for an embarrassing week via impeachment #2. It does look like his minions don’t have the balls to call it out for what it was. Partly due to their implicit involvement via support of Trump and “the big election lie” and partly not looking to alienate the right fringe.

The book I mentioned last week is still not quite finished. But a snippet from it:

“It’s in these moments of insecurity, of deep despair, that we become susceptible to an insidious entitlement: believing that we deserve to cheat a little to get our own way, that other people deserve to be punished, that we deserve to take what we want, and sometimes violently.” Given the book was written the year before Trump took office, I don’t think it was a political statement at the time – but fits nicely into what Trump (and some of his wackier supporters) think.

The final result for DJT was over 30,000 lies whilst a President – surely the greatest of all time…

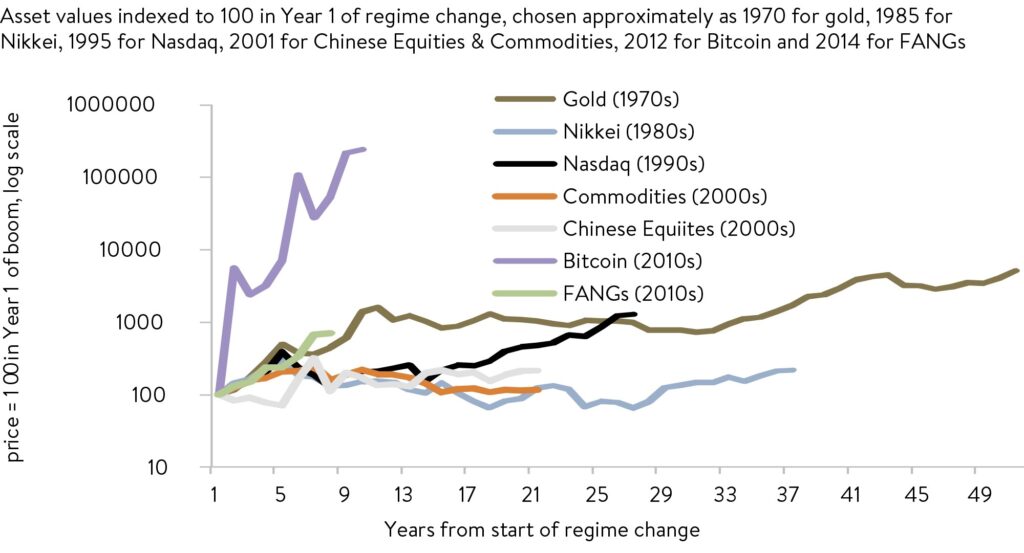

Internationally the story of the week was Elon Musk’s Tesla business buying $1.5B of Bitcoin as an investment. As you would expect it has put another fire under the price of Bitcoin. If you are a Bitcoin believer then this is a serious commercial player giving Bitcoin a tick of approval – you can buy a Tesla with .88 of a Bitcoin.

If you are a cynic then you would say that Elon fudged $1.5B worth of tax credits from the US Government (aka tax payers) for his environmental car production and then invested it in one of the most carbon polluting schemes going around.

What can’t be denied is that early adopters to Crypto have done well. Very well indeed if you look at the purple line.

It is time for this old dog to confess – I don’t fully understand Bitcoin fundamentals and as far as I can tell it is impossible to “value” via basic fundamentals. It is not like a Shopping Centre where you can crunch rental income, apply a discount and come up with an effective yield/return and thus a saleable value.

It is not like cash or a bond where you get interest and can net present value ahead. Not like industrial stock that will give you a dividend from profit.

Maybe I should listen to Jim Cramer, hedge fund manager from 1987-2001. “Who cares about the fundamentals? The great thing about the market is that it has nothing to do with the actual stocks.”

It is a “thing” on computers that is in high demand at present and momentum is your friend. Bitcoin trading at USD $45,300 this morning so Greg may not be happy.

Which thus brings us back to bubbles.

I criticise bank economists because they have a mindset that is framed by education and “experience” and the numbers always speak to them a certain way. Thus their views (for you) are tainted by their bias.

I, for example, am a natural bear – things are always on the precipice of collapse and ruin. But I am aware of that and spend way too much time questioning my hypothesis and seeking faults in my belief.

Equities wise of course you can look towards global low interest rates, fiscal stimulus pumping cash out and investors looking to place funds. All good reasons why the punchbowl can stay out on the table and we can all drink into oblivion…at least till 2023, right? This time is different.

I accept part of that, and we in Oz are well positioned for what should be solid growth ahead. But Black Swan by nature fears the unknown.

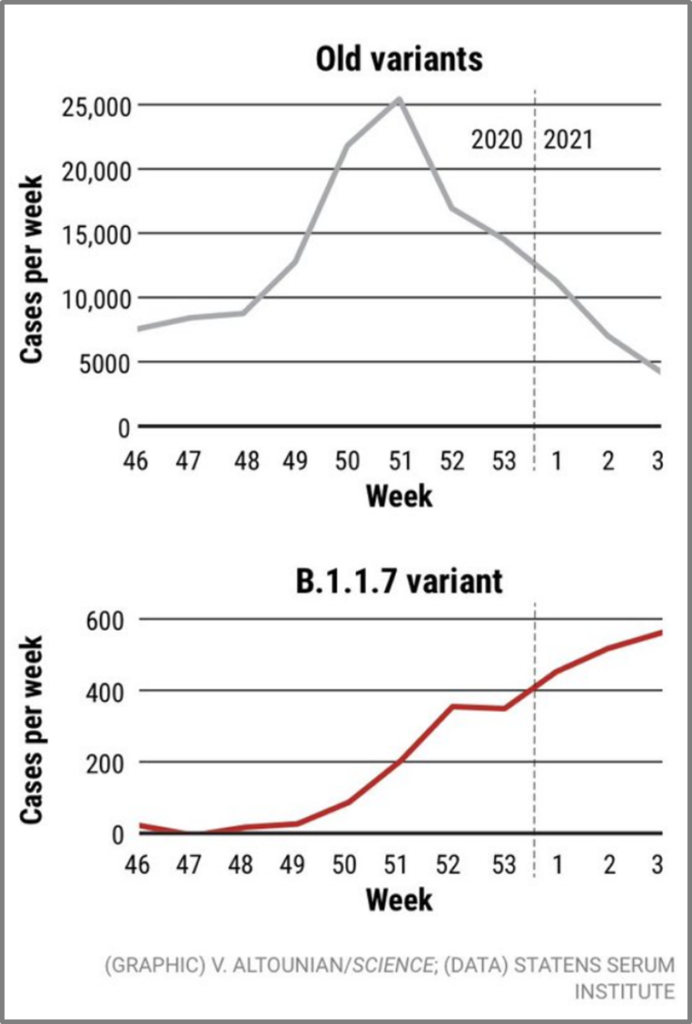

Is it new strains of the virus (left hand chart), is it unrecognised inflation or just the classic leverage margin call crunch? And when?

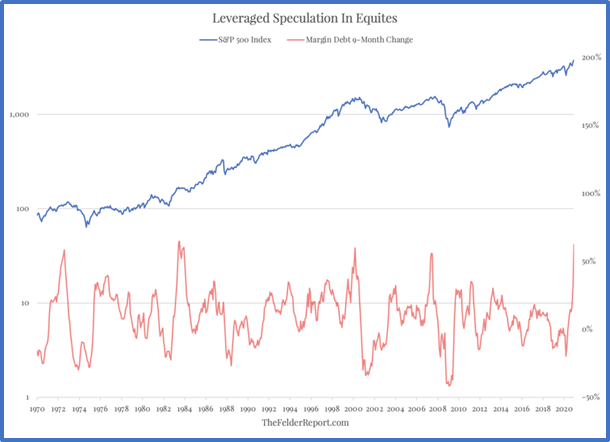

In my head it was all those pimply Reddit teenagers with stimulus cash having a red hot crack in the USA. They may well be spending their cash, but margin lending debt (red line) is as high in the US as any time since 1970.

You can rationalise that by saying smart people use leverage when it is cheap to super charge their return. That would be fair, but don’t drink too much punch. When the trend reverses, leverage is a bitch. It will bite a few in the arse. Or as someone smarter than I put it:

“Even the most circumspect friend of the market would concede that the volume of brokers’ loans – of loans collateralized by the securities purchased on margin – is a good index of the volume of speculation.”

– John Kenneth Galbraith, The Great Crash 1929

We are all smart enough to sell just before that happens…aren’t we?

Anyway – post rationalisation of my thoughts and position, I tipped a third of my equity portfolio out this week back into cash. If the market rallies on, I will be less happy than I could have been…but still happy. If it tanks, at least I would feel I’ve done something. Black Swan’s hound has a nervous disposition. Maybe he and I should share the bacon flavoured hemp extract and just chill the fuck out….

I’ll eat bacon flavoured anything.

Packer’s Crown Casino business under the pump for allowing money laundering and may lose their licence. Fun fact: Former Liberal minister Helen Coonan is currently the chair of both Crown Resorts AND the Australian Financial Complaints Authority! A foot in both camps.

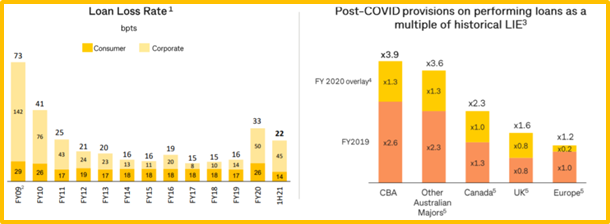

CBA half year results out. 21% drop in profit, but that was better than expected and share price is steady. Couple of charts you may be interested in:

- Loan loss rate is still well down on original GFC hit – noting there is more to come.

- More to come is well provisioned by historical and international standards

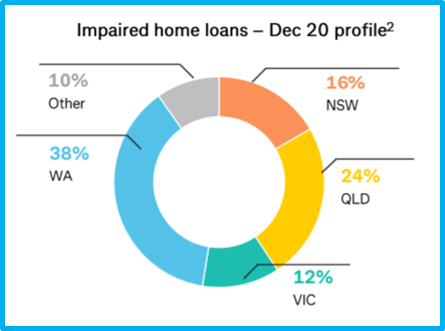

- WA leads the impaired home loan book. No explanation, just tickled my interest.

- Not on the charts – CBA opened more than 230,000 new online share trading accounts in 2020. Refer my earlier thoughts….

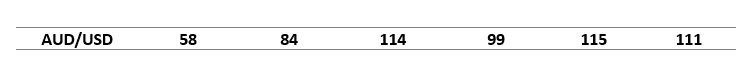

CBA daily data shows as:

Thought of the week.

Short thought this week.

When I was in banking I would often be asked (and often told)…” what is the best day to trade?”

I had one importer swear black and blue that Friday was the best day, others thought it was a Monday…or was it Wednesday? Of course the “best” day for an importer is the “worst” day for an exporter to trade FX.

I always thought that market randomness meant any day could be the best or worst.

But I have done some research – so that you don’t have to.

First key assumption (fact) is that there is no specific day when the AUD trades higher, or lower, than any other.

So the “best” day is the one that has the most liquidity (aka players that are playing) and the most volatility – the spread between daily highs and daily lows.

The forex market runs 24 hours a day Monday to Friday. It goes something like this:

- Sydney market kicks the week off on Monday morning (remember that is Sunday arvo in New York) – The smallest of the four in volume

- Tokyo next – mainly trades the Asian currencies, but bigger volume than Sydney

- London – surprisingly the big dog. 43% of global trade. Often sets the trend for New York

- New York – #2. Limited by the fact that 90% of trades in NY are USD.

My study here assumes you are looking for the day/time to do a spot trade or place an order. From reading and talking to traders the answer may not help you unless you are trading from your bed late at night.

Liquidity wise it is best to avoid Friday afternoons – the traders are either off to their weekend holiday home or pissed from lunch.

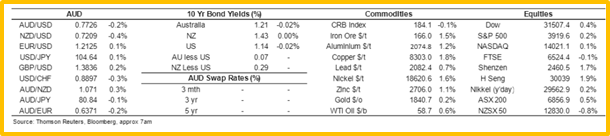

Volatility wise the only empirical data I could find was via New York. Below is the daily point range for AUD/USD from Sunday to Friday.

From that you would choose Wednesday or Thursday (our time zone) to have a crack. And if you want a month it would be September.

With all above being assumed as bullshit, a quick recent story about an interest derivative trade I was involved in. The bank had advised the borrower to wait to execute the hedge given the Christmas trading zone had seen limited liquidity. The borrower understood but ultimately elected to “pay” a point or two extra in liquidity to get the trade away. Trade completed, the underlying instrument then climbed 15 basis points that very night. Two points paid for 13 point gain. Fair trade, but highlights if the end rate is within your appetite then maybe just take it.

I see so many Aussie importers “like” the current level but are waiting for even better levels ahead. Maybe better to start averaging in and taking a bit now?

It is a bit like the reverse of picking a bottom when you usually just end up with a smelly, dirty finger.

Bottom picking

Interesting that the meme below has capitalism in red (Republicans) and socialists in blue (Democrats). Not a personal gun fan, but the notion of such opposite views and perspectives are humorous to me.

What is Black Swan drinking?

A quiet drinking week, although I reconfirmed my agreeability with a Melbourne Bitter can or two.

Adelaide Hills winery Murdoch Hill makes very nice plonk. Owned by the Downer family (yes related to the famous cross dresser), the Sulky is what might be called a weird blend. 85% Syrah topped up with 15% pinot noir. As you can imagine it has strength and bite but with just a touch of subtleness.

I’ve had better Murdoch Hill wines, but worse wine than this one.

8/10

Hello big boy

And listening?

Gone from old school last week to newcomer this week. Mia comes from Covidland, Melbourne and has a really punchy voice.

I’ll leave you with this. Year of the squirrel ox.

Like anything, timing is everything.

Cheers BS