2021 Edition #37 – Get the Mail Here

25 October 2021

Rare reveal of inside the National Party Cabinet

Big Picture

We are still keeping an eye on inflation.

Australia gets a look at what happened to the end of September this Wednesday.

The Melbourne and Sydney lockdown should keep a lid on the number, but trimmed mean at 0.5% would only see an annual rate of 1.8%. That should be all good, but the Headline number may well still show 3% or higher. Don’t forget the NZ inflation number for Q3 was well over market expectations and sent the markets into a mini trauma.

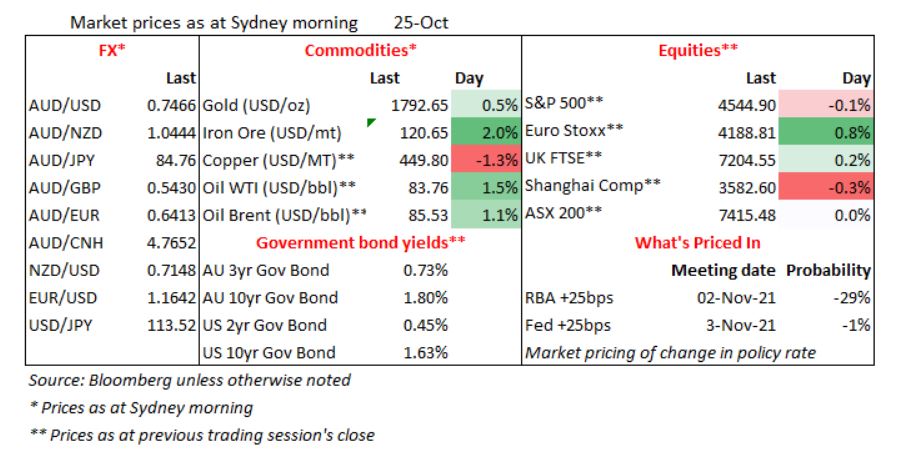

USA and global inflation has also seen the US 10-year rates go nuts – but they have cooled their jets a little lately. They are only a few basis points higher now than at June 30.

The US Federal Reserve meet next week and it’s highly likely there will be an update on the tapering of Quantitative Easing’s (QE). It will be another sign of the punchbowl about to be pulled from the table.

US 10 year rates.

The tapering in the US (and ultimately here) is indeed reason enough to push yields up alone. Government Treasuries are the initiators of bonds (sellers, if you like) and with government debt going through the roof, they have a lot of selling to do. Central Banks have been purchasing bonds (the very essence of QE) to keep rates low (buyers). If that buying stops, or severely slows down, then you have more selling than buying. In bonds, that means prices will fall… which means yields rise.

So, some of the September/October yield rise was in part due to above – pricing for policy.

But it also represented “real” inflation fears. Some of those fears are well founded, but others may be temporary (or transitory, as the buzz words have it). This is pricing for fundamentals.

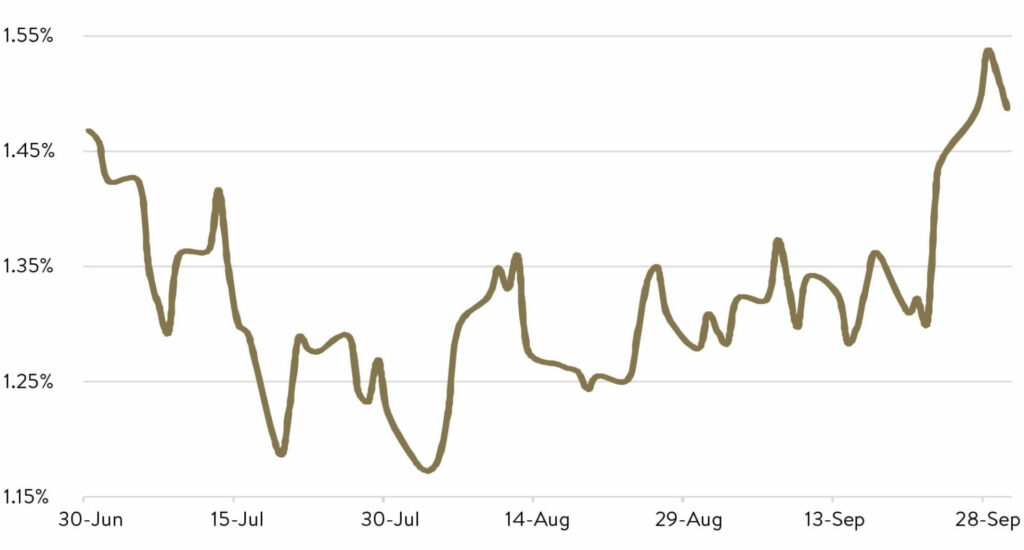

Supply chain issues have been blamed for much of this fundamentals transitory stuff.

Just look at freight shipping costs below as well as 70 ships sitting in harbour in California. LA ports account for 40% of US cargo, so not insignificant.

Much of this supply chain issue seems to be a shortage of labour. You would think in a ‘living with Covid’ world this will correct as workers can begin to cross borders again.

The low rates have, however, given real estate a boost to ridiculous levels. This has to eventually filter into real inflation both in housing purchase price and rentals. This inflation will be stickier – but the levels of price appreciation is already starting to slow, I reckon. Higher rates will slow it quicker – or even see it reverse some of the gains. Take a look in the housing section below for an example of Australian prices being basically stupid. No subtitles needed.

Some inflation is a good thing of course. You only have to see Japan over the last 25 years to see a country that wishes so hard for inflation to be a problem.

One thing inflation will do is help Central Governments pay back debt… at least make it look less unpleasant.

Commercial Banks, like our Big 4, would also benefit from some inflation to help push margins higher.

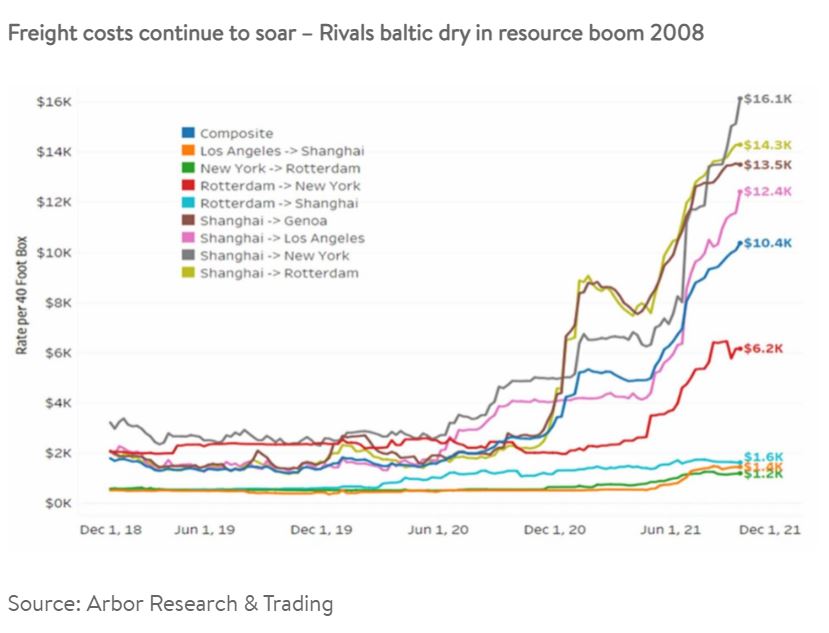

Our equities have had a better week or two after a bit of a Barry Crocker period. In fact, the US company reporting season is in full swing, and all appears solid.

A more than normal 84% of companies beat expectations, and 13.4% were above market estimates. Net margins are also tracking at their third highest levels since records started in 2008.

All pretty rosy, especially with cashed up households apparently eager to spend hard going into December.

The S&P index looks to have that ALL factored in…

So no need to be bearish…

Banks

Not much to report of interest to me this week.

General ‘man in the street’ feedback I get is that the quality of bankers continues to fall. This is especially so in commercial lending. You can borrow as much as you like, provided you either don’t need it, or can cover it 2x with real estate security.

If you have a good banker, try to hold on to him/her.

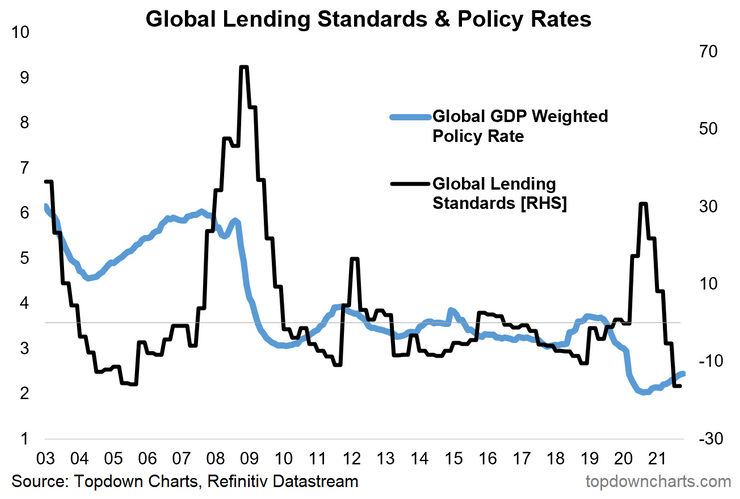

Whilst I also hear of the pain it takes to get a mortgage these days, thanks to increased APRA regulations, I can happily say I don’t think Australia is reflective of the chart below.

Average global rates are historically very low, but lending standards are even lower.

This can only ever (or Evergrande) end in tears.

The Aussie Dollar and Commodities:

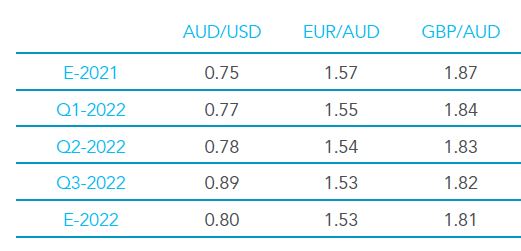

The Aussie dollar starts the week in the mid 74 cent range against a USD that has fallen on the week.

With the USA likely to hike rates well before Australia, I remain inclined to think the AUD will not climb much higher.

Certainly, FX provider Ebury disagrees though. Their London office gave the following forecast for a much higher AUD next year. Possible – but will need a renewed commodity boom.

Oil just finished it’s ninth week in a row with a higher price. It has not had a run like that for 6 years.

Newcastle thermal coal now down 34% from early October. China looking to put a plug in chimneys until after the winter Olympics.

Gold finally getting a small run higher – but small indeed given apparent inflation fears.

Politics

It is funny – easiest memes to find seem to be about our politics.

Interestingly, for the first time since the last Federal election, Betfair has the Labor party narrowly ahead of the Coalition to win the next election.

I would argue that a three legged dog could be favourite over the Coalition rabble.

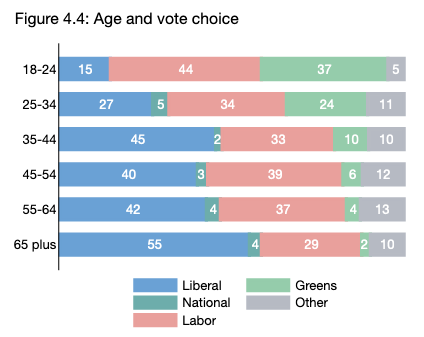

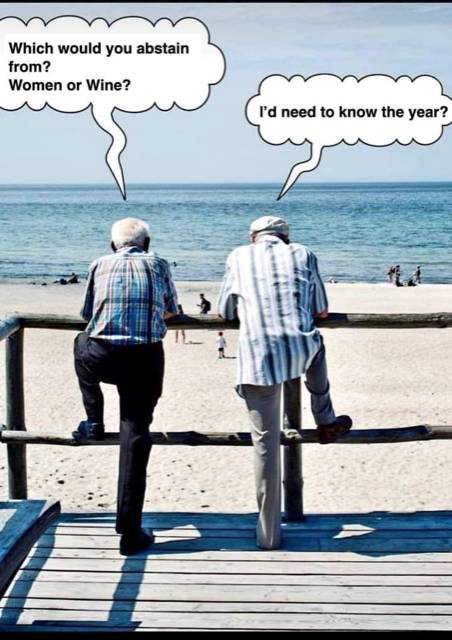

Seems we get less green and more blue as we age….

Australia is a commodity powerhouse. They have given us all a fantastic country of wealth. And that will not end this decade, or the next.

My perspective is not ‘stopping’ what we have – just the harsh economics of staying in the ‘too hard’ camp of the Coalition is batshit crazy. The cost of doing nothing will FAR exceed what a respectable and responsible transition will cost. Even before any benefits of going fossil free are generated – of which we could have been a leader.

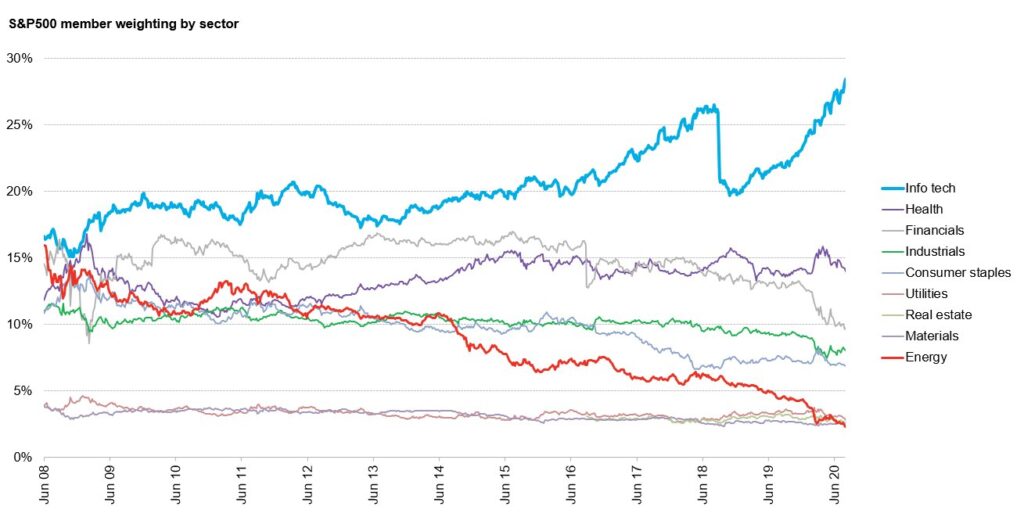

Just look to America. Follow the money trail. Look where the red line has gone compared to Info and Technology.

Backing energy is just frankly a bad economic idea.

I suspect even after ‘winning’ the National’s support for a net zero 2050 target, SlowMo will get carved up in Glasgow when 2030 targets are discussed.

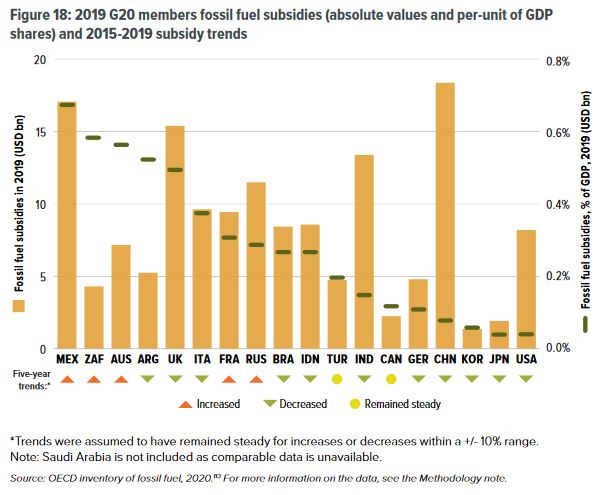

Australia has the third highest subsidies for fossils when measured as a percentage of GDP. With some effort, maybe we can catch Mexico…

To be fair, some of this same irrational argument is taking place in the USA as well. Joe Biden’s right hand man, Senator Joe Machin, is putting sticks in the spokes of the Build Back Better Plan that is before the House. A big part of that plan is to transition away from coal. Problem is, Machin is not a supporter of that AT ALL. Then you work out why that might be…

Joe Manchin comes from West Virginia – a coal State. He owns $3m of a coal mine and earns 71% of his income from the dividends.

Of course he argues that he is fighting for his constituents. West Virginia employs less than 3% of its workers as coal miners. They do take a much higher share of wages than that though.

I have seen the same statistics for Australia and it is surprisingly similar. Not many, and well paid.

Our biggest climate change “sceptic” in Cabinet has a brother that is Managing Director of a Queensland coal miner.

Glady’s ICAC investigation not going well for her so far. If you want a great laugh, track down Nigel Blunden’s memo regarding the Clay Shooting grant application. It is just hilarious. She testifies next week from memory. Not much noise coming from Murdoch press or Federal Liberal’s of late on this matter.

Finally, for the first time in Australian Parliamentary history, the Coalition voted against their own appointed Speaker of the House recommendation that the Christian Porter ‘blind trust’ be referred to the Privilege’s Committee. It is an absolute disgrace. You know it is, when even his mate PVO says it is.

To quote Robin William’s line, “when you’re violating your own standards faster than you can lower them, you know it’s time for rehab!”

Housing

No sea views. Knock down job. Crazy.

For something different… WBC data:

Crypto and Gold Land

Couple of quick things here.

Firstly, I’ve been told that the market capitalisation for Ethereum went past that of JP Morgan and Visa last week. At USD $513B, maybe a few less people will be treating crypto as a joke.

A reader also pointed out a recent Bank for International Settlements (BIS) survey that more and more Central Banks are looking at Central Bank Digital Currencies (CBDC) to make international payments more efficient.

That is fantastic for my first foray into Crypto – Ripple XRP. That is exactly what they are trying to make as their niche.

So can somebody explain why XRP is below my purchase price, whilst BTC hits new all time highs?

Gold still sideways. It has been pointed out that gold does suffer when rates rise, as holding costs thus increase compared to other assets.

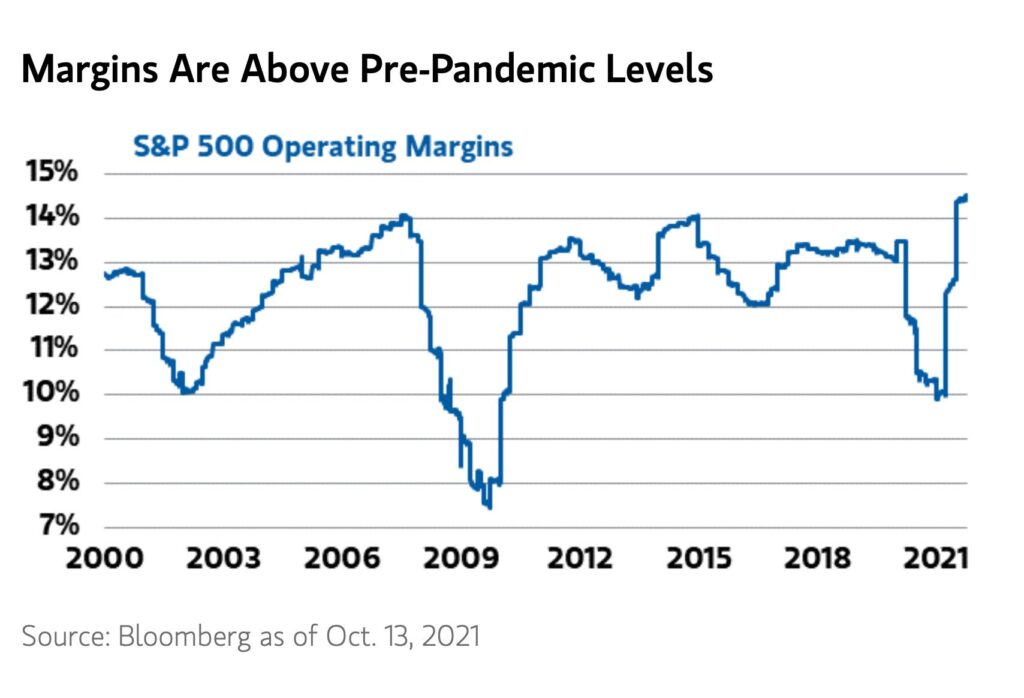

Thought of the week – which sector is best.

I may struggle with my time and your patience, so it will be cut down.

I do often get asked what sectors should “I” target to position best.

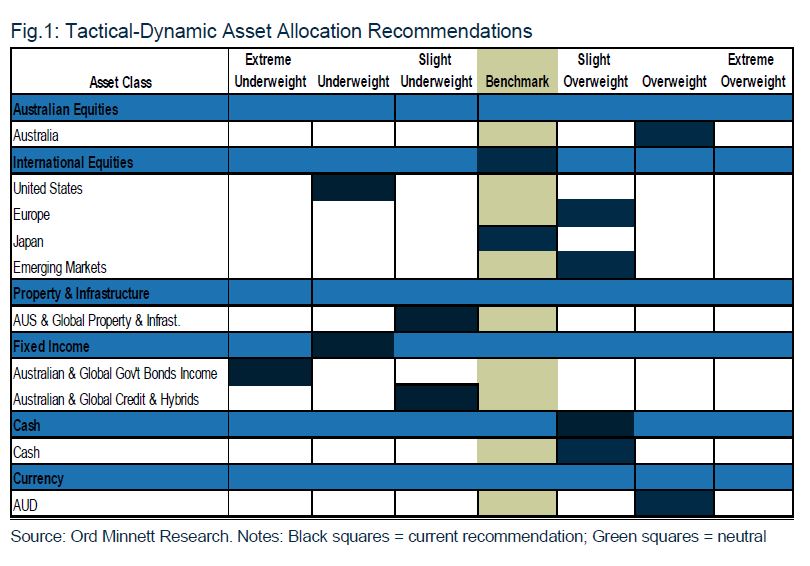

I won’t go deep, but Ord Minnett have down some solid work on that, summarised in the chart below.

Their rationale:

- Aussie shares: bullish with a V shaped spending led recovery.

- US shares: go short. Higher interest rates will hurt.

- Property: neutral. Some recovery in commercial offset by higher rates.

- Aussie dollar: Go long. 85 cents a chance with commodity boom to hold.

- Fixed Interest: Get short. Higher rates will hurt.

It is hard to argue against too much of their thinking, with maybe a slight divergence on their AUD view.

Drinking favourite…

An interesting one this week.

Firstly, for the name, Incognito

Secondly, I didn’t get to try it.

A long time reader presented his views on the wine. He said, and I quote, “it was alright for a Pinot”.

Clearly a man with a fine, well manicured palate.

Apparently, this is a third line pinot made by the well known Savvy Blanc maker, Shaw and Smith.

Only made in ‘special years’ (read when the tonnage yield is very high), it sells for much less than their flagship varieties.

It is claimed to have loads of bright upfront fruit, a whisper of wet soil and earthiness and then a lovely combination of juicy acidity and soft tannins to close. Very succulent and moreish.

I can’t score it until I track a bottle down.

?/10

Listening to…

For my Melbourne mates:

I have actually listened to this a few times during the week and it is surprisingly good.

Get on the Beers…

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

Cheers, BS