2021 Edition #33 – Here’s to you Pal…

22 September 2021

Come on pal…

Right… let’s get straight into it.

I don’t always claim to have all the answers… let alone all the questions.

But some weeks ago I flagged Evergrande financial woes as a potential spilling into global markets. That is exactly what has happened.

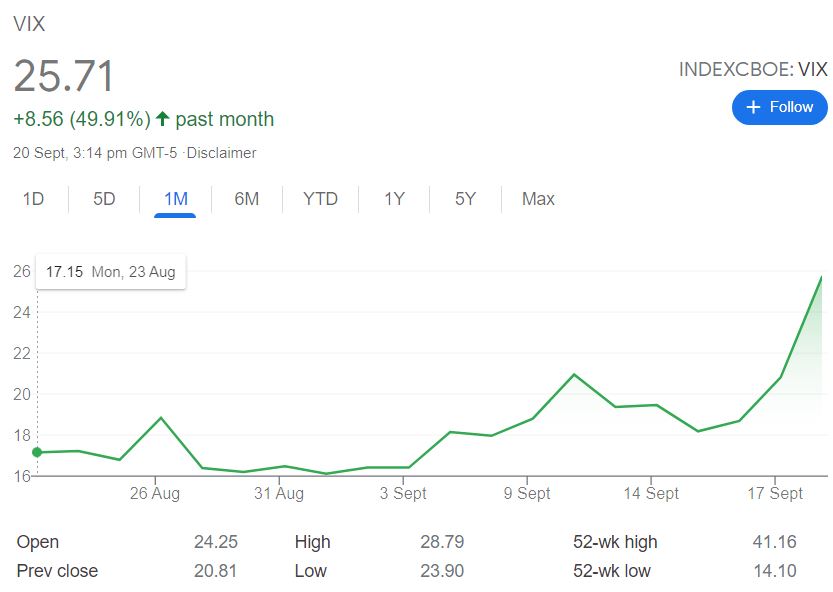

The Fear Index (VIX) has gone up 50% on the month. Not sure if I mentioned it, but last month I did research into how you could “buy” the VIX. The feedback was that it was a bad idea.

Like a clock that is right twice a day, yes I have been bearish.

But I put it to you though that this fall in the share-market is more a correction than the big fall – that part is waiting on the horizon. Nor, however, am I seeing this as a chance to buy.

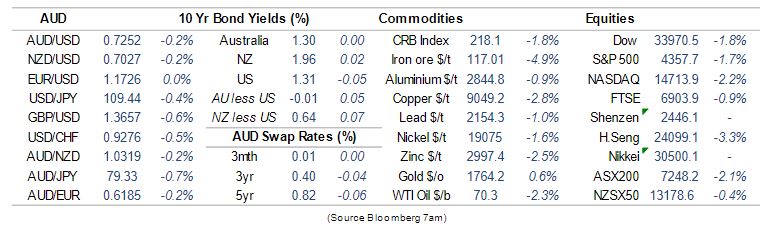

The Aussie market is getting punched in the guts and the head though. Iron ore prices have more than halved in price since May. Of course most of this is driven by Chinese demand. One feels they would be quite happy “stickin’ it to the man”. Not sure on the given theory that China is trying to clear the smog to blue sky for the Winter Olympics early next year. Maybe. Of course the possible massive slow down in Chinese construction (Evergrande again) would not be helping.

China account for approximately 30% of the entire global construction industry and Evergrande do around a quarter of all Chinese construction.

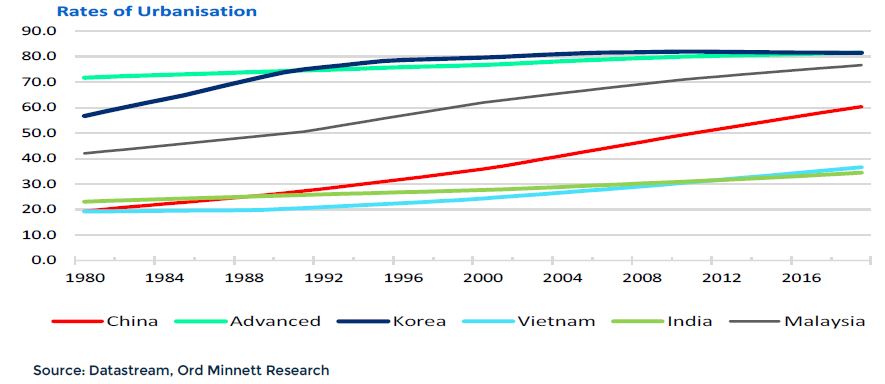

If you think that is a lot, take a look at the chart below. In our lifetime, China (appropriately the red line) has moved from 80/20 rural vs city to 60/40 city vs rural. In people numbers that is massive.

I have read from two sources today that the chances the Chinese Central Authorities stepping in to save Evergrande, at least in some form, are very high. And China have a lot of financial horsepower under the bonnet – strong reserves, current account surplus and a currency that is well priced internationally.

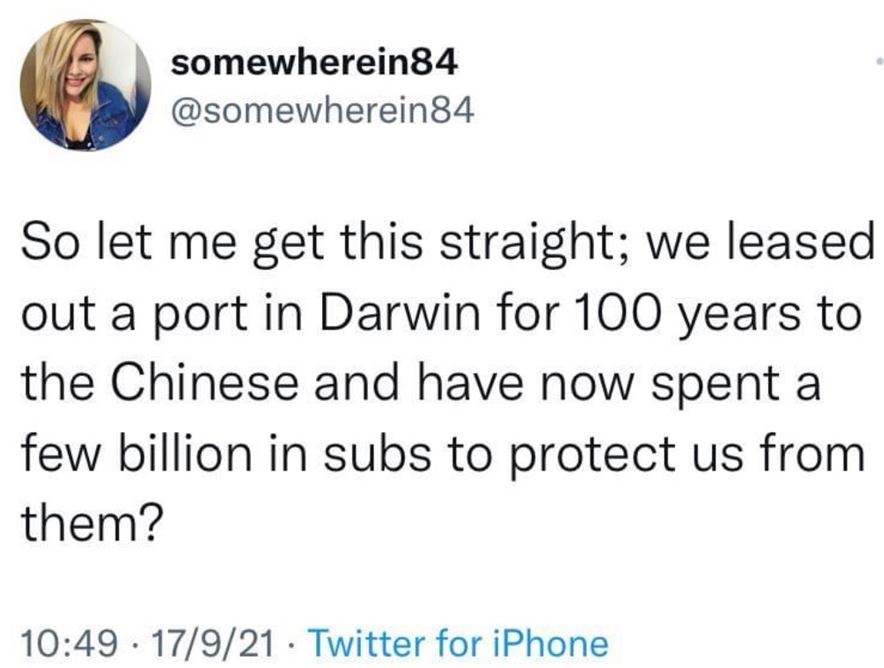

Whilst on China, they will no doubt be pi$$ed off with Australia and the submarine deal.

The big announcement seemed to come out of the blue (no pun intended). Initially taken well, but once digested by the media, it had a few holes in it. No price tag, no real time line and a very angry French President.

The former ASC CEO with the best name ever, Hans Ohff, gave the plan a resounding thumbs down. No one knows how much it will cost to tear up the French contract, but Simon Birmingham didn’t argue with a rough figure of $2B being spent already. Lucky money doesn’t count anymore for this (and most) governments.

Hitching our wagon to the USA has traditionally been a good bet, but recent events and Presidents makes that no longer a certainty.

Tweet of the week:

Back to the real markets.

September is always a bad equities month as ABC pointed out last night.

Hard to get a real grasp on a few things. Stagflation (high inflation but low demand with tepid employment) is being mentioned in the USA a lot of late. I’m not really in that camp.

Even allowing for USA’s strange political landscape, their journey from COVID lockdown to “freedom” is ahead of Australia’s – as frankly every developed country is. Is it worthwhile to gauge how a few of the key economic indicators performed?

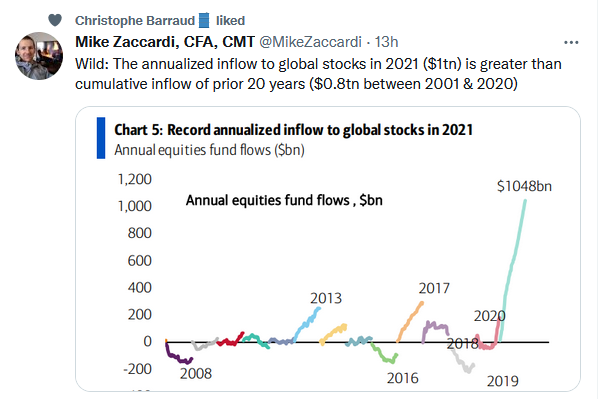

Firstly – as we all know, it’s allowing a truck load of cash to enter the system. Looking for a home, global money into the share market just this year to date is greater than the last 20 years combined.

Thus, explaining why the S&P is at record highs, is not hard.

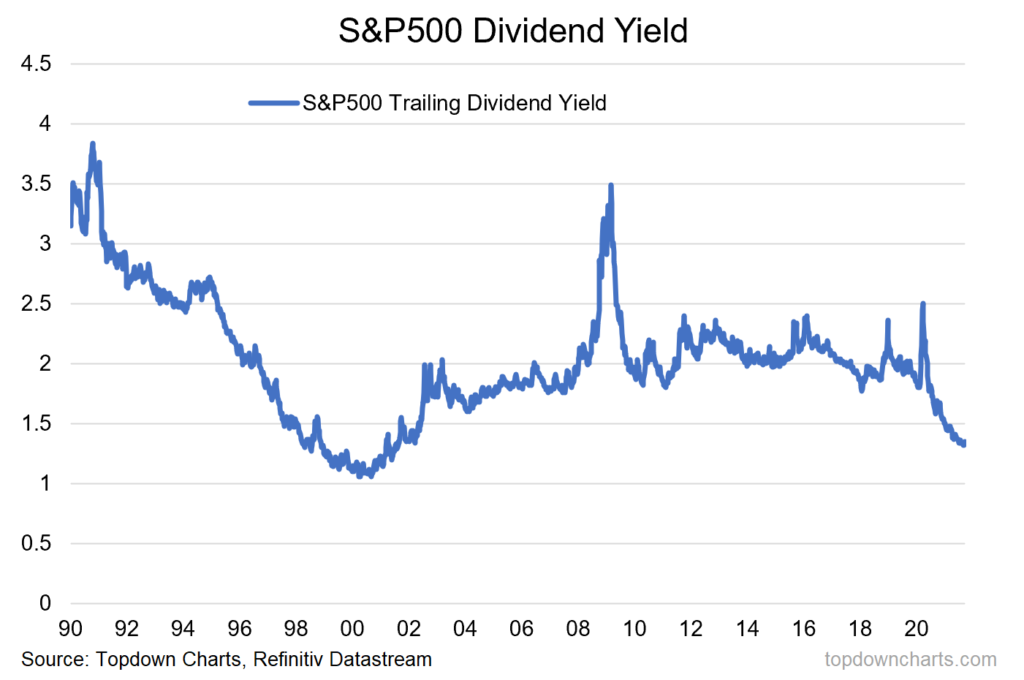

But as prices rise, the yield on stocks fall… despite rising profit margins.

Current dividend yields are near 20 year lows. Interesting.

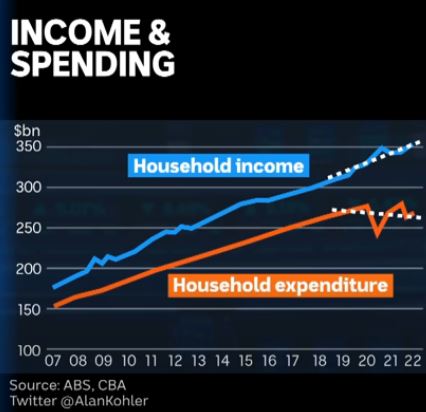

But here is the one that scares me a tad. We in Oz think that our imminent “freedom” day will see a spending spree that will give retailers a huge boost. Alan Kohler said as much on his report this week – see the right hand chart.

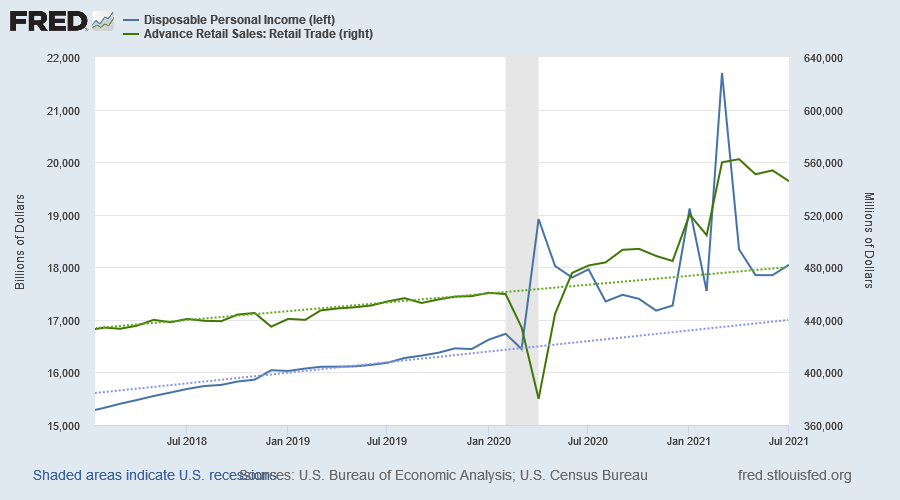

But in the USA, we can see from the left hand chart that retail sales peaked and are actually falling.

Part of the possible explanation is that pent up “demand” and cash has been diverted to services rather than goods. We would rather dine out than buy those new shoes.

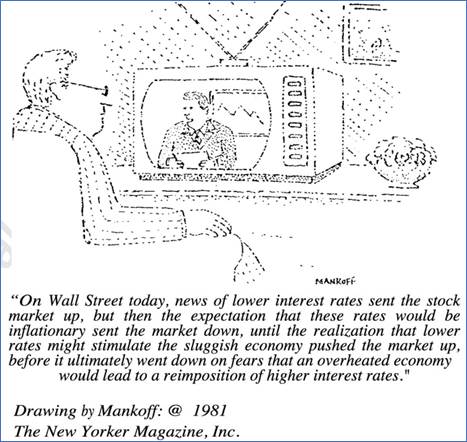

So maybe this 1981 cartoon covers it.

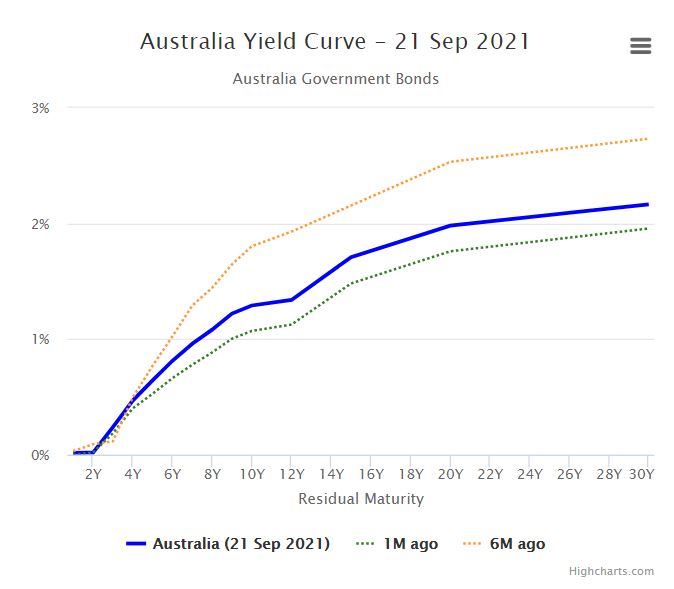

Our interest rates are higher than a month ago, but still not factoring any major move soon away from emergency levels.

NAB and Westpac have recently raised their 3/4/5 year fixed home loan rates.

The AUD is getting beaten up with the fall in iron ore prices, but the rise in volatility has also seen a rush to the USD. Thus, we see the AUD looking to fall lower from current .7280.

For those that are chartists, a further fall looks inevitable.

CBA data:

Crypto and Gold land

After buying XRP last week, and getting my banking facilities back, I was very disappointed. I fully expected to make or lose 50% in a week.

Rather it did stuff all.

At least until the share-market sell off when it shat itself. Down 10% on the week.

What I am a little confused by is, if money is lost in the “fiat” world (of real money) why crypto needs to not only follow, but by a significant matter of degrees.

That said – I could argue the same but different case for my gold stocks. Should have risen in price as fear goes up… but did stuff all.

I live in hope.

Apparently one in six Aussies now own crypto.

Chart below is the combined market cap of ALL crypto globally. Whilst not being a chartist – I would argue that although trend is higher, it needs more new punters with more money than I to keep that trend “on trend”.

Thought of the week. Sorry but politics again

Maybe skip if you are wearing a blue tie.

The ineptness of our Federal Opposition is breath-taking.

The governing Federal Coalition is imploding into it’s own bubble, yet Albo and his team can only do wet fish slaps rather than knockout punches.

Where do I start…

Strong claims this week from Barnaby Joyce that there is no need for a Federal ICAC.

The current acting PM has rebounded from sexual harassment claims that saw him head to the bank benches (very distinct from his extra marital affair with his political staffer). He also denies all claims regarding “Water Rort” allegations or any conflict when cabinet passed a proposal to build a train line through his land holdings in 2016.

The Minister for Science and Technology steps down for taking anonymous donations for a private debt of circa $1m. The Prime Minister (now in exile) at this time sees no reason to pursue the matter further and appears comfortable that he can keep the cash.

Speaking of cash… his old Attorney General’s portfolio is now run by Michaela Cash who, as a coincidence, crowd funded her legal defence in her role with the AFP raid on the AWU in 2017. The same raid that her office tipped off media about before the event.

The new Minister for Science and Technology doesn’t know how to spell EV. He has a confirmed Cayman Island bank account and was investigated for forging documents against the Sydney Lord Mayor (until the dogs were called off).

Then you have sports rorts Minister back in the Cabinet after a time in the 2’s, then $2B Robodebt scandal, CarPark rorts, and more that I have forgotten.

This is a “team” that use voters as puppets and care more about their welfare than that of the country. If they are your team, maybe think about switching? Don’t need to vote for the other major party, but not this team. Find a worthy Independent. Go back to this team once they have restructured and rebuilt.

Drinking favourite…

You may think I never actually buy a bottle – this one bought and shared with a mate.

Listening to…

Willy Mason is no relation to Willy Nelson. But he is a cross between Johnny Cash and Nirvana. Like the markets, Talk me Down is one of my long time favourites. His voice and the percussion stand out.

You know the world is batshit crazy when John Setka complains about too many right wing nut jobs at a CFMEU protest. I did like his quote along the lines of…”if you are a member of CFMEU and you were at that protest, you might as well go starting to pick fruit because you won’t get another job in the construction industry again.”

Have a good week.

Feedback always appreciated….

If you want to write a piece – long or short, drop us a DM.

Cheers BS