2021 Edition #31 – You gotta laugh

8 September 2021

Rupert when asked if he was backing Albanese at the next election

The RBA left cash rates unchanged at 0.1%.

They also made it clear they are in no hurry to lift rates until we hit full employment and inflation rises further. Neither are imminent.

Outside of that, the two big events of the last week have been the Aussie GDP and the US employment report.

Both had some scary numbers mixed with a silver lining or two.

Starting with the Aussie GDP, I was expecting a pull back based on the NSW/Vic lockdowns. It surprised to the top side with a quarterly growth of 0.7%. The annual figure of 9.6% meant stuff all given it includes the disaster that was Q2 of 2020.

Demand was strong from the private household sector. Plenty of cash still sloshing around looking to be spent.

Accelerated depreciation also saw business investment increase.

Iron ore volumes exported are falling – see later.

Labor jumped on what I saw as pretty good results. In line with all politics of the day, it centred the argument on what it could have been if SlowMo had got his “two jobs” done last year.

It is now definitely a race – NSW Covid cases are on the surge but the Premiers message is that vaccinations will be the free pass to get out of jail. It clearly is, but again the fragility of this Federation is on display with the release of data that seems to support an argument that Labor States are effectively subsidising the NSW vaccination campaign. They will use this to wedge their constituents further against the Coalition.

With a change of Leader for the Vic Opposition, maybe this chart is also relevant.

Apparently Gladys would prefer to deal with Peter Spud Dutton rather than SlowMo. That is amazing. Maybe the “time” is not 4pm but rather closer to 9pm.

The US employment data was a clear miss against expectations of 750,00+ new jobs. A mere 235,000 jobs registered surprised the market like this monkey.

But is the weird world of stock market 2021, this was a blessing in disguise. The market then got “comfort” that the US Central Bank will not only keep the punchbowl out on the table for longer, but will add another bottle of vodka in for good measure.

Bond yields would usually fall with that release, but the other silver lining here, was unemployment fell from 5.4% to 5.2% and wages went up 0.6% on the month – double expectations.

Wages up?

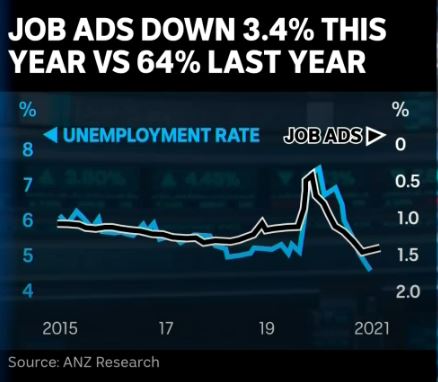

No great sign of wage pressures here, but a good chart from ABC/ANZ below.

I love correlations, and Job Advertisements (in black) have been inverted to show how closely they track unemployment. Makes sense – more job ads leads to less unemployment.

Jobs Ads are slowing, but only modestly (given half the country is in an extended lockdown).

This should be a good news story for unemployment once with hit the magical 70%/80% vaccination rates. Who knows may even lead to pay increases for some…

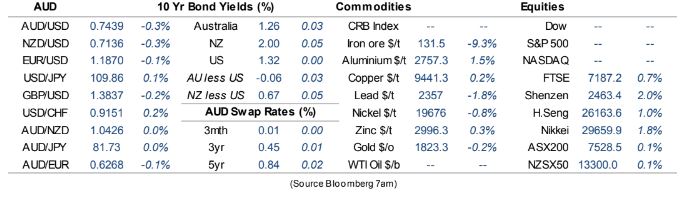

The Aussie dollar has bounced around a fair bit of late, but seems to have found some friends in the 74 cents space.

My view on the AUD is similar to Craig Kelly’s……no view at all.

Iron ore is off another 10 odd percent this week.

The fall is being attributed to China’s latest environmental curbs. Interesting conundrum where the Coalition calls upon China to do more on Climate Change, but wants them to buy as much coal and iron from us as they want…

UBS did a deep dive into China and iron. Demand looks ok, but my take is that their port and mill inventories are higher than normal. They also appear to have actually increased imports from Brazil against Australia.

If there is a positive for Aussie iron ore, Chinese plans to replace our iron ore with African supply from the Simanou Mine in Guinea looks to have gone pear-shaped after a military coup over the weekend. Difficult to see much export action from there for some time.

This ship looks like it is keen to “export” Gibraltar.

CBA data:

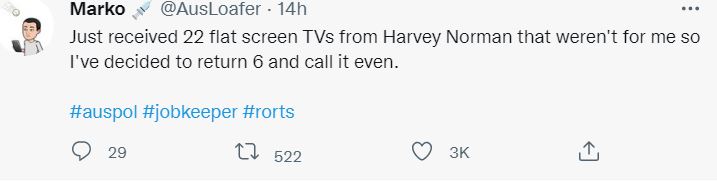

My Tweet of the week goes to Marko.

Crypto and Gold land

Gold up marginally but very boring.

Was asked last week why the concentrated focus on Bitcoin over other forms of crypto.

Before I answer that, maybe time to re-affirm my broader views re crypto.

I am a believer in new technology. I am a firm believer in new technology that can act as a disruptor in the market place.

I believe in blockchain and it will be part of the future. Far more so than NFT’s.

I do not believe that a large percentage of investors in crypto actually understand what it is they have bought. They are acting in the purest sense of FOMO. Momentum is taking all before it.

Old school market players will not give up the keys to the Executive bathroom easily though.

Risks to crypto in my opinion have been well identified…namely:

- Central regulations (ie money laundering issues). While this issue is really at the edges of crypto, the big players will use it for leverage to hurt new entrants.

- If regulation dents “appetite” all those momentum buyers will run out of sight quicker than Charlie Cameron. Another (and more serious rout) will damage crypto as a “store of value”.

Elon Musk will then look like this squirrel against the FOMC:

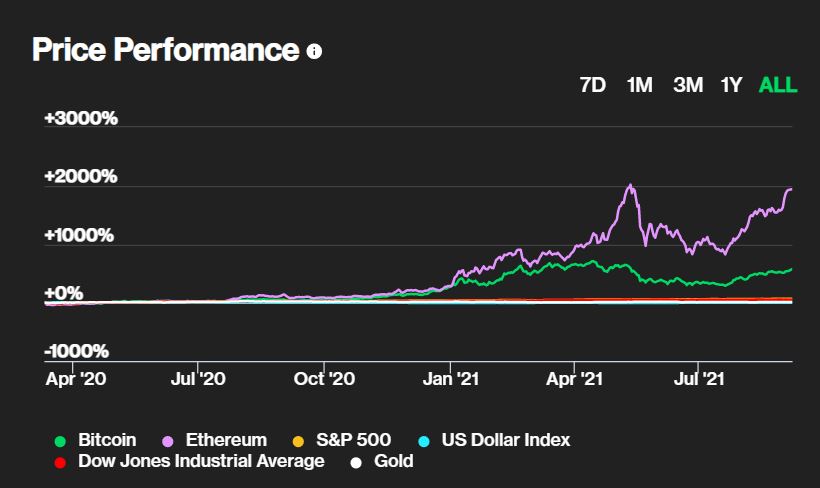

Anyway…Ether (ETH) is the token of Ethereum. Also Blockchain technology – and appears to have some smart add-ons.

The price is up 130+% in 6 months and near all time highs. Certainly looks to have performed better than BTC (and clearly gold) :

So it looks the goods. The only thing that I see as a negative is that the number of transactions on the platform does not seem to be growing that much – although different sources give different numbers.

So the question I have is it hype over substance?

And to finish on disruptors, Afterpay continues to climb higher. Some of my comments above fit in to that space as well. Except perhaps worse. It is not a technological improvement nor does it streamline any process improvement. Studies shows it is in effect only a delayed credit card scheme and as has been seen…easily replicated.

Thought of the week. You can Bank on it.

Couple of things on Banks.

Firstly I could write a very long book on current Federal Government announcements that then fizzled to no action.

One that is near to me though, is the Banking and Financial Services Royal Commission. Hayne’s came up with 76 recommendations. The government said it would act on them all.

Two and a half years later, where are we? The government claim they are past 80% complete. A recent review showed however that more than 40 of the recommendations remain incomplete.

One in particular is interesting. Aptly named BEAR, the Banking Executive Accountability Regime proposed that senior banking executives be PERSONALLY responsible for breaches of the law, with penalties of up to $1.5M. This is on top of any Corporate breach. After many amendments, the July 2021 version dropped out the personal responsibility piece.

How serious is the government?

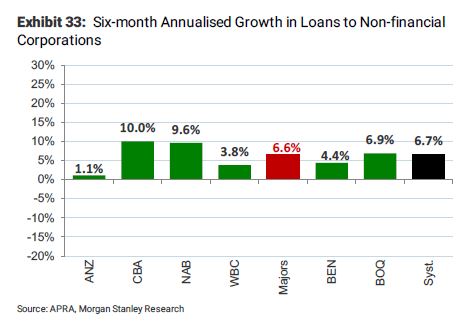

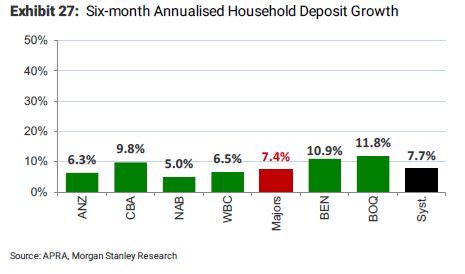

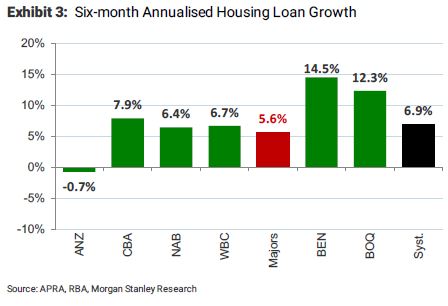

Secondly UBS did some great research into the various Banks recently.

Summary of their findings:

- Housing loan growth is slowing

- Deposits are still growing sharply

- Business growth just OK.

Looking at the last 6 months though, one of the majors is trailing well behind the other three.

ANZ is doing it tough.

Business loan growth is worst in the pack, including non majors.

Deposits fare better – but second “worse” to NAB.

Home loans are a disaster for them. Look how strong Bendigo and BOQ are in that space.

Stories I hear are that the majors are just too “tough” to deal with at present.

Big Banks have a knack of knowing this stuff pretty quickly. I suspect ANZ will take steps to fix a few things. If not it is hard to see too many analysts putting a buy signal on.

Drinking favourite…

Drinking with mates again….

Not sure a chicken schnitty was the perfect match, but the wine is a cracker.

Some reviewers put it down as “bold” but to me it screamed cool climate and charm, quality…unlike my dodgy mates…

Looks like we paid “overs” for inhouse service.

9.5/10

Listening to…

I mentioned The Killers last week.

For those poor sods not on Spotify, here is there new album “Pressure Machine” on YouTube.

Watching with interest how the Murdoch media fights back against its sworn enemy …Aunty ABC.

Watching what unfolded in the USA post the 2020 election, I can not help but see that the powers of Murdoch has literally blood on its hands…..oops I mean questions to answer.

More however, I fear we are moving to a USA style of presidential politics, where media play as puppet masters. Is there little chance of getting a Bob Hawke or John Howard in as PM these days, because they can not fit a mould? We tried Daggy Dad though recently, and that has been a let down.

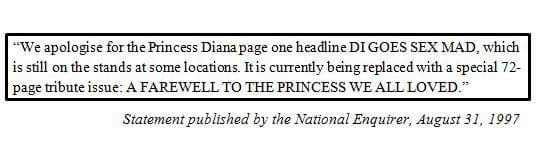

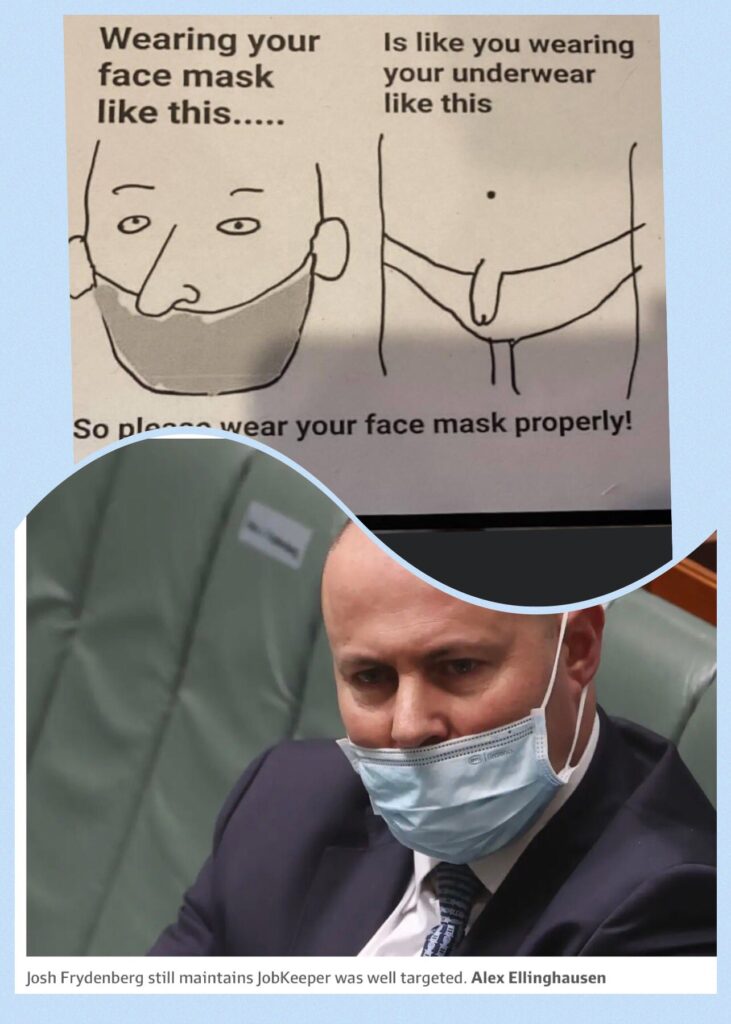

On media, I saw this last week. Some news just doesn’t age well – even over a week, let alone 24 years.

Have a good week.

Feedback always appreciated….

If you want to write a piece – long or short, drop us a DM.

Cheers BS