2021 Edition #3 – No free stuff…but wait…

5 February 2021

See below for chance to win a top notch cool climate shiraz delivered free.

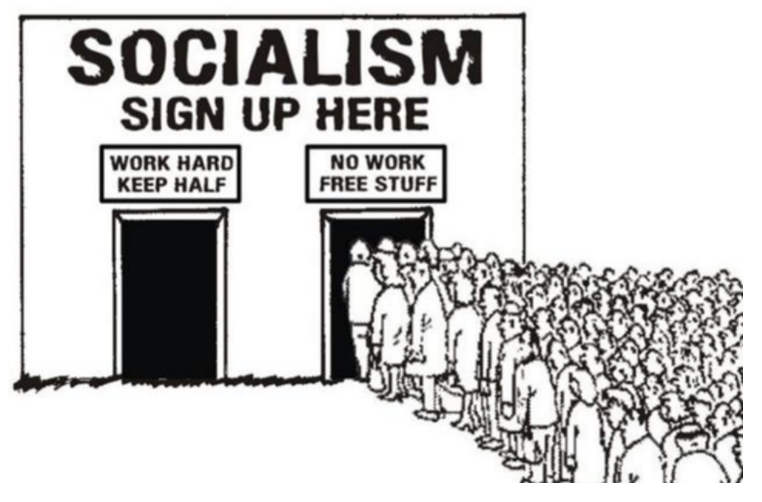

I would want a middle door.

Old cartoon but seems more relavant than ever. Feels like a lot of people have their hand out for a hand out. Even my cygnets have more than their share of entitlement. Maybe they should read last week’s edition.

Entitlement is one thing, but also no shortage of offence and outrage. Rarely does Black Swan read books other than economic/markets, but I bought a copy of The Subtle Art of Not Giving a F*ck. (his asterix not mine).

I haven’t completely finished it yet, but two snippets below seem appropriate for this edition:

- “People get addicted to feeling offended all the time because it gives them a high; being self-righteous and morally superior feels good. As political cartoonist Tim Kreider put it : “Outrage is like a lot of other things that feel good but over time devour us from the inside out. And it’s even more insidious than most vices because we don’t even consciously acknowledge that it’s a pleasure.”

- “Victimhood chic” is in style on both the right and the left today, among both the rich and the poor. In fact, this may be the first time in human history that every single demographic group has felt unfairly victimized simultaneously. And they’re all riding the highs of the moral indignation that comes along with it.”

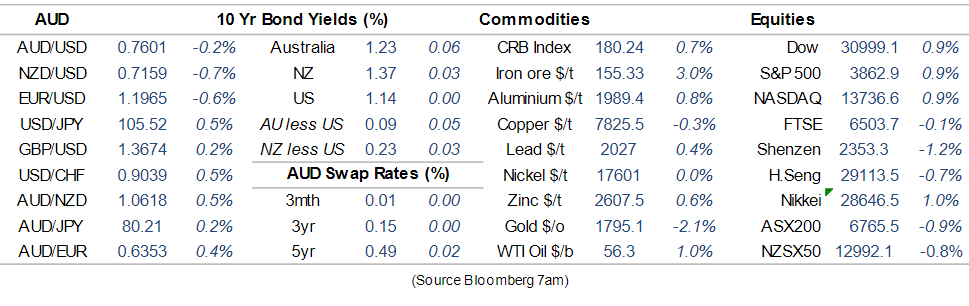

The markets generally had a good week. Equities solid again in USA and Oz.

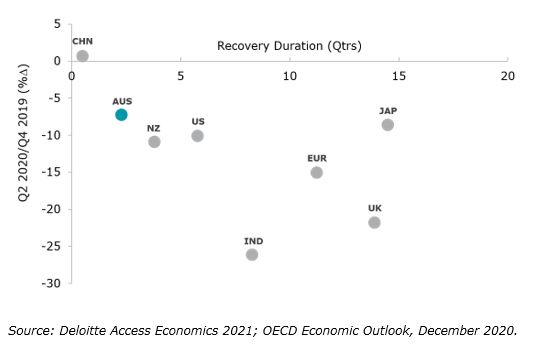

Some good basis for the positive vibe. Deloittes had a nifty chart that helps understand. Our GDP dipped by 7% post Covid but bounced back to be positive in 2 quarters. The UK on the other hand dipped by more than 20% and is not expected to recover to positive territory until late 2022 or early 2023. Of course they are also dealing with Brexit fall out.

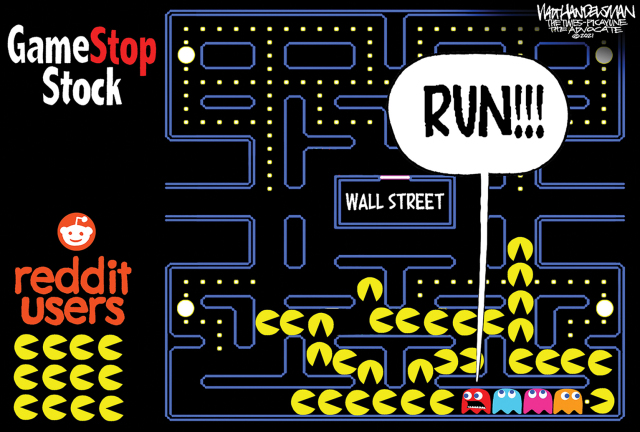

The interest in #WallStreetBets is already waning. The big question is more a matter of what it all was about. Was it the little man stickin’ it to the big boys, or just a new version of “pump and dump”. Who made the money, who lost and why?

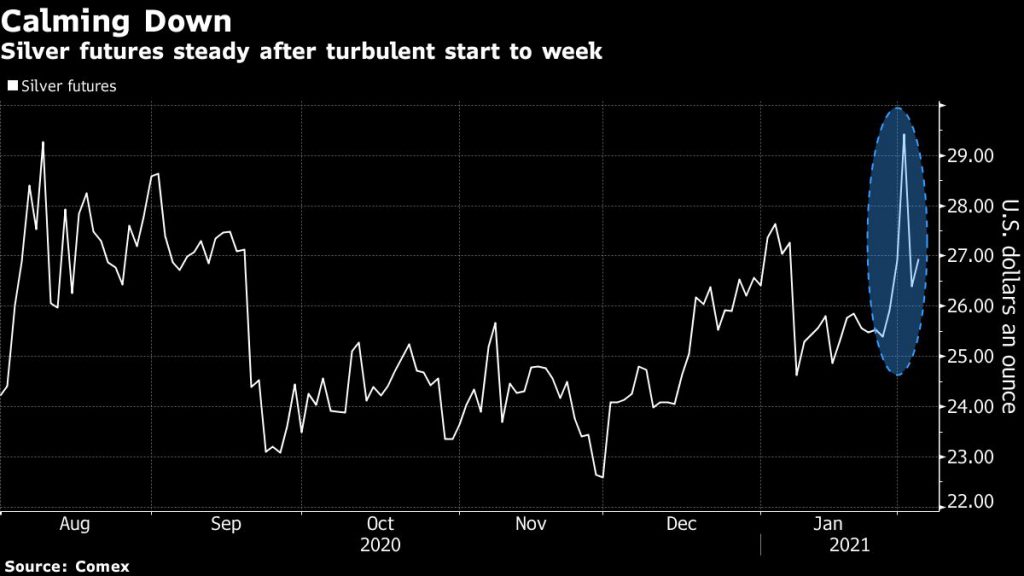

My silver call from last week looked brilliant, till it pulled back as quick as it’s rocket. Some talk is that it was not #Wallstreetbets but hedge funds looking to recoup losses. Others say it was both parties combined. How weird would that be…?

Hi ho silver

Want to spend a bit of time looking at Reserve Bank of Australia. Paul Keating is no fan, but age does weary him.

RBA kept rates unchanged (as expected) but increased their bond issuance by yet another $100B as flagged last week.

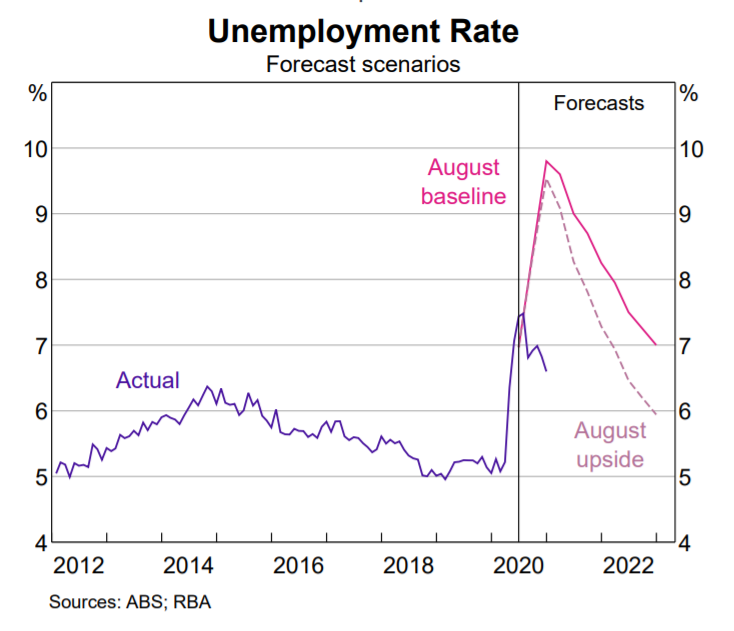

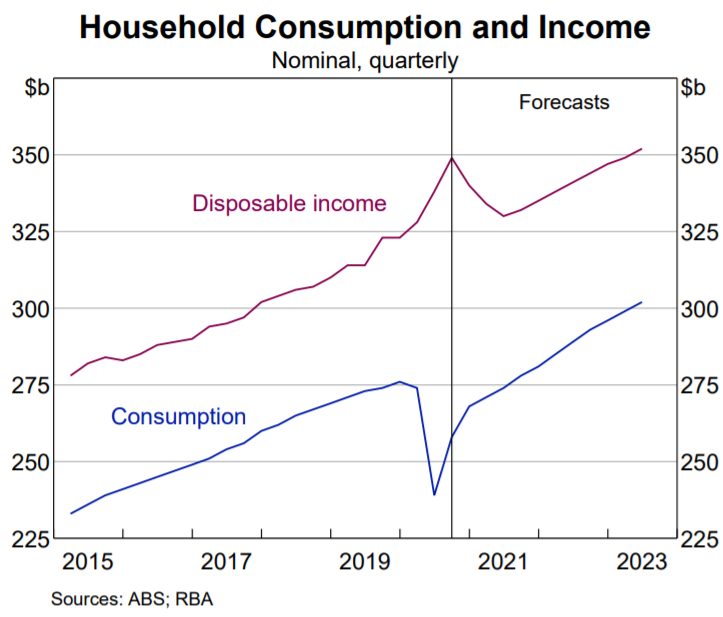

RBA Lowe was pretty upbeat. Recovery has been better than forecast, unemployment should fall quicker than forecast, and households have a strong balance sheet (house prices and cash in bank)

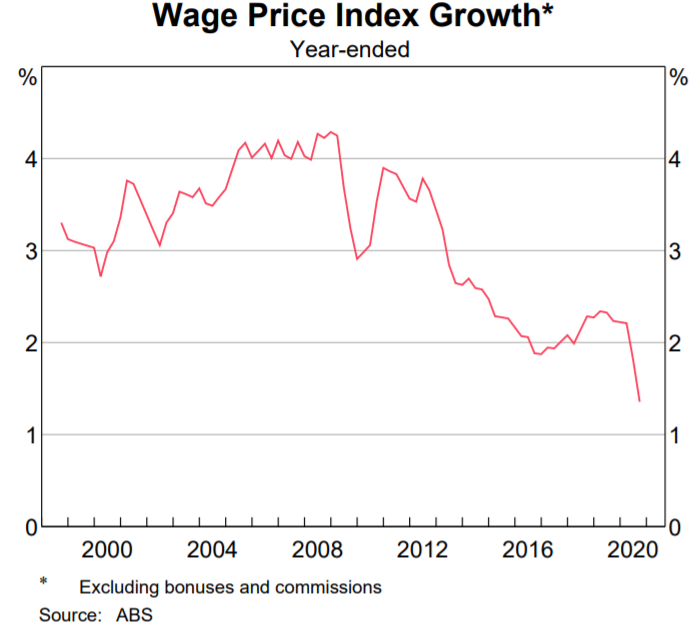

He called (with strong conviction) that inflation will remain low for at least the next three years. Wage growth – or more to the point, lack of…is one of the main reasons.

He made a personal view that some permanent increase to JobSeeker payments should be considered by the government. I agree from a social and economic perspective.

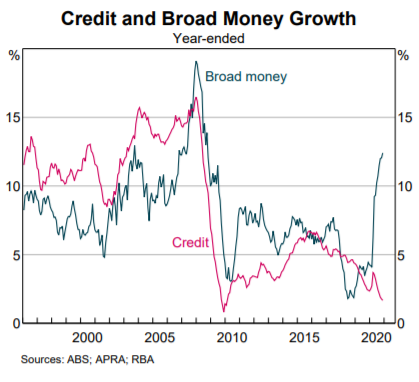

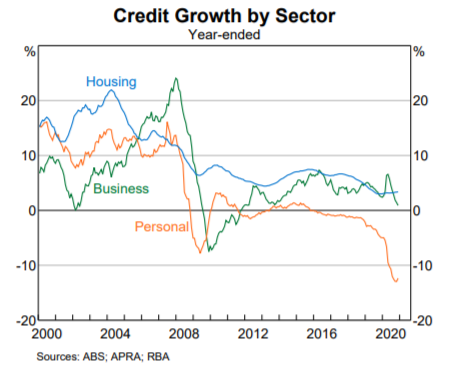

A few charts from yesterday:

They also had an interesting chart about credit. First chart shows just how much cash has been splashed into the economy. Credit (money to you from the Banks) usually coincides pretty closely, but ScoMo is the new banker in 2020/21. No interest rate and no repayments necessary.

The sector chart proves that all that money has helped repay credit card, car, Sportsbet debts.

So I was asked this week by a senior banker what the risks are for Australia this year.

Obvious answer is that JobKeeper comes to and end in March. We will then see a likely spike in company insolvencies and as a flow on, higher unemployment. If that is a blip then all good, if it is massive then all bad. House prices, equity and the AUD would be under the pump.

All the news was clearly a surprise to Gladys.

Gold took a price whack this week – clearly not sexy enough for the RobinHood millenialls.

AUD resting around 76 cents at present. Still looks to be struggling to retain that upward momentum. More a case of USD strength on some good employment data and solid company earnings to date. USD also supported by the belief that Biden will get some, if not all of his stimulus plan approved.

Thought of the week.

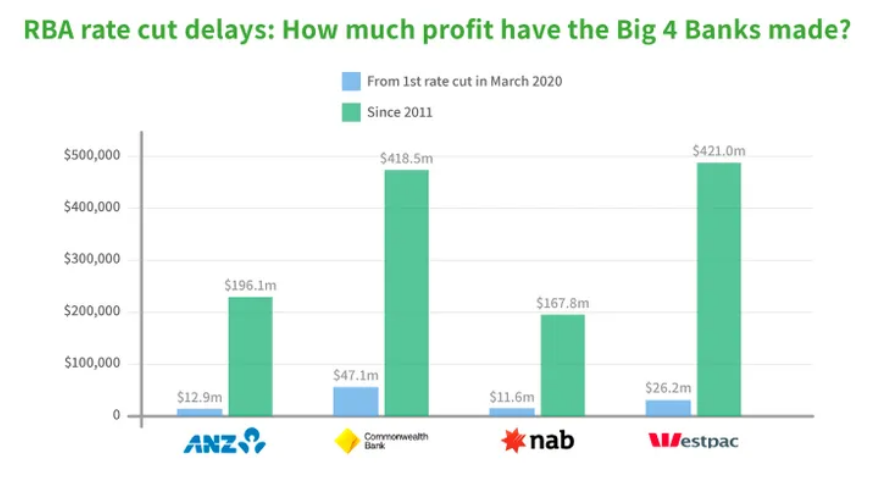

I gave banks a whack last week on a couple of fronts.

This week I will reverse some of that. Channel 9 had an info session on how banks had ripped off borrowers by not implementing the full RBA rate cuts or delaying the application of the reduction.

Their expert analysis was from Mozo Finance. The web site states “we are a bunch of like-minded, financial revolutionaries, here to help you make smarter money decisions. A trailblazer in financial comparison”.

Specifically they stated :

- Some home loan lenders including the big banks are known to lag behind when passing on Reserve Bank rate cuts, costing mortgage holders $1.2 billion since 2011.

- They also made $4,308,577 in extra interest a day by not cutting variable rates after the November 2020 RBA cut.

Those thieving bastards…?

They might be a like minded bunch of revolutionaries – but so is the Ku Klux Klan. Doesn’t make them right.

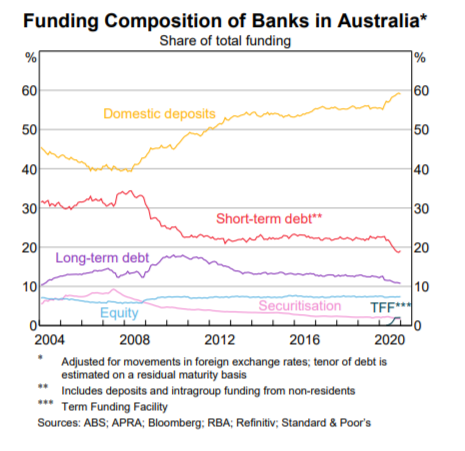

Firstly it has become well known that banks do not benchmark their lending to RBA for some time now. The cost of funds is a mixture of Bank Bills/Deposits/Wholesale Term Funding.

Depositors lend 60 cents in the dollar.

Depositors lend 60 cents in the dollar.

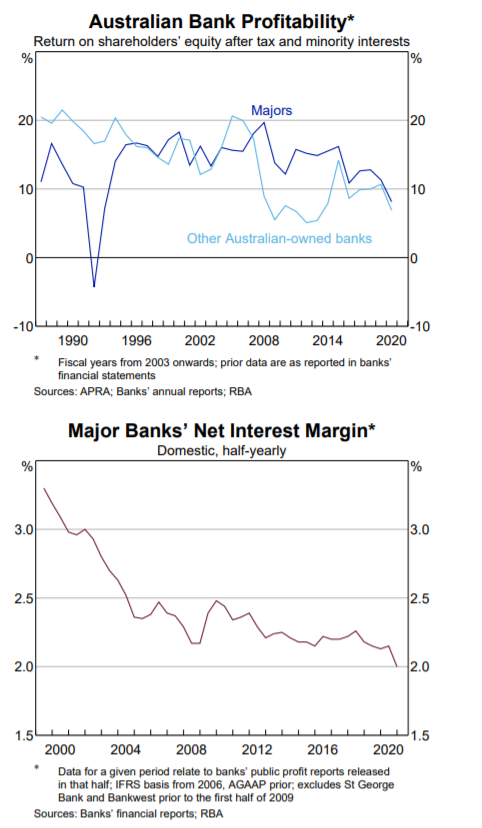

Secondly – if all other things were equal, an extra $1.2B in profit would show up in banks NIM (net interest margin). This is a key metric for ultimate bank bottom lines.

Even allowing for Covid, RBA reports show both the major and minor Aussie banks have seen ROE and NIM in long term decline since 2007/08. No tears needed though – they still rank well above international peers thanks to the reining oligopoly.

If I was a bank Credit officer, I would worry about the trends here..

So where has this $1.2 B mozo”profit” gone? One major impediment for banks is the current low rates. Typical bank in typical times might pay you 4% on your deposit in a 6% market then lend it at 8%. Take some costs out and plenty of meat left on that bone.

At present, this would see depositors paying the banks 1.5% for the privilege of looking after the cash. Clearly not possible. What could be said better then, is that bank borrowers are effectively subsidising depositors with higher lending rates than would otherwise be applied. I think this is a more accurate description.

Banks do many things wrong, but Channel 9 should stick to their strengths like Married at First Sight or interviewing Gladys.

What is Black Swan drinking?

Non alcholic, but I loved this old add for a VW beetle that could be bought (AUD eqiv $52) with an optional coffee maker. Brilliant German engineering – magnetic cup and holder to support the less than adequate suspension. Shame they could never apply the same skill to the windscreen wipers.

I’ve gone back to my roots – Shiraz.

But this puppy doesn’t have the sledgehammer tannins of the warmer climate variety.

96 points from the Adelaide Wine Show.

Well priced and will cellar well. Better than adequate 8.5/10

But wait there is more….

For one reader we will deliver a bottle of Anderson Hill Shiraz to your door.

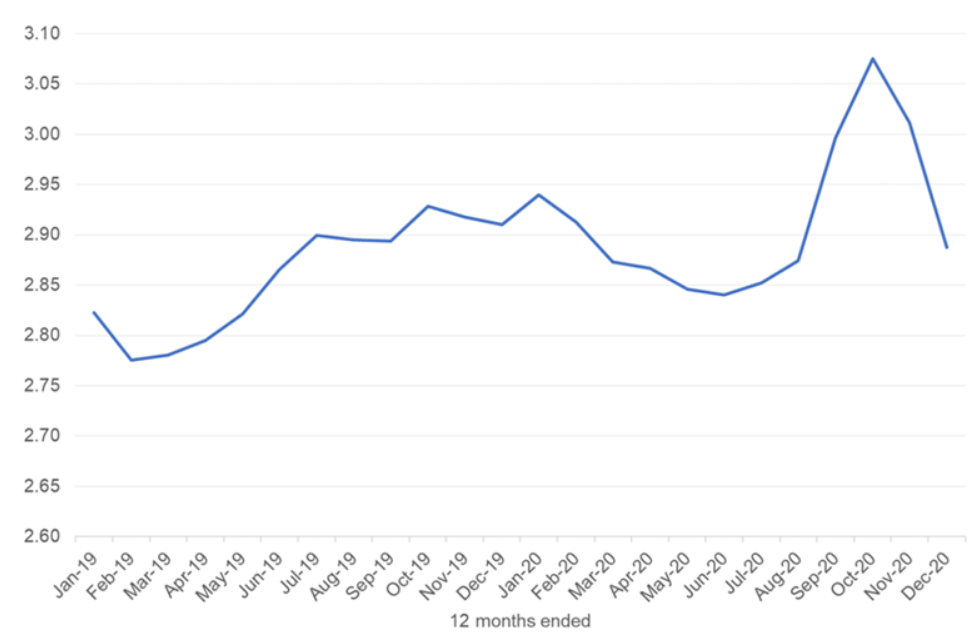

All you have to do is tell us what the chart below is showing.

We will even do a “nearest the pin” in case no one gets it. Nearest the pin may just be the funniest response. Judges decision will be final !

And the chart :

Want the wine, do the time.

And listening?

Every wants a bit of candy.

Song still sounds “fresh” so I was staggered to find out it was released in 1992. Maybe Black Swan is getting old.

To finish the week, remember you need to practice good hygiene in a pandemic. Wipe your hands after touching things…

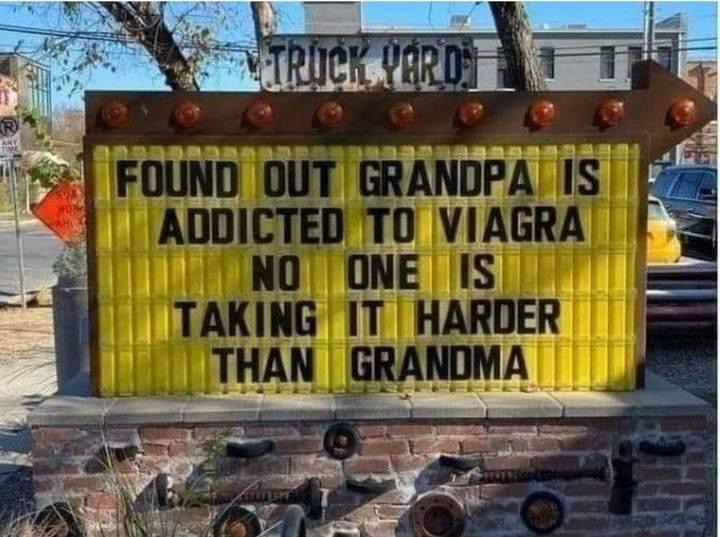

And stay off drugs

Cheers BS