2021 Edition #29 – Just the fax

23 August 2021

The fax are not always the facts

More time slippage on the report this week.

I must confess – watching the news it has been tough to get “up and about”. Earthquakes, hurricanes, raging fires and country collapses. And that is before Covid Delta kicks in both here and abroad.

Within the markets, there remains a quiet confidence that all will be generally well though. Looking at the Tech Wreck pull back and the GFC, debt and poor banking standards led the carnage. Only half of that exists at present.

I read that global debt has risen by $28 trillion in the last 12 months – predominately via developed economies. Yet insolvencies and bankruptcies are at very low levels in most countries. The cash splash is working for now.

But a lot of systemic confidence is resting on the banking sector holding up well – in both profit and lending standards. Certainly in Australia I have been sceptical about the Big 4 and how they would handle 2020/21. They have performed well. Net interest margins are holding up and lending is solid – especially in housing. Yet people I speak to tell me just how hard it is to qualify for a loan. A positive sign in many respects.

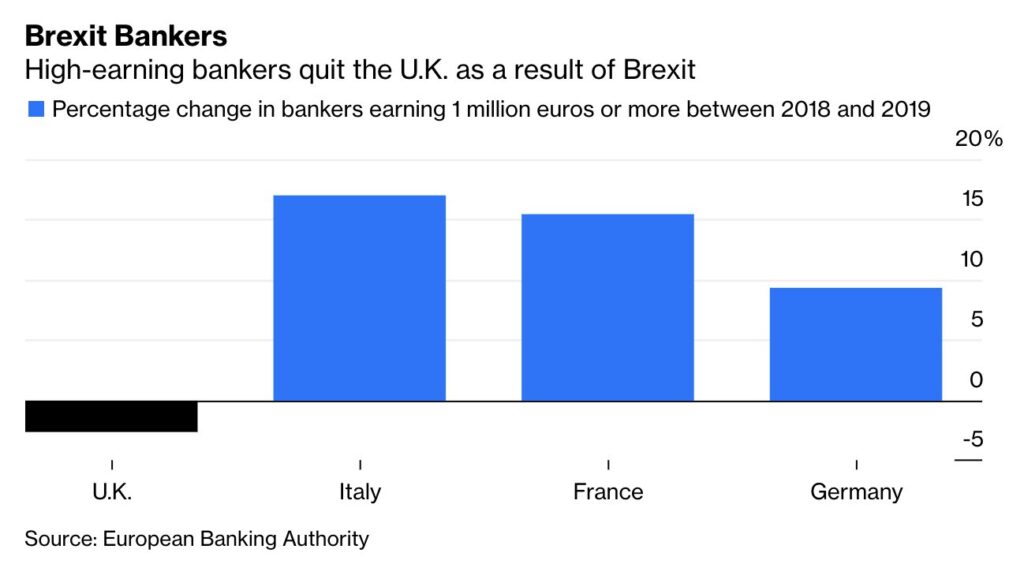

British bankers doing it tough now. Post Brexit check of pay cheques indicate they have all moved to Lake Como.

The ASX lost a couple of percent on the week. Somewhat pleasing to have some sort of pause in all-time-highs. The continued slide in iron ore contributed, especially when overlaid with BHP announcement.

Iron ore is getting smashed. Not that long ago, many were talking about a commodity super-cycle. Iron ore has lost 30% since it’s May peak.

I did chuckle when one of the satirical sites posted” Morrison Declares Pandemic Officially Over After COVIDSafe App Records 500th Consecutive Day Of Zero Cases”

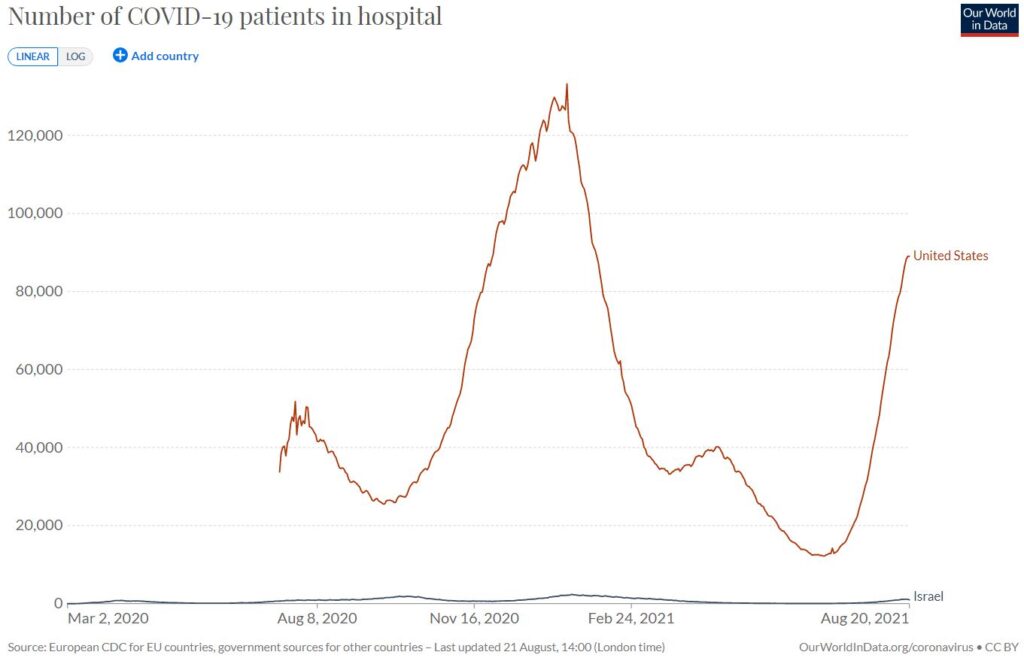

As we have all seen, Covid “cases” are less critical when the population is well vaccinated – and the measure should then be hospitalisations.

Both NSW and the Federal Government have begun that campaign – all about “living with Covid”.

It is important – as Australia has shown – you need to get on top on Covid to get the economy humming.

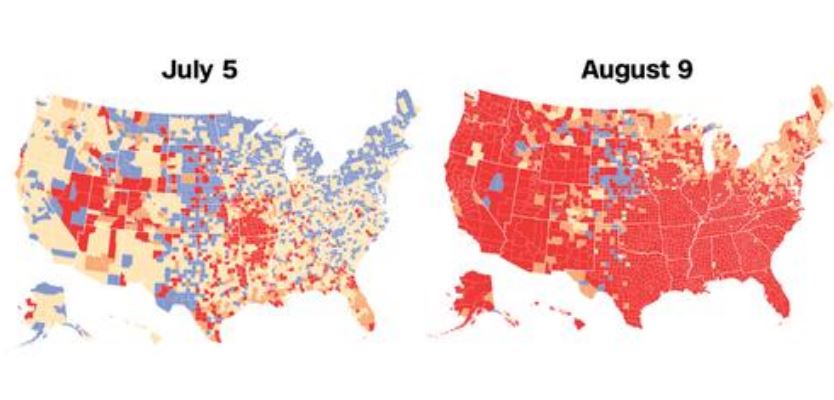

Map below shows cases only – blue cases falling, red on the increase. Ouch.

But USA are well advanced in vaccinations – right?

Well yes and no. Well only 51% are fully vaccinated. Thanks to Trump and his GOP goons, supported by Murdoch this is very much now a pandemic of the unvaccinated.

Israeli is the poster-boy for vaccination, but their cases are also on the rise – the differences between the two are obvious.

All that said and declared as fully vaccinated, even I question the latest news that booster shots are needed – a multi-billion dollar “windfall” for big pharma.

Protests here and abroad also indicate to me that lockdown compliance may have a limited time-line. One for Victoria maybe:

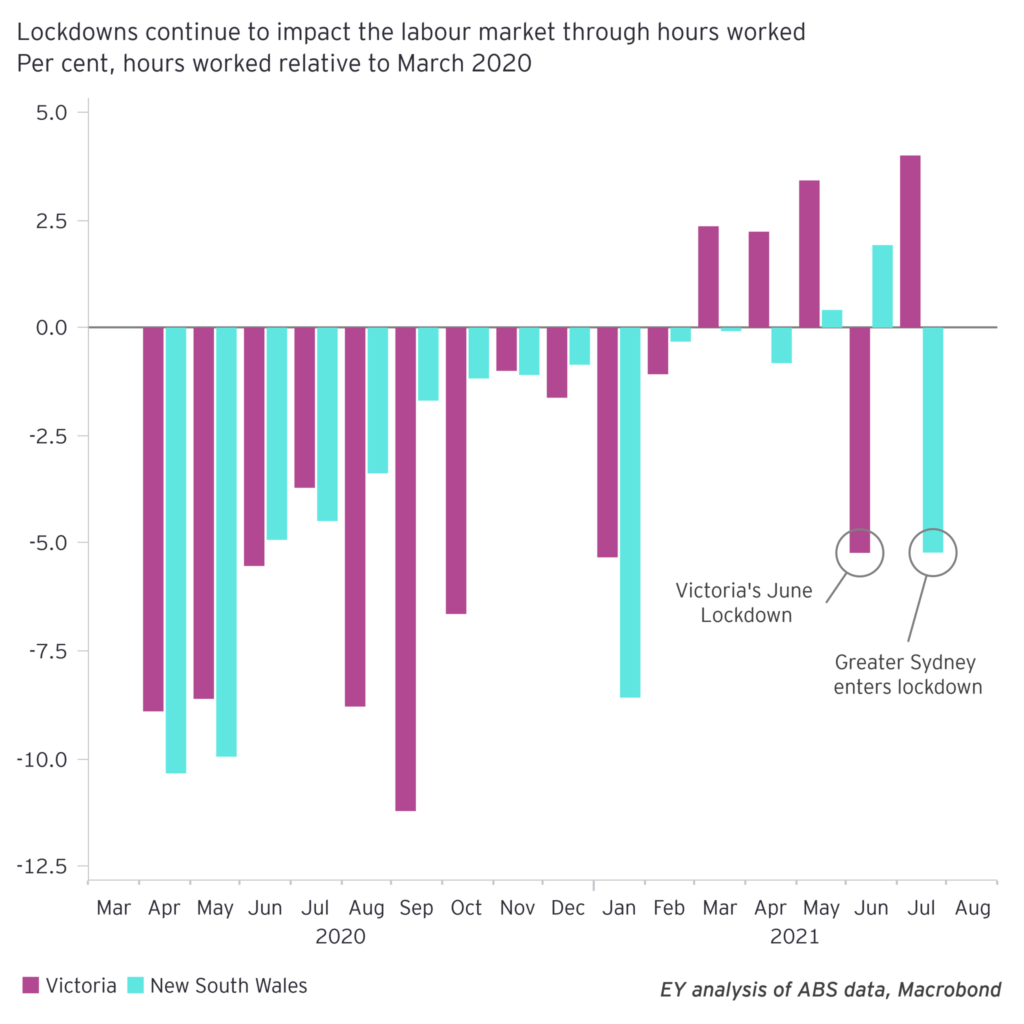

The big local release this week was Employment/Unemployment. With NSW and Vic in lockdown, a jump in unemployment from 4.9% back into the 5%’s seemed inevitable.

In keeping with these times, it was totally different. Unemployment fell to 4.6%.

Dig deeper though, and the corks stay in the bottles for now. The survey was very early in the latest lockdowns. The participation rate also fell as presumably some gave up hope and ceased looking.

Hours worked are perhaps a more accurate measure of how we are tracking. In Victoria and NSW a lot of the gains made earlier this year have been lost.

BHP announced huge profits this week and the back of booming iron ore prices (which are less booming now).

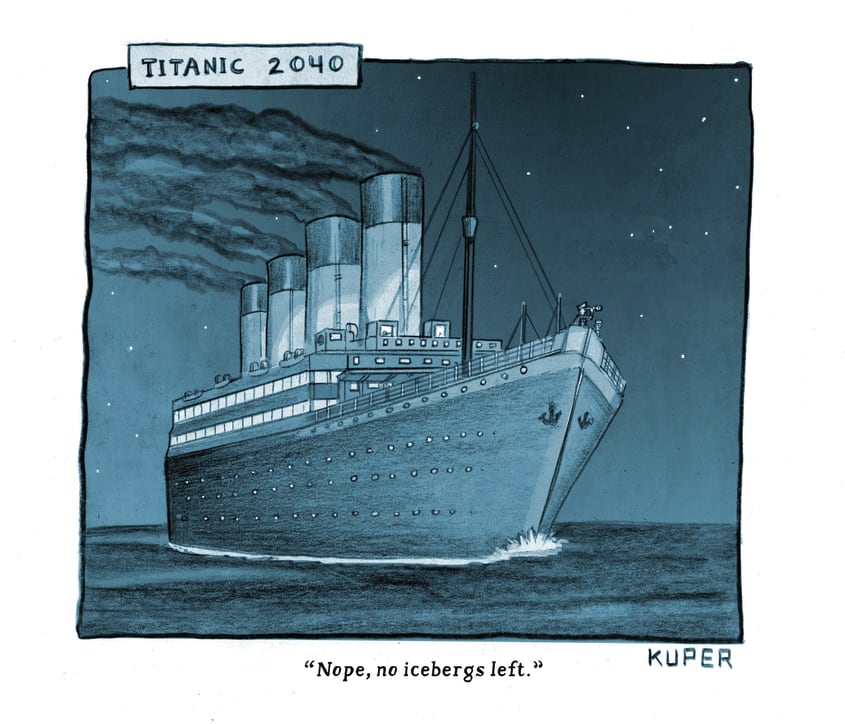

It has lost over 13% this week. The ore price fall was only part of it. BHP have announced they want out of fossil fuels, and coal in particular. Investors may not be happy – but maybe they know a bit more than they let on.

Here is a link to a story about BHP Negative value

Short version is they have tried to sell a Hunter Valley coal mine. Seven months ago it was on their book at over $1.7B and wrote it down to $550M. Now it will “sell” the mine to any buyer…and pay them $275M. NSW government hold $3.3B in security from BHP set aside for rehabilitation.

Remember this as the Federal Government support the Hunter Valley coal industry and refute the risks of government “stranded” assets.

Another example of the market and corporate sector leading the donkey.

This would usually be reason for me to get pretty bearish – a really bad dip. But both the market and I, seem to be reasonably ok with the “bad news”.

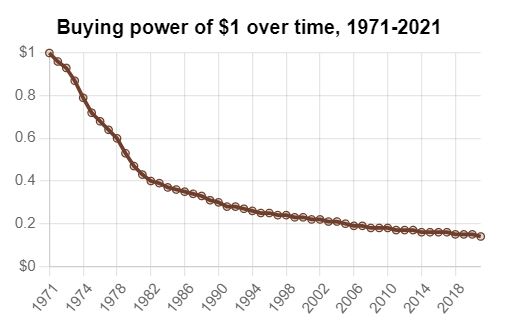

Fifty year anniversary this week. Up until August 1971, under a USA government mandate known as the Bretton Woods system, you could convert your US Dollars to gold at any time. President Nixon and the FOMC were worried about inflation and a looming gold rise. They abandoned the system and floated the USD to what is known as a Fiat currency.

Not quite like above. Crypto players use the term Fiat Currency like Right Wingers use the term woke. Meant to be offensive, but is actually mis-used.

Fiat just means, it is a government unit of which the value of the currency is set by demand. One US dollar is worth a dollar because people believe it is. If people lose faith in the US government then you can assume one USD would be worth a lot less. As long as that faith holds true, in theory at least, the US Federal Reserve can print and issue dollars until the cows come home.

Unlike the gold standard though, inflation does eat into value. Since floating, the one USD you are holding is worth less than 15 cents today. The fact in that the USD is not 85% lower on foreign exchange markets is the wonder of fiat.

Maybe it is a bit closer to Bitcoin than many would like to recognise.

Keating did the exact same thing to our AUD in 1983.

Housing

Everyone has an opinion – as a market’s person, the natural default is to analyse the supply and demand equation.

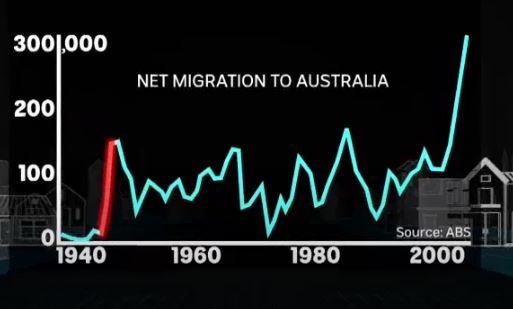

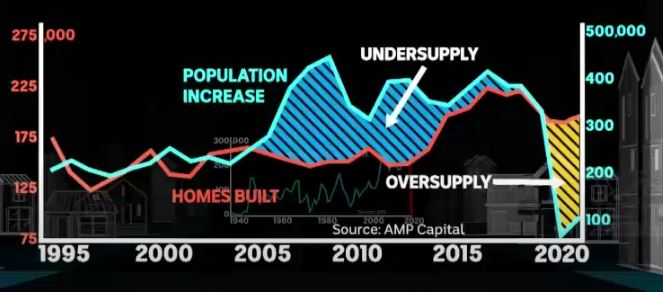

ABC looked at that last week. Net migration in the post WW2 era and again in the early 1960’s and 2000’s saw a strong under-supply of housing that supported house price rises.

Clearly in the last 18 months, that has turned sharply. We now have a pretty significant over-supply.

Prices will therefore fall right? No sign of that in the near term…the exact opposite.

The supply/demand equation is over simplistic and ignores the key component of housing…cost…a.k.a. interest rates. With interest rates so low, the “cost” to play in property has never been cheaper.

I did some research this morning. You buy a $800k house or apartment. Assuming you steal $200k as a deposit then the place will be costing you $500 a week.

You rent a similar unit and it will cost you more.

All good with two massive provisos. Firstly you have the deposit and secondly that interest rates never go up….

I note that Qantas is giving away prizes to encourage passengers to be vaccinated.

Likewise, Fox News is giving away prizes to subscribers….

CBA data:

Crypto and Gold land

Bitcoin up again. Smack on $50k USD.

Could have doubled my money in a month, but chose not to.

Will get it at $25k next time round.

Regulation remains my primary expectation of lower prices. Victorian police have seized $8.5m of crypto drug “money” from bad dudes after a tip off via the FBI. Well played, but I thought password protection etc would make seizure difficult?

Gold going nowhere.

Some conspiracy theories have been speculating on why there has been a significant move to relocate Central Banks gold reserves in recent years. Many European countries (including Netherlands, Austria and Germany) have taken their gold reserves out of the US Fed and the Bank of England and moved it “home”.

As a side point, interestingly enough, 99% of RBA 80 tonne gold holding is stashed in the Bank of England.

Central Bank’s see gold as a key plank of financial stability.

Tin foil hat proponents are suggesting a return to a gold currency standard around the world (see above). Others say it is just a trend towards localisation and protection against unlikely future events…

Side point #2…Afghanistan holds $1.3B worth of gold in the US Fed. Unlikely the Taliban will be able to get their hands on that nor the other $8B in foreign reserves. Does it just go into a lost and found locker?

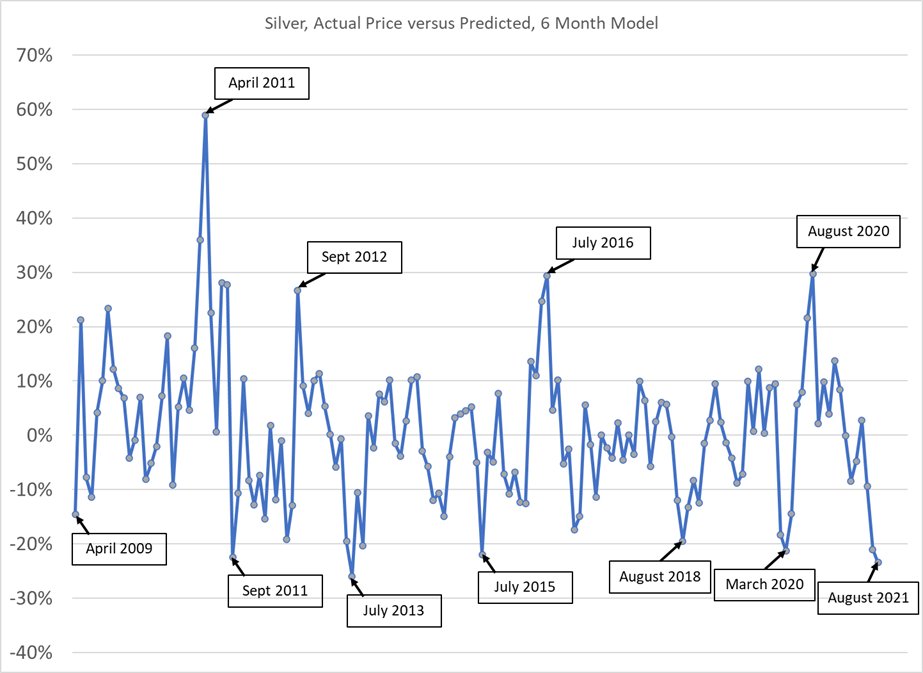

Finally, silver has been knocked around of late too. Chart below tracks where PREDICTED silver ended up to actual. At over 20% below predictions, history shows it may be a good time to buy. Not for me though.

Thought of the week. Politicians give me the shits

No time, but the headline remains…

Some data to share next week re the UK economy and their approach to re-engineering their CO2 emissions

Drinking favourite…

Back into Grenache again.

Shared with good friends over lunch, as you can see it is light in colour but has a good depth of character.

Apparently Ovitelli means “egg life”. Old vine (1946) the wine naturally ferments in ceramic eggs for 200 days.

Took a lot less time to drink. Not cheap at $110.

9/10

Listening to…

Was given a few suggestions this week, but have ignored all. I stumbled across this YouTube classic. I was at that game of footy….

Feedback always appreciated….

Cheers BS