2021 Edition #28 – Australians are the winners

12 August 2021

Time to find the mongrel within

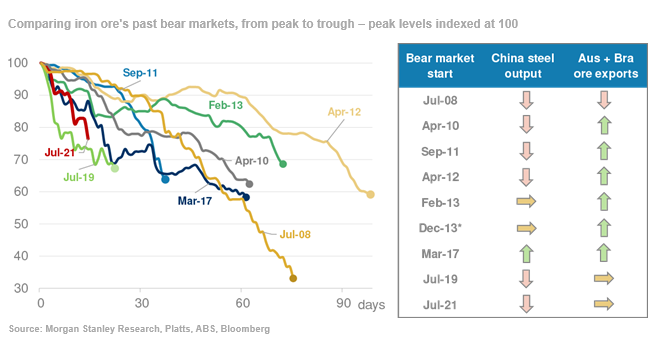

Iron ore is getting smashed. Not that long ago, many were talking about a commodity super-cycle. Iron ore has lost 30% since it’s May peak.

Why? Fear over demand contraction – especially from China.

If you are interested read about Evergrande. Chinese property falling down…

Chinese property construction titan. They owe over $300 Billion in USD via bank debt and HK issued bonds.

Chinese property construction use about 50% of the huge amount of steel used in China. These guys are the biggest – and look for all money to be going down the tube.

Will Chinese government bail them out? Doubtful – and against their stated position. Having said that, as we said in recent issues….China can do very Olympic standard reverse pikes.

The red line in the chart below shows just how far and how fast, the pullback has been in historical terms.

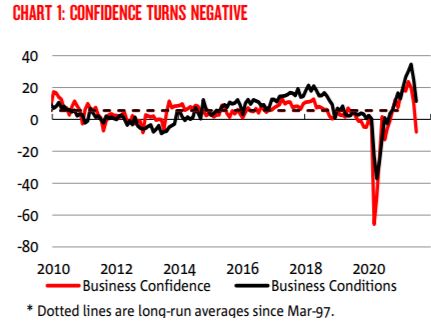

Locally we had the NAB confidence and conditions survey released this week.

Not surprisingly it was massively negatively impacted by NSW/VIC lockdowns.

Confidence is back at September 2020 levels.

This would usually be reason for me to get pretty bearish – a really bad dip. But both the market and I, seem to be reasonably ok with the “bad news”.

CBA profit result also quasi reflects this. Profit up 6% yoy. and share price well up.

Meanwhile NAB has so much cash it has agreed to buy Citigroups Aussie consumer lending book for asset value + $250M. Should be earnings positive for them and they have always been traditionally underweight in home loans compared to the other big 3.

Also interesting in that purchase is NAB is looking to white label their own version of a Buy Now Pay Later scheme. Given Square has “paid” a fortune for AfterPay – which is essentially a middle man between consumers and bank credit cards, this will be interesting to watch.

Punters (and I) believe this is a temporary brake on the Aussie economy. Demand (and cash) is still there…only a timing issue of when that demand begins to flow.

It does of course all end up with the timing and success of the vaccine roll out. A reader proposes a fast track solution..

For those in lockdown with kids…

And one solution if you feel trapped…

The US equity market remains up and about.

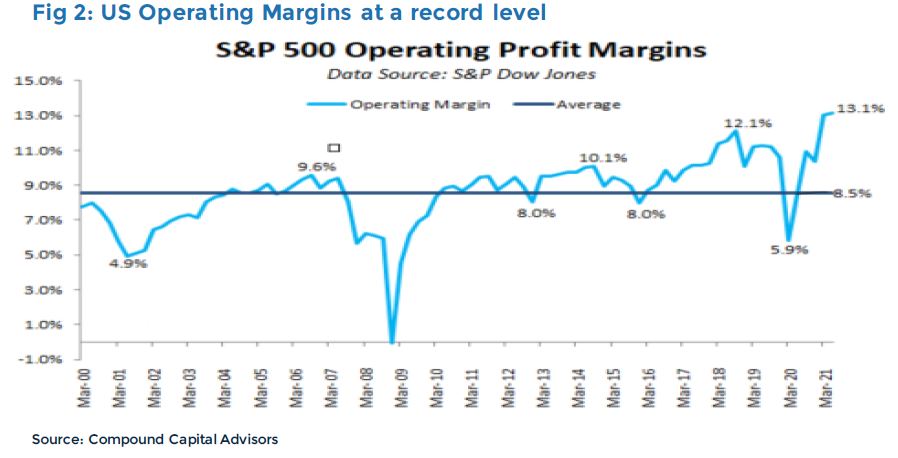

As an interest rate guy, it would be easy for me to back the bond market and declare US share prices “toppy”. That remains a thought that rattles around, but the company reporting season does go a long way to justify some lofty valuations. Average long term profit margins are 8.5%. The last 12 months has seen that rise to a 2 decade high of 13.1%.

I have always believed that profits should drive share prices so fair enough.

One word of caution though….Many companies are stating that the profit margin was fattened by their new found ability to increase prices…and they are confident that they can increase prices again in the near future.

That is great….but in layman’s terms that is inflation. If that holds true, then cheap capital may be under threat.

But for now, the S&P and our ASX are like this goose…

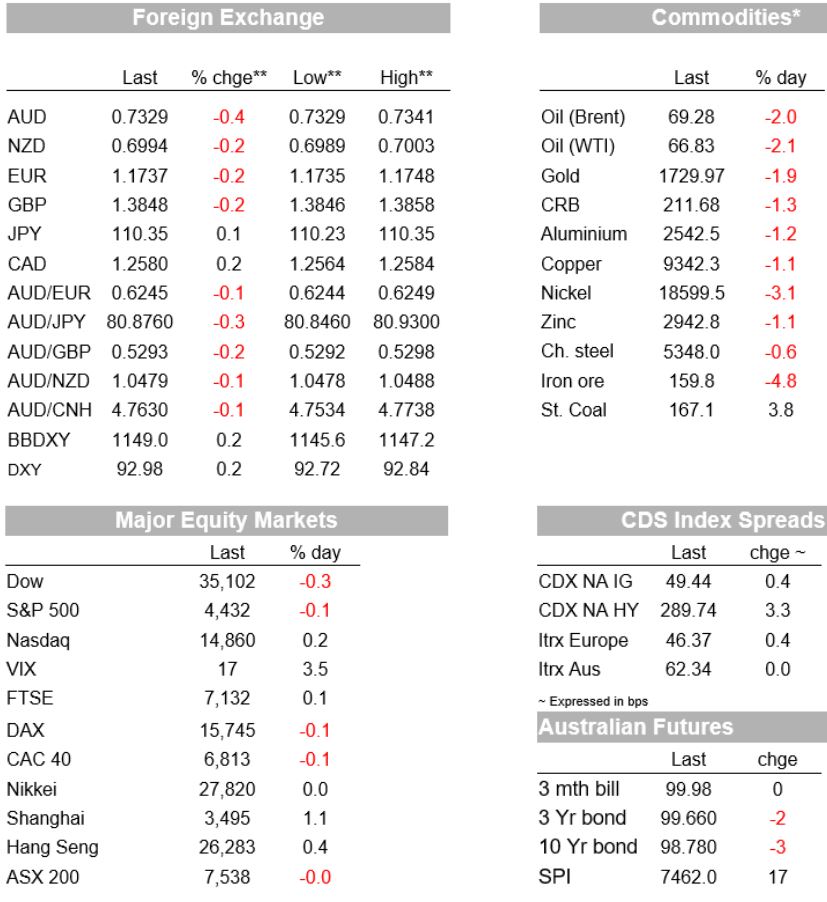

NAB data:

Crypto and Gold land

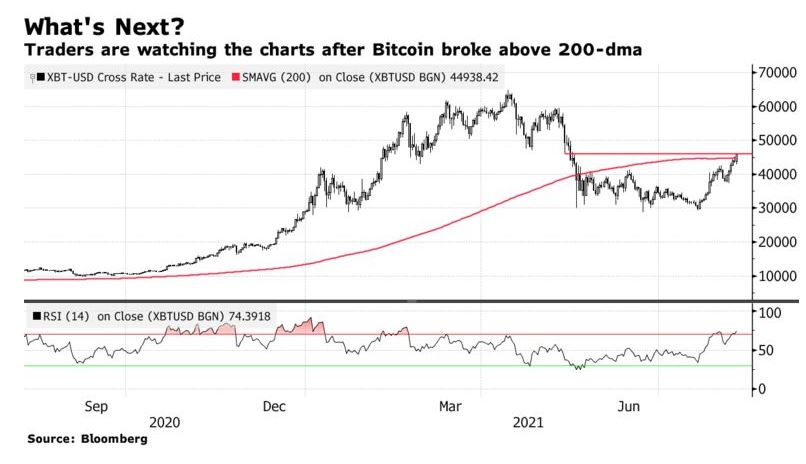

Bitcoin up 17% on the week. Talk that “the worst is behind us”…

Sitting around USD 46k I might have to concede I set my buy target too low.

The believers are saying $50k is next on its way to $100k. All other cryptos are following similar paths.

My fear is that I am using fear of potential regulation as an excuse not to play.

Maybe I need to be like Dino…

Thought of the week. Politicians give me the shits

I started work in a Treasury Dealing room many years ago. I worked under a very smart, but very eccentric mentor. We ultimately became very good friends.

Talking religion and politics over lunch one day, I proffered I did not follow any political party. He put it to me in a way that made sense at the time. Paraphrasing, it went along the lines of:

“if you work in finance you should support free market concepts – that is Liberal. The problem with Labor is that they think they know how to spend your money better than you know. They will be higher taxes and slow businesses down”.

Those words stuck with me. There is no doubt that a 100% “free market” would not be optimal though. Workers conditions and environmental/societal damage as just some concerns. So, what we need is a party that moves closest to the optimal line between market forces and lifestyle equity.

So, which party, or which individuals work towards that line? None that I can see presently.

The Coalition call themselves “low tax” yet are happy to pump millions into Gerry Harvey. They feel that $650M of our money can be used for pork barrelling. They feel building a gas power station in the Hunter is ok, despite the market giving it a resounding thumbs down.

On the flip side of that, they denounce $300 vaccination payments as wasteful, despite originally being their idea. The NSW lockdown is costing Australia $7B a month. Seems a valid proposal to me.

Yet Labor seems to be taking the general approach of “say nothing and propose nothing….maybe people will vote for us then”.

Then you get the SlowMo stating “we” won’t be taxing our way towards net zero carbon emissions. Like many of his rambling plans, it is unclear what path we will take, although technology is oft mentioned. The same guy that slammed EV’s and hailed the V8 ute as the king.

Car manufacturers dump their old technology cars into Australia, because we have the least requirement for sulphur reduction in our fuel. Most new cars would see their catalytic converter fail in Australia – so we get the duds.

The same party that describes wind farms as ugly and noisy. The same party that argued so hard to get the Great Barrier Reef off any endangered list. The same party that held coal aloft and claimed “don’t be afraid of it”.

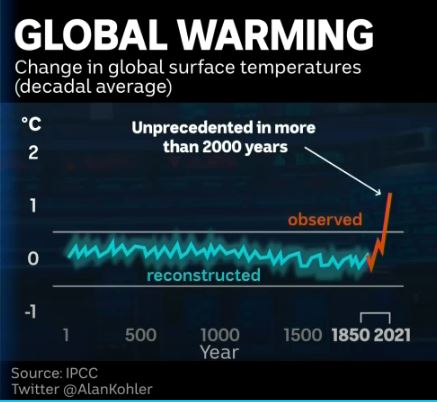

The intergovernmental report from 192 countries, indicate maybe we should be afraid of it…

After the Ice Age it took the globe about 1,000 years to see temperatures rise by 1.5%C. The world has “achieved” that in the last 50 years. Another 1% and we will be living in a world that has not existed for 3 million years.

Not even I remember that far back.

So as the waters start lapping into Kirribilli House, perhaps SlowMo won’t be in power, but just how much will need to be spent to keep this country literally afloat?

Rant over again

Well not quite. Track down the vision of Barnaby on the House floor in question time.

If you or I did that in a work place we are out on our ear.

.

.

And Gladys is now looking under the pump more than Andrew Cuomo.

Delta sees her squeezed between political dogma and reality. She needs a good man to support her, but instead had a Daryl Maguire. SlowMo seems to have thrown her under the bus. She looks as lonely as Bernie.

Drinking favourite…

Bloody cold winter…despite climate warming comments…

Never got into dark beers as a youngster, but palate seems to be changing

Quasi confession though – bought a few of these puppies on special this week….without knowing they were a dark beer. Maybe Premium Black should have been a clue.

Not a heavy dark beer – perfect after a day of manual labour??

680 mls is a value proposition if Mrs Swan is watching consumption.

8/10

Listening to…

Picked it from nowhere but always liked the song.

Morrisey – That’s entertainment. 2021 version with Bowie.

Good version. Tad slower than original.

Takes me back to my skinny jeans days. Mrs Swan believes this is what I look like in them these days…

Until next week, as SlowMo says….Australian are the winners.

Don’t be a monkey.

Feedback always appreciated….

Cheers BS