2021 Edition #27 – On the home straight

3 August 2021

Say what?

Late edition again. I’ve been tied to the telly watching Olympics.

Early candidate for Tweet of the week:

Heartbreak for our track pursuit team. Teach them to buy cheap handlebars via Alibaba.

Every four (or five) years they trudge out the actual composition of the medals. Only 6 grams of gold in a gold medal…only AUD $180 odd of value, excluding endorsement income

I reckon the BMX winner passed me in the mall last year whilst eluding police.

Nothing like watching elite sports, but something to be said for the theory below;

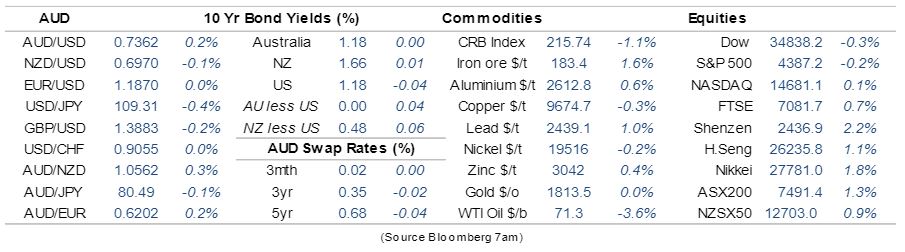

Not much took my fancy in the markets this week.

We have mentioned it a number of times, but the dislocation between bond markets and equity markets is getting extreme.

Of course inflation is the typical driving force for bond yields – and inflation is typically driven by economic growth.

To quote Mutual Ltd on current corporate earnings:

“Most of the US reporting season heavy lifting has been done with two-thirds of the S&P 500 now reported.

Aggregate sales have exceeded expectations by +4.5% with 83% of companies beating, while earnings have exceeded expectations by 17.8% on aggregate, with 86% of firms beating.

Aggregate sales growth has come in at +27.1% YoY and aggregate earnings have grown +100.0% YoY with c.90% of firms reporting sales and / or earnings growth.”

So, great results should see bond rates climb….right? 10 year yields have fallen from 1.75% in March to 1.17% at present – huge drop.

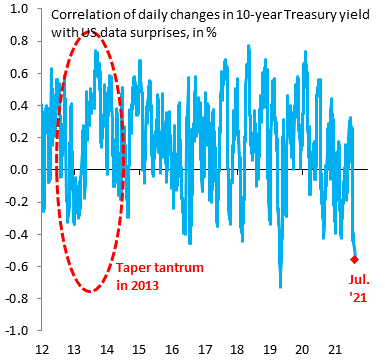

A couple of charts to review.

The first is the correlation between interest rates and positive US data. When the blue line is above the zero line it means that good economic news has seen interest rates move higher.

The economy is reporting solid results. Why then is the blue line at negative .5?

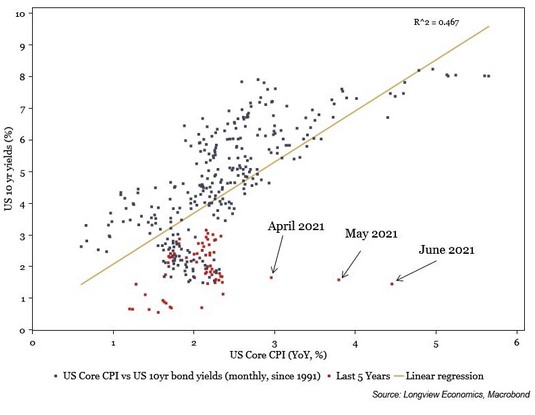

This second one is even better – if not a tad more complicated. Each dot is a plotting of US yields against inflation over the last 30 years. As mentioned above, inflation and interest rates are inextricably linked.

The last five years (red dots) have all clustered below the linear regression line. That is unusual, but just look at where the dots have been sitting since April. In their own galaxy.

Of course the equity pedlars would say that shares can stay higher for longer because of the amount of cash sloshing about – and more importantly inflation WILL NOT stay this high for very long. Equally the bond market could argue that government bond buying is “falsely” creating demand that pushed prices higher and yields lower.

To quote Mutual again…: “That’s as good as its going to get, it can only be downhill from here.”

Everything hinges on US and global rates – when will they rise?

Like most countries, the USA is having some difficulty dealing with the Delta virus strain and some concern it may be a factor in slowing the economy down in the back end of this year. China is in the same boat.

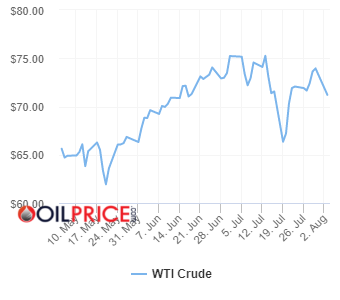

One commodity that is reflecting these concerns is oil. OPEC production has been ramping up, but demand has fallen. So the price rises in May and June are now reversing.

Domestically business and consumer confidence has been rocked by NSW lockdown. Victoria and SA have relaxed conditions but you feel like Australia will be in and out of lockdowns for many months to come. One wag showed Adelaide post lockdown… Sydney not much better though with Bin Birds taking over.

This with a Chinese slow down, has seen the value of the AUD kept in the 73 cents. Hard to see much higher in the short term, and watch out for a significant dip lower into the 72 cents if the RBA release any sniff that the bond buying programme will be extended and increased. This didn’t happen Tuesday at the RBA monthly meeting, where as expected the cash rate remained pinned down at 0.1%.

CBA data:

Crypto and Gold land

Bugger all to talk about. Bitcoin at $38k USD is barely changed on the week.

Someone told me recently that Bitcoin was a momentum play, and the fact that it has held up now for a number of weeks with a raft of negative news items is a very positive sign.

Caveat – they hold BTC.

Thought of the week. Housing affordability

Some apt push back against Labor’s move to “Liberal Light” status last week.

If they are that keen on getting elected how about presenting and educating the public on their policy differences and why it is imperative to overhaul many aspects of the taxation platform.

Housing affordability is an important issue – and vexed. I proffer that everyone that is reading this most likely owns at least one property – and is secretly enjoying the increased capital value of their “castle” over the last 12 months in particular.

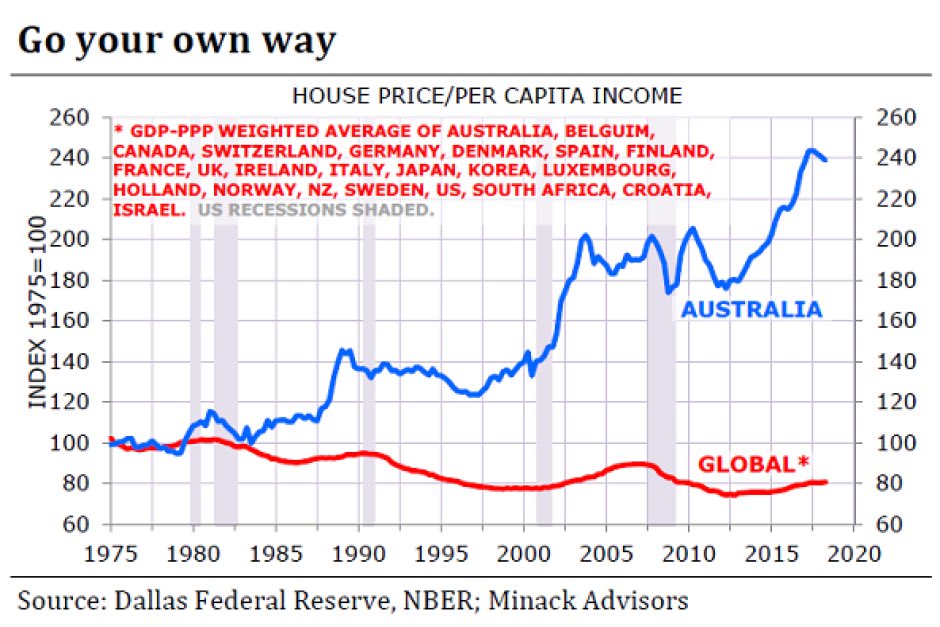

Whilst I thought this issue was not isolated to Australia, the chart below is a bit of a wake-up call.

We are a bit out of sync. Exasperated no doubt by the lack of wage growth over many years.

All banks predicted the rise to continue into 2022 albeit at a slower pace.

All good, at least until our children are looking to buy.

I read the plight of a Sydneysider this week. Young professional with a reasonable job. They are saving to buy their first home.

With a 13% kick in the last year the median house price is now $1.3M. Let’s say they move to Shitsville and they buy well for $1M.

For a deposit and equity they will need circa 260K. Sacrificing their smashed avo’s, they are saving $5k a month.

It will take them over 4 years to save the necessary deposit – just don’t get married or have kids of your own.

If property price rises revert lower to historical norms, they will then need 320K as a deposit…which is another year of saving…and so on and so on…

If the argument originally was that taking away negative gearing would see house prices fall significantly, then yes I’m all for it. Changes can be grandfathered at worst.

Drinking favourite…

Back to back pinot noir week.

Usually stay clear of wine labels that stray too far from tradition.

This one had a few years on it as well – 2010.

Professionals say : A beautifully fruity Pinot with bursts of berry and cherry flavours. Silky smooth and with an oak note finish. Enjoy it by itself, or pair it with lightly smoked cheeses or meats for the perfect evening unwind.

I had not had a Central Otago wine for some years. Forgot they have nice wine.

9/10

Listening to…

A rogue song that popped into my play list.

Not a dinner party song, but John Grant’s “Your Portfolio” harks back to techno years.

I particularly liked the lines : “Your portfolio is making me wet. It makes me want to go deeper into debt…”

No time to dissect the Afterpay buy out and story. The founders reap 2.7 BILLION each. Nice work lads. Note however that is not cash – only scrip.

Maybe the cash comes later in four easy payments…

Until next week, back a winner.

Feedback always appreciated….

Cheers BS