2021 Edition #26 – Gold Silver Bronze Coal

25 July 2021

Careful, it bites.

Mood in Australia has dipped. 11 million currently under lockdown.

Put your masks on…

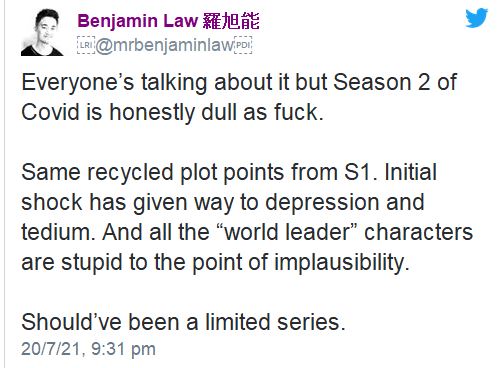

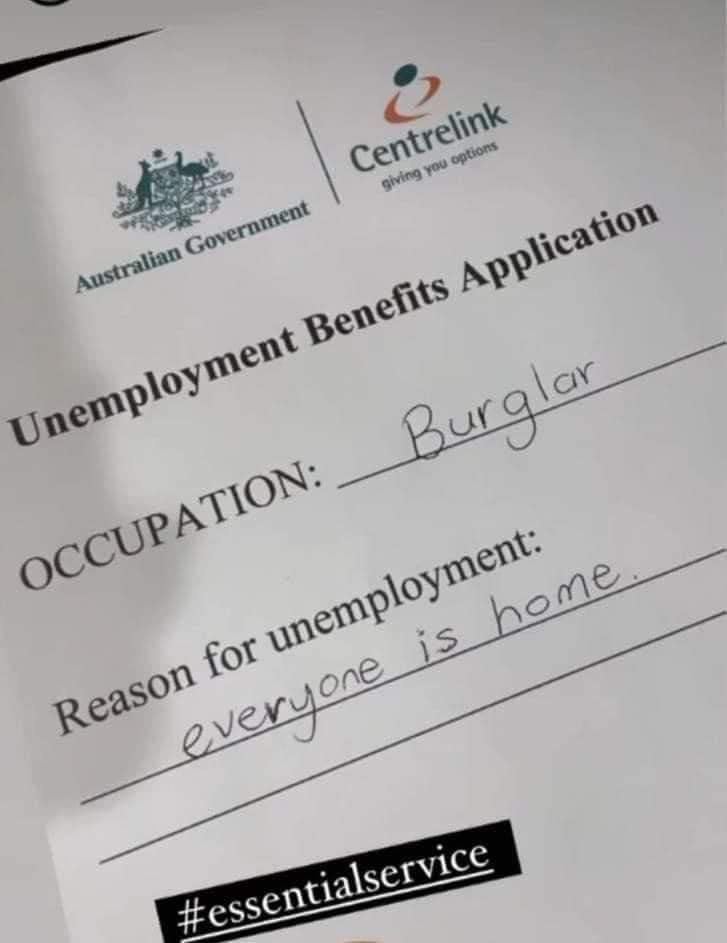

I reckon this could be Tweet of the week and covers my feeling.

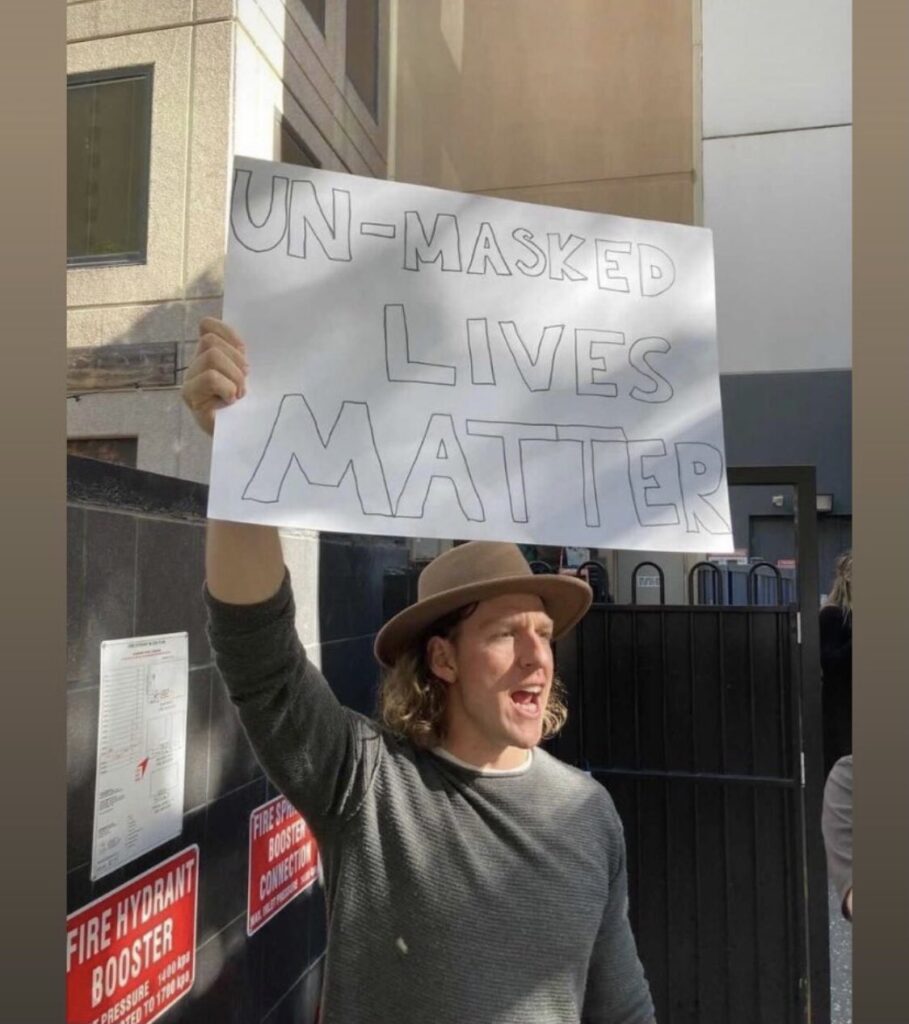

That Tweet was before this weekend’s “Freedom March” in Sydney.

What a bunch of complete F-wits. Australians can be sometimes too compliant – especially for a convict nation. But that march almost certainly will only prolong the lockdown. News footage showed there actually might be more Covid cases in the march than combined IQ.

Of course the underlying cause and frustration is as much an interest. Is it anti-vaccers (I think not) or Gladys haters (I think not)?

Clearly some of it may be off the back of so much politicisation of the virus and our response. Some of it fair and some of it not.

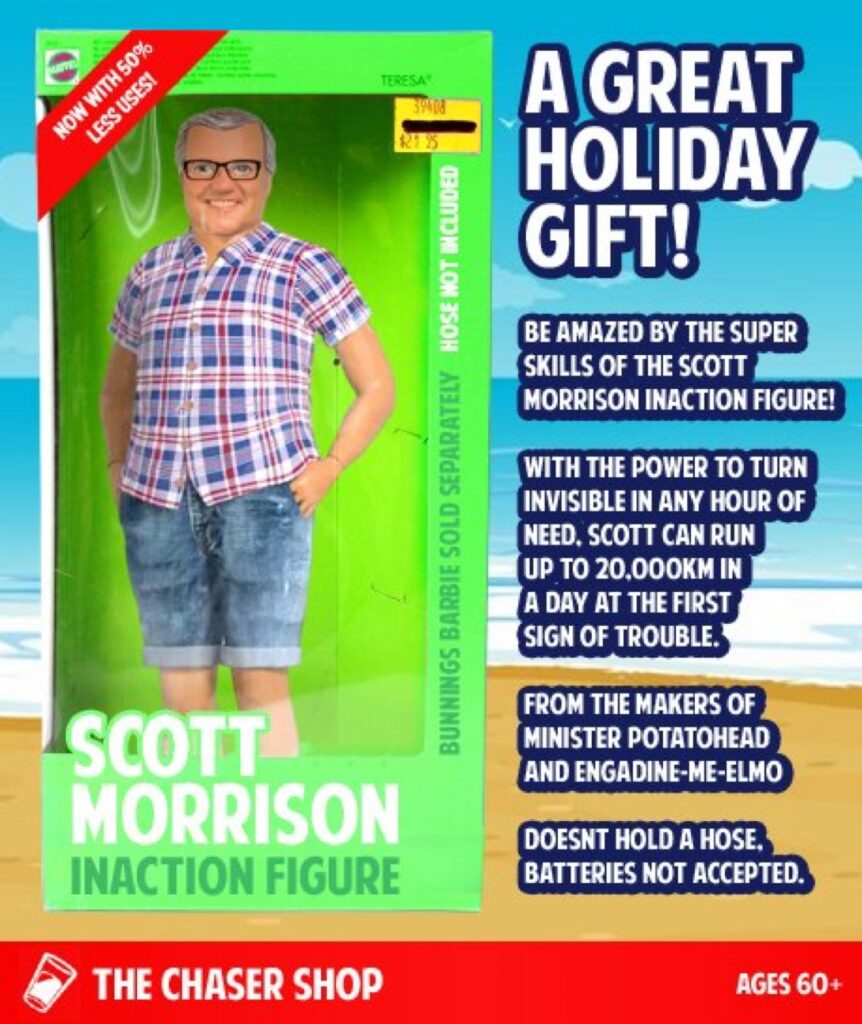

The Prime Minister’s poll ratings are in a dip, and I loved the Chasers latest take down. Read some of the “features”.

USA

My Wall Street insider has supplied some US inflation comments this week. Google Mohammed El-Erian if you want some bed time reading. The views basically are that the US FOMC have gone “all in” on transitory inflation theory. If they are wrong, then instead of a gentle tapping of the monetary policy brakes, it could be a four wheeled lock up with chance of air bag explosion.

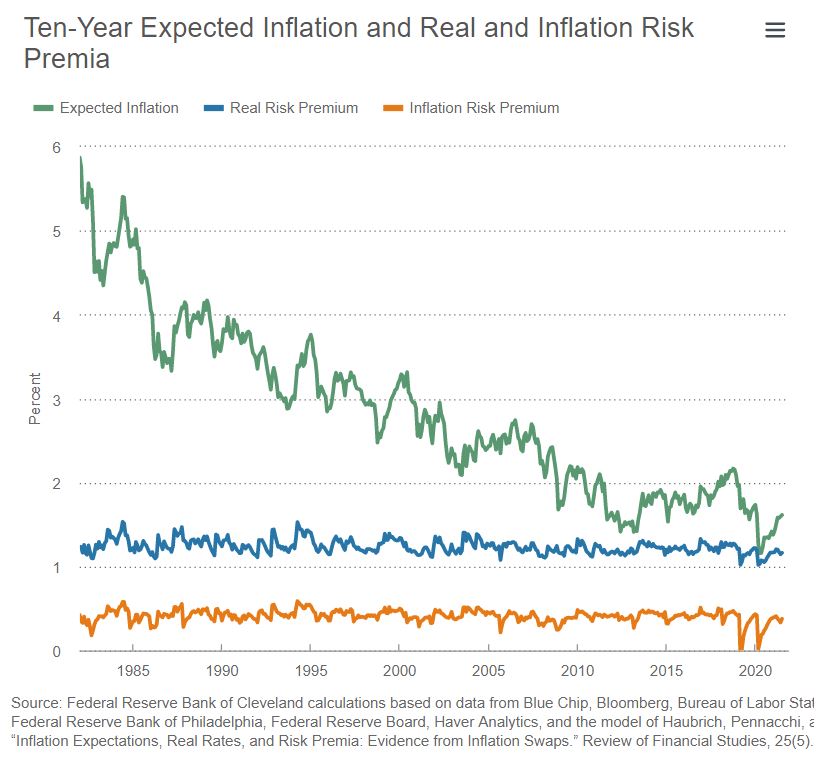

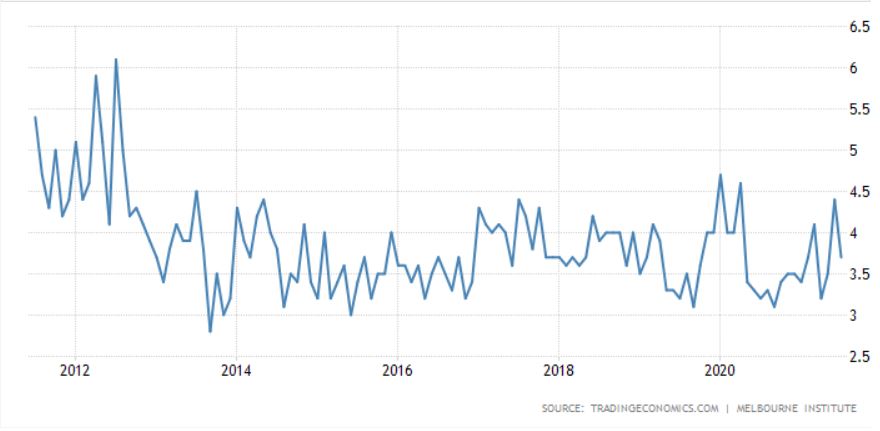

As we have mentioned before inflation expectations are as important as past inflation readings. That is because businesses and consumers behaviour often makes the expectations reality. Thus it was interesting to compare US expectations to ours.

Our inflation expectations are falling (second chart) whilst the USA’s are very much on the rise (first chart green line).

El-Erian sees many companies starting to hike prices and expect those prices to hold and maybe even rise. As a watcher of the USA bond market he argues that the falling 10 year bond yield does not fairly represent this point, but yields are artificially dragged lower by central bank interference.

More space action in the USA as well this week.

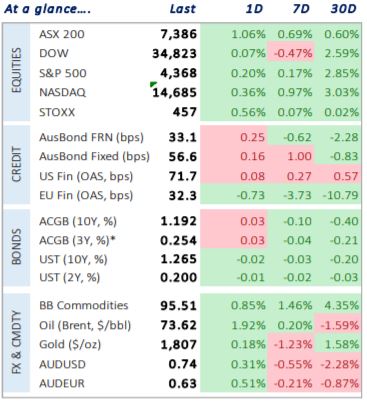

Markets have had a mixed week. Commodity prices bounced around. Equities looked like they were about to crack, then found a new lease of life again and crypto found new mugs to buy in.

The AUD dropped, and at one stage even had a 72 handle, before also finding some love. Spending the weekend in the mid 73 cents.

We assisted a long term property investor/holder negotiate a long dated interest rate hedge with their bank this week.

These are not easy decisions. They will be paying a “premium” over floating rates for some time into the future. The direction of the next move is not in doubt (rates WILL be higher), but the timing is difficult to predict. Their view though is that the cost of “getting it wrong” will be small by historical standards, and that they can feel comfortable that for the next five years there will be a known cost of funding that is below rental return. Locking in profit and no need to negotiate in any liquidity tightening whilst securing a good/fair margin.

Some suggestion that unemployment may kick up to 5.8% on the back of the latest lockdowns. Under-employment may suffer worse.

Centrelink will be busy.

Data this week supplied by Mutual Ltd that also had a great quote : “Fixed income markets are behaving as if a key turning point is at hand, though in which direction remains to be seen…this is one of those cases where the explanation will seem more obvious in hindsight than it does at the moment.”

Crypto and Gold land

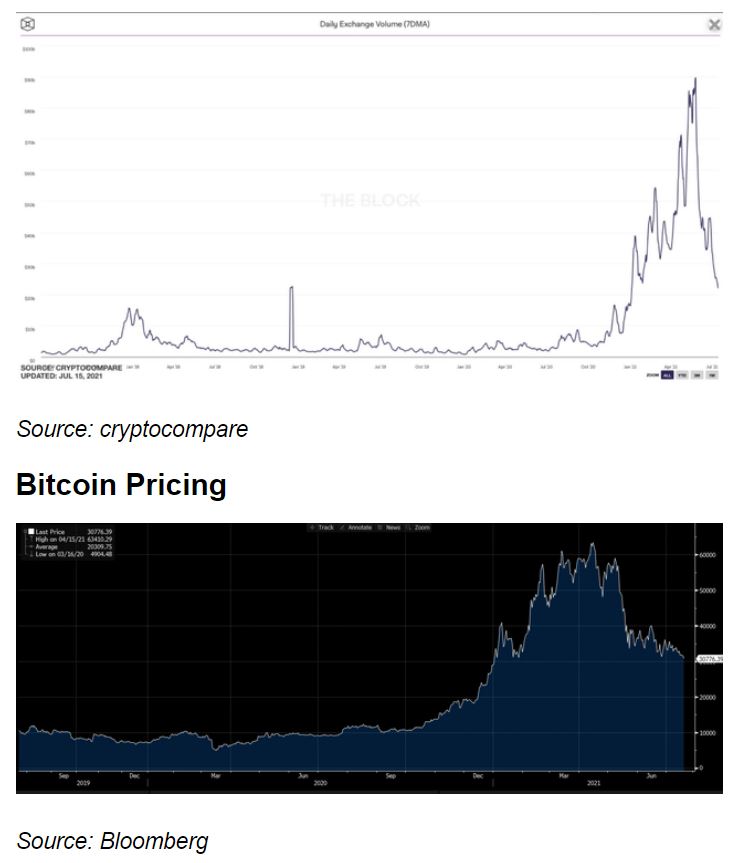

I was a bit concerned last week. My Bitcoin entry point of $25k USD was threatening.

Fortunately it rallied before I had a chance to buy. Back just under $35K USD at present.

The bottom chart is BTC price (pre rally)

The top chart is crypto trading volumes.

Pretty close match, I think you would agree. Like all good Ponzi’s you can only ramp the price with new players.

Five year commodity charts below. Trend higher for all. Copper as a benchmark for future economic expectations is one to watch.

Growing reports suggesting the possibility that China and USA may actually already be past peak “post” Covid bounce.

Thought of the week. Double up

First thought/

You may recall we covered the NUIX issue very early on – see edition #18. Dodgy float, “allegedly” supported by some sub optimal prospectus claims, supported by Macquarie Bank that made a truck load of money on the float. Shares have since done an Olympic style high dive.

If the smell was not already an overflowing septic, a bucket of fresh poo has just been tossed on. ASIC has not acted quickly and under Parliamentary privilege, a Labor senator has suggested maybe (just maybe) it had something to do with ASIC Commissioner, Cathie Armour’s, previous role as General Counsel for Macquarie.

Purely by coincidence, Armour chose to step aside for the moment, to avoid any possibility of a conflict of interest. Some may say 6 months too late. Investors have been duded. Fox in charge of chickens.

Second thought/

Following on from my general disgust with a piss poor Federal Opposition that seems comfortable remaining in opposition…without really opposing anything.

Put to one side a car parks rort that proposed to build train car parks (at over 5 times market value) in 90% Coalition or marginal seats…some without actually having a train station. That alone should be enough to vote a government out and guarantee a proper Federal ICAC.

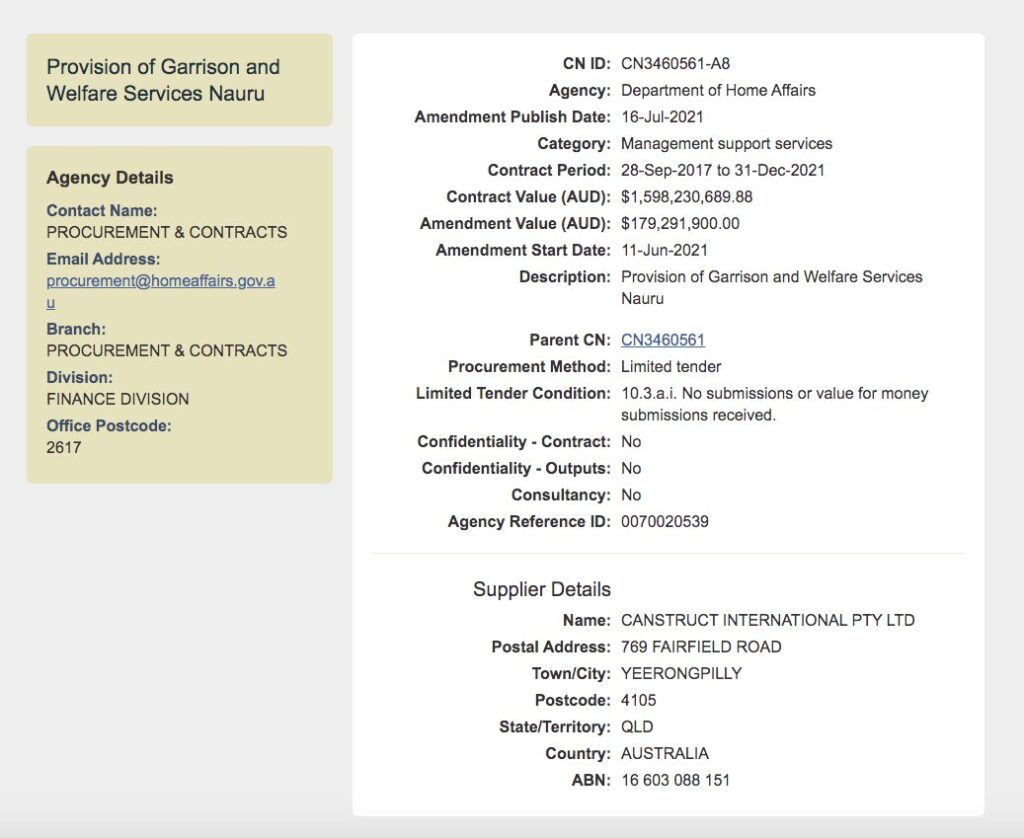

But the Federal Government’s handling of off shore asylum facilities, for political gain requires some serious questions.

A closed “tender” for Nauru was recently revealed and increased in value. The winning bidder made over $100M in profit last year.

The latest $200M increase will cover the 100 odd remaining detainees in Nauru.

The actual offshore processing policy is a very complicated issue – and I make no comment on the policy or alternatives.

My comment is purely economic.

I know money doesn’t matter any more in this post Covid cash splash. But Australia has spent over $7 BILLION on the detention programme since 2012.

Nauru detainees are now costing you and I $10,000 a day…for EACH detainee.

I’ve got space here for 5 at that price. Mrs Swan will cook and clean a treat for $50,000 a day. Caviar for entrée followed by truffle pizza.

Drinking favourite…

Lockdown special to go with a slow roast Porterhouse.

Professionals say : “handpicked and made according to Curly Flat’s high standards of wine making. You can expect a medium bodied elegant wine, with beautiful juicy red fruits, cherries & a hint of vanilla and spice.”

Priced in the mid $30’s the bottle disappeared very quickly with the help of a cygnet.

Get the feeling it would improve further with another year or two.

8/10

Listening to…

In honour of our Sydney freedom marchers…

Nobody likes a Bogan only hit 48 on the charts, but the Melbourne band channels Madness’s ska feel.

Released on this day 20 years ago (or thereabouts…)

I dream of coffee shop gatherings again soon…

Feedback always appreciated….

Cheers BS