2021 Edition #24 – Who is driving this bus?

12 July 2021

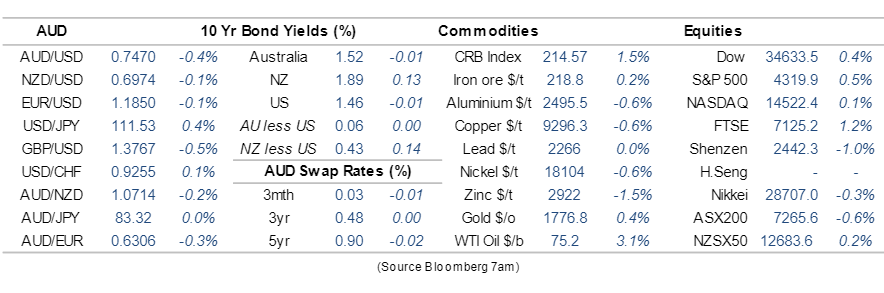

No more horsing around.

Sorry for delay, I had to get the Loire Chateau ready for the helicopter fly overs for Le Tour de France. Hard to get the servants aligned over Facetime.

Speaking of Le Tour, it must be hard to get up every morning to ride 200kms+.

You are probably like me – starting to get just a tad fed up with this Covid crap.

The Delta variant is starting to make a difference in financial markets though.

Some believe lockdowns and set-backs will be around for quite some time yet. Yet bizarrely that might be a “good thing” – at least for interest rates.

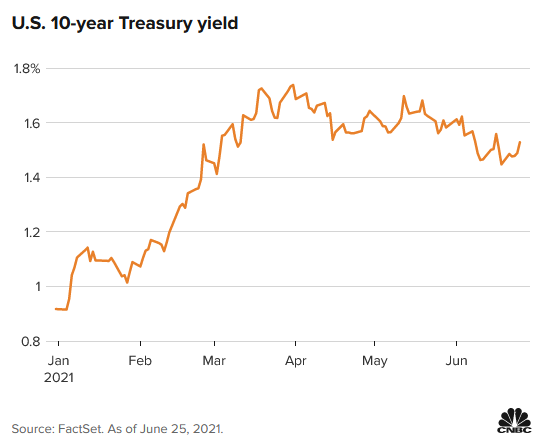

US yields started to rise when the pace of economic recovery was picking up and signs of inflation appeared. Ten year bonds hit 1.75% and 2% was the target by around about now. Instead, on Wednesday that rate fell below 1.3%.

Perhaps the economic recovery will not be “a one way street” and indeed those that called inflation transitory may have got it right. If so the days/months/years of easy, low cost capital may continue.

Australia has similar issues to contend with, and the NSW gold standard lockdown will give our broader economy a nasty hit – without the depths of Federal Government support from 2020.

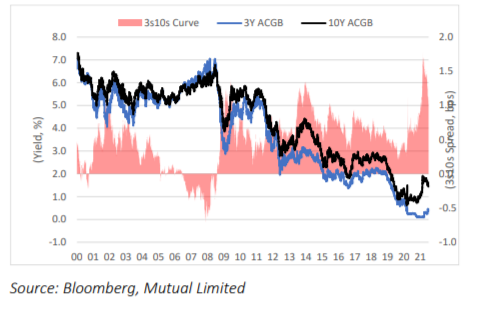

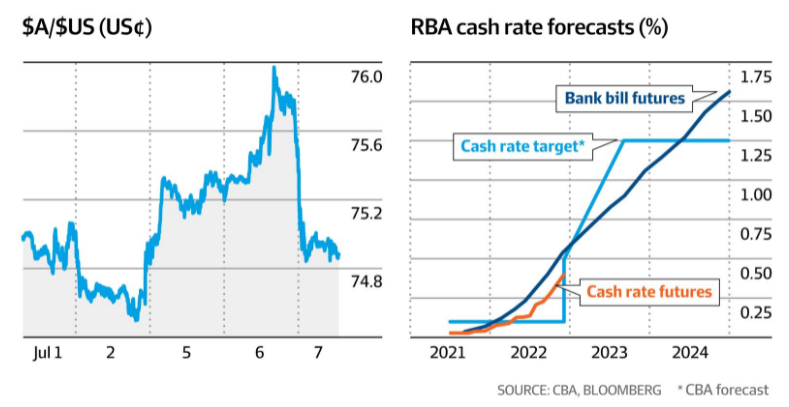

The first chart above shows the interesting position we are in. In the second, Aussie 10 year bonds (black) are trading about 1.5% higher than 3 year bonds (blue). This is as the steepest curve as we have seen since well before the millennium bug never hit.

RBA is forcibly keeping the 3 year bond low but there is the increasing expectation that the RBA will reluctantly have to raise cash rates well before 2024. CBA charted their expectations below. They seem legit, given where bank bill futures are pricing.

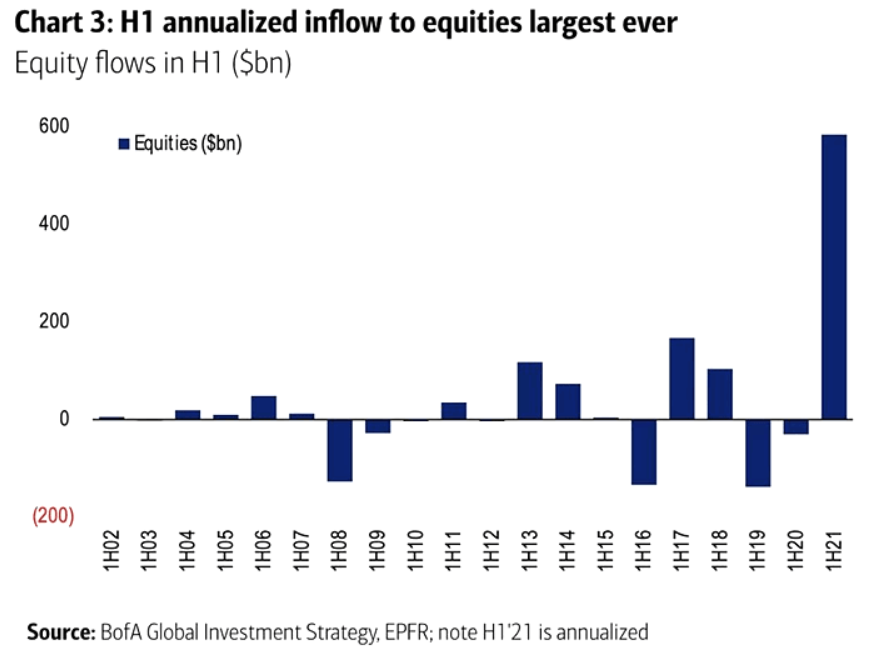

Cheap and easy money means there is a big sway towards equities.

Equity hedge fund managers are reporting record levels of leverage to equities.

Hard to quantify but Bank of America confirms that inflows to shares are at the highest level ever.

When you have that much momentum flowing one way into a market, prices tend to rise…share prices up. No surprises then that the annualised return for the first half of this year is the seventh best in the last 100 years.

Is it just me, or is there something fundamentally wrong with things going so “well” in the middle of a global pandemic?

At least we have a 3 phase plan…

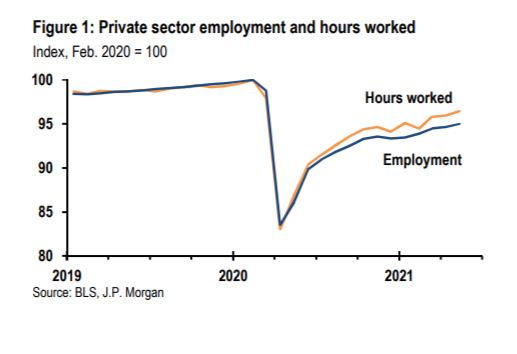

RBA seems to be hellbent on employment being its main benchmark rather than inflation. Noble sentiment.

Employment here in Australia has bounced back strongly.

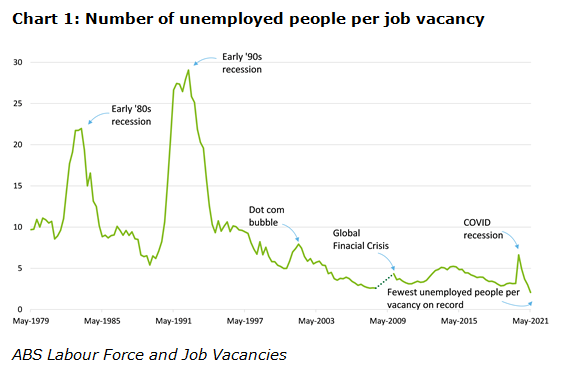

You could argue that under-employment is also a big factor holding us back, but hours worked are well up too. Deloitte’s big chart of the week surprised the shit out of me though. Since records began in the late 1970’s. there has never been so few unemployed people for each vacancy.

How can this be, I hear you say?

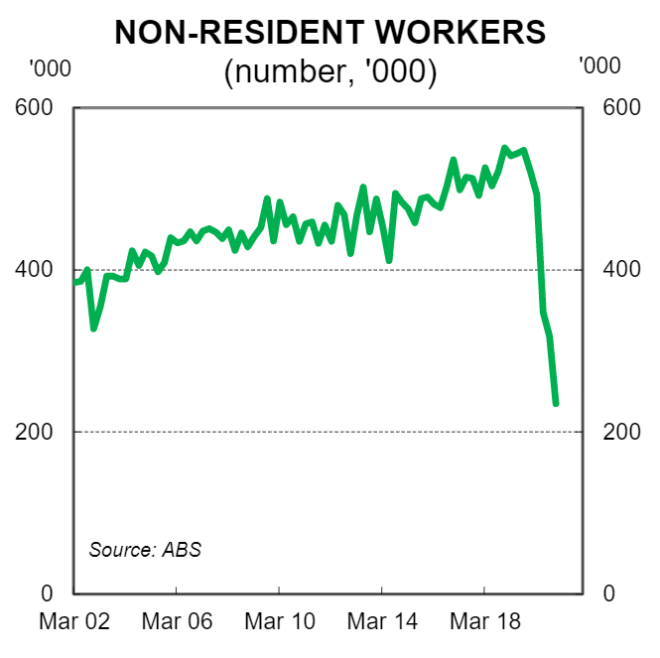

Let us think about it. Oh, yes. We don’t have anyone coming into Australia to fill those jobs.

So, the market is “booming”, people have accumulated demand to spend on travel and entertainment and housing is flying.

Cheap labour (especially provided from offshore) keeps unemployment higher than it otherwise would be and wages lower than they could be.

Reverse that and you would hope for higher wages and lower unemployment from here on…and maybe just a small stroke of the inflation beast.

Speaking of inflation – energy prices are a major contributor. Oil prices remain high as does gas.

My old mate in Fluro, Matt Canavan is pushing his standard agenda. His quote this week : “We face shortages of gas in east Australia, seen in skyrocketing gas prices this week. We should build coal fired power stations, not gas, because we have ample supplies of coal but not of affordable gas.”

If that truly is the answer the market would find a way to fund and develop – it can not and will not. But more importantly, why is gas so expensive, when seemingly we have it underground and under-sea in spades?

Australia is on track to overtake Qatar this year and become the world’s largest gas exporter.

There are discussions about building LNG import terminals in NSW and Victoria. What the…

We would then “mine” our gas in Bass Straight or Queensland, freeze it then ship it to Japan. Japan then would thaw it before refreezing and sending it to Australia.

“It’s absolutely insane,” one market expert put it.

Matt needs to get his office in order.

As one small counter, WA reserved 15 per cent of its output from its new gas projects for domestic use.

The Aussie dollar remains around 75 cents – for decades that seems where it likes to hang for long periods of time.

Our earlier call of 80 cents by year end is looking dodgy. A possible pull back in commodity prices and a stronger USD may scuttle that. Still possible but no longer as confident. Importers would be getting their Christmas orders in now, so some hedging at current levels may be appropriate – especially if your sales price is not that elastic. Maybe keep a bit aside for spot or future cover just in case.

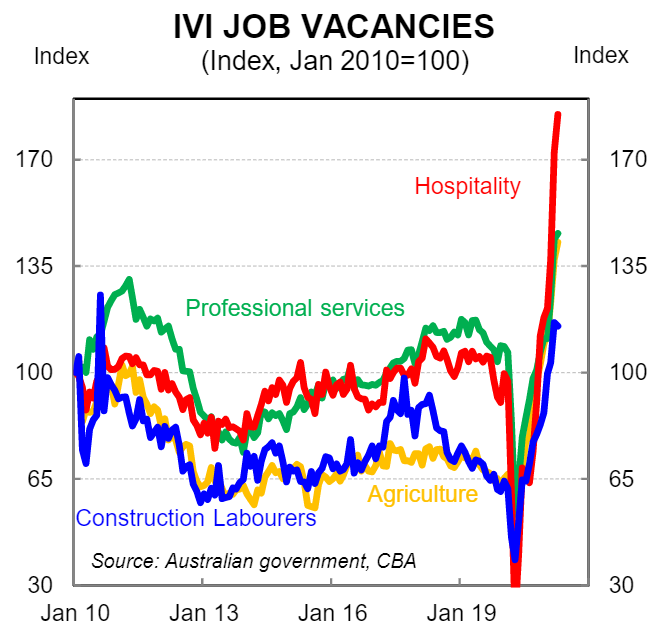

CBA data:

Crypto and Gold land

All the crypto’s have had a pretty much sideways week.

Bitcoin at $USD34k.

Some confusion about my commitment last week to buy Bitcoin if it hit $25k. It won’t be much and I don’t expect a return…of anything. My point was that with this much cash slushing around and that many people looking for investment homes, on chart terms there should be support for the dip.

The “real” stuff, aka GOLD, rose 1.5% on the week but has been generally disappointing. Possibly because the inflationary narrative is losing some support.

If the above is actually true, you would think gold would be on the fly. Chart tells a different story. Will know by the end of July.

Thought of the week. 我们还能做朋友吗

Can we still be friends?

Amazing survey data that indicates Australians are more concerned about Chinese military action in Australia than the Taiwanese are about their homeland.

Maybe the broad media has a part to play.

But a few good articles have been sent to me that gives China a different perspective.

We see them as the big bully boys that are “picking on” us poor Aussies (and a few others at the same time).

The People’s Bank of China (like RBA but with guns) has lowered the levels of capital required by their commercial banks over the weekend. This is designed to release $1 trillion CNY for borrowing.

As Ord Minnett put it “China was the first-in and first-out of the COVID-downturn. Recent trends point to a combination of the cyclical recovery losing momentum, and structural concerns. China needs pro-consumer structural reforms on top of a cyclical policy easing.”

A deeper article is here: China’s Economic Reckoning

A long read, but to summarise – it positions China as being in a potentially tight squeeze. It will either resolve itself via central restructure or implode…and in the next 2 years.

It looks at the previous steady economic growth of around 5% p.a. that went full ballistic at double digit since the mid 1990’s.

A lot of this growth was fuelled by:

- Making and exporting stuff

- Cheap labour (see above)

- Urbanisation of a rural population (see above and above)

The low hanging fruit has been picked already and high sustained growth will be much, much harder from here on.

Importantly, Xi Jinping and the Chinese Communist Party are well aware of this fact and are trying everything to keep the ship afloat. This includes the restructure of State owned entities, banking, technology and currency. But every time they try to restructure, things go tits up, and they revert/backtrack to prior positions.

They also look at the USA capitalist system and see risks that are too high to endorse.

But to quote from the article – “At some point, China’s leaders must confront this trade-off: sustainable economic efficiency and political omnipotence do not go hand in hand.”

Xi is a man that wants to control everything, but is a man under the pump big time.

Maybe China is not the big bad bully boy, but just a big scaredy cat.

Always useful to understand other cultures.

Drinking favourite…

I’m “lucky” enough to get access to a number of small batch wine producers that like to be authentic.

As ABC’s Landline put it this week, they call their style Lo-Fi. Minimal intervention.

Wild yeasts, often little or minimal filtration.

I agree the taste is very different.

Maybe it needs to be acquired, because I am missing the point.

Lucy Margaux pinot was such an example tried.

Keep it for special friends or family…especially if you don’t like them. Best with spelt bread…

2/10

Ordered some new furniture this week for winter.

Listening to…

Go Solo by Tom Rosenthal.

Another soundtrack song. Great piano and apt for July.

Seemingly no one likes my choices, so at least it is only 3 mins…

Speaking of apt for July.

Feedback always appreciated….

Cheers BS