2021 Edition #22 – Let’s Re-Joyce

25 June 2021

Yeah…those “leftie” AFR journo’s.

How happy does Littleproud and “Sports-rort” look? Has Barnarby let one rip?

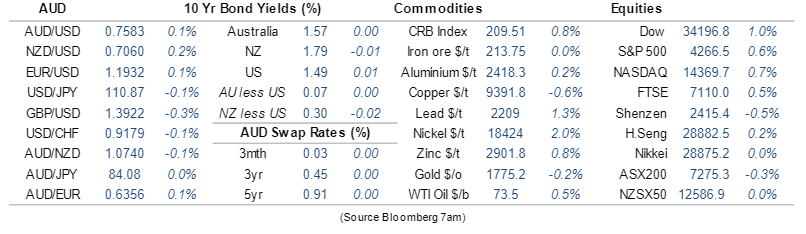

Straight to the USA this week. You may wonder why the markets often seem fixated on the USA…even though China is technically a larger economy these days.

Maybe this quote about the USA may help explain…..

“I think the best analogy for where we are right now is that America is Elvis Presley — the most beautiful, talented, rebellious nation in the history of Earth. And now, you’re in your Vegas years. You’ve squeezed yourself into a white jumpsuit, you’re wheezing your way through ‘Love Me Tender’ and you might be about to pass away bloated on the toilet. But you’re still the King.”– John Oliver…

But the real reason is correlation – on bonds and equities. Studies show that if there is 200 trading days a year, if the US share market rises or falls, we will follow that direction in just over 180 days.

In 2020 ASX 200 fell 36% between 20 February and 23 March. The S&P 500 fell 34% over the same dates.

Since then, the ASX 200 has risen approximately 35%. The S&P 500 is up by a touch more at 40%.

Get it? If you understand where the US is headed then you are well ahead of the pack.

We called the possibility that the US inflation fear might be crushed by higher interest rates. So far that is a wrong assumption. Bond rates have fallen the last few weeks.

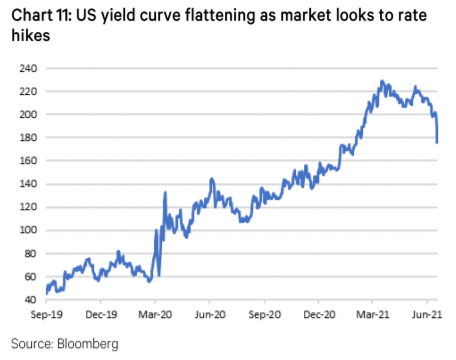

The chart below is the yield curve (differences between 1 year and 10 year rates).

Rationale is that the US central bank will raise cash rates earlier than expected and that in and of itself will be a good step towards quelling inflation. Might be fair enough. Things like timber prices are also now falling sharply, supporting the theory of “transitory” inflation – even if I am not a 100% believer.

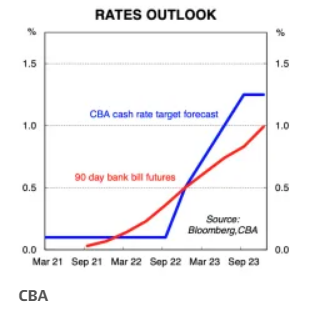

Back in OZ, a number of the main banks are also calling for the RBA to hike rates sooner. CBA calling for the first hike in late 2022 with a very quick follow up.

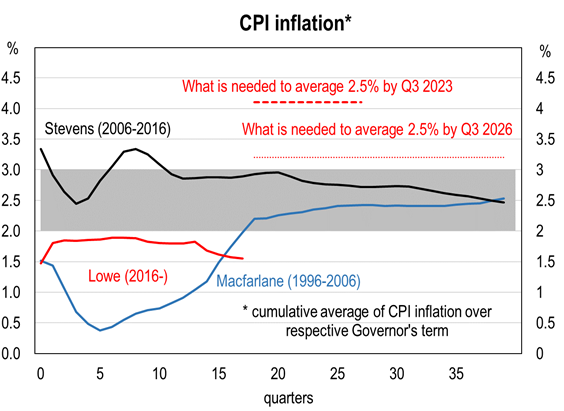

One interesting chart below. Going back 25 years all RBA Governors have comfortably kept inflation below the 3% warning line. Maybe another reason why they are so sanguine. Lowe has some “work” ahead before he hits the danger zone. You could argue then that all is good. But that would be your argument…not mine. As Split Enz said – I see red, I see red, I see red.

The expectation for a 2022 rate hike supported the AUD that has looked weak for some time now. Higher commodity prices also supported a push up to .7570 but our view is that it may struggle to get too much further for awhile.

One big difference between Oz and the USA is that they had their Father Day last weekend.

Latest CBA data:

Crypto Land

Crypto values took a big dip Monday as China’s crackdown on bitcoin mining expanded to the province of Sichuan.

BTC is now down 50% from its peak and back at the price it traded in very early January of this year.

It has bounced off the bottom for now….to my mind more because of “value” buyers looking for a bargain. Much like the ever more consistent bounce in the share market after every bad day.

One of the money market heroes and predictor of many a calamity (and reason for my moniker) The Black Swan author Nassim Taleb took another big swipe at Bitcoin, saying the cryptocurrency is worth exactly zero, and that there is no evidence that blockchain is a useful technology. This is a big move from 2017 when he claimed blockchain was an excellent idea.

The end game will always be the final assessment of crypto as a:

- currency

- an investable asset

- a store of wealth.

Asset allocation consultant Tim Farrelly, of Farrelly’s Investment Strategy, says that since bitcoin is investable, it qualifies as an asset class. However, until he’s convinced you can get a meaningful forecast for its price and relationship to other assets, there’s no chance it will be included in his portfolios.

“Do I see it like gold? I’m prepared to give a nod to 2000 years of history that gold isn’t going away. I’m not so sure bitcoin will stack up in the same way. I wouldn’t be surprised if in 10 years’ time everyone says ‘what were we thinking?’”

The upside of the technology is that it can transfer funds fast and cheaply. Rumours this week of a $1 Billion USD transfer that happened in less than 2 hours for a total fee of $25. Now that is impressive.

On the flip side, if BTC is going to be used as a medium of exchange it will need to lift capacity. At present it can globally process just 5 transactions per seconds compared to something like Visa that can handle 65,000 per second.

China land

Saw the always impressive Minister for Trade interviewed this week. In reply to China complaining to the WTO about Australian tariffs he responded like a jilted lover. “I sent a letter to my Chinese counter-party in January and I have not yet had a response.” Tip for Dan….that relationship is in trouble and a bunch of roses and a bottle of Jacobs Creek may not fix it.

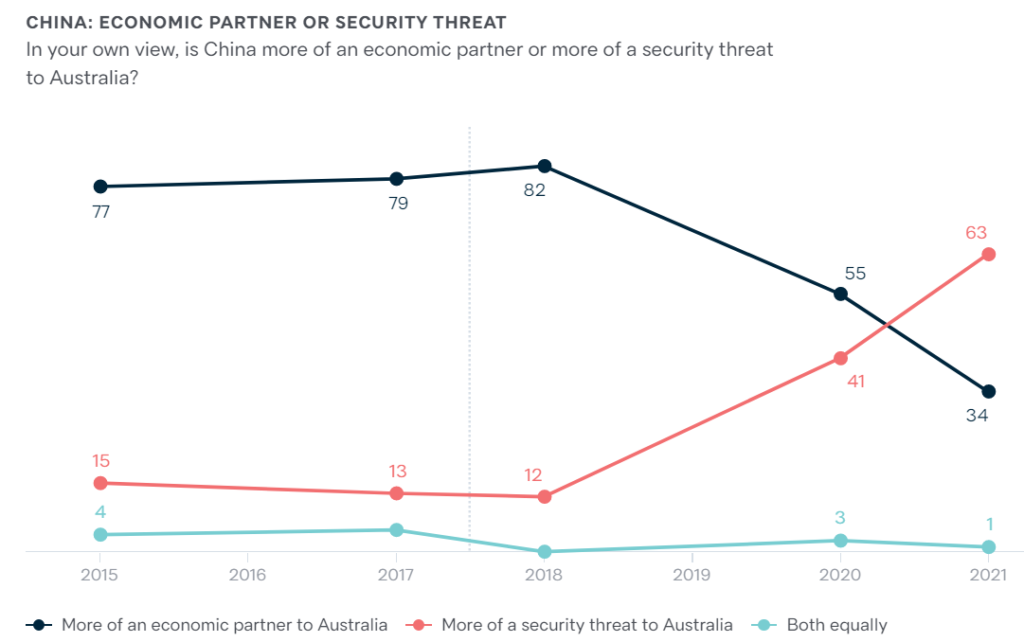

The Lowry Institute released the results of their poll this week.

Very interesting to see such a significant change in our attitudes to China. The last three years has seen an incredible increase in our security fears and a massive decrease in China as an economic “partner”.

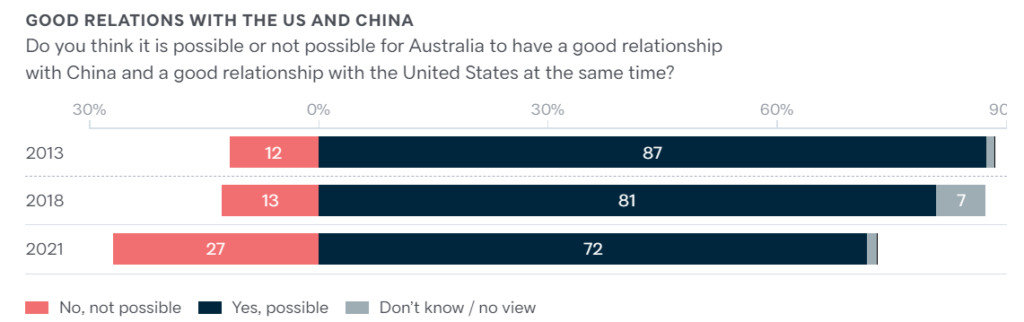

Tip for the Federal Government though….I absolutely agree with the majority of respondents below. We don’t need to choose a bedroom partner between China and the USA….we can easily and happily have a cool threesome. The thought of Biden swinging from the chandelier is a bit too much for me though.

I do sometimes get my WTO mixed up with my WHO. Apparently the English do too…..

Thought of the week.

Politics – why bother?

I studied economics because it made sense to me to understand supply/demand and how money is earnt, spent, held and invested.

The purity of it appealed.

Then you get corruption of that purity via government meddling.

Then you get corruption.

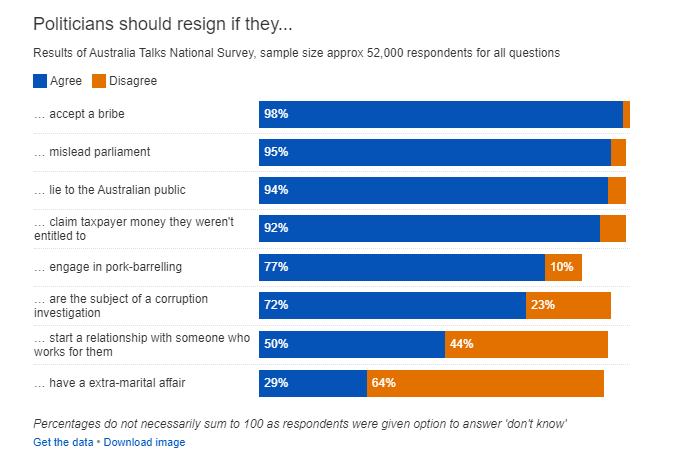

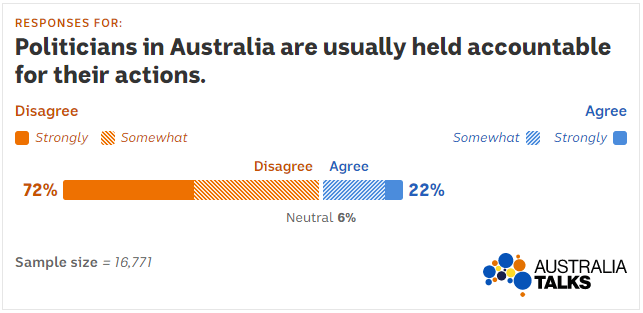

It would be easy to dismiss the “Australia Talks” questionnaire as lefty bullshit – and the TV special did not help that cause. Annabel Crabb didn’t even need to lead little Johnnie Howard into a trap….he gladly set and trapped himself.

It must be clear to all that the current state of Australian politics is appalling. Under the chart below, the LNP Coalition wouldn’t have anyone left in Canberra. It is clear that self regulation is not working and accountability is lacking.

Not to say the Opposition is much better.

I was going to say I will vote at the next election for whichever party promises to introduce an effective ICAC. Then again the current ruling party did say that 3 years ago with no progress…and no pressure via an insipid Opposition that seems bereft of policy and comfortable where they are.

Speaking of Johnny Howard, I can imagine the conversation below as common place at the Australia Club…women as guests only of course.

Totally unrelated to anything……

I can’t believe:

1/ The Federal Government is so outraged about the Great Barrier Reef being tagged as endangered. It the science idiots.

2/ Adani may have water problems. Plenty of coal available but not so re water. By their own modelling they expect to use 11 billion litres of water a year. Yet they don’t have that available. Barnaby….help.

2a/ refer #1.

Drinking favourite…

Unlike Andrew Dolt I am not usually spirits man, other than a good G n T.

But I am trying to get better at scotch – for instance never add ice. My training not helped by the fact I usually only drink it when I’m as full as a Public school hat rack.

Glenlivet is apparently a “soft” introduction. Reviewer says : “Smooth, sweet and easy drinking Floral nose, spicy finish with nutty undertones. A good scotch for those who are new to single malt whisky or those who are not a fan of the peated sort.”

More practice needed by me.

I scored it 6/10

Listening to…

Bad band name, but punchy version of the famous song that you will sing along to.

The mention for Tony Abbott to take walk does age it some what but perhaps just change the sentiment for the current PM.

Tour De France starts this weekend. Usually a time to see spectacular images and plan for your next European trip. Not this year.

Cheers BS