2021 Edition #21 – Inflation…what inflation?

19 June 2021

How lucky….

The much anticipated US Fed meeting addressed that elephant in the room – inflation.

Much like a circus elephant, Chairman Powell delicately balanced himself and cleverly juggled the market vs reality.

The RBA haven’t traditionally given too much “away” about their thinking until recently.

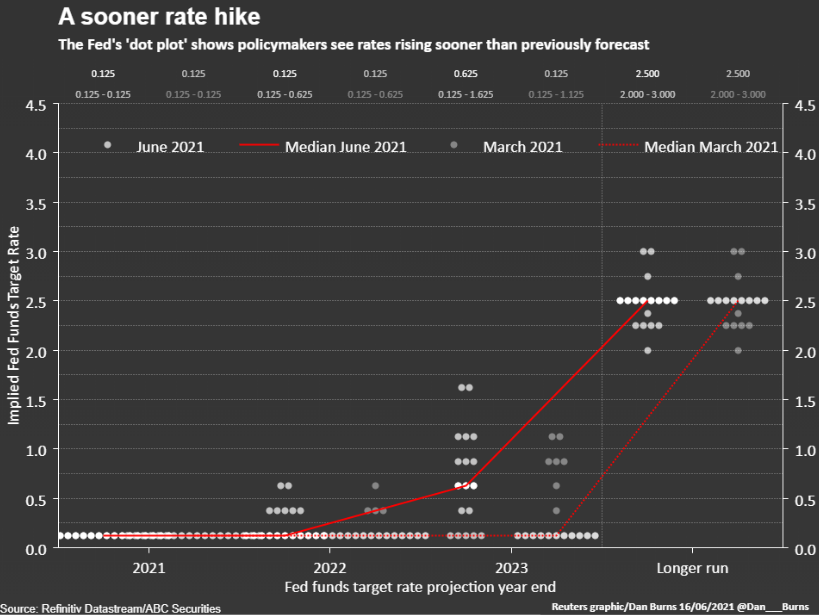

The US Fed committee has for some time used what is called “dot points” to help the market understand what they are seeing. Each member gives a dot for expected cash rates each year ahead. The red dotted line was the median thinking in March. The solid red line is the same from this month. The end goal is unchanged, but they expect to get there sooner.

A perfect balance of letting the bond market know they are aware that the economic recovery is well on track, but comfort for the equity markets that the sugar hit of cheap money is around for the next while.

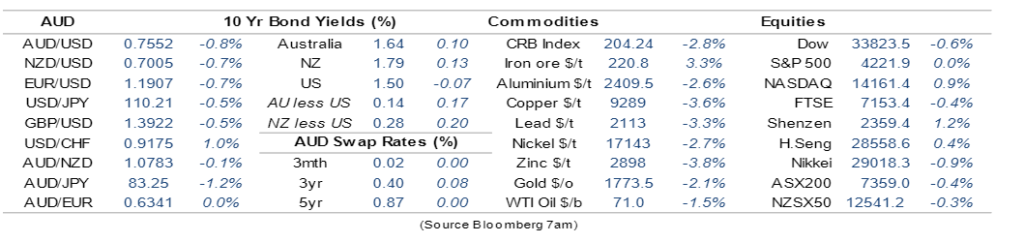

End result was only a modest share price pull back and surprisingly bond yields are little changed on the week.

The biggest movement was actually the USD that rose quite a bit…meaning our AUD fell in comparison….as we predicted last week.

Reuters reported “The Federal Reserve on Wednesday began closing the door on its pandemic-driven monetary policy as officials projected an accelerated timetable for interest rate increases, opened talks on how to end crisis-era bond-buying, and said the 15-month-old health emergency was no longer a core constraint on U.S. commerce.

Signalling that broad changes in policy may happen sooner than expected, U.S. central bank officials moved their first projected rate increases from 2024 into 2023, with 13 of 18 policymakers foreseeing a “lift-off” in borrowing costs that year and 11 seeing two quarter-percentage-point rate increases.

Seven of the officials see rates moving higher next year, opening the possibility of even more aggressive action.”

In our opinion, is the FOMC on the right track? Answer will be found in future history books to be honest. But as we have mentioned before, it is the move of Central Banks from pre-emptive rate changes based off forecasts to post event monitoring and rear view mirror action as the biggest risk. I don’t think inflation is transitionary. History shows it is a beast that you can not kill with just a few blows of a little stick. It needs to get smashed hard and early.

One reason I hold the inflationary fear card high, is from the increased money supply story. One pillow-thought I had during the week – doesn’t money supply have to increase at times just to keep up with population growth? The question popped into my head, but the answer did not, and Google is not really giving me a definitive answer. Let me know your thoughts….. Any which ways, current money supply growth far exceeds population growth.

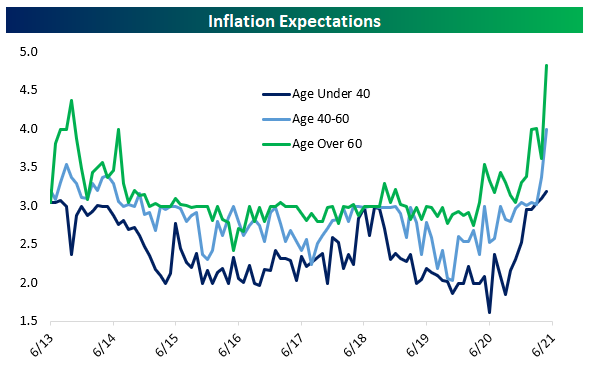

Nothing made the young vs experienced issue clearer to me than the chart below.

Most market participants are now too young to remember past impacts and effects of inflation. Inflation is also a weird bugger. What we expect to happen in the future (Inflation Expectations) is almost always self fulfilling. If you expect prices to rise then you negotiate harder on your wages and you are also more likely to buy now rather than wait. Both then make inflation real.

Crusty old farts expect inflation to be double that of the latte drinking young inner city Melbourne barristers and baristas. The real test will be when coffee goes to $5 in the Docklands.

Of course thinking about inflation, there is a chance that it will “self correct”. If the market starts to really worry about inflation, then bond rates will move sharply higher and equity prices sharply lower. Then you would see business investment and consumer sentiment fall…and thus avoid the worst of it. Maybe….

One of the main characters from the famous “The Big Short” tweeted this week…“People always ask me what is going on in the markets……. it is simple. Greatest Speculative Bubble of All Time in All Things.”

Stuff like that gets me worried. That and the AFR’s revelation that Global Fund Managers are sitting on cash levels at or near historic lows (you obviously sit on cash when you are worried) and that net asset allocation into equities are at 8 year highs of over 61%.

Are you a Bull or Bear??

I continue my fence sitting on personal investing. My portfolio has inched higher in value over June. The investment in BBOZ (short fund) has lost 10% of its value in 2 months. My plan thus is working well. I loaded up a bit more into BBOZ to keep the balance near where I feel comfortable.

On the local front ScoMo has been away fighting the good fight for us.

He walked away with a solid in principle promise to possibly do something for someone in some years ahead.

He left his main man in charge. What could go wrong…?

“We will decide what’s best for Australia in Australia’s national interest,” McCormack said, adding the government wanted to “make sure that we’ve got a manufacturing sector in Australia”. McCormack said coal had “a part to play for many more years to come”. He noted export earnings from the coal industry paid for “a lot” of schools and hospitals. “It pays for a lot of barista machines that produces the coffee that inner-city people sit and talk about the death of coal,” the acting prime minister said.

Pitting country against city in 2021 for political gain when we need to unite to get a workable energy transition policy. F/wit.

Speaking of diversity in opinion, the Fair Work Commission handed a pay rise to our least paid workers this week…

The Morrison government warned against a major increase, arguing it could dampen employment in small business during the coronavirus pandemic.

Unions pushed for a 3.5 per cent increase. The Australian Industry Group urged the commission to limit its increase to 1.1 per cent, or $8.29 a week.

The FWC settled at a comfortable mid point of 1.75 per cent increase to $753.80 a week, or $19.84 an hour. Should not break the banks of employers.

The government did get some good news on employment this week though.

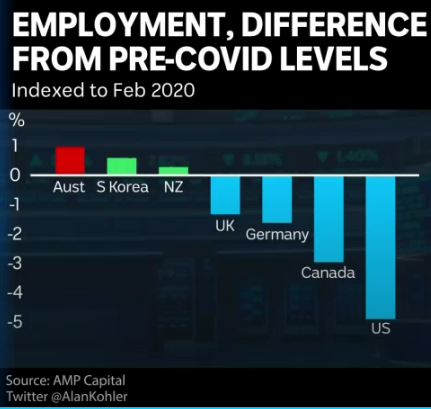

It turns out being under the doona can actually help. Australia is the best performed country in the world re employment bounce back from Covid.

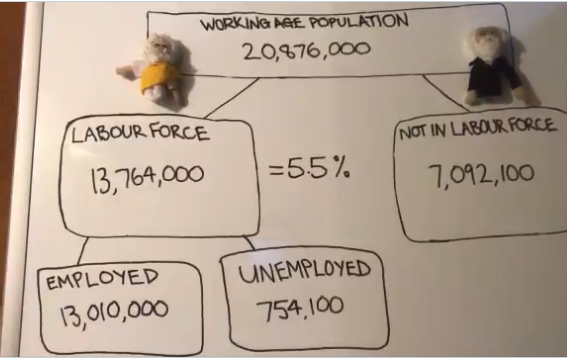

Off the Twitter-sphere I saw this “simple” explanation of how our unemployment rate has fallen to 5.1%.

The total labour force increased as the Participation rate rose and as did the number of employed people.

Of course the sceptics could criticise the actual definition of “employed” …which is one hour a week or more. That aside, under-employment is also falling, to a semi respectable 7.4%

Job vacancies are also through the roof so expect unemployment to get through the 5% barrier very soon.

Aussie banks had a tough week – even “the cloud” was against them with IT outages.

NAB is still stoushing with ASIC over Fee for Service…or more specifically Fee for NO Service. ASIC revealed the bank had received complaints from customers as far back as 2009 with members of the bank’s executive team being made aware of the risk that it was charging fees to which it had no right by early 2010. Come on…you can’t expect NAB to fix something as complex as that in a mere 11 years….. They need Terry on ASIC.

Gold and crypto also having bad weeks. If they are the “true” protection against inflation WTF is going on? The stronger USD is only part of the story.

Mining stocks of all kinds are softer though. A stockbroker/colleague always believes copper is the ONE TRUE predictor of economic fortunes ahead. If that is the case…watch out…

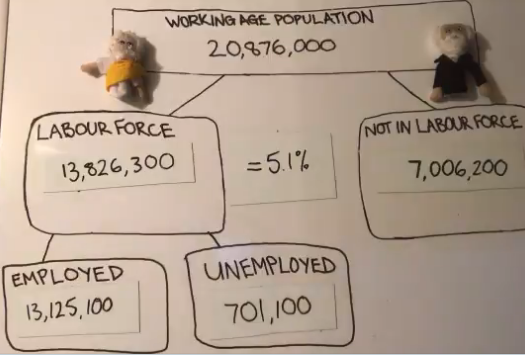

Our Crypto question to readers show:

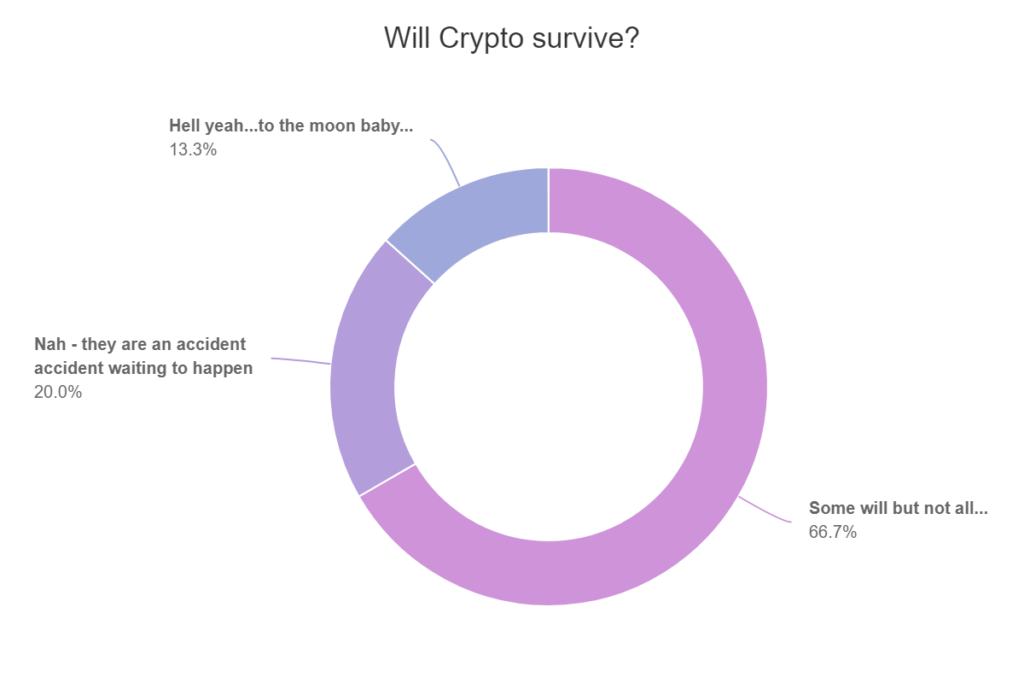

Two thirds agree with Black Swan. Crypto is here to stay, but the form and the players are not yet set. Goldman Sachs’s view on Bitcoin is a little bit all or nothing.

A very long but detailed analysis of Gold and Crypto has just come out.

To save you an hour, a couple of quick snippets…

The article explains just why crypto and gold is so different to traditional “money” – and the advantages and disadvantages.

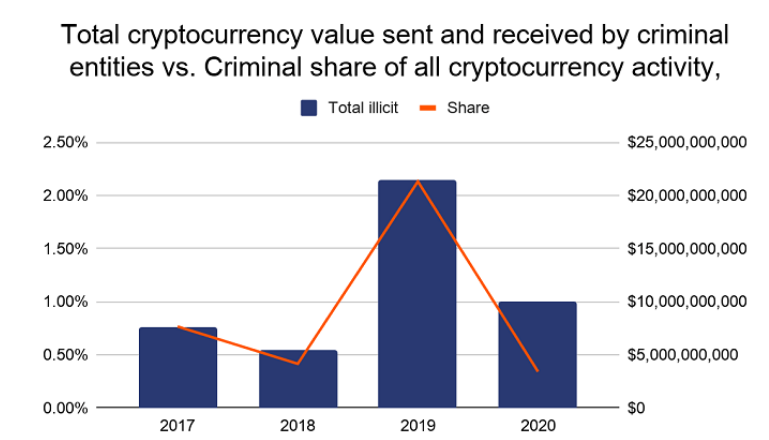

As an aside, the common perception is that Bitcoin turnover is dominated by shady characters doing shady deeds. Analysis firm Chainalysis believes the actual amount is less than 1% and less than the total fines paid by investment banks for illegal activity. Fair point.

CBA data

Thought of the week.

Red-n-White Swan gave us a look at China and potential population changes last week leading to expanded growth.

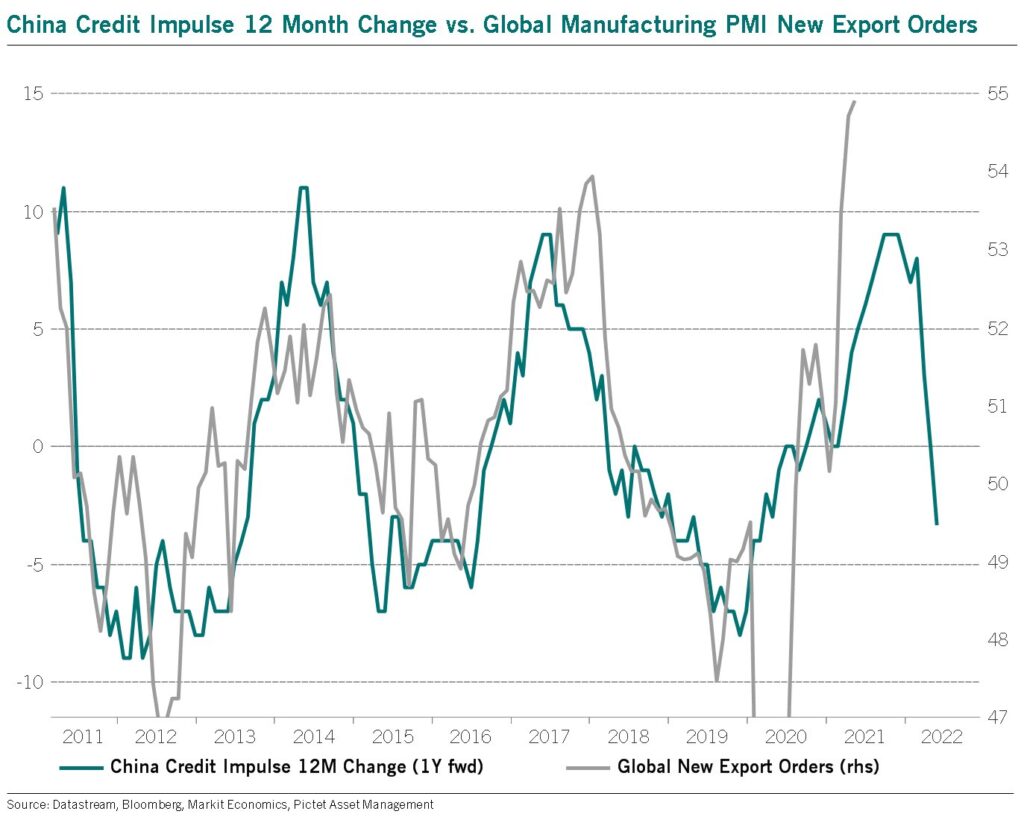

Some recent analysis challenges that assumption. China may seek to put the brakes on.

Time has run out, but Escala Partners makes a few interesting points:

We sometimes forget that China is not a capitalistic economy. Its leaders have been raised under the Marxist tradition. And under this tradition, inflation should be avoided at all costs because it is seen to lead to social upheaval and insurrection.

• So, avoiding the inequality gap that now plagues the West and avoiding inflation is key right now.

• That means it will slow growth, it will impose heavy fines on companies that seem too monopolistic, and it will allow the currency to rise if it eases inflation pressure for its producers. All this clouds the investment thesis for investing in China.

• It challenges the environment for Australia as well. We could see the Australian dollar come under pressure if China continues to slow and clamps down on speculative activity in commodity prices. The most important commodity price for Australia is iron ore – this is off 9% from its peak in May.

• It’s worth noting that while equities in the US, and Europe and other parts of Asia are up 30-40% over the last 12 months, equity prices in China are up just 6.8%.

Note worthy then is the recent issue with Alibarba and the missing CEO. Makes sense.

Drinking favourite…

A mate put me onto Heirloom for a lot less than Dan Murphy’s who is selling it at $80 a bottle.

The Heirloom Vineyards Anevo Fortress McLaren Vale Grenache 60% Touriga 25% Tempranillo 15% produced from McLaren Vale Vineyards whose clones and viticulture embody the very best in cutting edge but old school viticulture and winemaking. Hand tended vines, whole bunch fermented, basket pressed and stored in French oak barrels from bespoke coopers. Texture and powdery tannins take over before bright fruits lift the back palate, signifying a wine that is pert and alive.

Had it at a duck Asian restaurant.

The poem on the back says it all. Pretty bloody good.

I scored it 9/10

Listening to…

Been listening to Seasick Steve for awhile. Certainly an acquired taste.

I sat with a neighbour recently that was going through a rough patch. I played this for him.

I started out with nothing, and I still have most of it left.

Not sure if it cheered him up or the opposite.

Cheers BS