2021 Edition #20 – Queen’s Birthday edition – China and crypto

14 June 2021

Peta Credlin got a Queen’s Birthday gong, so it must be my turn next year…

Late again – interstate visitors that destroyed my cellar have just left.

Inflation is the the word still. US data showed what we all knew…costs are on the rise. The Fed maintains its innocence – it is only transitory.

We will dig deeper into crypto later, but the many crypto “bulls” are still calling for fantastic returns ahead – and the sceptics question on what grounds is that claim made?

I say the same re inflation. There is a truck load of cash slushing around the globe, but the speed/velocity of spending is not accelerating. Thus you could argue inflation will not rise too much. You could likewise argue if you take food and energy out of the readings then things are a lot calmer.

But the truth is that loose monetary policies are just half the “potential” problem – fiscal policy is in total alignment, which is not always the case. Governments all over the world have committed trillions of dollars worth of spending on infrastructure to vaccinate their respective economies against Covid effects.

As Napoléon spoke in 1812 after seeing his army against Russia fall from 360k to 15k…” It’s only a small step from the sublime to the ridiculous.” Hitler described his losses on the Western Front in 1943 as a “temporary setback”.

Central Banks have gone full socialist. Inflation is to be ignored and all intellectual and financial inputs must be towards employment…even with the stated aim to push wages up to chase inflation. To me that seems like smoking a cigar on the Hindenburg.

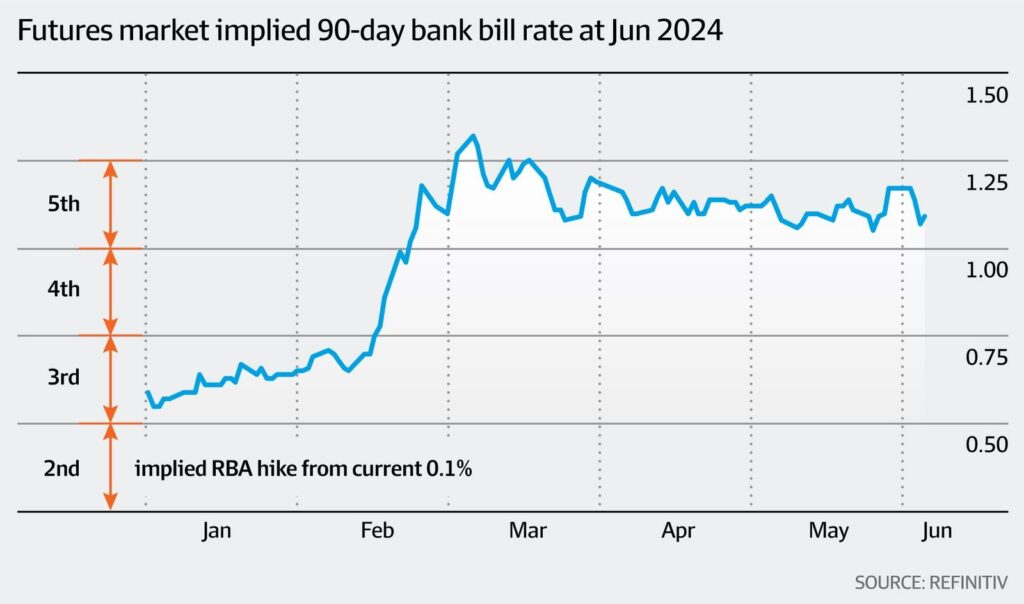

And yet Aussie bank bill futures seem to kinda believe that the RBA will stay true to its word. Only modest cash rate hikes between now and early 2024.

ANZ released a report this week stating they believed the hiking cycle to commence in 2023. One thing from the past week, is that Australia holding onto it’s AAA stable rating will help allow Aussie banks to keep borrowing offshore cheaply and thus in theory lend cheaply…ish…

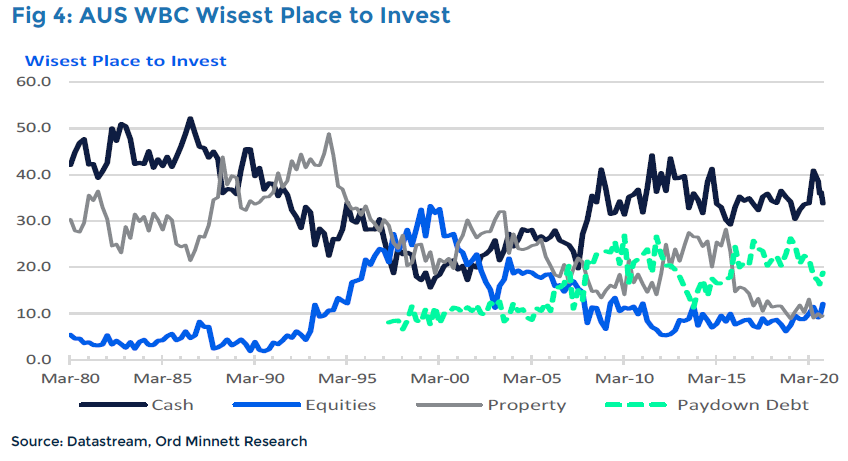

Thus is struck me as interesting that the latest Westpac survey asked where the wisest place is for punters to put their cash…and no timber was not an option.

Keeping your investment in cash remains around 2010 levels – when cash rates were 4,650% higher. Paying down debt comes in a distant second with the trend falling. Equities and property bring up the rear.

Perhaps shares and property are seen as a bit “frothy” by some at present?

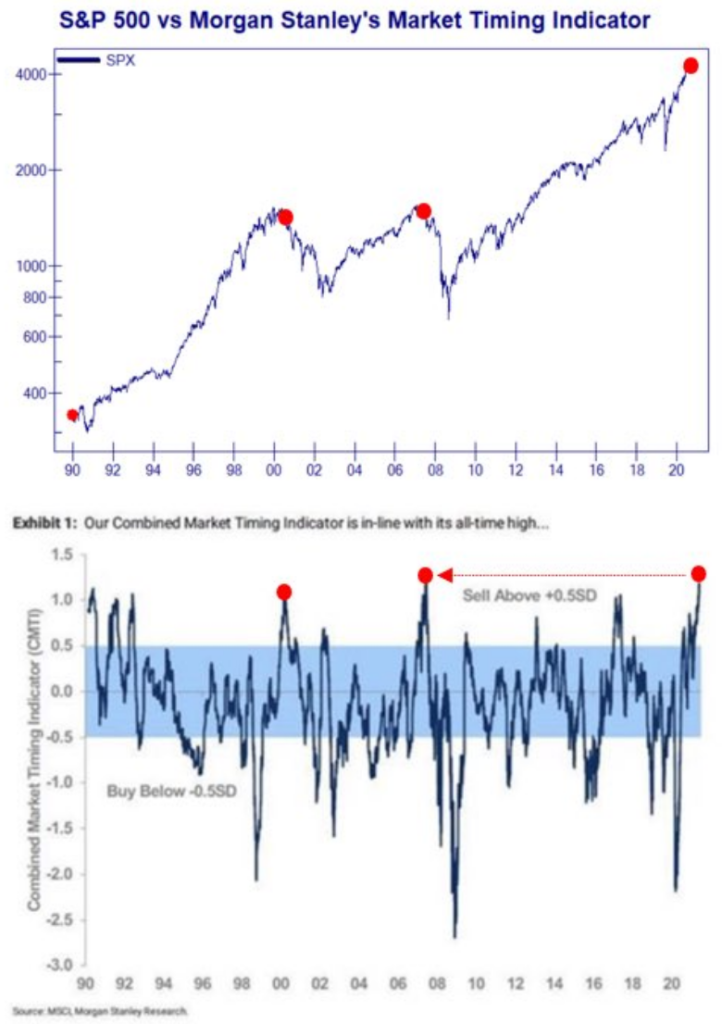

That could have some validity if you look at Stanley Morgan’s timing chart for the USA’s index.

The bottom section shows when the flags are suggesting buy or sell. The two red dots both preceded a big sell off and the last red dot as of now should worry many.

Make NO mistake – I believe the ASX sell off will be triggered by the USA, not domestic issues.

Of that I am certain – but as flagged many times – the reason I’m not living on my own Caribbean island drinking rum all day, is that timing is as clear as mud.

In the meantime – Bloomberg suggest we should all feel sorry for Wall Street traders. Yeah…nah.

More chance of feeling sorry for Elon

Looking at China today in deep dive, but before that – crypto headlines grow.

Bitcoin has had a nice little rally and sitting circa $39k USD at present.

If you were onboard you would be pleased to see some countries embracing and endorsing crypto. El Salvador has just approved Bitcoin.

Call me a cynic but if 70% of their population do not have access to a bank account, then I can’t see many sitting home trading crypto for fun.

More likely they are out helping Daddy do his job.

If you were not onboard the crypto train then a few announcements this week would support the view that many powerful people will look to crush new challengers.

The Bank for International Settlements’ Basel Committee is a very powerful organisation that sets rules for Banks to follow to try to eliminate financial catastrophes – and especially the domino effects of any one bank getting into trouble. One way they achieve this is to ensure there is enough capital held by a bank to see though a seriously rough patch. In broad terms if an Aussie bank lends $100 it is expected to hold $8 back in the vault just in case. Given it can’t lend that $8, it becomes an effective cost.

Basel is saying if any bank plays in Bitcoin, then it will need to hold $1 capital for every $1 of Bitcoin – i.e. 100% of the asset. Boom….game over. Only proposed for now – deadline comes in September.

Second hit to the body comes via Washington. We have mentioned here previously that the Securities and Exchange Commission Chair Gary Gensler was seen as a quasi crypto fan – or at least understood it and has been less critical.

Late last month he came out and stated crypto needed more regulation to protect investors. For crypto fans that is like suggesting you get dog drug sniffers to a Bryon Bay music festival – good idea but piss off.

The noose is closing though and the ransomware hack on US pipelines (paid in Bitcoin) may just seal that fate.

Bloomberg did an article on it – found it accessible via Thailand of all places…read it here…Crypto ping pong

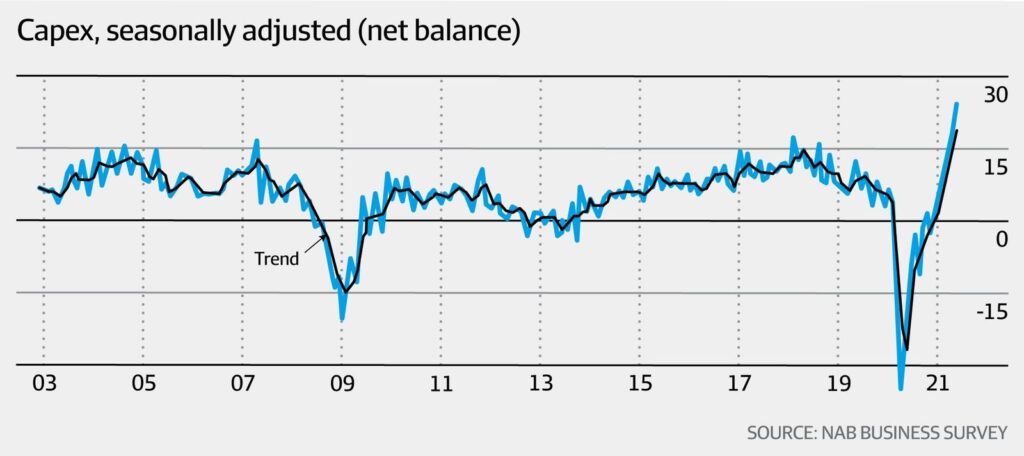

Aussie dollar got a bit of a lift with frankly spectacular Capex plans for business ahead.

It is hard to see an imminent disaster ahead with this chart.

As has been the case of late, the AUD then just slipped back into the mid 77 cents.

For a few reasons including China and commodities I’m just a little less bullish on the AUD ahead. Maybe 80 cents is a big ask for Christmas and more like 75 cents.

CBA data

Couple of randoms:

- ScoMo is offshore pushing Australia’s “green” credentials….aka sucking up to Biden and Boris.

- ScoMo still pushing re source of Covid, but at least trying this time around to be at least a trifle subtle towards China. And Hydrogen is “the bomb”….

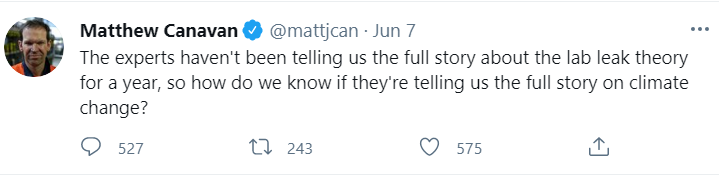

Wonder then what he thinks of his idiot mates’ tweet ..

At least he is away when pressure builds on Christmas Island and Biloela migration issues.

You know you have gone too far if Albrechtsen calls for compassion.

Thought of the week.

Red-n-White Swan (may give you a hint about their location) is back with a quick look at China growth…of people…

China – Buns in the oven

It is flattering to see the Chinese Government take a lesson out of Australia’s economic play book at a time of such a well publicised spat.

We’ve known for some time that the best way to boost economic growth in Australia is to let more people come and live here. Whilst the type of immigration is always a party-political hot potato increasing our population means more dwellings needed, more jobs sought and more money spent on our high streets and shopping malls to say the least. Population growth was the largest single contributor to our 30 consecutive years of recession proof growth up until recently ( other than our trading relationship with China).

China’s decision to introduce a third-child policy appears targeted at addressing falling birth rates. It took the PRC 36 years and many Premiers to remove the one child policy that existed from 1979 to 2016. You may recall it was a catalyst for a very large boost in household sentiment and economic growth when announced that two was better than one in 2016. Unsurprisingly, birthing rates went up and initially and it coincided with another wave of Chinese and global economic abundance. Roll forward and its 5 years rather than 35 that sees the arrival of the three -child policy.

With trade disputes a plenty, we didn’t see the usual wave in initial optimism from financial markets. But the Shanghai Composite Index nudged up 5% over the month on the news to very near pre covid -19 all-time highs.

With 1.4bn people and an average fertility rate of 1.3 children per child bearing aged woman, China is facing up against an ageing population and UN projections are that India will surpass Chinese total population levels by the end of the decade.

Dual income households in China have driven similar reductions in fertility rates after the initial two child policy boost (think of Peter Costello’s sugar rush baby boomer hand-outs) . There is further talk of raising the retirement age is in China as well – which seems quite Canberrasque in its design.

Is this a sign of China stimulating more domestic demand in the face of further international economic headwinds and going it further alone ?

For a country creating 10 million new urban jobs each year where the proportion of those 65 years and above hit 13.5% in 2020 (up from 9% in 2010), this is a significant economic boost in policy setting terms.

It can only be net constructive for the Chinese economy (based on the Australian experience) and ultimately the global economy… at some point.

When we kiss and make up that means more ugg boots, infant powder, fluffy koalas, ore briquettes and demand for university admissions one would expect.

The bao bao or little hillocks may well be a boom, but were going to need to see the yeast rise yet and those buns may need a little more time in the oven before we can dine out again locally.

Editorial comment:

Hard to disagree with the above, and I will look to explore deeper next week. I have read a few articles that seem to position China very differently from current Western economies. They want to prevent an over heated economy, they fear inflation far more than is evident in the West and finally have a mandate and ability to prevent a growing chasm of inequality….something we have done very poorly (no pun intended)

More on that next week.

Drinking favourite…

Cellar faith restored.

Good friends birthday so I gave them this wine…then promptly pulled the cork out…

Good drinking (with good Indian food) – this online review tells it in a unique way..

“Meaty core that touches deep pleasure centres. Dark berries and fleshy blackcurrants dive down into great depths of flavour. Perfect for the power Australian crowd… many of them are my friends.”

She scored it 92/100

Listening to…

Not my selection, but I watched Southpaw this week.

I wanted to choose The Beast as the song, but it might blow your speaker.

“What about the rest of us” is just a bit more mellow. I know stuff all about Action Branson.

We are coming up for our first birthday – it will be time for reflection and who knows…maybe improvement.

Cheers BS