2021 Edition #17 – Yeah…nah….

14 May 2021

You can’t argue with that…

Chose that opening meme after seeing a US Republican talk about the dangers on embracing electric cars. She started by saying “we all want a cleaner world. I want this Earth the be the cleanest in the world.” There is no way you can argue with that logic.

Speaking of US politics, I kid you not…a true quote….”I voted Republican this year; the Democrats left a bad taste in my mouth”. Monica Lewinsky

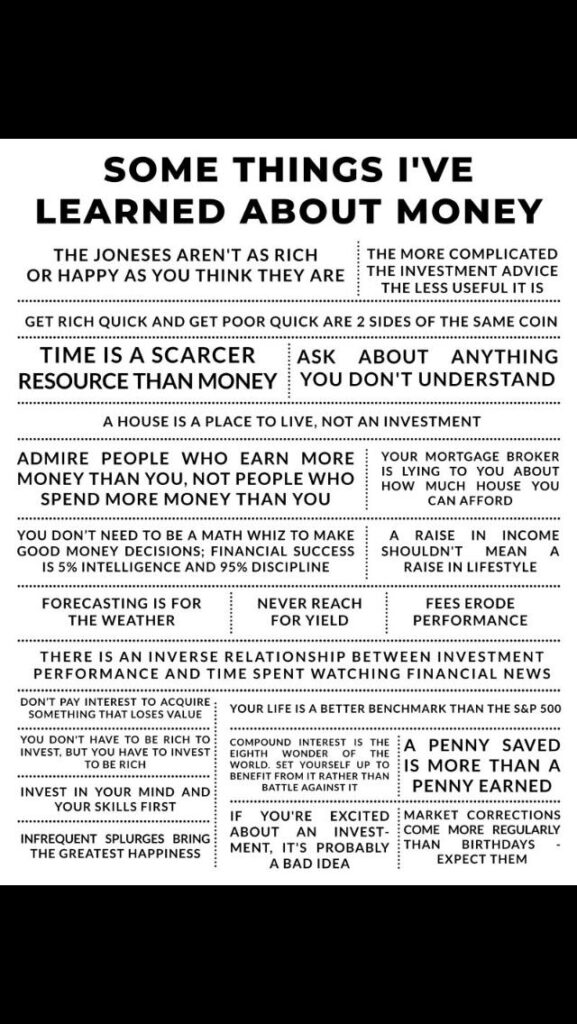

Before I start this week….I saw below and it is FANTASTIC. Snatch and grab a copy and stick it on your kids bedroom wall.

USA had some issues to contend with this week. A pipeline supplying petrol, gas and jet fuel from Texas up the east coast got targeted by Ransomware hackers and was shut down. This pipeline supplies 40% of the entire country’s fuel. The minute authorities said “don’t panic” everyone panicked and chaos ensued. The Biden administration have indicated they believe the hackers were Russian and if not government, then government sanctioned. Expect fall-out to follow. It does make you wonder if Bruce Willis was ahead of his time. The next country on country “attacks” may actually be IT based rather than military.

I tried to turn bullish last week, just in time for the market to move into correction mode. Yields up and equities well down.

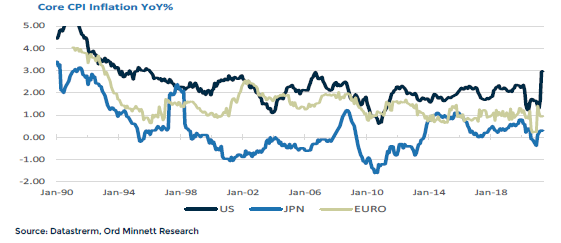

Some of that rot happened early in the week, but a very high reading in the US inflation. CPI lifted by 0.8% for the quarter – the highest since June 2009. That is 4.2% higher on a year-on-year comparison. Core inflation rose 0.9% – the highest since 1982.

That sort of data would scare most punters. I think back to FOMC’s Jerome Powell’s quote…”I’m not even thinking about starting to think about higher rates”. I think they have painted themselves into a corner.

The chart above is interesting. Many are comparing the “new low rate paradigm” that the USA (and Australia) find themselves in to Japan over the last decade. Low rates, low growth and low inflation. I’m not sure I agree. Japan dances to a different taiko drum.

Of course if the market was 100% convinced that higher rates were coming sooner, the sell off carnage would be much, much worse. Powell will argue that the Fed remains confident that the inflation data is transitionary. They are being compared to Q1 of 2020 which was when the world economy stopped. Thus being compared to a very soft quarter. Others also argue that while prices for some goods are higher, the service sector is still deflationary.

I do think both the FOMC and RBA think along similar lines. Whilst they have a charter to follow, both would rather lie inert unless pushed. And when they move, they move to a theme of “what will hurt us less?”. For the FOMC if they tighten too early and send the economy down a slide and see unemployment rise they will go down in history as idiots. If they get unemployment down at a cost of inflation in the short term they would think that a good trade off. They can deal with that later and still keep their reputations – or even better pass on that problem to the next committee. Not many can remember back 30+ years ago when the inflation monster could not just be killed off easily.

So ultimately it will come down to employment and wage growth. The USA seems in the same spot as us. Plenty of available labour…but not always the right stuff. Skilled labour is getting harder to find. Just no hint of anyone paying more for it as yet.

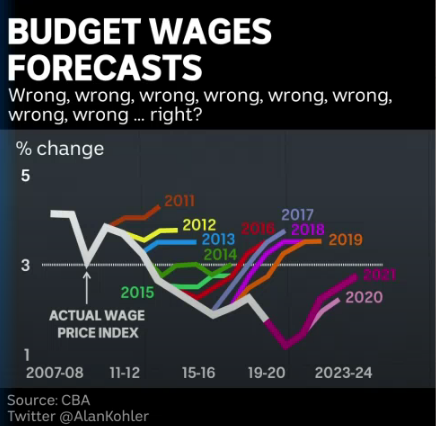

Speaking of wages. It was Australian budget week. The budget papers include forecasts for wages. Alan Kohler highlighted how all budgets going back to Wayne Swan over estimated wage growth. If, like gambling, and crypto currencies, “the trend is your friend”, then forward predictions from this week may also be at best optimistic.

The effects of a lack of skilled migration into Australia for some time will throw a wild card into the mix this time though.

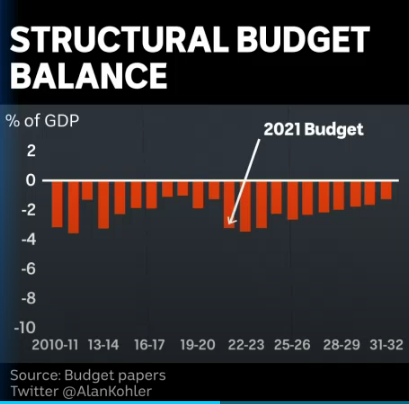

If you had just returned from Mars this week, and saw the hand down of this Budget you would have sworn it was Labor in power.

Massive increases in spending for social services. Damn the torpedoes and damn the deficit.

All said and done though, from what I have read, I give it a solid 7.5/10 score. The alternative of being skinny on spending at this time…. both politically and economically, was never likely.

If we are going to get our deficit out towards $1 TRILLION, I would have liked to see more spending on what I would call smart stuff.

The value of CSIRO became clear early last year, and their ability to respond or assist was limited by the fact that for the last 10 years it has been financially gutted by budget cuts.

Similarly what a great opportunity to jump into bed with Joe Biden’s administration and spend some cash on renewable “smarts”.

The problem is that the Coalition just can not get their shit together and still want to sit on that barbed wire fence. Whilst The Guardian may not be your normal choice of reading, take a quick look at this one and a half minute clip from Sky News. Keith Pitt see’s the word ‘battery’ as his kryptonite. Very funny This is the Pitts

It is interesting though that this budget has taken the entire wind out of the ALP’s sail. They can grizzle around the edges but this is effectively a Labor budget. It leaves them with no room on the dance floor. Whilst an election is not due until mid/late next year, I get the feeling it just might be late 2021.

Final point: Yep low interest rates make debt “less bad” at present, but someone at sometime will need to pay it back, unless Modern Monetary Theory becomes accepted, which I doubt.

“Money” :

- a medium of exchange;

- a unit of account;

- a store of value;

- and, occasionally, a standard of deferred payment.

Some 42 million Bitcoin holders in the USA believe cryptocurrency is money.

To state again – I think Blockchain payments and technology are here to stay. The 10,000+ crypto versions may not be.

Elon Musk went on USA’s Saturday Night Live as host last weekend looking like James Bond. All was good until he spoke – hard not to as a host.

He kicked off by revealing he had Asperger’s Syndrome.

Then, as if to prove it, he agreed that Dogecoin was a hustle. Good way to wipe a quick 30% off your investment (albeit it recovered somewhat).

Not content with that, later this week he confirmed Tesla would no longer accept Bitcoin for cars…see #1 above. He justified that move as he had just realised how much fossil energy was needed to “mine” Bitcoin. He could not therefore balance his green renewable EV car business with Bitcoin. Seems in keeping with an old tweet of his.

All crypto’s are about 10% lower as a result – Dogecoin took yet another hit. See the LHS chart. If you bought a year ago, you are only up 9,254% now.

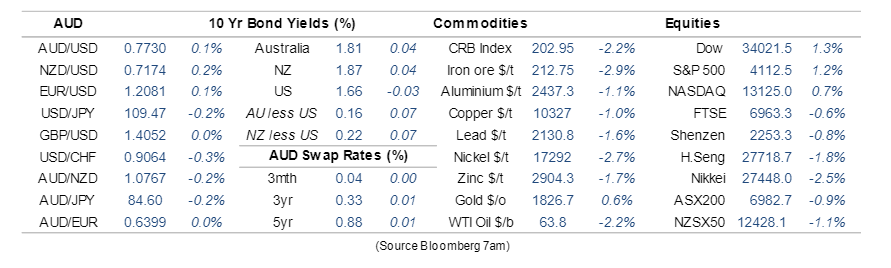

10 year yields jumped about 10 basis points on the inflation data. US 10 year yields are back near 1.70%, ours are about 5 points higher than that.

You would think gold would have jumped for two reasons – inflation and crypto news. It actually fell a bit. Rather disappointing for my gold punt. But I’m still a believer.

I began pricing some puts to protect my equity portfolio this week and last. With volatility low (well last week anyway) I thought it a good time to take some “risk off” but still give me a chance to participate if this lunacy continues. To give you a sense of cost, it looked like to cover the ASX200 at around 6,500 (ie 10% lower than what was at the time current) it would have been about 1.5% of the portfolio – per quarter.

Thus I would need to pay some 6% pa when I would only get a return once I had already lost 10%. The maths just didn’t stack up.

I will tell you if I deal, but instead I am thinking of buying a small chunk of ASX BBOZ. It is a BetaShare Triple Bear Fund. They position themselves to be inverted to the ASX by a factor of 3. In other words if the ASX200 goes up by 1% they fall by 3%…and vice versa. To me this makes better sense.

Of course I just read a report from Ord Minnett that recommended going hard into growth stocks and underweight into defensive. Thus my thinking goes against the tide – and most likely your views as well.

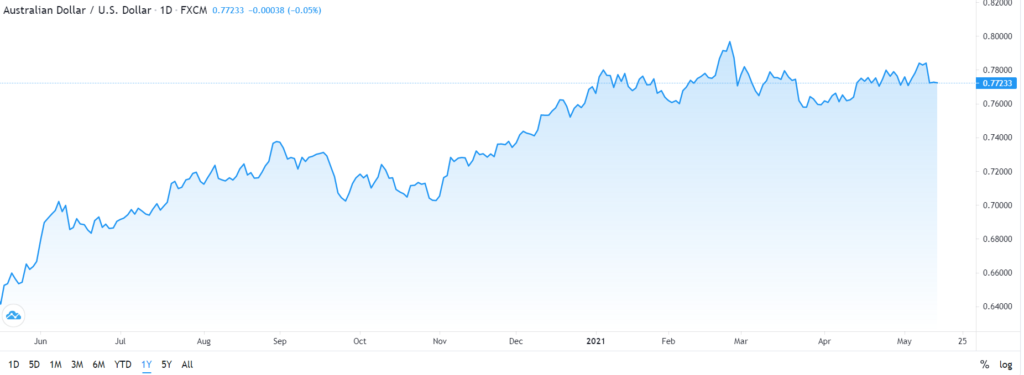

The Aussie dollar is bouncing around at present. Commodity prices support for now, but the USD strength was not expected.

Best guess remains we move higher over coming months, with the odd dip.

CBA data:

Local Victorian MP found himself in trouble last week, but I say well played Sir. Let’s not get too PC.

Thought of the week. Chasing a dividend. RBA

Only a brief thought this week – I’ve been Captain Hook with man flu.

RBA web site has an enormous amount of information available to all.

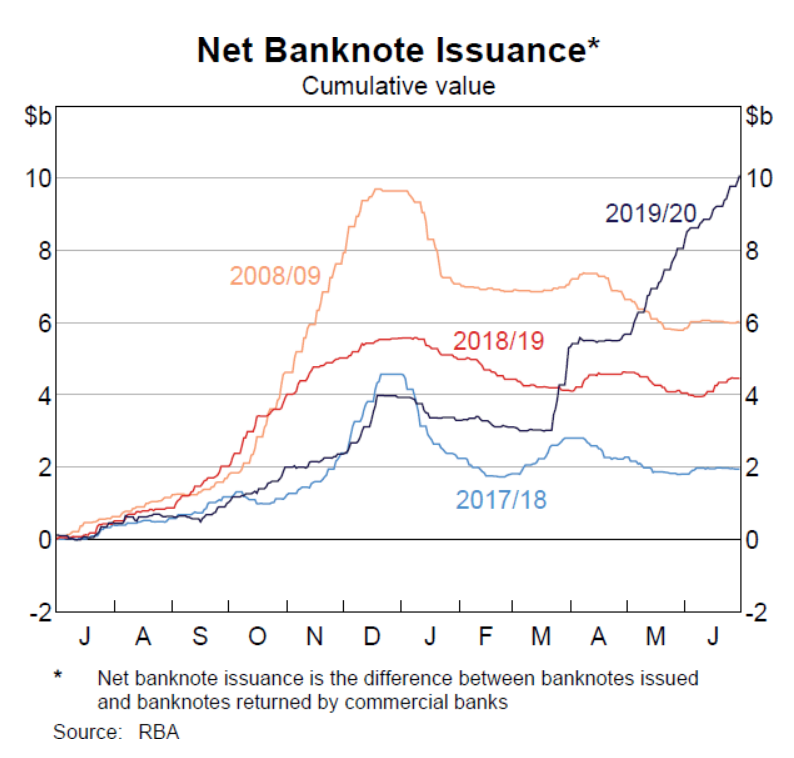

One thing that surprised me was the amount of notes issued last year. Massive increase of circa $6B.

With Covid and most retailers wanting contactless EFTPOS payments this goes against common sense.

Smaller notes are in decline. The growth was all in pineapples and jolly green giants ($50’s and $100’s). So you can only assume this is a response to fear/safety, and many people must be sleeping on lumpy mattresses.

The AFR had an article this week about RBA setting up a quasi future fund AFR – 2 swans to support financial markets in the event of a “double black swan” (surely one of me is enough). Even in these crazy times, $5BILLION is a lot of money. So I thought…where is this likely to come from?

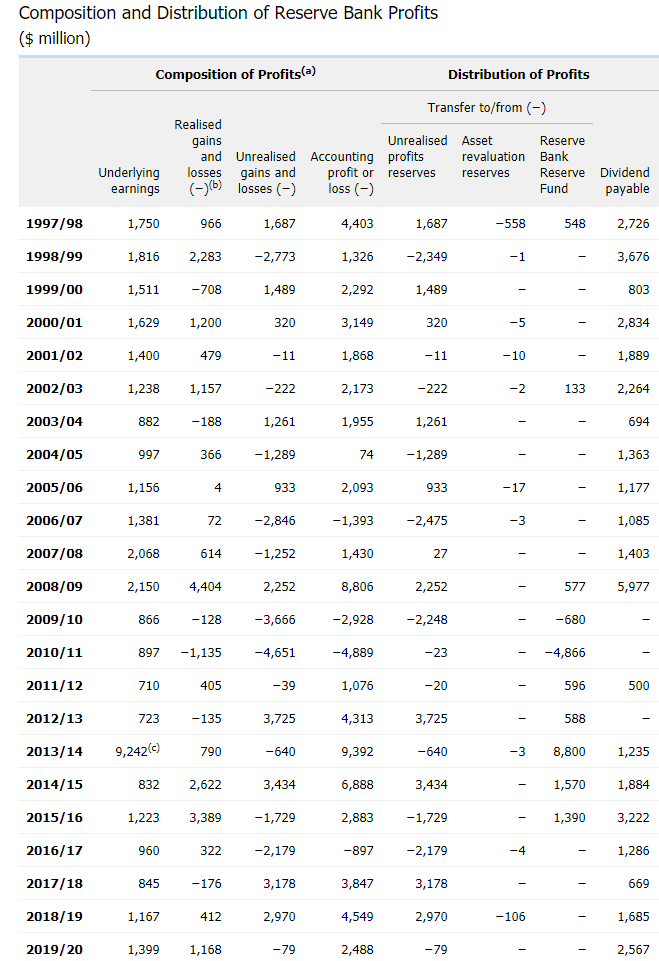

So I had a look at firstly their “profits” and secondly their reserves.

The RBA often makes as much profit from asset revaluations as “trading”. Maybe like a casino, it is easy for the house to win.

Also interesting is the dividend paid to their owners ……us. Unfortunately the Federal Government get their mitts on it first. Over the last 25 years this seems to be a source of funding when the government is running a bit tough.

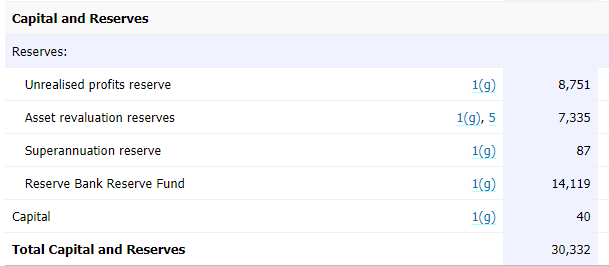

But the reserves are spectacular – over $30B. The first line seems to me mainly FX gains held. The second line is mostly gold reserves. The fourth line appears to be pure slush.

I’m thinking this $5B fund might just be an internal transfer from the slush.

Drinking favourite…

Bizarre, but alcohol free week. No entries to rate. Will correct next week.

Listening to…

Got sent a link for Duke Dumont’s “Therapy”. I like it. Reminded me of Moby when he was cool.

Until next week….

Cheers BS